Manual DE Instrucciones

Avertissement

Warnung

Advertencia

U T I O N

Introduction

Never operate the register with wet hands

Contents

Other Basic Sales Entries

Part2 for the Operator

Part3 for the Manager

Correction After Finalizing a Transaction Void mode

Printer

External View Front view Rear view

X1/Z1

Mode Switch and Mode Keys

Keyboard Keyboard layout

Key names

Keyboard sheet ➂ Close the keyboard cover

Keyboard sheet

Customer display Pop-up type Drawer Lock Key

Displays Operator display

Initializing the Cash Register

Preparing the Cash Register

Display will disappear Close the battery compartment cover

Installing Batteries

Be careful with the paper cutter, so as not to cut yourself

Feed the end of the paper along with

Installing a Paper Roll

When using the take-up spool using as journal paper

When not using the take-up spool using as receipt paper

Code entry

If necessary, issue programming reports for your reference

Abbreviations and Terminology

Description of special keys

Backs up the cursor, erasing the character to the left

Using character keys Keys on the shaded area

Guidance for text programming

Keyboard sheet for text programming

Date and Time Programming

Language Selection

Time

Tax rate programming

Tax Programming

Sign and tax rate X YYY.YYYY

To delete a tax rate, use the following sequence

Department Programming

Dept. code VAT/tax status Sign

Key operation Operator display

Specify the department code

Text programming Press s to skip. / Press a to terminate

300

Select of TAX1 TAX1 YES

Sign programming Press s to skip. / Press a to terminate

Press the Akey to terminate department code Programming

Terminate programming

Selection Print

Direct PLU key programming For PLU code 1 to

PLU Price Look-Up and Subdepartment Programming

Specify the direct PLU key and its level

500

Text programming Press sto skip. / Press a to terminate

Press the Akey to terminate direct PLU key programming

Text Programming

Clerk names 12 digits

Function programming Press sto skip. / Press a to terminate

Logo message print format 3 types

Key operation example

Programming Other Necessary Items

Decimal point position tab setting for domestic currency

Rounding system

Receipt print

Turn the mode switch to the REG position

Basic Sales Entry Example

Press the skey to display the amount due

Direct PLU keys Operator display Receipt print

PLU Entry

Direct PLU entry

PLU code entry

Correction of the Last Entry direct void

Cancellation of the Numeric Entry

1250 600 d 328 ¡ 250 f

1310 1755

Subtotal Void

1310 1755 d 350 250 f 825

350 v ª

Part1 Quick Start Guide

Key operation Sample report Operator display

Full sales report

