MA-186-100 Series

Page

Meanings of Each Symbol

Safety Summary

Safety Summary

Precaution

Table of Contents

Toshiba TEC

Introduction

Unpacking

REG

Outline of Preparation Procedure Before Operating

Offz SET

REG Offz SET

Appearance and Nomenclature

Control Lock

Control Lock and Control Keys

Control Keys

REG Key

Operator’s Display

Display

Customer’s Display

ALM

Numeric Display

Message Descriptors Triangular Lamps

OFF

Standard Keyboard Layout

Keyboard

Other Optional Keys

CID

Installing the Paper Roll

REG OFF

Duplicate Sheet Original Sheet

EO1-11115 MA-186-100 Series

Time and Date Setting

Time Setting or Adjustment

Date now set

Date Setting or Adjustment

REG OFF @/FOR AT/TL SET

04.- 15.- 9 05.- 28.- 9 00.9

Displaying the Time

Tax Table Setting

Printing the Time and Date

Setting Procedure

A single-tax area, the TX1/M key may be labeled as TX/M key

Setting Examples

To indicate that no breaks are entered

Ex Tax 1 Full Breaks

05.- 28.- 9 01.7

Ex Tax 1 a Break and % Rate Combination

Ex Tax 1 % Rate only

05.- 28.- 9 10. % 01.8

Thank you

GST/M

01.5

Tax 1 memory

Non-taxable Limit Amount Setting

05.- 28.- 9 20.0 02.4

Taxable Limit Amount programmed

Tax Calculation Test

Optional Key Setting

Operating Procedure

List of Keys

Receipt Issue Post-receipt

Department Keys 1 to

Refer to the List Keys on the pre Ceding For the Standard

Key Installation Setting

REG OFF AT/TL SET Blind

Keyboard Layout Refer to Chapter

Issue without entering numbers

That the setting operation is completed. No printing occurs

Plan before starting the setting procedure

Receipt Issue Post-receipt Key

During Business Hours

Daily Operation Flow

Before Opening the Store

After Closing the Store

Entries in Training Mode

Training

41.3

Setting Preparation of Each Key and Transaction Entries

Receipt-issue/Non-issue Selection

41.4

Combination of 6 +

Thank you ←

No-sale Exchange

Void

10.2

Received-on-Account Payment

12.5 10.3

Programming Department Keys

Paid Out

Department Keys

10.4

Programming Procedure

Department Status Programming

Be entered within one sale receipt sequence

DP Amount

Payment of electricity and gas, and donation

TX1/M TX2/M

Department Status Program Receipt Format

00.5

Department LC Program Receipt Format

Department LC Listing Capacity Programming

01.1

Last setting is effective

Department Preset Price Setting

Department Preset Price Setting Receipt Format

05.- 28.- 9 34.5 02.0

Entry of One Item

Sale Item Entries Using Department Keys

Repeat Entry

Repeat

Quantity Extension Multiplication

