User Guide

HP Prime Graphing Calculator

Product Regulatory & Environment Information

Edition1 Part Number NW280-2001 Legal Notices

Edition

Printing History

July

Page

Contents

Plot view

Application Library App views Symbolic view

Common operations in Plot view Zoom Trace

Function app

Computed statistics

233

Getting started with the Polar app 277

Getting started with the Parametric app 271

Variables

Lists

Status messages

Basic integer arithmetic

Manual conventions

Preface

Function, Polar, Parametric, Ans, etc

Before starting

Getting started

On/off, cancel operations

Display

Sections of the display

You are working in CAS view, not

Be entered in uppercase when a

Uppercase when a key is pressed

Lowercase when a key is pressed

Navigation

Touch gestures

Keyboard

Context-sensitive menu

Primary entry and edit keys are

Entry and edit keys

Characters

Minute, or second symbol accord

Comparison operators and Bool

Ean operators

Shift keys

Adding text

Math template

Math keys

Math shortcuts

Original decimal representation

Fractions Hexagesimal numbers

236…. Press conce to see 219602 and again to see

Pressing ca third time will cycle back to

Return home H Enter 4BQ13 s6B23n 3BQ5

EEX key powers

To select from a menu

Menus

Toolbox menus

Input forms

Alternatively, select the field and tap

Home settings

System-wide settings

Becomes 1.23E9 in Engineer

Becomes 123.46

Fixed 2 format

23E2 in Scientific

Or a+b*i

Or in common mathematical

Commands on the Math and CAS

Shorthand. The default is to provide

Menus are presented descriptively

MM/DD/YYYY

YYYY/MM/DD, DD/MM/YYYY, or

Press SH Settings to open

Specifying a Home setting

Choosing an entry type

Where to start

Always one-dimensional

Mathematical calculations

Textbook

Examples that follow assume that the entry mode is

Entering expressions

RPN Reverse Polish Notation. Not available in CAS view

R23jw14S j8nQ3 h45E

Example Parentheses

Sj85s9

Negative numbers

Algebraic precedence

E45+Sz

Explicit and implied multiplication Large results

Reusing previous expressions and results

To reuse the last

Using the clipboard

Result

Sj2E

Storing a value in a variable

SjS+E

Szj AQAcE

Szj AaE

Example To assign π2 to to the variable a

Sharing data

Complex numbers

R2o3 Ay6E

HP Prime to another

When is tapped

Online Help

RPN Reverse Polish Notation

Reverse Polish Notation RPN

RPN is available in Home view, but not in CAS view

History in RPN mode

SzX3

Re-using

Sample calculations

Results

Reverse Polish Notation RPN

Swap

Manipulating the stack

Stack

Show an item Delete an item Delete all items

CAS view

Computer algebra system CAS

Menu buttons in CAS view are Assigns an object to a variable

CAS calculations

5Asjw6

Settings

2Asj+3

Asw2

Standard or Scientific or Engineering

Ments Radians or Degrees

Recursive Replacement

Tion above

See also Recursive Evalua

Computer algebra system CAS

Computer algebra system CAS

Exam Mode

Press O+ A+ c

Modifying the default configuration

Press SH. The Home Settings screen appears Tap

Don’t want disabled are not selected

Before, the only base configuration will be Default Exam

Creating a new configuration

Activating Exam Mode

Tap If a configuration other than Default

To activate exam mode

Cancelling exam mode

Modifying configurations

To change a configuration

Deleting configurations

To return to the default configuration

Tap Exam Mode screen appears

Exam Mode

An introduction to HP apps

Equations

Linear Solver

Solve Explore equations in one or more real

Application Library

To delete an app Other options

Test

Symbolic view

App views

Confidence level, and select a type

Symbolic Setup view

Plot view

Symbolic view

Solve

Plot Setup view

Numeric view

Test selected in Symbolic view

Advanced View a table of numbers generated by Graphing

Symbolic view, and set the zoom factor

Numeric Setup view

Advanced Specify the numbers to be calculated Graphing

N2f

Quick example

Open the app

4Szf n2f jE

Press SP Set the second θRNG field to 4π by entering

Press P

Press Pto return to Plot view and see the complete plot

Θ column to be 1. You set this up in the Numeric Setup view

Common operations in Symbolic view

Numeric View

Modify a definition

Add a definition

Definitional building blocks

From Home variables

X2+X+ 2 *X2

Evaluate a dependent definition

Select or deselect a definition to explore

F9X=X2+Statistics2Var.PredY6

Delete a definition

Choose a color for plots

Symbolic view Summary of menu buttons

Press SYto open Symbolic Setup view

Common operations in Symbolic Setup view

Override system-wide settings

Restore default settings

Zoom

Common operations in Plot view

Zoom factors Zoom options

Shortcut press w

By the X Zoom and Y Zoom settings

Zoom setting

Center on

Apps, autoscaling rescales both axes

Given the supplied x axis settings. For

Graph with the original plot settings

Shows a representative piece of the plot

Viewing

Testing a

Zoom with

Split-screen

Out

Shown, tap

Integer

Square

Autoscale

Decimal

Trig

Trace

To evaluate a definition To turn tracing on or off

Configure Plot view

