ELECTRONIC CASH REGISTER

XE-A207 XE-A23S

INSTRUCTION MANUAL

MODEL

FOR YOUR RECORDS

INTRODUCTION

Customer Service Hotline 1-800-BE-SHARP

SD logo is a trademark of SD-3C, LLC

CONTENTS

How to take a X1/Z1 or X2/Z2 report

8 Reading X and Resetting Z of Sales Totals

How to Program Alphanumeric Characters

Percent calculations premium or discount

Optional Feature Selection

Date/Time Setting

Device Configuration Programming

Cash in drawer

12 Operator Maintenance

External View

1 Parts and Their Functions

Front view

Rear view

Printer

@ P l

R a w

Keyboard

Keyboard layout for XE-A207 Function key list

Keyboard layout for XE-A23S Function key list

t y f @ P l

R a w

CLK#

Operator display

Displays

Screen example 1 REG mode Sales information area

Numeric Entry Area Status area

Do not try to force the display beyond its full position

Customer display Screen save mode

Operating Modes

2 Selecting an Operating Mode

Mode selection window

Mode Selection

Procedure

3 Prior to Making Entries

Error Warning

Preparations for Entries

Receipt paper roll

Selecting the Function from the Menu

FUNCTION MENU Procedure

Error escape function

The HELP menu and printing guidance messages

HELP/FAQ Function

Example

Key operation

Procedure

The FAQ menu and guidance messages

Example

Key operation

When using the department code entry key

When using the department keys for department 1 to

4 Entries

Item Entries

PLU/sub-department open price entries

A $ A

the sales quantity is added

Example

Example

Repeat entries

Key operation

Print

A 15 @

7 P5 @ 165 2 @ 5 d

Multiplication entries

Procedure

Split-pricing entries

8 @5 @

Procedure

Example

Single item cash sale SICS

Display of Subtotals

Taxable subtotal

Including-tax subtotal complete subtotal

Cash or check tendering

Finalization of Transaction

Example Cash tendering

Check tendering

Charge credit sale

Cash or check sale that does not need any tender entry

Mixed-tender sale cash or check tendering + charge tendering

Example

Automatic tax

Tax Calculation

Manual tax

Procedure

25 wp 400 wQ A

725 515 Q

Tax delete

Tax status shift

Percent calculations premium or discount

Auxiliary Entries

Percent calculation for a subtotal

Percent calculation for item entries

75 J A

Q 100 J A

3 fp 7 @

Discount entries

700 z

Payment Treatment

Printing of non-add code numbers

Currency conversion

16 p

Example Preset conversion rate 0.8063 CONV 1 Key operation

Received-on-account entries

Open conversion rate 1.275 CONV

No-sale exchange

Paid-out entries

Procedure

Example

TRAINING Mode

Electronic Journal View

Example

Key operation

Correction of the Last Entry Direct Void

5 Correction

t 600 ¡ t 328 # 28 J t 250 f t A

Display

50 @5 p

Correction of the Next-to-Last or Earlier Entries Indirect Void

t 49 @5 tp A

Indirect void by cursor operation

Subtotal Void

Cancellation receipt

Correction after Finalizing a Transaction

Incorrect receipt

Copy Receipt Printing

6 Special Printing Function

Procedure

Example

Entering the Manager Mode

7 Manager Mode

Override Entries

NOTE Normal register operations may also be performed in this mode

How to take a X1/Z1 or X2/Z2 report

8 Reading X and Resetting Z of Sales Totals

View report

To take an X1 or X2 report

Description

Report type

Operating modes

Data to be entered

General report

Daily Sales Totals

Sample report

PLU report by associated department

PLU report by designated range

Clerk reports

Hourly report

General information

Periodic Report Sample

Sample report Full sales report

1 When you take X2 report, “X2” is printed

Programming Keyboard Layout

9 Prior to Programming

For XE-A207 For XE-A23S

Page

Mobile phone method

How to Program Alphanumeric Characters

