Washington, D.C

Annual report pursuant to or 15d

Securities Exchange Act

For the transition period from

Explanatory Note

Table of Contents

Item 9A

Part

Item 1. Business Overview

Developments in 2003

Business environment

Page

Other business developments

Strategic plan

2003

Networking solutions

Networking solutions

Networking

Network components

Wireless Networks

Products

Product development

Network access

Core networking

Markets

Customers

Enterprise Networks

Circuit and packet voice solutions

Competition

Data networking and security solutions

Wireline Networks

Circuit and packet voice solutions

Markets

Optical Networks

Product development

Markets

Sales and distribution

Backlog

Product standards, certification and regulations

Sources and availability of materials

Seasonality

Strategic alliances, acquisitions and minority investments

Research and development

Intellectual property

Employee relations

Environmental matters

Financial information by geographic area

Working capital

Risk factors

Item 2. Properties

Type of Site

Number of Sites Owned Leased

Geographic Locations

Item 3. Legal Proceedings

Page

Page

Environmental matters

Item 4. Submission of Matters to a Vote of Security Holders

High Low

Dividends

Canadian tax matters

Sales of unregistered securities

Dividends

Item 6. Selected Financial Data Unaudited

2003 2002 2001 2000

Revenues and cost of revenues adjustments

Total

Other adjustments

Business overview

Accounting changes and recent accounting pronouncements

Our business

Business overview

Our segments

Our business environment

How we measure performance

Our strategic plan and outlook

Consolidated results summary

Comprehensive Review and First Restatement

Second Restatement

Independent Review

Years ended December 31, 2002

Revenues and cost of revenues

Foreign exchange

Intercompany balances

Special charges

Other

Reclassifications

First, second and third quarters

Dis operations

Page

Revenues and cost of revenues

Intercompany balances

Personnel actions

Revenue Independent Review

EDC Support Facility

Credit facilities and security agreements

Debt securities

Shelf registration statement

Credit ratings

Regulatory actions and pending litigation

Stock-based compensation plans

Other business developments

Evolution of our supply chain strategy

Shareholder rights plan

Ownership adjustment in our French and German operations

Customer financing commitments

Sale of Entrust shares

Real estate

Results of operations continuing operations

Customer financing arrangements

Segment revenues

Geographic revenues

2002 vs

2003 vs

2004

Wireless Networks revenues

2002 vs

Enterprise Networks revenues

2002 vs

Wireline Networks revenues

Optical Networks revenues

2002 vs

Wireless Networks

Gross profit and gross margin

Segment gross profit and gross margin

For the years ended December 2003 vs 2002 vs 2001

Enterprise Networks

Wireline Networks

Optical Networks

Selling, general and administrative expense

Segment selling, general and administrative expense

Operating expenses

For the years ended December 2003 vs 2002 vs 2001 $ Change

Research and development expense

Segment research and development expense

Segment contribution margin

Segment Management EBT

Amortization of intangibles

Deferred stock option compensation

Special charges

Page

Gain loss on sale of businesses and assets

Other income expense net

Results of operations dis operations

Interest expense

Income tax benefit expense

Net earnings loss from continuing operations

Cash flows

Liquidity and capital resources

2003 2002