Common operations in Plot Setup view

Plot view Summary of menu buttons

Stats 1 Var only

Parametric Only

Polar only

Sequence Only

Sets the initial range of the y-axis. Note

Sets the initial range of the x-axis. Note

That here are two fields one for

Panning and zooming

Graphing methods

Common operations in Numeric view

Restore default settings

Zoom options Zoom keys Zoom menu

Evaluating

Deleting data

Custom tables

Start typing a new value Only visible if Numtype is set to

Numeric view Summary of menu buttons

Select Ascending or Descending ,

Modifying Numeric Setup

Common operations in Numeric Setup view

Adding a note to an app

Combining Plot and Numeric Views

Creating an app

Fibonacci in this example

Asjw5

App functions and variables

Select Statistics 1Var results MeanX

Tap This opens a menu of app variables

Getting started with the Function app

Function app

Function

Open the Function app Define the expressions

Rdw1 jw3E

Open the Function app ISelect

Set up the plot Plot the functions

Trace a graph Change the scale

Display the Numeric Setup view SMSetup

Display Numeric view Set up Numeric view

Substituted the values in the X column for x

Press SJClear to reset all the settings to their defaults

Explore Numeric view

To navigate around a table

To go directly to a value

To access the zoom

Options

=or\

Analyzing functions

Display the Plot view menu

To find a root of the quadratic function

Intersection

To find an

Intersection of two

Functions

To find the slope of the quadratic function

To find the signed area between the two functions

Quadratic

Function Variables

To find

Extremum

Function Select Results and then the variable of interest

Tap and select

Named Extremum

Summary of FCN operations

Slope

Advanced Graphing app

Getting started with the Advanced Graphing app

ISelect Advanced Graphing

Open the app Define the open sentence

Jn2

+ n5

128 Advanced Graphing app

Advanced Graphing app 129

Edge

You can move in any direction within

Region. Use this option for

Inequalities, for example

Numeric view Display the Numeric view Explore Numeric view

Trace in Numeric view

Numeric Setup

Sj3n2

Trace Edge

Trace PoI

Exploring a plot from the Plot Gallery

Plot Gallery

Getting started with the Geometry app

Geometry

Plot Function

3seASsE

With plotfunc on the entry line, enter 3*sinx

More Tangent

Derivative point

Create a

AbscissaGB,slopeGC

Add some calculations

140

Derivative changes by looking at a plot of it rather than

Plot view in detail

Derivative

Point D is the point whose ordinate value matches

142

Moving objects

Selecting an

Object

Hiding names

Undoing

Coloring objects

Filling objects

Removing fill

Moving about

Clearing an

Clearing all

Objects

Plot view buttons and keys

Key Result in Plot view

Symbolic view in detail

Tap either To move it down the list or Move it up

Re-ordering

Entries

Hiding an object

Tap Or press C To delete all objects, press SJ

Can delete an object in Symbolic view

Numeric view in detail

Deleting an

Enter radiusGC

Listing all

152

Points

Geometric objects

More

Element 0 . . Notice

Line

Ngon

Polygon

Special

Curve

Thus enclosing the triangle

Circumcircle is the circle

That passes through each

Triangle’s three vertices

Special Locus places

Geometric transformations

Given scale factor around a given point as center

Tap Select Reflection

Axis and press E. The object is reflected across

Symmetry axis defined in step

GK,angleGK,GL,GM

Select Transform Rotation

164

Barycenter

Geometry functions and commands

Symbolic view Cmds menu

Point

Inter

Center

Divisionpoint

Element

Point

Isobarycenter

Midpoint

Orthocenter

DrawSlp

Point2d

Stop trace

Erase trace

Line

Bisector

Exbisector

Halfline

Medianlinepoint1, point2, point3

Medianline

Parallel

Perpenbisector

Draws a segment defined by its endpoints

Perpendicular

Segment

Tangent

Equilateral triangle0,6, v draws an equilateral

Equilateraltriangle

Hexagon

Equilateral triangle0,6 draws an equilateral

IsoscelestriangleGA, GB, angleGC, GA, GB

Isoscelestriangle

Isopolygon

Parallelogram

Rhombus

Polygon

Quadrilateral

Rectangle

Square

Righttriangle

Triangle

CircumcircleGA, GB, GC draws the circle

Circle

Circumcircle

Conic

Excirclepoint1, point2, point3

Ellipse

Excircle

Hyperbola

Parabola

Transform

Incircle

Locus

Draws the orthogonal projection of a point onto a curve

Inversion

Projection

Reflection

RotateGA, angleGB, GC, GD,GK rotates

Rotation

Similarity

Translation

Measure Plot

Measure

Numeric view Cmds menu

Area

Affix

Angle

ArcLen

Area4-x2/4, x=-4..4 returns 14.666…

Coordinates

Distance

Distance2

Parameq

Equation

Extractmeasure

Ordinate

Isconcyclic

Test

Radius

Iscollinear

Isorthogonal

Iselement

Isequilateral

Isisoceles

Isrectangle

Isparallel

Isparallelogram

Isperpendicular

Harmonicconjugate

Other Geometry functions

Issquare

Convexhull

Isrhombus

Isharmonic

Isharmoniccirclebundle

Isharmoniclinebundle

Polar

LineHorz

LineVert

Openpolygon

Reciprocation

Powerpc

Pole

Radicalaxis

Verticesabca

Singleinter

Vector

Vertices

194