Entering alphanumeric characters

Entering double-size characters

Character code

Entering character codes

DC Double-size character code

To enter a digit, simply press a corresponding numeric key

Basic Instructions

a Programming

Programming screen

Programming example

A a

a press the Akey

If you return to the previous screen, press the akey

Pressing the Qkey displays all pertinent options

The Pkey toggles between two options as follows NOlYESlNOl

If you want to clear setting, press the lkey before you press the

DEPARTMENT

DEPT/PLU Programming

PLU RANGE

Procedure

PRICE Use the numeric entry Unit price max. 8 digits

Department

Description Use the character entry

TYPE Use the selective entry

PRICE Use the numeric entry

PLU range

DEPT. CODE Use the numeric entry

START Use the numeric entry Starting PLU code max. 5 digits

$ DISC

Functional Programming

1 DISC %1

2 DISC %2

AMOUNT Use the numeric entry Discount amount max. 8 digits

Discount

TEXT Use the character entry

SIGN Use the selective entry

Percent 0, %2

SUBTOTAL Used the selective entry YES Enables the subtotal %

RATE Use the numeric entry Percent rate 0.00 to

Procedure

Procedure

Cash in drawer

Procedure

Procedure

Cash key Cash

Media Key Programming

FOOTER PRINT Use the selective entry

TEND. Use the selective entry

Charge key Charge

Check key Check

+TEXT Use the character entry

Procedure

Currency conversion CONV1, CONV2

SYMBOL Use the character entry

RATE Use the numeric entry

TAB Use the selective entry Tabulation 0 to

TOTAL

Function Text Programming

Text Use the character entry

Function

Clerk

Personnel Programming

PASS CODE Use the numeric entry

AUTO KEY Use the selective entry

Mode Pass Code

Manager

Training Clerk

Program each item as follows

Terminal Programming

Date/Time Setting

Date/time

MACHINE# Use the numeric entry Machine number max. 6 digits 0 to

BASIC SYSTEM

Optional Feature Selection

FUNC.PROHIBIT

FUNC.AUTHORITY

Basic System

ERROR Use the selective entry

DATE FORMAT Use the selective entry

TIME FORMAT Use the selective entry

NON-ADD + NS Use the selective entry

Function Prohibit

SUBTOTAL0 Use the selective entry

TEND+DIRECT Use the selective entry

RA Use the selective entry

Function Authority

PO Use the selective entry

REFUND Use the selective entry

ST BEFORE TEND Use the selective entry

Function Selection

AFTER TRANS. Use the selective entry

E.J. FULL Use the selective entry

CONSECUTIVE NO. Use the selective entry YES Print the consecutive No

Print Selection

DATE Use the selective entry

TIME Use the selective entry YES Print the time

0 AMT PLU Use the selective entry

FOOTER Use the selective entry

ITEM JOURNAL Use the selective entry

CONV. SHORT TEND Use the selective entry

Procedure

Report Programming

DEPARTMENT Use the selective entry

Zero skip

TRANSACTION Use the selective entry

PLU Use the selective entry

GT2 ON Z Use the selective entry YES Print GT2 on the Z report

Print select

GT3 ON Z Use the selective entry YES Print GT3 on the Z report

GT1 ON Z Use the selective entry

Z Counter

RESET GT Use the selective entry YES Reset the GT

Z1 General report

Electronic Journal

Receipt logo

Message Programming

RECEIPT LOGO Use the character entry

PATTERN 1 3 line text header PATTERN 2 Image logo header

Keyboard

Device Configuration Programming

TOUCH SOUND Use the selective entry YES Set to sound

Procedure

TIME OUT1 Use the numeric entry Time out timer for ACK/NAK

POWER SAVE Use the numeric entry

TIME OUT3 Use the numeric entry Time out timer for batch close

Display

TAX SYSTEM

Tax Programming

TAX1

TAX2

Tax system Use the selective entry Selection of the tax system

Tax system

NOTE Tax system

For US tax system, select “AUTO TAX”