Item of the Department Nos to

Split-Package-Pricing Department SPP

Other Income Department Entry

PLU Price-Look-Up PLU Key

Single-item Department Entry

10.0 10.5

Programming PLUs PLU Table Setting

Dept

PLU Table Program Receipt Format

Deleting Individual PLUs

AMT

05.- 28.- 9 00.7

PLU Preset Price Changing

PLU Deletion Receipt Format

OFF PLU #/CID

Sale Item Entries of PLUs

PLU Price Change Setting Receipt Format

PL01.1 23.4 02.1

@/FOR AMT

40.0

Single-item PLU Entry

Listing Capacity Open

Percent Charge, Percent Discount

28.- 9 PL10.1 10.7

05.- 28.- 9 10. % + 01.3

Key Preset Rate Setting or Changing

05.- 28.- 9 01.4

6.0

Key Operations in Sale Entries

15.0

Dollar Discount

Item Correct Last Line Voiding

Repeat entry is not possible using the Void key

Void Designated Line Voiding

Returned Merchandise

All Void Transaction Cancel

18.7

SET #/CID

Non-add Number Print

23.0 0 0 #

Taxable Total Read

Subtotal Read

22.9

TAX

Manual Tax Entry

Finalizing a Sale

Media Total

11.8

Post-issue Receipt

Check Cashing Cashing Non-cash Media

Bit 3 on

Percent Charge

Tax Status Modification

TX/M

Percent Discount

To exempt the sale from designated taxes

Tax Exemption

To exempt the sale from all taxes

Tax / PST and GST

Print/Non-print Options on Sale Receipts

Tax / PST

Programming Hourly Range Table

Read and Reset Reports

Programming Operations Relating to Reports

Refer to Note on Condition on

Programming Example

Selecting Print/Non-print Items on Reports

05.- 28.- 9 01.0

Fundamental Concepts of Various Types of Reports

Taking Read and Reset Reports

Report Taking Operation

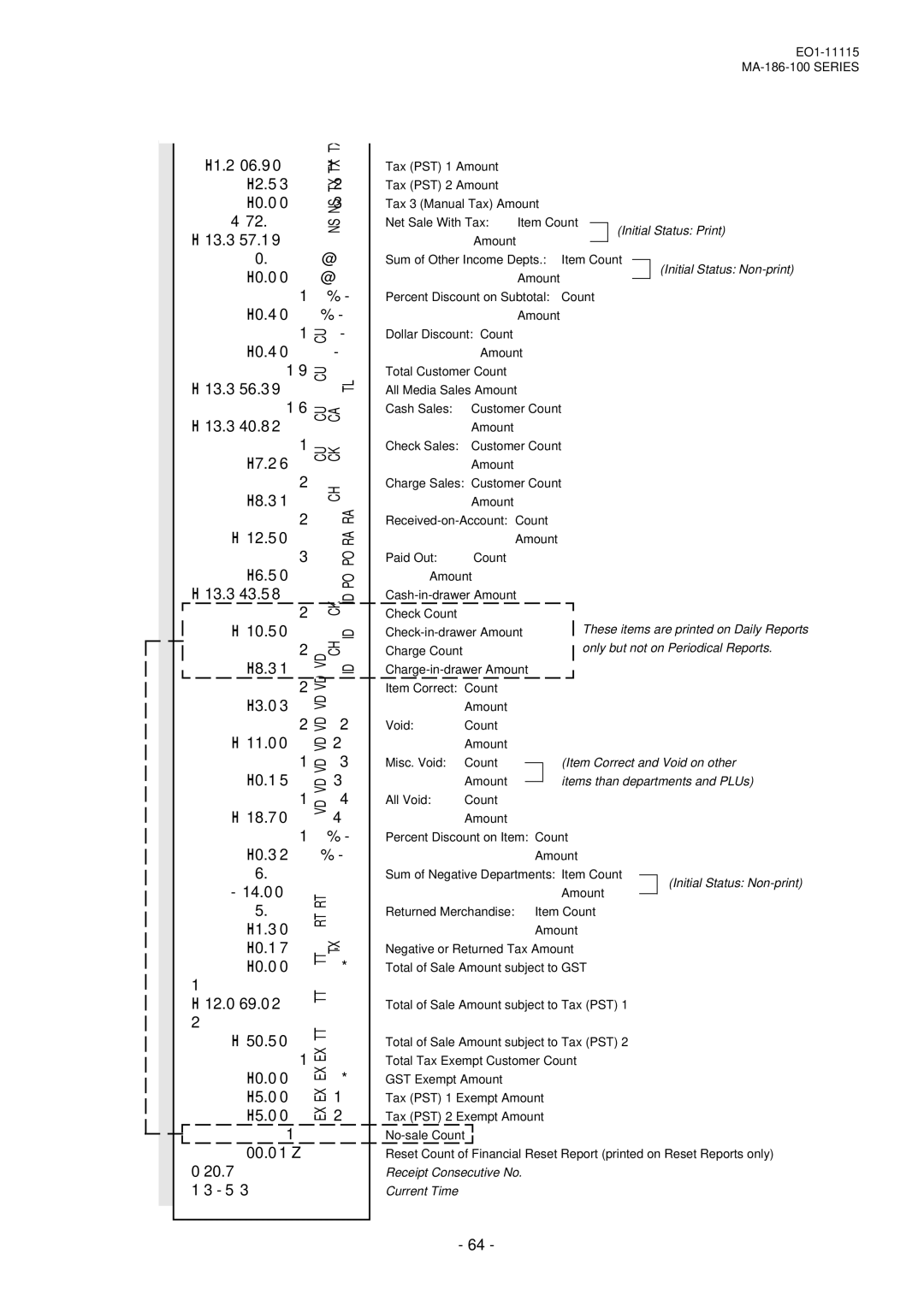

Report Sample Format

Daily Reports

Periodical Reports

Report Name Key Operation

05.7

Financial Read or Reset Report Daily or Periodical

05.7 42.7 31.0 12.0 75.5 10.0

00.0

14.0

20.7

Gross Sale

Memory Balance

Grand Total

Net Sale with Tax

Daily All PLU Read or Reset Report Thank you Call again

Daily Hourly Sales Read or Reset Report

Daily PLU Read or Reset Report All or Zone

Daily Zone PLU Read or Reset Report

Daily Cashier Read or Reset Report Thank you Call again

Cashier Read or Reset Report Daily or Periodical

Daily Media Sales & In-drawer Read Report

05.0

Daily Individual Department Read Report

33.4

10.0 00.0 10.0 67.1 32.2

Programming Procedure

System Option Setting

SET @/FOR

Address 1 refer to the next

05.- 28.- 9 01.2

Your Selection →

Address

Non-print Options

Vacant

Supplementary Description for Address

Optional Functions

Disc or Void key