Getting started with the Spreadsheet app

Spreadsheet

To open the Spreadsheet app, press Iand select Spreadsheet

196

Select cell C5

Select cell D1 Enter a formula to add up your takings

Select cell C3 Enter a label for your total commission

Select the heading cell for column C, tap and select

Enter a label for your fixed costs

Ancostse

Navigation, selection and gestures

Basic operations

Cell naming

Cell references

Method

Enter Cost and tap

Entering content

COST*0.33 and tap

Enter Statistics1Var.D1

Select Polynomial Find Roots

External functions

Format, both value and format, or both formula and format

External references

Copy and paste

To copy one or more cells, select them and press SVCopy

Referencing variables

= Row2-√Row-1. The only

Using the CAS in spreadsheet calculations

Changes to

Buttons and keys

Handled by the CAS, but only Evaluates it

Line is active

Formatting options appear

Formatting options

Font Size Auto or from 10 to 22 point

Format Parameters

Spreadsheet functions

Getting started with the Statistics 1Var app

Statistics 1Var app

Statistics 1Var

Sample data in D1

Enters D directly to save you having to press two keys

Symbolic view menu items

Menu items you can tap on in Symbolic view are

Editing. Tap when done

214

Entering and editing statistical data

Configure a histogram plot for the data Setup

Menu items you can tap on in Numeric view are

Edit a data set

1Var app open, return to Home view and enter

Spreadsheet.A1A10 D7 E

Delete data Insert data Generating data Sort data values

Computed statistics

Histogram

Plotting

Plot types

To plot statistical data

Bar graph

Box-and-Whisker

Normal probability

Line plot

Data in descending

Setting up the plot Plot Setup view

Pareto chart

Exploring the graph

Menu items you can tap on in Plot view are

Plot view menu items

Dependent, y

Statistics 2Var app

Getting started with the Statistics 2Var app

Advertising minutes Resulting sales $

Enter the advertising minutes data in column C1 2E1E3E5E5E4

Statistics 2Var

Statistics 2Var app 225

Setup plot Plot the graph

Display the equation Predict values

Spreadsheet.A1A10 C7 E

Buttons you can tap on in Numeric view are

Numeric view menu items

Tap , make your change, and tap

Descending

Delete data Insert data Sort data values

Fit types

Defining a regression model

Positive real value in L, or-if

Where L is the saturation value

Fits the data to a logistic curve

For growth. You can store a

COV

SCOV

ΣXY

SerrY

Plotting statistical data

Tracing a curve

Tracing a scatter

Tracing order

Connect

Plot setup

Plot view menu items

Plotting mark

Home view

Predicting values

Troubleshooting a plot

Inference

Inference app

Getting started with the Inference app

Open

Test μ1 μ2, the T-Test on

Symbolic view options

Population standard deviation Alpha level for the test

Select the inference method Enter data

Test 1 μ from the Type menu

Sample mean Sample size

Display the test results Plot the test results

Open the Statistics 1Var app Clear unwanted data Enter data

Importing statistics

82.5 E 83.1 E 82.6 E 83.7 E 82.4 E 83 E

Confidence Interval

Calculate statistics Open the Inference app

Select inference method and type Import the data

Tap on the Method field and select

Numerically

Hypothesis tests

Display

Results

Menu name

One-Sample Z-Test

Inputs

Two-Sample Z-Test

One-Proportion Z-Test

Two-Proportion Z-Test

This test measures the strength of the evidence for a

One-Sample T-Test

Test Z Test statistic Test Δ pˆ Difference between

With the test Z-value

Test μ1 μ2

Two-Sample T-Test

Each sample from a different population, this test

Sample 2 standard deviation

Sample 1 standard deviation

Α level that you supplied

One-Sample Z-Interval

Confidence intervals

Two-Sample Z-Interval

Sample success count Sample size Confidence level

One-Proportion Z-Interval

Int 1π

Number of successes

Proportions of successes in two populations

Two-Proportion Z-Interval

Menu name Int π1 π2

Confidence interval for the difference between

Two-Sample T-Interval

One-Sample T-Interval

Result Definition

258

Getting started with the Solve app

Solve app

AVjS.AU j+2AAAD

One equation

Open the Solve app

Clear the app and define the equation

Solve the unknown variable

Enter known variables

Kph over a distance Is approximately 2.4692 m/s2

Matches the value of a you calculated above

Where n is the number of the selected equation

Plot the equation

Select Auto Scale Select Both sides of En

Open the Solve app Define the equations Enter a seed value

Several equations

AXj+AYj S.16E AXwAYS. Q1E

Solve the unknown variables

Limitations

Reversal

Solution information

Zero

Sign

No values satisfy the selected equation or expression

Bad Guesses Constant?

Value of the equation is the same at every point sampled

Linear Solver

Linear Solver app

Getting started with the Linear Solver app

Open the Linear Solver app. ISelect

Coefficients and constants had been entered

Define and solve the equations

Solve a two-by- two system

Menu items

270

Parametric

Parametric app

Getting started with the Parametric app

Open the Parametric app

8ed? 8fd?

