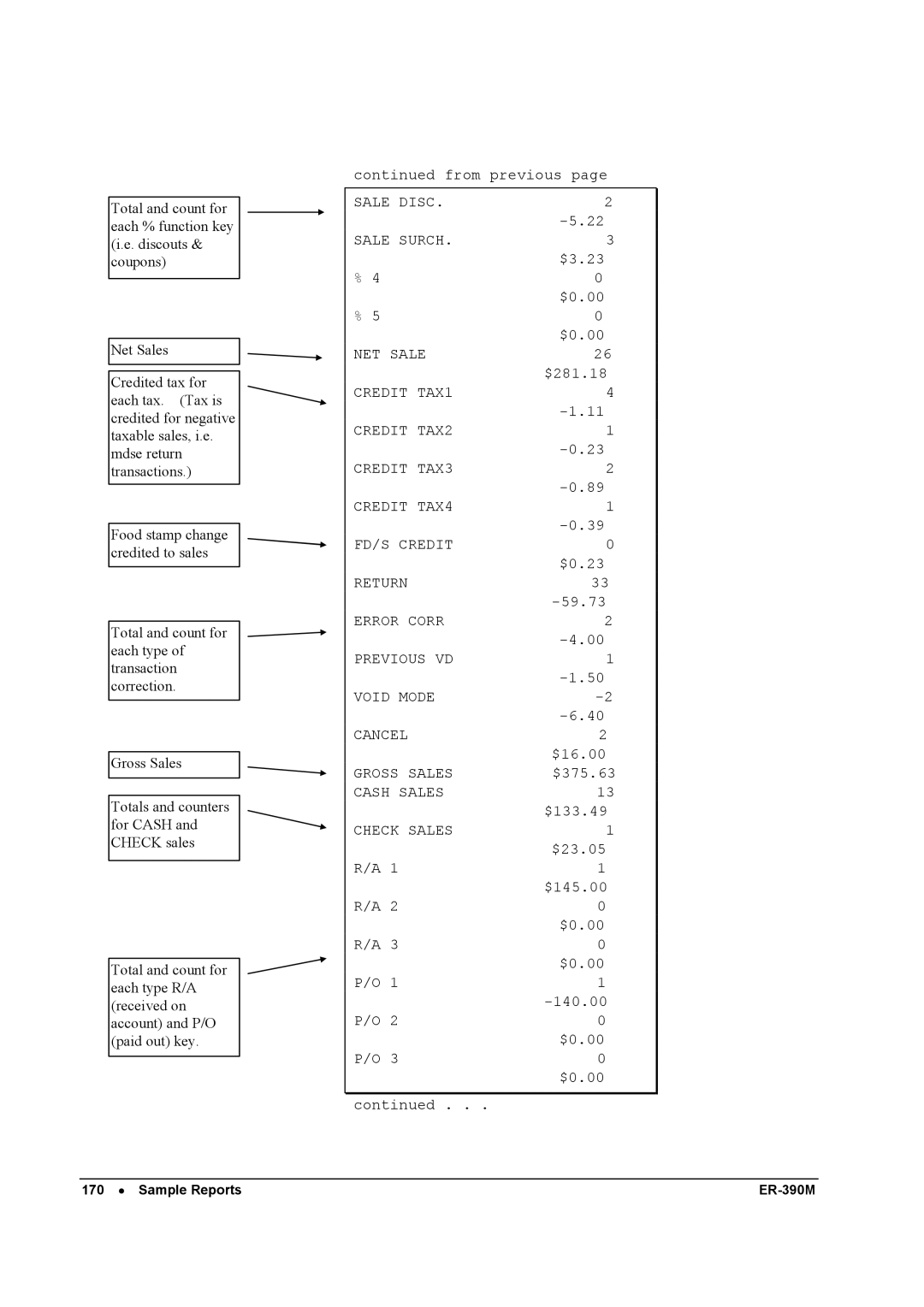

Total and count for each % function key (i.e. discouts & coupons)

Net Sales

Credited tax for each tax. (Tax is credited for negative taxable sales, i.e. mdse return transactions.)

Food stamp change credited to sales

Total and count for each type of transaction correction.

Gross Sales

Totals and counters for CASH and CHECK sales

Total and count for each type R/A (received on account) and P/O (paid out) key.

continued from previous page

SALE DISC. | 2 |

SALE SURCH. | |

3 | |

% 4 | $3.23 |

0 | |

% 5 | $0.00 |

0 | |

NET SALE | $0.00 |

26 | |

CREDIT TAX1 | $281.18 |

4 | |

CREDIT TAX2 | |

1 | |

CREDIT TAX3 | |

2 | |

CREDIT TAX4 | |

1 | |

FD/S CREDIT | |

0 | |

RETURN | $0.23 |

33 | |

ERROR CORR | |

2 | |

PREVIOUS VD | |

1 | |

VOID MODE | |

CANCEL | |

2 | |

GROSS SALES | $16.00 |

$375.63 | |

CASH SALES | 13 |

CHECK SALES | $133.49 |

1 | |

R/A 1 | $23.05 |

1 | |

R/A 2 | $145.00 |

0 | |

R/A 3 | $0.00 |

0 | |

P/O 1 | $0.00 |

1 | |

P/O 2 | |

0 | |

P/O 3 | $0.00 |

0 | |

| $0.00 |

continued . . .

170 • Sample Reports |