Periodic consolidation

Other Basic Sales Entries

Error Warning

Additional Information for Basic Sales Entry

Department entries

Item Entries Single item entries

PLU/subdepartment entries

50 d 1500 d d 41 d d 80 p p 500 fi fi 85 p 1200 p p

Repeat entries

1200 50 d 1500 d 41 d 80 p 500 fi 85 p 1200 p

1200

250

Multiplication entries

Single item cash sale Sics entry

@ 50 d 1500 d @ 41 d @ 80 p @ 500 fi @ 85 p 1200 p

PLU level shift for direct PLU key

Automatic return mode

Returning to level 1 after an item entry default

Lock shift mode

Displaying Subtotals

1000

Finalization of Transaction Cash or cheque tendering

Cash or cheque sale that does not require tender entry

1000 a

2500 3250 d

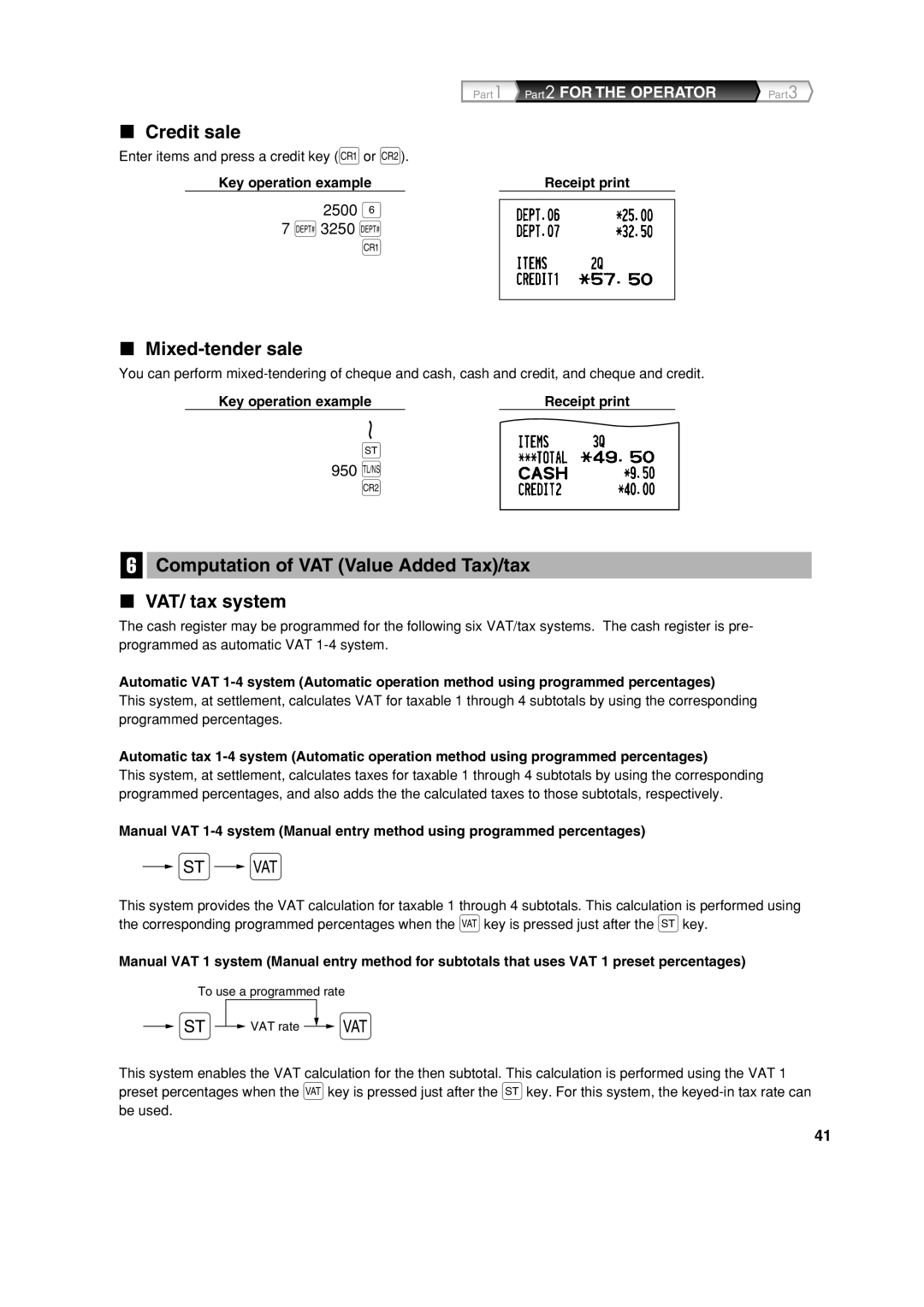

Credit sale

Mixed-tender sale

Computation of VAT Value Added Tax/tax VAT/ tax system

Automatic VAT 1 and automatic tax 2-4 system

VAT shift entries

Auxiliary Entries Percent calculations premium or discount

Optional Features

Deduction entries

675 d

Refund entries

Non-add code number entries and printing

Deduction for item entries

11 G 3500 2700 #

Guest Look-Up GLU

For new guest

Guest check receipt bill

1400 1600

Additional ordering

Settlement Key operation example Receipt print

Exchange rate 0.000000 to

Auxiliary Payment Treatment Currency exchange

Automatic Sequence Key a key Entries

Received-on account entries

Paid-out entries

No sale exchange

Prior to Programming

Procedure for programming

Guidance messages

Display

Entering character codes with numeric keys on the keyboard

Alphanumeric character code table

For the Manager

Specify the key to program

Auxiliary Function Programming

Miscellaneous Key Programming

Programming for

Part1 Part2 Part3 for the Manager

Press the Akey to terminate the -key Programming

Programming for %

15.00

Enter the rate using numeric keys, using a decimal

Point when setting fractional rates

Rate programming Press s to skip. / Press a to terminate

Press the Akey to terminate the %key Programming

Enter percent rate limit using numeric key

90.00

Rate limit can be set from 0.00 to

939938

Text programming Press s to skip

Press the Akey to terminate the Vkey Programming

Programming for r, o, X, Y, cand b

Cheque

Press the Akey to terminate the Xkey Programming

Function parameters for a

1Item Selection Entry

018 @

Foreign currency symbol 4 digits

Domestic currency symbol 4 digits

Other Text Programming

36 @ CARD1 s

Training mode text 12 digits

Function text 12 digits

S S Training S S

NET2

List of function texts

123456 s a

Register Number and Consecutive Number Programming

Register number

Consecutive number

00000100 s a

Example When programming for job code 5 as Abcdefgh