Define the functions

Degrees

Set the angle measure Set up the plot Plot the functions

274

Tap .The table scrolls to the value you entered

276

Open the Polar app

Open the Polar app ISelect Polar App opens in Symbolic view

Polar app

Getting started with the Polar app

5Szf dn2 fdj

Set angle measure Set up the plot

Define the expression 5πcosθ/2cosθ2

Plot the expression Explore the graph

280 Polar app

Getting started with the Sequence app

Sequence app

Sequence

App opens in Symbolic view Define the Fibonacci sequence

+ E

Open the Sequence app ISelect

Select Stairstep from the Seq Plot menu

Plot the sequence

Display Numeric view Explore the table of values

RQFand

Set up the table of values

Define the expression Setup the plot

Another example Explicitly-defined sequences

Plot the sequence Explore the table of sequence values

Getting Started with the Finance app

Finance app

288

Cash flow diagrams

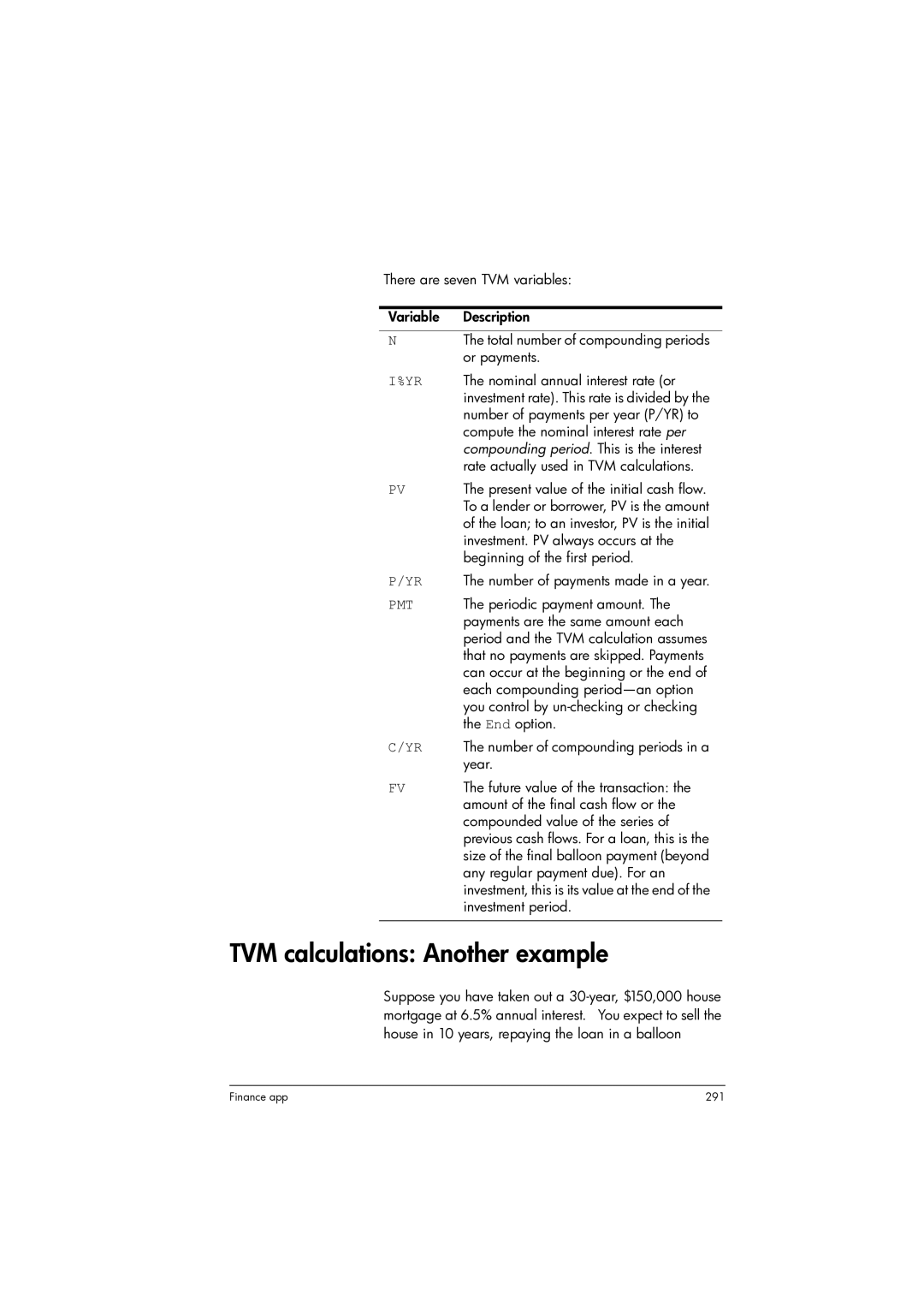

Time value of money TVM

PMT

TVM calculations Another example

292

To calculate amortizations

Calculating amortizations

Amortization graph

Finance app 295

Open the Triangle Solver app ISelect

Triangle Solver app

Getting started with the Triangle Solver app

Tapping

Specify the known values

Solve for the unknown values

Choosing triangle types

Special cases

Triangle Solver app 299

Linear Explorer app

Explorer apps

Between them by tapping or

Graph mode

Test mode

Equation mode Tap to enter

Explorer

Quadratic Explorer app

Open the app

Quadratic

Graphs that are harder match by tapping Respectively

Equation mode

Its value. When you are ready, tap To see if you

Tap To see the correct answer and tap Exit Test mode

Trig Explorer

Trig Explorer app

Are available.

