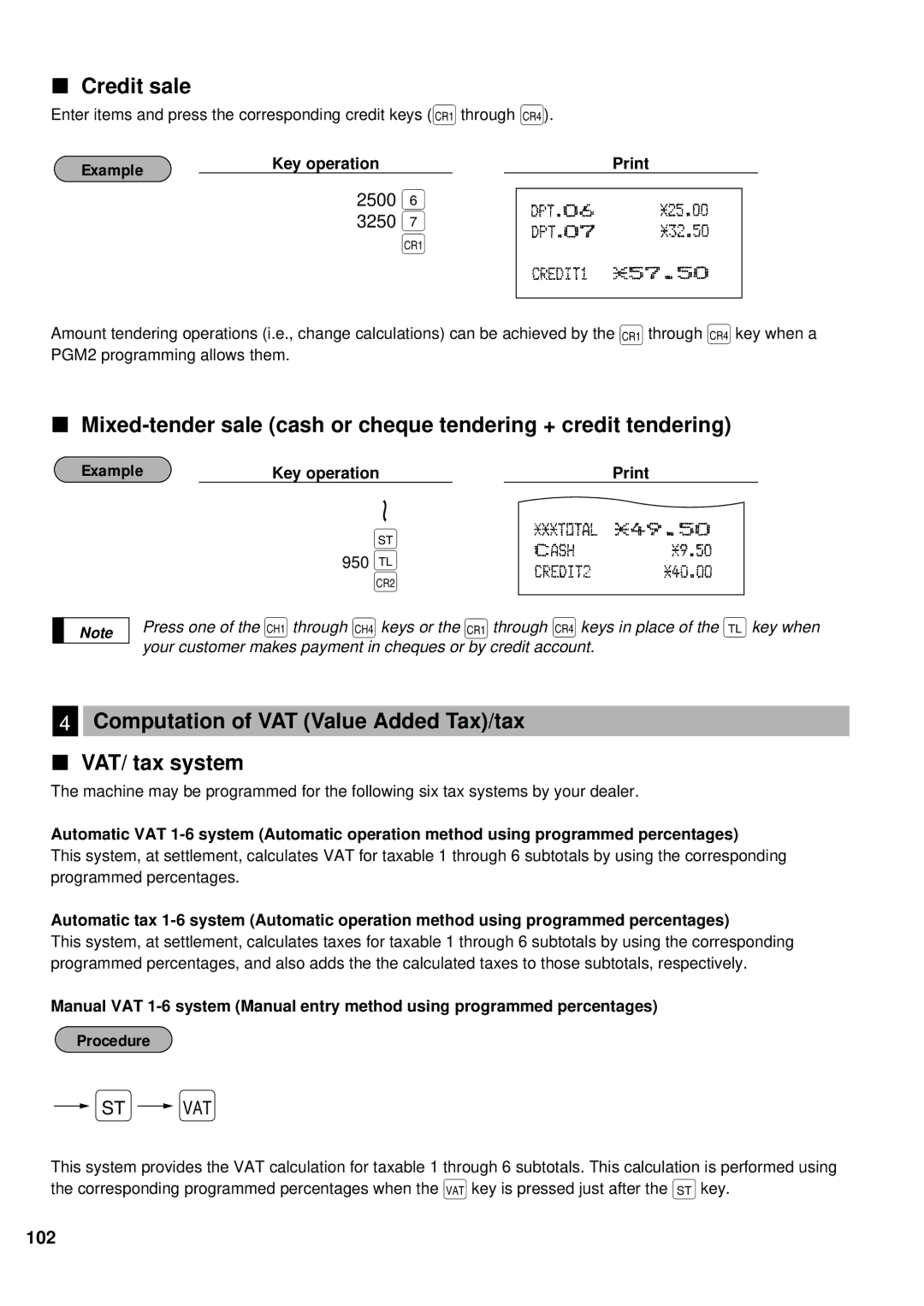

Credit sale

Enter items and press the corresponding credit keys (]through Õ).

Example | Key operation | ||

|

|

| |

2500 6

3250 7

]

Amount tendering operations (i.e., change calculations) can be achieved by the ]through Õkey when a PGM2 programming allows them.

Example | Key operation |

|

Note

:

950;

}

Press one of the (through + keys or the ]through Õkeys in place of the ;key when your customer makes payment in cheques or by credit account.

4Computation of VAT (Value Added Tax)/tax

VAT/ tax system

The machine may be programmed for the following six tax systems by your dealer.

Automatic VAT

This system, at settlement, calculates VAT for taxable 1 through 6 subtotals by using the corresponding programmed percentages.

Automatic tax

This system, at settlement, calculates taxes for taxable 1 through 6 subtotals by using the corresponding programmed percentages, and also adds the the calculated taxes to those subtotals, respectively.

Manual VAT

Procedure

:×

This system provides the VAT calculation for taxable 1 through 6 subtotals. This calculation is performed using the corresponding programmed percentages when the ×key is pressed just after the :key.

102