Tax 1 through

Table tax Procedure

INTERVAL Use the selective entry

TAX RATE Use the numeric entry

→ INITIAL TAX

Sample tax table New Jersey tax table 6%

→ LOWER TAX

→ CYCLE

Doughnut exempt

Tax Procedure

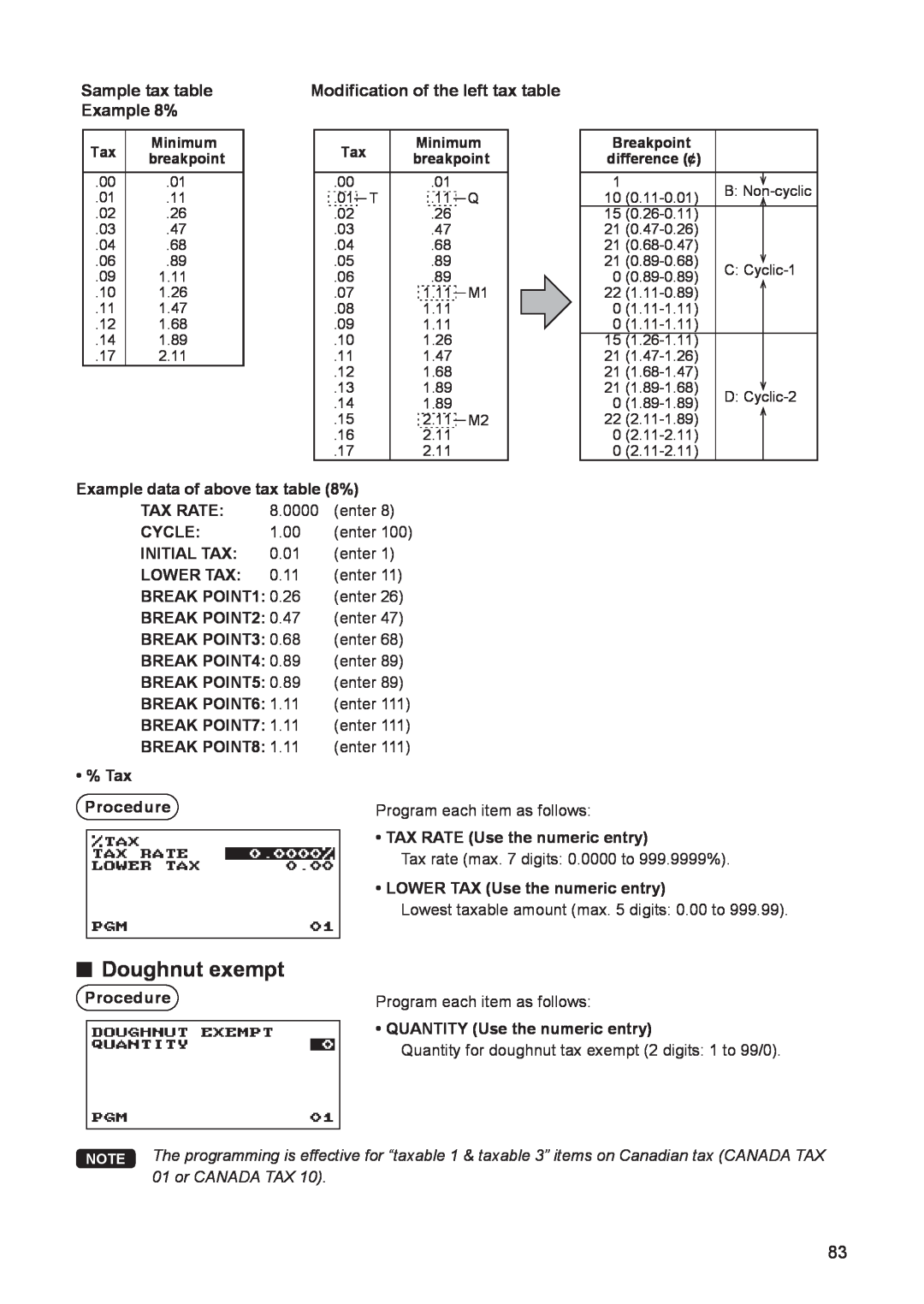

Sample tax table

Modification of the left tax table

Key Sequence

Automatic Sequencing Key Programming

Procedure

Key operation

Program reading sequence

Reading of Stored Programs

Description

Departments

Sample printouts

Media

Functions

Report type HALO Programming data Function text

Entry of amount tendered 0Non-Compulsory, 1Compulsory

Report type Function Text

Function text

Manager

Clerk

Mode pass code Training clerk

Auto key operation/Pass code 0 Enable 1 Disable

Setting

Optional feature

Report type

Device configuration

Report setting

Message

Report type Receipt logo text

AUTO key

EFT Test Function

ROM version

Procedure

Inserting and removing an SD memory card

SD CARD Mode

SD card formatting

Folder creating

Data saving

Folder name selecting

Procedure

Procedure

Data loading

Error message table of the SD card function

Procedure

b Electronic Journal

Resetting Z report

Electronic journal

Recording data

In Case of Power Failure

c Operator Maintenance

In Case of Printer Error

Cautions in Handling the Printer and Recording Paper

Never leave dead batteries in the battery compartment

Installing Batteries

If an incorrect battery is used, it may explode or leak

Replacement

Installing the Paper Roll

Recording paper specifications

Paper specification

How to set the paper roll

Removing a Paper Jam

Replacing the receipt paper roll

NOTE If the print roller arm is not securely locked

open the arm, and close the arm as instructed

Clean the roller and the sensor in the same manner

Cleaning the Printer Printer Head/Sensor/Roller

Reset the paper roll correctly by following the steps in

Opening the Drawer by Hand

Removing the Drawer

Drawer Lock Key

Fault

Before Calling for Service

Error message table

Checking

d Specifications

Warranty Period for this Product

END-USER LIMITED WARRANTY

Additional Items Excluded from Warranty Coverage if any

Where to Obtain Service What to do to Obtain Service

For additional information and product registration

SHARP ELECTRONICS CORPORATION

Sharp Plaza, Mahwah, New Jersey 1-800-BE-SHARP

Printed in Korea TTINSE2624BHZZ