Tap To switch to

Graph by pressing

Cursor keys. All four keys

Now press the cursor keys to select each parameter

Tap to see the correct answer and tap to exit Test mode

All the functions and commands

Functions and commands

308

Abbreviations used in this chapter

Keyboard functions

NORMALICDFμ,σ,p

ALOG3 returns

+,w,s, n

Shex

E5 returns

Efg

+2*i returns -1-2*i

1returns

2returns

Numbers

Math menu

Example XPON123456 returns 5 since 105.0915... equals

Arithmetic

Maximum Maximum. The greater of two values

Modulus Modulo. The remainder of value1/value2

Example ARG3+3*i returns 45 degrees mode

Percentage x percent of y that is, x/100*y Example

Trigonometry

Probability

Hyperbolic

Normal Random real number with normal distribution Nμ,σ

PERM5,2returns

STUDENTn,x

RANDSEEDvalue

NORMALDμ,σ,x

NORMALD0.5 and NORMALD0,1,0.5 both return

Is a real number

FISHERCDF5,5,2 returns

CHISQUARECDFn,k

CHISQUARECDF2,6.1 returns

FISHERCDFn,d,x

List

Special

Matrix

Algebra

CAS menu

Denoma/b

Syntax substExpr,Var=value

PartfracRatFrac or Opt

Numera,b

DiffExpr,var DiffExpr,var1$k1,var2$k2

Calculus

LimitExpr,Var,Val,Dir1, 0

DivergenceExpr1, Expr2, …, ExprN, Var1, Var2, …, VarN

SeriesExpr,Equalvar=limitpoint,Orde r,Dir1,0,-1

SumExpr,Var,Real1, Real2,Step

CurlExpr1, Expr2, …, ExprN, Var1, Var2, …, VarN

IbpufVar, uVar, Var, Real1, Real2

GradExpr,LstVar

Hessian Returns the Hessian matrix of an expression

HessianExpr,LstVar

DivpcPoly1,Poly2,Integer

PrevalExprFvar,Reala,Realb,Var

SumriemannExprXpr,Lstvar1,var2

TaylorExpr,Var=Value,Order

Solve

CZerosExpr,Var CZerosExpr1, Expr2,…,Var1, Var2,…

ZerosExpr,Var or zerosExpr1, Expr2,…,Var1, Var2,…

Zerosx2-4 returns -2

CsolveEq,Var CsolveEq1, Eq2,…, Var

Rewrite

Exp2trigExpr

TexpandExpr

Exp2powExpr

Pow2expExpr

Acos2atanExpr

Asin2atanExpr

Sin2costanExpr

Acos2asinExpr

Tan2sincosExpr

Atan2asinExpr

Atan2asinatan2*x returns

Atan2acosExpr

TlinExprTrig

TrigcosExpr

TrigtanExpr

Atrig2lnExpr

Integer

PrevprimeInteger

GcdIntgr1, Intgr2,…

IsPrimeInteger

NextprimeInteger

Powmoda, n, p,Expr,Var

Polynomial

IquoIntgr1, Intgr2

IremIntgr1, Intgr2

GcdPoly1,Poly2

CoeffPoly, Var, Integer

DivisPoly or divisPoly1, Poly2,…

FactorsPoly or factorsPoly1, Poly2,…

Poly2symbVector, Var

Symb2polyExpr,Var Symb2polyExpr, Var1, Var2,…

PcoefVect

QuoList1, List2, Var QuoPoly1, Poly2, Var

PminMtrx,Var

RemList1, List2, Var RemPoly1, Poly2, Var

SturmabPoly,Var,a,b

ContentPoly,Var

DegreePoly

FactorxnPoly

HermiteInteger

CyclotomicInteger

GbasisPoly1 Poly2…, Var1 Var2…

GreducePoly1, Poly2 Poly3 …, Var1 Var2…

Tchebyshev2Integer

LagrangeX1 X2…, Y1 Y2…

LaguerreInteger

Tchebyshev1Integer

Plot

PlotodeExpr, Var1, Var2, X0, Y0

App menu

PlotlistX1, Y1, X2, Y2, …

Function app functions

SOLVEX2-X-2,X,3returns2

Solve app functions

Spreadsheet app functions

SOLVEEn,var,guess

As in SUMB7C23

FunctionNameinput,optional Parameters

=STAT1A25A37

=STAT1A25A37,h n

Finance app

Calculates the arithmetic mean of a range of numbers

For example, AVERAGEB7B23 returns the arithmetic

Specify a block of cells, as in AVERAGB7C23

Place column headers Place row headers Serr

Second column is treated as the weight of the first

Columns are multiplied to generate a data point

Set to

STAT1A25A37

REGRSInput range,model, configuration

STAT1A25A37,h n x σ

Example REGRSA25B37,2

PredXmode, y, parameters

PredY

PredX

PredYmode, x, parameters

HypZ1mean The one-sample Z-test for a mean

HypZ1mean x, n,μ0,σ,α,mode, configuration

HypZ1mean0.461368, 50, 0.5, 0.2887, 0.05

HypZ2mean0.461368, 0.522851, 50, 50, 0.2887, 0.2887, 0.05

HypZ1prop

HypZ1propx,n,π0,α,mode

HypZ1prop21, 50, 0.5, 0.05,1

HypZ2prop

HypZ2prop21, 26, 50, 50, 0.05

Mode Specifies which alternative hypothesis to use ≠ μ0

HypT1mean x ,s,n,μ0, α,mode,configuration

HypT1mean The one-sample t-test for a mean

ConfZ1mean x ,n,s, C,configuration

HypT2meanx1,x2,s1,s2, n1,n2, α,pooled,mode, configuration

ConfZ2mean0.461368, 0.522851, 50, 50, 0.2887, 0.2887

ConfZ2mean x1, x2, n1, n2,s1,s2,C, configuration

ConfZ1propx,n,C,configuration

ConfZ1mean0.461368, 50, 0.2887

ConfT1mean

ConfZ2prop

ConfZ1prop21, 50

ConfT2mean0.461368, 0.522851, 0.2776, 0.2943, 50, 50, 0

ConfT2mean x1, x2, s1,s2,n1, n2,C,pooled, configuration

Statistics 1Var app functions

ConfT1mean0.461368, 0.2776, 50

SetFreq

Do1VStats

SetSample

SetDepend

Statistics 2Var app functions

Resid

Do2VStats

HypZ1mean

Inference app functions

SetIndep

DoInference

Critical value of π associated with the critical Z-value

Test π value

HypZ2mean x1, x2, n1, n2,σ1,σ2,α,mode

Critical value of the statistic associated with

HypT1mean

Order

Test Δπ value

HypT2meanx1,x2,s1,s2, n1,n2, α,pooled,mode

ConfZ2mean

ConfZ1mean

ConfZ1prop

Two proportions. Returns a list containing in order

CalcFVNbPmt,IPYR,PV,PMTV,PPYR,CPYR,BEG

Finance app functions

CalcFV

Solves for the future value of an investment or loan

CalcPV

CalcIPYR

CalcNbPmt

CalcPMT

Solve3x3

Linear Solver app functions

Triangle Solver app functions

Solve2x2

SSAside,side,angle

AASangle,angle,side

ASAangle,side,angle

SASside,angle,side

DoSolve

Linear Explorer functions

SolveForYIntercept

DELTAa, b, c

Quadratic Explorer functions

Common app functions

SOLVEa, b, c

Enter Sequence.UNCHECK2

Ctlg menu

Function.CHECK1

