On August 3, 2001, Nortel Networks announced the completion of the previously announced transfer of its ownership interest in Arris Interactive to Arris Group, ANTEC Corporation’s new parent company. As a result, as of December 31, 2001, Nortel Networks owned a

49.2percent

On July 25, 2001, Nortel Networks completed a transaction with GE Industrial Systems Technology Management Inc., a division of General Electric Company, to sell the Lentronics JungleMUX SONET multiplexer and

21. Related party transactions

In the ordinary course of business, Nortel Networks engages in transactions with certain of its

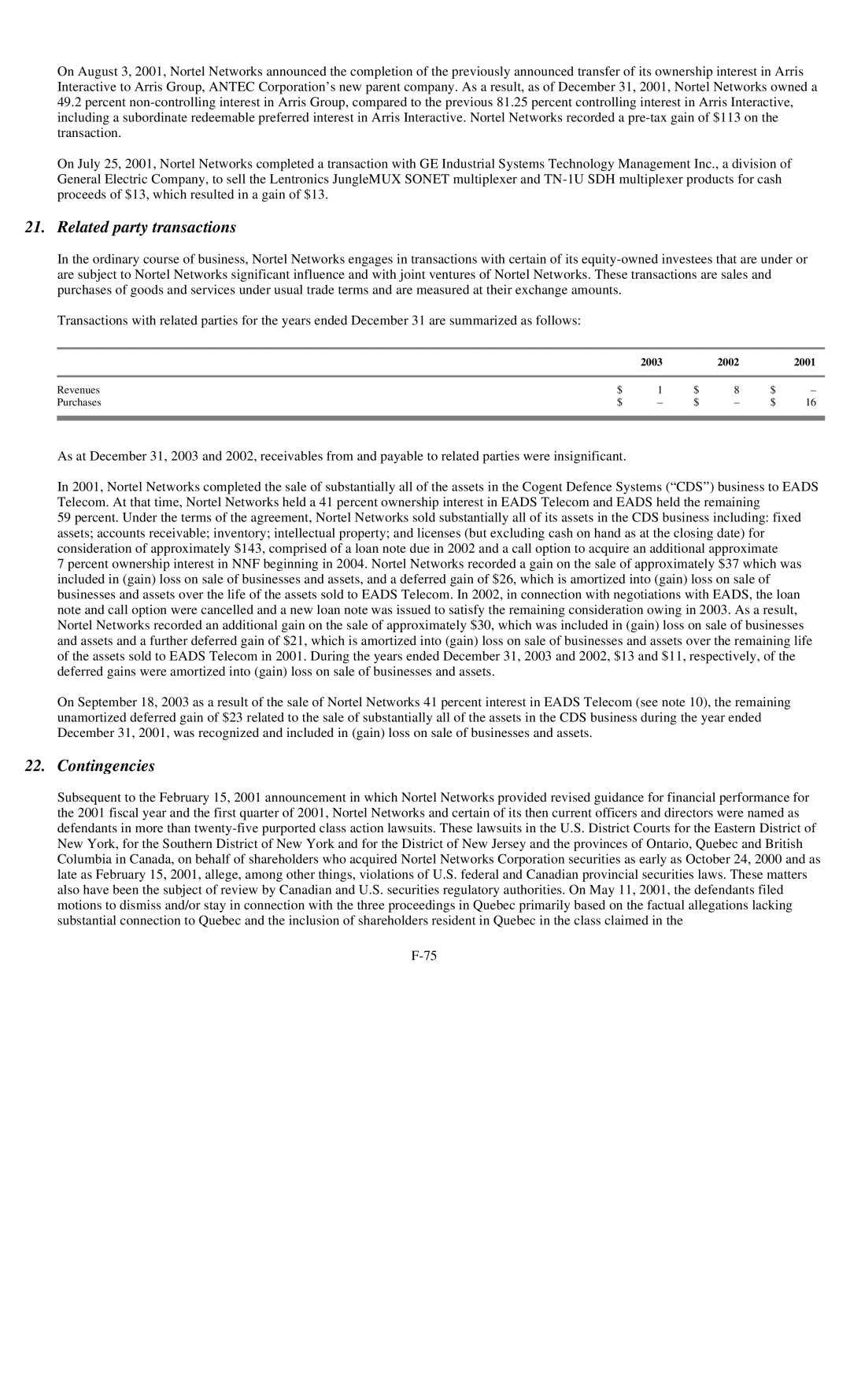

Transactions with related parties for the years ended December 31 are summarized as follows:

|

| 2003 |

| 2002 |

| 2001 |

|

|

|

|

|

|

|

Revenues | $ | 1 | $ | 8 | $ | – |

Purchases | $ | – | $ | – | $ | 16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As at December 31, 2003 and 2002, receivables from and payable to related parties were insignificant.

In 2001, Nortel Networks completed the sale of substantially all of the assets in the Cogent Defence Systems (“CDS”) business to EADS Telecom. At that time, Nortel Networks held a 41 percent ownership interest in EADS Telecom and EADS held the remaining

59 percent. Under the terms of the agreement, Nortel Networks sold substantially all of its assets in the CDS business including: fixed assets; accounts receivable; inventory; intellectual property; and licenses (but excluding cash on hand as at the closing date) for consideration of approximately $143, comprised of a loan note due in 2002 and a call option to acquire an additional approximate

7 percent ownership interest in NNF beginning in 2004. Nortel Networks recorded a gain on the sale of approximately $37 which was included in (gain) loss on sale of businesses and assets, and a deferred gain of $26, which is amortized into (gain) loss on sale of businesses and assets over the life of the assets sold to EADS Telecom. In 2002, in connection with negotiations with EADS, the loan note and call option were cancelled and a new loan note was issued to satisfy the remaining consideration owing in 2003. As a result, Nortel Networks recorded an additional gain on the sale of approximately $30, which was included in (gain) loss on sale of businesses and assets and a further deferred gain of $21, which is amortized into (gain) loss on sale of businesses and assets over the remaining life of the assets sold to EADS Telecom in 2001. During the years ended December 31, 2003 and 2002, $13 and $11, respectively, of the deferred gains were amortized into (gain) loss on sale of businesses and assets.

On September 18, 2003 as a result of the sale of Nortel Networks 41 percent interest in EADS Telecom (see note 10), the remaining unamortized deferred gain of $23 related to the sale of substantially all of the assets in the CDS business during the year ended December 31, 2001, was recognized and included in (gain) loss on sale of businesses and assets.

22. Contingencies

Subsequent to the February 15, 2001 announcement in which Nortel Networks provided revised guidance for financial performance for the 2001 fiscal year and the first quarter of 2001, Nortel Networks and certain of its then current officers and directors were named as defendants in more than