For the transition period from

Washington, D.C

Annual report pursuant to or 15d

Securities Exchange Act

Explanatory Note

Table of Contents

Item 9A

Item 1. Business Overview

Part

Business environment

Developments in 2003

Page

2003

Strategic plan

Other business developments

Network components

Networking solutions

Networking solutions

Networking

Products

Wireless Networks

Core networking

Network access

Product development

Customers

Markets

Competition

Circuit and packet voice solutions

Enterprise Networks

Data networking and security solutions

Wireline Networks

Circuit and packet voice solutions

Markets

Optical Networks

Product development

Markets

Backlog

Sales and distribution

Sources and availability of materials

Product standards, certification and regulations

Strategic alliances, acquisitions and minority investments

Seasonality

Intellectual property

Research and development

Employee relations

Financial information by geographic area

Environmental matters

Risk factors

Working capital

Geographic Locations

Item 2. Properties

Type of Site

Number of Sites Owned Leased

Item 3. Legal Proceedings

Page

Page

Environmental matters

High Low

Item 4. Submission of Matters to a Vote of Security Holders

Dividends

Dividends

Canadian tax matters

Sales of unregistered securities

Item 6. Selected Financial Data Unaudited

2003 2002 2001 2000

Total

Revenues and cost of revenues adjustments

Other adjustments

Business overview

Accounting changes and recent accounting pronouncements

Our segments

Business overview

Our business

Our business environment

How we measure performance

Our strategic plan and outlook

Comprehensive Review and First Restatement

Consolidated results summary

Years ended December 31, 2002

Independent Review

Second Restatement

Revenues and cost of revenues

Other

Foreign exchange

Intercompany balances

Special charges

Dis operations

First, second and third quarters

Reclassifications

Page

Revenues and cost of revenues

Intercompany balances

EDC Support Facility

Revenue Independent Review

Personnel actions

Debt securities

Credit facilities and security agreements

Stock-based compensation plans

Shelf registration statement

Credit ratings

Regulatory actions and pending litigation

Shareholder rights plan

Evolution of our supply chain strategy

Other business developments

Real estate

Ownership adjustment in our French and German operations

Customer financing commitments

Sale of Entrust shares

Geographic revenues

Results of operations continuing operations

Customer financing arrangements

Segment revenues

2004

2003 vs

2002 vs

Wireless Networks revenues

2002 vs

Enterprise Networks revenues

2002 vs

Wireline Networks revenues

Optical Networks revenues

2002 vs

For the years ended December 2003 vs 2002 vs 2001

Wireless Networks

Gross profit and gross margin

Segment gross profit and gross margin

Optical Networks

Wireline Networks

Enterprise Networks

For the years ended December 2003 vs 2002 vs 2001 $ Change

Selling, general and administrative expense

Segment selling, general and administrative expense

Operating expenses

Research and development expense

Segment research and development expense

Deferred stock option compensation

Segment contribution margin

Segment Management EBT

Amortization of intangibles

Special charges

Page

Other income expense net

Gain loss on sale of businesses and assets

Net earnings loss from continuing operations

Results of operations dis operations

Interest expense

Income tax benefit expense

2003 2002

Liquidity and capital resources

Cash flows