UNCHECKDigit

Change Percent change from x to y. Returns 100*y-x/x

Percent of y. Returns x/100*y Example

3,4.*3,4,5,6 gives 3,8,15,24

List1.*List2 or Matrix1.*Matrix2

List.Integer or Matrix.Integer

Var=expression

Abcuvx2+2*x+1,x2-1,x+1 returns 1/2 -1/2

A2qMatrix, Var1, Var2…

A2q1,2,4,4,x,y returns x2+6*x*y+4*y2

AbcuvPolyA, PolyB, PolyC, Var

Append Appends an element to a list or vector

CatObject1, Object2,…

BasisMatrix

CanonicalformQuadraticExpr,Var

Canonicalform2*x2-12*x+1 gives 2*x-32-17

ColDim Returns the number of columns of a matrix

Complexrootx3+8, 0.01 returns

Companion Returns the companion matrix of a polynomial

CorrelationList or correlationMatrix

ContainsList, Element or containsVector, Element

Contains0,1,2,3,2 returns

CopyVarVar1,Var2

Returns

Enters the mathematical constant e Euler’s number

Eval Evaluates an expression

Eigenvals Returns the sequence of eigenvalues of a matrix

Even1251 returns

EvalcExpr

EvalfExpr,Integer

Evalf2/3 gives

ExprX+10 returns 100, if the variable X has the value

Expr Parses the string String into a number or expression

FMinx2-2*x+1,x gives

FMaxExpr,Var

FMax-x2+2*x+1,x gives

FMinExpr,Var

GaussExpr,VectVar

FsolveExpr,Var,Guess or Interval,Method

FunctiondiffFnc

Functiondiffsin gives x→cosx

HamdistInteger1, Integer2

GramschmidtVector, Function

Halftanhyp2expExprTrig

Halftanhyp2expsinx+sinhx returns

HeavisideReal

IcontentPoly,Var

Icontent24x3+6x2-12x+18 gives

Head1,2,3 gives

Inv Returns the inverse of an expression or matrix

Interval2center Returns the center of an interval

IPart4.3 returns

JacobisymbolInteger1, Integer2

Jacobisymbol132,5 gives

IPartReal or iPartList

Lin Returns an expression with the exponentials linearized

Logb Returns the logarithm of base b of a

Lname Returns a list of the variables in an expression

Mat2list Returns a list containing the elements of a matrix

Lvar Returns a list of variables used in an expression

Median1,2,3,5,10,4 gives

MeanList1, List2 or meanMatrix

Mean1,2,3,1,2,3 gives 7/3

MedianList1, List2 or medianMatrix

MultcconjugateExpr

ModgcdPoly1,Poly2

Modgcdx4-1,x-12 gives

MRowExpr, Matrix, Integer

NormalizeVector or normalizeComplex

NDerivfx,x,h returns fx+h-fx-h*0.5/h

NormalExpr

Normal2*x*2 gives 4*x

PIECEWISE⎪

PI Inserts π

Plotpolarπ/2x, x=-π..π plots a partial spiral

PlotparamfVar+i*gVar, Var= Interval

Plotparamcost+i*sint, t=0..2*π plots the unit circle

PlotpolarExpr,Var=Interval

POLYCOEF-1, 1 returns 1, 0

PoleCrcle,Line

Polecircle0, 1, line1+i, 2 returns point1/2,1/2

POLYCOEFVector or POLYCOEFList

POLYROOTPoly or POLYROOTVector

PolygonscatterplotMatrix

PolynomialregressionList1, List2, Integer

Polynomialregression1, 2, 3, 4, 1, 4, 9, 16,3 returns 0 1 0

Prepend1,2,3 gives 3,1,2

PowerregressionList1, List2

Powerregression1, 2, 3, 4, 1, 4, 9, 16 returns 2

Powerpccircle0,1+i,3+i gives

Purge Unassigns a variable name

Quote Returns an expression unevaluated

⎠ returns

Remove6,1 2 6 7 returns 1 2

Reducedconicx2+2*x-2*y+1 returns

RefMatrix

RemoveElement, Vector or removeElement, List

Restart Purges all the variables

Residue Returns the residue of an expression at a value

Example Gives

RowDim Returns the number of rows of a matrix

Signature Returns the signature of a permutation

Sqrt Returns the square root of an expression

Sto Stores a real or string in a variable

Transpose Returns a matrix transposed without conjugation

Sylvester Returns the Sylvester matrix of two polynomials

Type Returns the type of an expression e.g. list, string

Returns the square of an expression

When Used to introduce a conditional statement

Inserts the imaginary number

Creating your own functions

Expr

Function field, enter the function. eAA+fABAC

Variables

AaE

Working with Home variables

Result is written to history Multiply a by

AAxotwAS. Sq1o2 o3 E

Working with user variables Working with app variables

Example 3 You can also store objects in variables

More about the Vars menu

Qualifying variables

Home variables

Home variables are accessed by pressing aand Tapping

AAngle ADigits AComplex AFormat

App variables

Function app variables

NumStart NumType NumStep NumZoom NumIndep

Results variables

Geometry app variables

ColWidth RowHeight

Category Names Symbolic Plot

Spreadsheet app variables

Solve app variables

NumXStart

Advanced Graphing app variables

NumYStart NumType NumXStep NumXZoom NumYStep NumYZoom

Statistics 1Var app variables

MaxVal

NbItem

MinVal

MedVal

Statistics 2Var app variables

ΣCov

Corr

CoefDet

SCov

SerrY

Inference app variables

Contains the sum of the dependent values Y

Prob

CritScore

CritVal1

CritVal2

NumStart NumType NumStep NumZoom

Parametric app variables

NumIndep NumType NumStart NumZoom NumStep

Polar app variables

Finance app variables

Θmin Recenter

Quadratic Explorer app variables

Linear Solver app variables

Triangle Solver app variables

Linear Explorer app variables

Sequence app variables

Trig Explorer app variables

Category Names Modes

Length Acceleration

Units and constants

Units

Unit categories

Palette of prefixes

Unit calculations

Prefixes

Units menu includes an entry that is not a unit

+5 SF

MKSA8.175cm/s returns .08175m*s-1

Unit tools

UFACTOR100C,1A returns 100A*s

Physical constants

USIMPLIFY5kg*m2/s2 returns 5J

Value or measurement?