Page

Uses of liquidity

Contractual cash obligations

Purchase obligations

Outsourcing contracts

Obligations under special charges

JDS purchase arrangement

Customer financing

Pension, post-retirement and post-employment obligations

Other long-term liabilities reflected on the balance sheets

Joint ventures/minority interests

Dis operations

Sources of liquidity

Credit facilities

Shelf registration statement and base shelf prospectus

Credit ratings

Off-balance sheet arrangements

Bid, performance related and other bonds

Other indemnifications or guarantees

Application of critical accounting estimates

Revenue recognition

Provisions for doubtful accounts

Provisions for inventory

Income taxes

Tax asset valuation

Tax contingencies

Goodwill valuation

Pension and post-retirement benefits

Special charges

Change in Assumption

Other contingencies

Accounting changes and recent accounting pronouncements

Accounting changes

Recent accounting pronouncements

Market risk

Equity price risk

Risk factors/forward looking statements

Legal proceedings

Risks relating to our restatements and related matters

Page

Operations, financial condition and liquidity

Page

Page

Page

Page

Risks relating to our business

Page

Page

Page

Page

104

Page

Page

Page

Page

Page

Page

Page

Index to Consolidated Financial Statements

Report of Independent Registered Chartered Accountants

Nortel Networks Corporation

Consolidated Balance Sheets as of December

Assets

Total comprehensive income loss for the year

Cash flows from used in operating activities

Nortel Networks Corporation

Significant accounting policies

Basis of presentation

Principles of consolidation

Translation of foreign currencies

Revenue recognition

Research and development

Income taxes

Earnings loss per common share

Cash and cash equivalents

Restricted cash and cash equivalents

Investments

Receivables sales

Plant and equipment

Long-lived assets held and used

Goodwill

Warranty costs

Intangible assets

Pension, post-retirement and post-employment benefits

Derivative financial instruments

Stock-based compensation

Weighted-average stock option fair value per option granted

2003 2002 2001 Black-Scholes weighted-average assumptions

2003 2002 2001

Comparative figures

Recent accounting pronouncements

First Restatement

Restatement

Second Restatement

Page

Page

121 Total restatement adjustments 289 183 314 272

Page

Revenues and cost of revenues

Revenue recognition adjustments

Other adjustments

Application of SAB 101 or SOP

Revenues Cost of revenues 2002 2001

Other revenue recognition adjustments

Presentation errors

Reseller transactions

Foreign exchange

Other errors

Functional currency designation

Intercompany transaction designation

Goodwill impairment 980 Nplc business acquisition

Other special charges

Goodwill impairment other acquisitions

Other

Selling, general and administrative expense

2002 2001 Other adjustments

Cost of revenues

Research and development expense

Other income expense net

Interest expense

Income taxes and minority interests

Reclassifications

Dis operations

Decrease to net loss on disposal of operations net of tax

Other adjustments

Balance sheet

Consolidated Balance Sheet as of December 31

Guarantees

Accounting changes

Asset retirement obligations

Consolidation of variable interest entities

Page

Determining whether an arrangement contains a lease

Pensions and other post-retirement benefits

Stock-based compensation

Accounting for goodwill and other intangible assets

23,270

Consolidated financial statement details

Derivative financial instruments