Page

Uses of liquidity

Obligations under special charges

Contractual cash obligations

Purchase obligations

Outsourcing contracts

Other long-term liabilities reflected on the balance sheets

JDS purchase arrangement

Customer financing

Pension, post-retirement and post-employment obligations

Credit facilities

Joint ventures/minority interests

Dis operations

Sources of liquidity

Shelf registration statement and base shelf prospectus

Bid, performance related and other bonds

Off-balance sheet arrangements

Credit ratings

Other indemnifications or guarantees

Revenue recognition

Application of critical accounting estimates

Provisions for doubtful accounts

Provisions for inventory

Tax asset valuation

Income taxes

Goodwill valuation

Tax contingencies

Pension and post-retirement benefits

Change in Assumption

Special charges

Accounting changes

Accounting changes and recent accounting pronouncements

Other contingencies

Recent accounting pronouncements

Market risk

Equity price risk

Risks relating to our restatements and related matters

Legal proceedings

Risk factors/forward looking statements

Page

Operations, financial condition and liquidity

Page

Page

Page

Page

Risks relating to our business

Page

Page

Page

Page

104

Page

Page

Page

Page

Page

Page

Page

Index to Consolidated Financial Statements

Report of Independent Registered Chartered Accountants

Nortel Networks Corporation

Assets

Consolidated Balance Sheets as of December

Total comprehensive income loss for the year

Cash flows from used in operating activities

Principles of consolidation

Nortel Networks Corporation

Significant accounting policies

Basis of presentation

Revenue recognition

Translation of foreign currencies

Research and development

Restricted cash and cash equivalents

Income taxes

Earnings loss per common share

Cash and cash equivalents

Plant and equipment

Receivables sales

Investments

Goodwill

Long-lived assets held and used

Derivative financial instruments

Warranty costs

Intangible assets

Pension, post-retirement and post-employment benefits

Stock-based compensation

2003 2002 2001

2003 2002 2001 Black-Scholes weighted-average assumptions

Weighted-average stock option fair value per option granted

Recent accounting pronouncements

Comparative figures

Second Restatement

Restatement

First Restatement

Page

Page

121 Total restatement adjustments 289 183 314 272

Page

Revenues and cost of revenues

Revenues Cost of revenues 2002 2001

Revenue recognition adjustments

Other adjustments

Application of SAB 101 or SOP

Foreign exchange

Other revenue recognition adjustments

Presentation errors

Reseller transactions

Goodwill impairment 980 Nplc business acquisition

Other errors

Functional currency designation

Intercompany transaction designation

Other

Goodwill impairment other acquisitions

Other special charges

Research and development expense

Selling, general and administrative expense

2002 2001 Other adjustments

Cost of revenues

Reclassifications

Other income expense net

Interest expense

Income taxes and minority interests

Decrease to net loss on disposal of operations net of tax

Dis operations

Balance sheet

Other adjustments

Accounting changes

Guarantees

Consolidated Balance Sheet as of December 31

Consolidation of variable interest entities

Asset retirement obligations

Page

Accounting for goodwill and other intangible assets

Determining whether an arrangement contains a lease

Pensions and other post-retirement benefits

Stock-based compensation

23,270

Consolidated statements of operations

Derivative financial instruments