Avogadro, NA

List of constants

450

Create a list in the List Catalog

Lists

= or \

=or \

List Editor

List Editor Buttons

Keys

To insert an element

To edit a list

A list

To createa list

Deleting lists

Lists in Home view

To delete a list

To display one

To store a list

Aj7

To display a list

2,3 returns 5,10,15

List functions

To send a list

Data on page 44 for instructions

Aajo

Make List

Sort

Menu format

Reverse Concatenate Position Size

Aj5 E

Aj5E

Ad1E

Finding statistical values for lists

Aj1E

Aj1

Beginning on page 211, for the meaning of each statistic

Vectors

Matrices

Matrices

POLYROOT1,0,-1,0M1

Creating and storing matrices

Editor

Working with matrices

Matrix Editor

To create a matrix in the Matrix Editor

View

Matrices in Home

To store a matrix

To display a matrix

Matrixnamerow,column

Matrix arithmetic

R1o2

To send a matrix

Divide by a scalar

E3 E

HAQ1 +

To multiply

AQ1k5

AQ1sA

AQ1kQ

Q1 n AQ2

Solving systems of linear equations

2E3E Tap in cell R1, C3 E

1E1E Q1E

4EQ1

Commands

Matrix functions and commands

Sns AQ1E

TRN ⎜

Matrix functions

Argument conventions

TRN matrix

IDENMATsize

Rref matrix

Rref

3,2,3,4

Cos1 -sin1sin1 cos1

JordanBlockExpr,n

0 JordanBlock7,3 returns 0 7 1 0 0

Hilbertn

Rownorm ⎜

Rank

Specnorm ⎜

Specrad ⎜

Cond

Eigenvv

EIGENVALmatrix

37228… -0.37228…

Eigenvv matrix

IhermiteMtrxA

Choleskymatrix

Example CAS view

Cholesky ⎜

Ismith ⎜

HessenbergMtrxA

278

IsmithMtrxA

LUmatrix

LSQmatrix1, matrix2

LSQ

P*A=L*U

SVD ⎝

QRmatrix A,var1,var2

SCHURmatrix

Example Schur ⎛⎜ 1 2 ⎞⎟ returns

L2normVect

4649… 0.3659…

Cross 1 2 , 3 4 returns

DOT 1 2 , 3 4 returns

MaxnormVect or Mtrx

Examples

Maxnorm 1 2 3 -4 returns

+ y z = 5 2x y = 2y + z =

488

Begins a new note,

Features. See below

Opens the selected note for

Editing

Rename renames the selected note

To create a note from the Notes Catalog

Open the Note Catalog

To create a note for an app

Are adding or editing a note

Keys

With lowercase locked, make next character uppercase

Make the next character upper-case

Text formatting

Mathematical

Inserting

Expressions

Sharing notes

Pixon xposition, yposition ,color

HP Prime Programs Command Structure

Programming in HP PPL

Pixon xposition, yposition

END

Program Catalog

Program Structure Comments

Export Myprogam Begin

Program Catalog buttons and keys

Open Program Catalog

=or S\

Myprogram

Creating a new program

Program Editor

Or S=and Checks the current program for errors

Strings Drawing Matrix App Functions Integer More

Press Jto return to the main menu

Begin and END

For N from 1 to 3 do

Tap Myprogram to expand the menu and select Myprogram

Run a Program

Parameters

Debug a Program

Multi-function

Programs

Program Catalog, select

Edit a program Copy a program or part of a program

510

To share a program

HP Prime programming language

Variables and visibility

Export Radius Export Getradius Begin Inputradius END

Programming in HP PPL 513

Return 1+RANDINTN-1

Program Rolldie

Program

Export Rolldien

Return 1+RANDINTn-1 END

L2roll+1 L2roll

Rolldie

ROLLDIEn

User Keyboard Customizing key presses

User mode

Begin Return 1+RANDINTN-1 END

Re-assigning keys

Internal name of keys and key states

Key names

KDiv

KAMath

App programs

View text, function

Using dedicated program functions Redefining the View menu

Resets or Initializes an app

Starts an app

Customizing an app

DiceSimulation

Tap Enter a name for the new app such as

View Roll Dice,ROLLMANY

Dicesimvars Rolldie

Export SIDES,ROLLS Export DiceSimulation

Begin END

Until Sides =4 STARTVIEW7,1 END

Sides

Begin Repeat

SIDES= Floorsides If SIDES2 then

Sides END

STARTVIEW1,1 END

STARTVIEW0,1 END

Export ROLLS,SIDES Export Dicesimvars Begin

Roll Dice

Program commands

Export SQM1X Begin Return END

Commands under the Tmplt menu Block

Begin END Syntax Begin command1 command2… commandN END

Branch

Loop

Default commands END

Case

Export Drawpattern Begin

Export Maxfactorsn Begin

MSGBOXMax of + max + factors for +result

MAXFACTORS100

END Wait

Rect

Export ISPERFECTn

INPUTSIDES,Die Sides,N = ,Enter num sides,2

