Part1 Part2 FOR THE OPERATOR | Part3 |

Manual tax

st

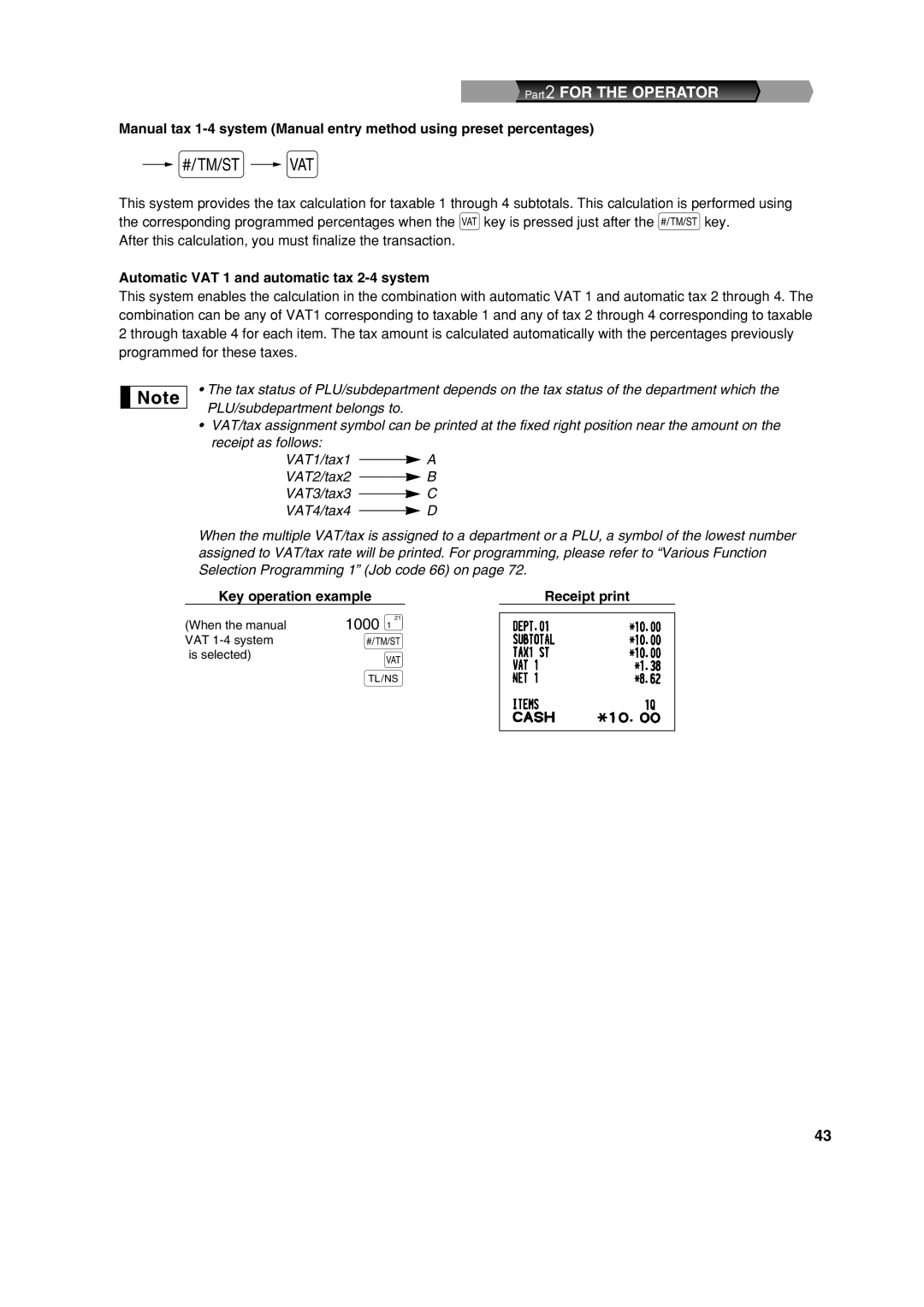

This system provides the tax calculation for taxable 1 through 4 subtotals. This calculation is performed using the corresponding programmed percentages when the tkey is pressed just after the skey.

After this calculation, you must finalize the transaction.

Automatic VAT 1 and automatic tax 2-4 system

This system enables the calculation in the combination with automatic VAT 1 and automatic tax 2 through 4. The combination can be any of VAT1 corresponding to taxable 1 and any of tax 2 through 4 corresponding to taxable 2 through taxable 4 for each item. The tax amount is calculated automatically with the percentages previously programmed for these taxes.

•The tax status of PLU/subdepartment depends on the tax status of the department which the PLU/subdepartment belongs to.

•VAT/tax assignment symbol can be printed at the fixed right position near the amount on the receipt as follows:

VAT1/tax1 ![]() A

A

VAT2/tax2 ![]() B

B

VAT3/tax3 ![]() C

C

VAT4/tax4 ![]() D

D

When the multiple VAT/tax is assigned to a department or a PLU, a symbol of the lowest number assigned to VAT/tax rate will be printed. For programming, please refer to “Various Function Selection Programming 1” (Job code 66) on page 72.

Key operation example

(When the manual | 1000 ¡ |

VAT | s |

is selected) | t |

| A |

Receipt print

43