Consolidated financial statement details

Other current assets

Consolidated balance sheets

Accounts receivable net

Inventories net

Other accrued liabilities

Wireless Enterprise Wireline

Goodwill

Intangible assets net

Change in operating assets and liabilities

Interest and taxes paid recovered

Other liabilities

Minority interests in subsidiary companies

Segment information General description

Receivables sales

Contribution margin

Segments

Product revenues

2003 2002 2001 Revenues

Long-lived assets

Geographic information

Year ended December 31

Special charges

During December 2003 Lease costs a

Accrued Costs Payments Adjustments Balance as Incurred Made

January

Year ended December 31

Income taxes

2003 2002 2001

Credits b Total

Employee benefit plans

Net Operating Capital Tax Losses

Page

Change in plan assets

2003 2002 Change in benefit obligation

Defined benefit plans 20032002

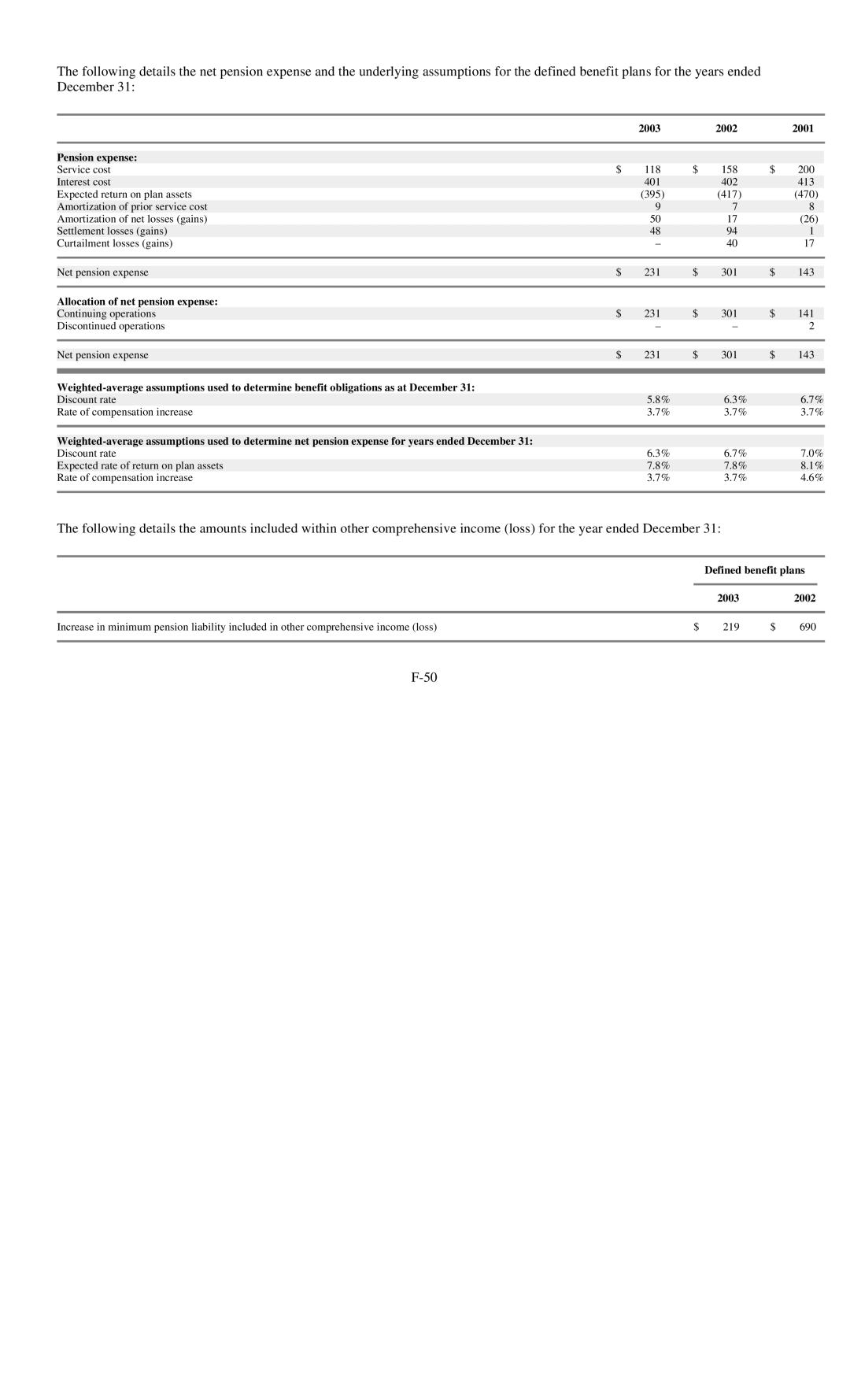

2003 2002 2001 Pension expense

Allocation of net pension expense

2003 2002 Target Actual

2003 2002 2001 Post-retirement benefit cost

Page

Compensation

Other acquisitions

Net tangible Deferred Closing date Purchase

Acquisition Price Goodwill Technology

High speed module operations

Service commerce operations

Divestitures

Sale of Arris Group, Inc. investment

Long-term debt

Sale of Clarify

Closures

Long-term debt, credit and support facilities

Credit facilities

Foreign currency risk

Support facility

Financial instruments and hedging activities

Risk management

Cross currency coupon swap contracts

Equity price risk

Fair value

2003 2002 Interest rate swap contracts

Fair

Credit risk

Other derivatives

Receivables sales

Intellectual property indemnification obligations

Guarantees

Business sale and business combination agreements

Third party debt agreements

Lease agreements

Bid, performance related and other bonds

Other indemnification agreements

Product warranties

Commitments

Venture capital financing

Customer financing

Leases Contracts Charges Income

Purchase commitments

Operating leases and other commitments

Operating Outsourcing

Capital stock Common shares

Restricted cash and cash equivalents

Prepaid forward purchase contracts

Earnings loss per common share

Preferred shares

Dividends

Shareholder rights plan

Stock-based compensation plans Stock options

Accumulated other comprehensive loss

Maximum

Options

Restricted stock unit plan

Employee stock purchase plans

Directors’ deferred share compensation plans

Dis operations

2003 2002 2001 Cash flows from used in dis operations

Activity

Activity

Contingencies

Related party transactions

Page

Page

Environmental matters

Subsequent events

EDC Support Facility

Credit facilities and security agreements

Stock exchanges

Directory and operator services business

Debt securities

Stock-based compensation plans

Evolution of Nortel Networks supply chain strategy

Supplemental consolidating financial information

Nortel Non

Nortel Non

612 450 15,364 380

Supplemental Consolidating Balance Sheets as of December 31

182 240 413 388 262 16,961

Nortel Non Networks

818 592 487 525 768

572 111 648 206

Quarterly Financial Data Unaudited

Report of Independent Registered Chartered Accountants

Beginning To costs End

Schedule Consolidated

Additions

Charged

Item 9A. Controls and Procedures

114

Scope of the Independent Review

Summary of Findings of the Independent Review

Page

Page

Page

Governing Principles for Remedial Measures

Page

Page

Page

Page

Additional Background

Page

Second Restatement Independent Review

Second Restatement Process

Page

