On September 30, 2001, Nortel Networks France sold its subsidiary MNCD to a third party. Under this transaction, Nortel Networks France has taken certain commitments relative to the amount of the net assets of MNCD as of September 30, 2001. Nortel Networks France has already had to make several payments under this commitment. An amount of 2,226 was accrued and is included in “Other accrued liabilities”. Further costs could be incurred in relation to this transaction that cannot be reasonably estimated at this time.

Operating leases and other commitments

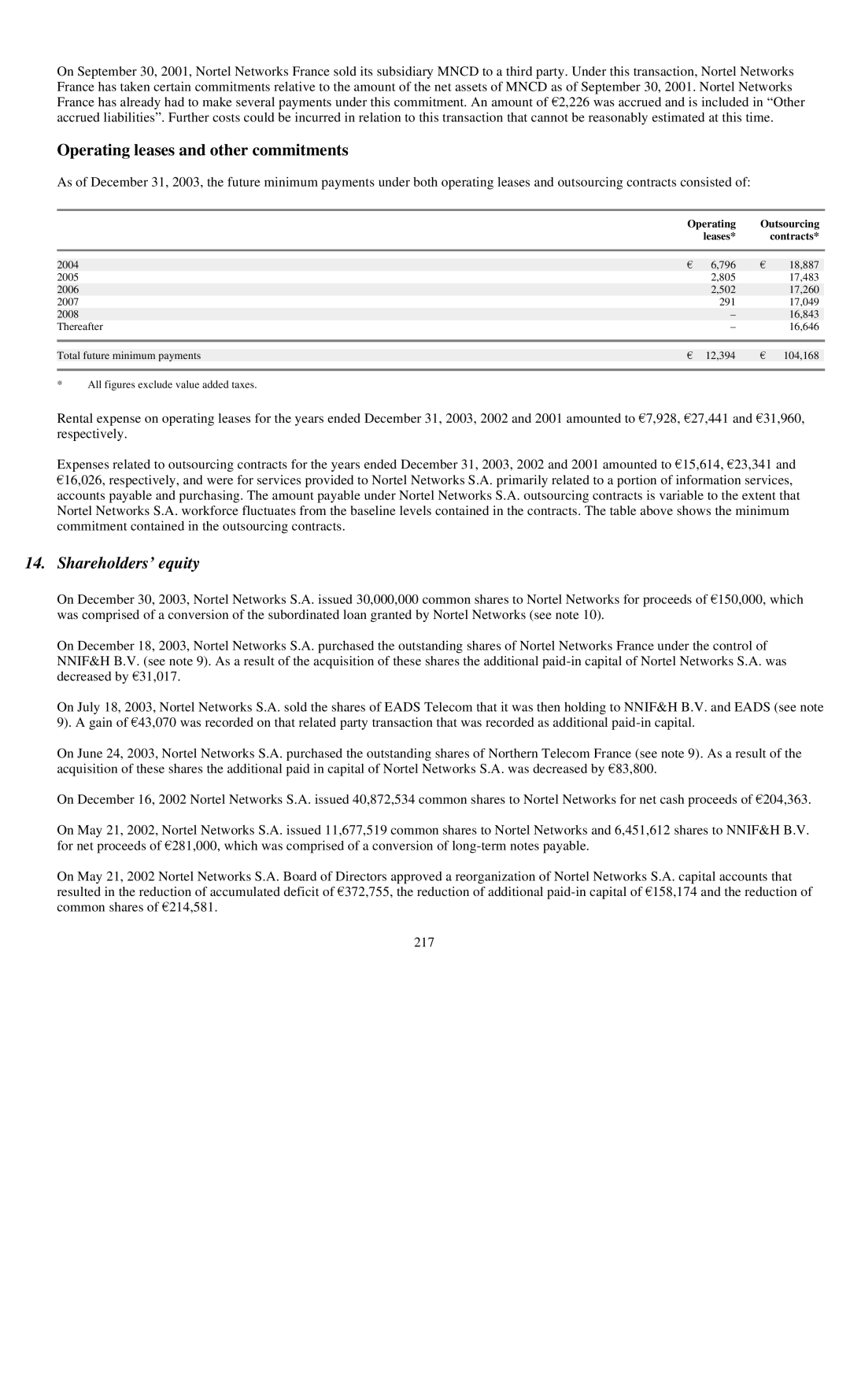

As of December 31, 2003, the future minimum payments under both operating leases and outsourcing contracts consisted of:

|

|

| Operating | Outsourcing |

|

|

| leases* | contracts* |

|

|

|

|

|

|

|

|

|

|

2004 |

|

| 6,796 | 18,887 |

2005 |

|

| 2,805 | 17,483 |

2006 |

|

| 2,502 | 17,260 |

2007 |

|

| 291 | 17,049 |

2008 |

| € | – | 16,843 |

Thereafter |

| – | 16,646 | |

|

|

|

|

|

Total future minimum payments |

| 12,394 | 104,168 | |

|

|

|

|

|

* | All figures exclude value added taxes. |

|

|

|

Rental expense on operating leases for the years ended December 31, 2003, 2002 and 2001 amounted to 7,928, | 27,441 and | 31,960, | ||

respectively. |

|

|

| |

Expenses related to outsourcing contracts for the years ended December 31, 2003, 2002 and 2001 amounted to | 15,614, 23,341 and | |||

On July 18, 2003, Nortel Networks S.A. sold the shares of EADS Telecom that it was then holding to NNIF&H€B.V.€and EADS€(see note 9). A gain of €43,070 was recorded on that related party transaction that was recorded as additional

acquisition of these shares the additional paid in capital of Nortel Networks S.A. was decreased by 83,800. €€

16,026, respectively, and were for services provided to Nortel Networks S.A. primarily related to a portion of information services, accounts payable and purchasing. The amount payable under Nortel Networks S.A. outsourcing contracts is variable to the extent that

Nortel Networks S.A. workforce fluctuates from the baseline levels contained in the contracts. The table above shows the minimum commitment contained in the outsourcing contracts.

14. Shareholders’ equity

On December 30, 2003, Nortel Networks S.A. issued 30,000,000 common shares to Nortel Networks for proceeds of 150,000, which was comprised of a conversion of the subordinated loan granted by Nortel Networks (see note 10).

On December 18, 2003, Nortel Networks S.A. purchased the outstanding shares of Nortel Networks France under the control of

NNIF&H B.V. (see note 9). As a result of the acquisition of these shares the additional

On June 24, 2003, Nortel Networks S.A. purchased the outstanding shares of Northern Telecom France (see note 9). As a result of the

On December 16, 2002 Nortel Networks S.A. issued 40,872,534 common shares to Nortel Networks for net cash proceeds of 204,363.

On May 21, 2002, Nortel Networks S.A. issued 11,677,519 common shares to Nortel Networks and 6,451,612 shares to NNIF&H B.V. for net proceeds of 281,000, which was comprised of a conversion of

On May 21, 2002 Nortel Networks S.A. Board of Directors approved a reorganization of Nortel Networks S.A. capital accounts that

resulted in the reduction of accumulated deficit of |

| 372,755, the reduction of additional | 158,174 and the reduction of | |||

common shares of €€214,581. | € | 217 | € | € | € | € |