Consolidated statements of operations

Consolidated balance sheets

Accounts receivable net

Inventories net

Other current assets

Wireless Enterprise Wireline

Goodwill

Intangible assets net

Other accrued liabilities

Interest and taxes paid recovered

Other liabilities

Minority interests in subsidiary companies

Change in operating assets and liabilities

Receivables sales

Segment information General description

Segments

Product revenues

2003 2002 2001 Revenues

Contribution margin

Geographic information

Long-lived assets

Special charges

Year ended December 31

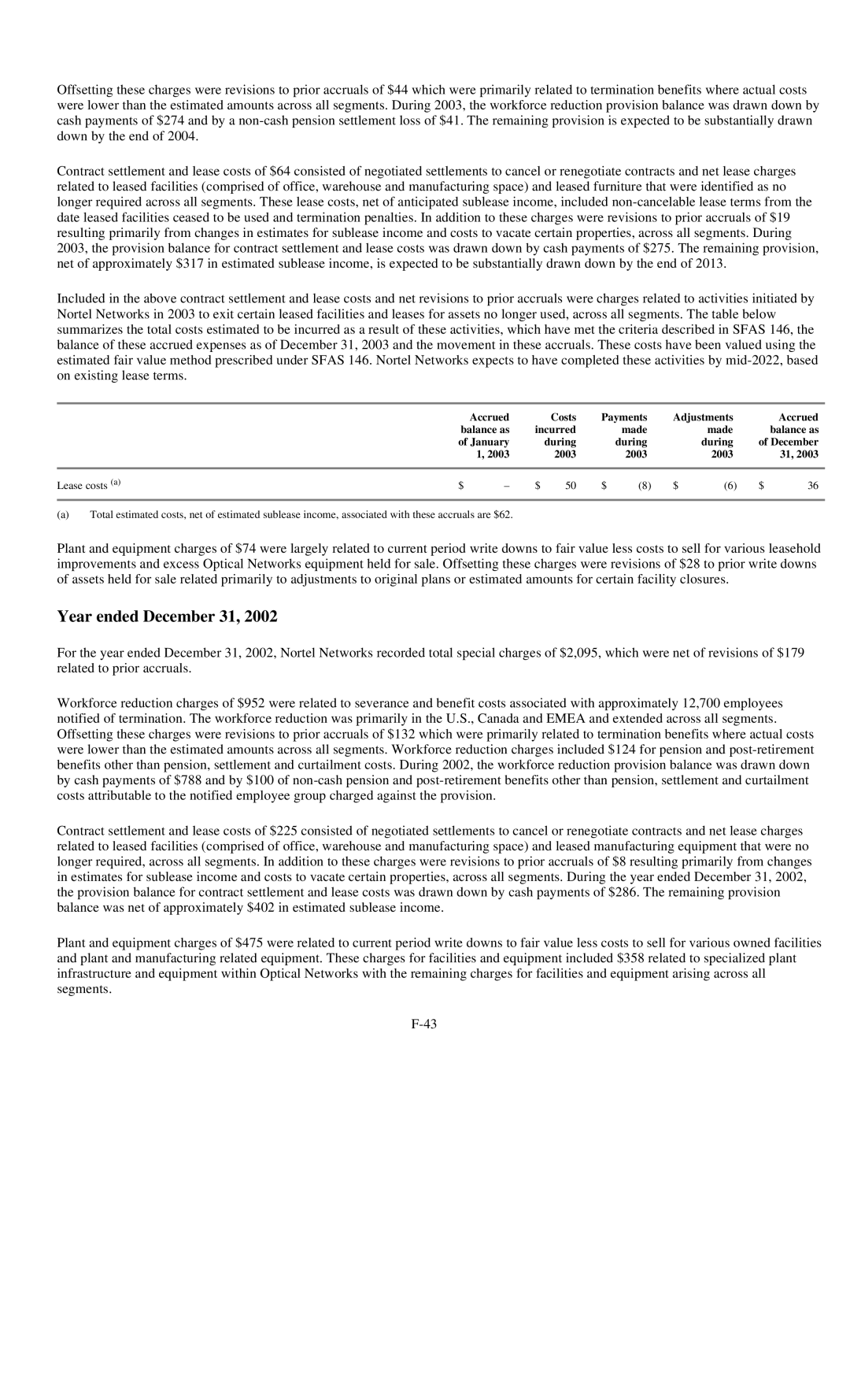

January

Accrued Costs Payments Adjustments Balance as Incurred Made

During December 2003 Lease costs a

Year ended December 31

Income taxes

2003 2002 2001

Net Operating Capital Tax Losses

Employee benefit plans

Credits b Total

Page

2003 2002 Change in benefit obligation

Change in plan assets

Allocation of net pension expense

2003 2002 2001 Pension expense

Defined benefit plans 20032002

2003 2002 2001 Post-retirement benefit cost

2003 2002 Target Actual

Page

Other acquisitions

Net tangible Deferred Closing date Purchase

Acquisition Price Goodwill Technology

Compensation

Service commerce operations

Divestitures

Sale of Arris Group, Inc. investment

High speed module operations

Sale of Clarify

Closures

Long-term debt, credit and support facilities

Long-term debt

Credit facilities

Support facility

Financial instruments and hedging activities

Risk management

Foreign currency risk

Equity price risk

Fair value

2003 2002 Interest rate swap contracts

Cross currency coupon swap contracts

Credit risk

Other derivatives

Receivables sales

Fair

Business sale and business combination agreements

Guarantees

Intellectual property indemnification obligations

Lease agreements

Third party debt agreements

Other indemnification agreements

Product warranties

Commitments

Bid, performance related and other bonds

Customer financing

Venture capital financing

Purchase commitments

Operating leases and other commitments

Operating Outsourcing

Leases Contracts Charges Income

Restricted cash and cash equivalents

Capital stock Common shares

Prepaid forward purchase contracts

Preferred shares

Dividends

Shareholder rights plan

Earnings loss per common share

Accumulated other comprehensive loss

Stock-based compensation plans Stock options

Maximum

Restricted stock unit plan

Options

Directors’ deferred share compensation plans

Employee stock purchase plans

Dis operations

Activity

2003 2002 2001 Cash flows from used in dis operations

Activity

Related party transactions

Contingencies

Page

Page

Environmental matters

Subsequent events

EDC Support Facility

Credit facilities and security agreements

Directory and operator services business

Debt securities

Stock-based compensation plans

Stock exchanges

Evolution of Nortel Networks supply chain strategy

Supplemental consolidating financial information

Nortel Non

Nortel Non

612 450 15,364 380

Supplemental Consolidating Balance Sheets as of December 31

182 240 413 388 262 16,961

Nortel Non Networks

818 592 487 525 768

572 111 648 206

Quarterly Financial Data Unaudited

Report of Independent Registered Chartered Accountants

Schedule Consolidated

Additions

Charged

Beginning To costs End

Item 9A. Controls and Procedures

114

Scope of the Independent Review

Summary of Findings of the Independent Review

Page

Page

Page

Governing Principles for Remedial Measures

Page

Page

Page

Page

Additional Background

Page

Second Restatement Independent Review

Second Restatement Process

Page