Fixed or determinable fees-An increase of $133 million

Page

Principal Adjustments

Page

Page

Revenue Independent Review

Remedial Measures

Page

Name Age Position with the Company

Page

Page

Page

Name and age Office and position currently held Appointment

Year

Subsequent appointment

Code of ethics and other corporate governance matters

Beneficial ownership reporting compliance

Audit committee financial expert

Audit committee

Summary compensation table

Item 11. Executive Compensation

Salary Bonus

Long Term Compensation Name Principal Position

Year

Annual Compensation

147

148

149

150

Option grants in 2004

Annual cash incentive awards

Realized $ Exercisable

Common

Value of Unexercised

In-the-Money

152

Exercisable Unexercisable

Dunn Debon Spradley Bolouri DeRoma

Maturation or Payout Threshold# Target# Maximum# #12

Long-term incentive plans awards in last two fiscal years

Retirement plans

Page

Total Earnings

Certain employment arrangements

Page

Compensation of directors

Security ownership of directors and management

Compensation committee interlocks and insider participation

Title of Class of Security

Name of Beneficial Owner

163

Plan category

Equity compensation plan information

Indebtedness of management

Item 13. Certain Relationships and Related Transactions

January 1

Item 14. Principal Accountant Fees and Services

Table of Indebtedness of Directors and Executive Officers

Audit Fees

All Other Fees

Audit-Related Fees

Tax Fees

Reports on Form 8-K

Page

Page

Page

Number Description

Exhibit Index

Exhibit

Number Description

Number Description

Number Description

Number Description

Number Description

Subsidiary of Nortel Networks Limited

Report of Independent Registered Public Accounting Firm

182

183

184

Nortel Networks S.A

Nortel Networks S.A

Use of estimates

Research and development

Cash and cash equivalents

Plant and equipment

Financial instruments

State sponsored pension plans

192

Restatement

Restated

Second Pooling Previously

Interest

Reported

Interest Pooled Reported

Accruals

Net increase decrease of cost of revenues

Accruals and provisions

Net increase decrease to net loss

2002 2001 Increase decrease of cost of revenues

Net increase decrease of research and development

Other expenses

Related party transactions

2002 2001 Increase decrease of research and development

Plant and equipment

Residual profit sharing

Related party revenues and cost of revenues

Related party out of balances

Interest on long- term debt

Costs of revenues, research and development expense

Consolidated Balance Sheets as of December 31

Guarantees

Consolidation of variable interest entities

Asset retirement obligations

Accounting for goodwill and other intangible assets

Determining whether an arrangement contains a lease

Stock-based compensation

Derivative financial instruments

204

Networks

Wireless

Wireline Optical

Investment at cost net

Long-term debt

Segment information General description

Major customers

Contract

Geographic information

Long-lived assets

2003 2002 2001 External revenues

Expected sublease revenue on leases

Income taxes

Matra Nortel Communication Distribution

Acquisitions and divestitures Acquisitions

Northern Telecom France

Nortel Networks France

Other profit sharing agreements

Financing transactions

Royalties

Sale of investment

Share pledge

Financial instruments

Joint ventures/minority interests/disposed business

Leases Contracts

Shareholders’ equity

Plan a

Outstanding Weighted Options

Nortel Networks Company Savings Plan

Security agreements

Page

Signatures

Directors