Register. Refer to on page 82 for

Vacant Supplementary Description for Address

Tax Status

Addresses 4, 5 are vacant

AT/TL Key Function

Total

Vacant Cashing with no purchase, using this key

CHK TND Key Function Bit Content Selective Status

Over-tendering tendering an amount larger than the sale

Prohibited

Reset

Chg Key Function

Allowed Prohibited

TL, CHK TND, Chg

Address 1

Address 12 is vacant

Separate

Line Print Lines

Your Selection

Initial SET Bit Nos

GST Options ... for Canada

Subtotal

Resettable

Taxable Total

ANY Number Only Once

Times

Cashier Sign on & Sign OFF

Cashier Signing Operation optional function

Programming Requirements

10.1

Cashier Reports

Near-Full Warning in REG Mode

Electronic Journal E.J. Print optional function

Programming Requirement

Operation

Reading of the Remaining Lines of E.J. Memory

Electronic Journal Report

OFF SET

PL20.0 10.0 18.7 12.7

10.1 10.2

32.0

Operating Procedure

Program Data Verification

Department LC and Status Read

Department Preset Price Read

66.6 01.7

PLU Table Read

Other Programmed Data Read

System Option Read

02.2

Paper Roll Replacement and Other Maintenance

Replacing the Paper Roll When used for receipt

Replacing the Paper Roll When used for journal

EO1-11115 MA-186-100 Series

Replacing the Ink Ribbon

REG7 Offz SET

Replenishing Ink to the Store Name Stamp

Allow time for ink to saturate the stamp

Manual Drawer Release and Lock

Battery Exchange

Removing the Drawer

Changing the Layout of the Money Case

Media Slot

Trouble concerning Power Supply Power is not turned on

Case of the Power Failure

Troubleshooting

Been selected. . System Option Setting, Address 2 Bit 7 on

Printing as a whole is too light

Paper roll wrinkles

Printer prints nothing

Printing gets stained

Trouble during Normal Operations

Trouble concerning Drawer Drawer does not open

Trouble concerning Display Display displays nothing

Normal operations cannot be carried out

System Option Setting, Address 2 Bit 8 on

Error tone beeps

Setting, Address 16 Bit 1 on

Bit 1 on

Status Clear

Operating Procedure

Status Clear and Memory Clear Operations

27.1

OperationX

Sales Memory Clear

05.- 28.- 9 00.1

An All Memory Clear receipt is issued

All Memory Clear

Size of Paper Roll

Specifications

Amount and Counter Totals in Report Memory

Specifications are subject to change without notice

Memory Protection

Toshiba TEC Model MA-186-100

Date

Company Name Address City Country Your Name Phone ZIP Code

Unit Price QTY Amount Stamp

EO1-11115 MA-186-100 Series

Page

Page

TEC