+1 d END Return sum==n END

Export Perfectnums Begin

Export Sides Export Getsides Begin Repeat

Syntax Export FunctionName

Variable

Function

Export Syntax Export var1, var2, …, varn

Char Syntax CHARvector or CHARinteger

Commands under the Cmds menu Strings

INSTRINGvanilla,van returns Instring banana,na returns

StringF1, when F1X Cosx = Cosx

666666666667

String

Drawing

Ymax

Pixels and Cartesian

Grobhpg

Getpix Syntax GETPIXG, x, y

GETPIXPG, x, y

Grobh Syntax Grobhg

INVERTPG, x1, y1, x2, y2

Grobwpg

PIXOFFPG, x, y

PIXONPG, x, y ,color

Pixon Syntax PIXONG, x, y ,color

Wait END

Export BOX Begin Rect RECTP40,90,#0

+sign*4/2*K-1 a

Export Piseries Begin

Local sign K=2 A=4 sign=−1 Rect TEXTOUTPN=,0,0

Textoutppi APPROX=,0,30 Repeat

Addrow Syntax ADDROWmatrixname, vector, rownumber

Sign*-1 sign K+1 K

Until END

Addcol Syntax ADDCOLmatrixname, vector, columnnumber

SUB Syntax SUB name, start, end

Replace Syntax REPLACEname, start, object

Scale Syntax SCALEname, value, rownumber

Scaleadd Syntax Scaleadd name, value, row1, row2

App Functions

Bitand Syntax BITANDint1, int2, … intn

Commands

→R Syntax B→R#integerm

Bitsl Syntax BITSLint1 ,int2

Getbase Syntax GETBASE#integerm

Choose Syntax CHOOSEvar, title, item1, item2,…,itemn

Getbits Syntax GETBITS#integer

Example GETBITS#22122 returns #20h or →B Syntax R→Binteger

Setbits Syntax SETBITS#integerm ,bits

Taps Example EDITMATM1 edits matrix M1 Getkey Syntax Getkey

Editmat Syntax EDITMATmatrixvar

Export Sides Export Getsides

Input Syntax INPUTvar ,title, label, help, reset

Begin INPUTSIDES,D ie Sides,N = ,Enter num sides,2 END

Export Areacalc Begin

Msgbox Syntax MSGBOXexpression or string ,okcancel?

Programming in HP PPL 553

Execon Syntax EXECON&expr, List1, list2,…

Executes the function or returns the variable using

More

CAS Syntax CAS.function or CAS.variable

Example ITERATEX2, X, 2, 3 returns

Example →HMS54.8763 returns 5452′34.68″

EXECON&23+&1,1,5,16,4,5,6,7 returns 7,12

Variables and Programs

Programming in HP PPL 557

Cursor

App variables

Plot view variables

Axes

Labels

GridLines

Hmin/Hmax

Hwidth

Θmin/θmax

Nmin/Nmax

Recenter S1mark-S5mark

SeqPlot

Tstep

Θstep Polar Tmin/Tmax

Xtick Ytick Xmin/Xmax

Yzoom

Symbolic view variables

Ymin/Ymax

Xzoom

H1...H5

F0...F9

H1Type...H5Type

S1...S5

R0...R9

S1Type...S5Type

X0, Y0...X9,Y9

Type

U0...U9

NumIndep

Numeric view variables

C0...C9

D0...D9

NumType-forAutomatic default NumType-forBuildYourOwn

NumStep where n

NumXStep where n

NumYStep where n

Alpha Conf

NumXZoom where n

NumYZoom where n

Inference app variables

Mean2

Mean1

Mean2

Mean1

Difference of two means or two proportions, sets

Pooled-for not pooled default

Pooled

Pooled-for pooled

Variables

Finance app

CPYR

PMTV

NbPmt

IPYR

NbPmt

Triangle

Linear Solver app variables

Solver app

AngleC

SideC

AngleA

AngleB

Home

Settings

Language

HComplex

Date

Time

Signed

Entry

Base

Bits

AComplex

Symbolic

Setup

AAngle

AFormat

AFormat

580

Basic integer arithmetic

Default base

Binary, Octal, Decimal or Hex

Changing the default base

Mixed-base arithmetic

Examples of integer arithmetic

Integer manipulation

These are described in Integer, beginning on

Base functions

Glossary

Catalog

Symbolic, and Symbolic Setup

Matrix Two-dimensional array of real or

Record using the Program Editor

Vector One-dimensional array of real or

590

If the calculator does not turn on

Troubleshooting

To reset

Calculator not responding

Status messages

Operating limits

Apps, matrices, lists, notes, or

Correct. Look up the function

Name in the index to find its

Proper syntax

594

Cables

Product regulatory information

Federal Communications Commission notice

Modifications

596

European Union Regulatory Notice

598

Substances

Chemical

Parliament and the Council. a chemical information

600

Index

CAS 54

Menu 324-347 settings 30, 55 view

370-371

Functions 118-122, 348 variables

366-369

299-301

606

Samples 514-516, 524-527 structure

Zoom 88-94 points Polar app 70, 277-280 variables

215

Solve app 70, 259-266 functions 349 limitations 264 messages

App 109, 558-579 CAS

Types of 89-90