Fixed or determinable fees-An increase of $133 million

Page

Principal Adjustments

Page

Page

Revenue Independent Review

Remedial Measures

Page

Name Age Position with the Company

Page

Page

Page

Year

Name and age Office and position currently held Appointment

Subsequent appointment

Beneficial ownership reporting compliance

Audit committee financial expert

Audit committee

Code of ethics and other corporate governance matters

Item 11. Executive Compensation

Summary compensation table

Long Term Compensation Name Principal Position

Year

Annual Compensation

Salary Bonus

147

148

149

150

Annual cash incentive awards

Option grants in 2004

Common

Value of Unexercised

In-the-Money

Realized $ Exercisable

152

Dunn Debon Spradley Bolouri DeRoma

Exercisable Unexercisable

Long-term incentive plans awards in last two fiscal years

Maturation or Payout Threshold# Target# Maximum# #12

Retirement plans

Page

Total Earnings

Certain employment arrangements

Page

Compensation of directors

Compensation committee interlocks and insider participation

Security ownership of directors and management

Name of Beneficial Owner

Title of Class of Security

163

Equity compensation plan information

Plan category

Item 13. Certain Relationships and Related Transactions

Indebtedness of management

Item 14. Principal Accountant Fees and Services

Table of Indebtedness of Directors and Executive Officers

Audit Fees

January 1

Tax Fees

Audit-Related Fees

All Other Fees

Reports on Form 8-K

Page

Page

Page

Exhibit

Exhibit Index

Number Description

Number Description

Number Description

Number Description

Number Description

Number Description

Subsidiary of Nortel Networks Limited

Report of Independent Registered Public Accounting Firm

182

183

184

Nortel Networks S.A

Nortel Networks S.A

Use of estimates

Research and development

Cash and cash equivalents

Plant and equipment

State sponsored pension plans

Financial instruments

192

Restatement

Second Pooling Previously

Interest

Reported

Restated

Accruals

Interest Pooled Reported

Accruals and provisions

Net increase decrease to net loss

2002 2001 Increase decrease of cost of revenues

Net increase decrease of cost of revenues

Other expenses

Related party transactions

2002 2001 Increase decrease of research and development

Net increase decrease of research and development

Residual profit sharing

Related party revenues and cost of revenues

Related party out of balances

Plant and equipment

Costs of revenues, research and development expense

Interest on long- term debt

Guarantees

Consolidated Balance Sheets as of December 31

Asset retirement obligations

Consolidation of variable interest entities

Stock-based compensation

Determining whether an arrangement contains a lease

Accounting for goodwill and other intangible assets

Derivative financial instruments

204

Wireless

Wireline Optical

Investment at cost net

Networks

Long-term debt

Segment information General description

Major customers

Geographic information

Long-lived assets

2003 2002 2001 External revenues

Contract

Expected sublease revenue on leases

Income taxes

Acquisitions and divestitures Acquisitions

Northern Telecom France

Nortel Networks France

Matra Nortel Communication Distribution

Other profit sharing agreements

Sale of investment

Royalties

Financing transactions

Financial instruments

Share pledge

Joint ventures/minority interests/disposed business

Shareholders’ equity

Leases Contracts

Plan a

Outstanding Weighted Options

Nortel Networks Company Savings Plan

Security agreements

Page

Signatures

Directors