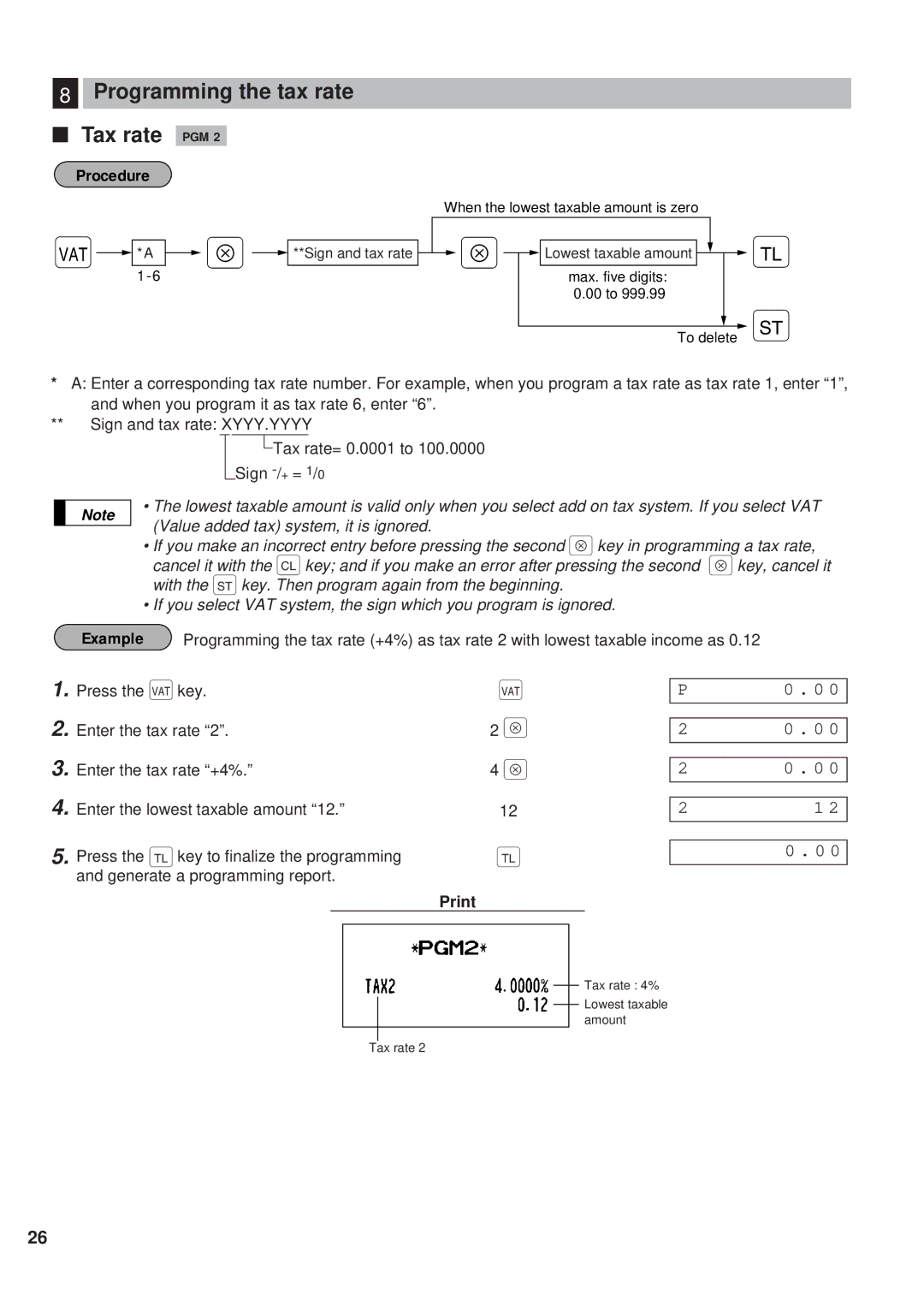

8Programming the tax rate

Tax rate PGM 2

Procedure

When the lowest taxable amount is zero

×![]()

![]() *A

*A ![]() Å

Å ![]()

![]() **Sign and tax rate 1 - 6

**Sign and tax rate 1 - 6

Å | Lowest taxable amount | ; |

| max. five digits: |

|

| 0.00 to 999.99 |

|

| To delete | : |

*A: Enter a corresponding tax rate number. For example, when you program a tax rate as tax rate 1, enter “1”, and when you program it as tax rate 6, enter “6”.

**Sign and tax rate: XYYY.YYYY

|

|

|

|

|

|

|

|

|

|

|

| Tax rate= 0.0001 to 100.0000 | |

|

|

|

|

| ||

|

|

| Sign | |||

|

|

|

|

|

|

|

|

| • The lowest taxable amount is valid only when you select add on tax system. If you select VAT | ||||

| Note | |||||

| (Value added tax) system, it is ignored. | |||||

|

| |||||

|

| • If you make an incorrect entry before pressing the second Åkey in programming a tax rate, | ||||

|

| cancel it with the ckey; and if you make an error after pressing the second Åkey, cancel it | ||||

|

| with the :key. Then program again from the beginning. | ||||

|

| • If you select VAT system, the sign which you program is ignored. | ||||

Example | Programming the tax rate (+4%) as tax rate 2 with lowest taxable income as 0.12 |

1.Press the ×key.

2.Enter the tax rate “2”.

3.Enter the tax rate “+4%.”

4.Enter the lowest taxable amount “12.”

5.Press the ;key to finalize the programming and generate a programming report.

×

2Å

4Å

12

;

P | 0 . 0 0 |

|

|

|

|

2 | 0 . 0 0 |

|

|

|

|

2 | 0 . 0 0 |

|

|

21 2

0 . 0 0

Tax rate : 4%

Lowest taxable amount

Tax rate 2

26