Various Function Selection Programming

Function selection for miscellaneous keys

Receipt print format

Print format

Printing style

Other programming

PLU level shift and GLU function parameters

Job code Selection Entry

Compression print on journal

Part2 Part3 for the Manager

South Africa Payment Arbitrary

Only

Action when EJ memory area is full

PGM mode operation records type

Temporary EJ printing during a transaction

10 @ 0060 s a

Power save mode

Selection Entry

Thermal printer density

Logo message print format

EJ memory type

100

Training clerk specification for training mode

Auto key programming Automatic sequence key

86 @ 20 s a

1000 s

Euro system settings

Automatic Euro modification operation settings

Euro Programming

Key sequence for reading stored program

Date setting for Euro modification operation

Time setting for Euro modification operation

Reading Stored Programs

Programming report

Sample printouts

Printer density programming report

Programming report Department programming report

PLU programming report

Auto key programming report

1000

Training Mode

Summary of Reading X and Resetting Z Reports

Reading X and Resetting Z of Sales Totals

Full clerk report

When you take Z1 report, Z1 is printed

Daily Sales Totals

PLU report by designated range Individual clerk report

Open GLU report

Hourly report

Open GLU report by clerk Balance report

Sample EJ report

To reset all of the data

Printing journal data on the way of a transaction

Sample print

Override Entries

Incorrect receipt Cancellation receipt

Period

Euro Migration Function

How currencies are treated in your register

Automatic Euro modification operation

Euro status

Items

Checking the current Euro status

Optional Programming for the Introduction of Euro

Programming for Exchange Key

Case of Power Failure

Operator Maintenance

Case of Printer Error

Replacing the Paper Roll

Paper specification

How to set the paper roll

Replacing the Batteries

Removing the paper roll

Installing the receipt paper roll

Installing the paper roll

Installing the journal paper roll

Removing a Paper Jam

Cleaning the Printer Print Head / Sensor / Roller

Opening the Drawer by Hand

Removing the Till and the Drawer

Drawer will not open if it is locked with the key

Error message table

Before Calling for Service

Specifications

European Union

Information on Disposal for Users private households

Information on Disposal for Business Users

European Union

Österreich 08-205 505

Einleitung

Wichtig

Hotline Nummern

Teil

Inhalt

Andere Grundlegenden Registrierungen

Teil 2 FÜR DEN Bediener

Storno-Modus

Teil 3 FÜR DEN Geschäftsinhaber

Drucker

Außenansicht Vorderansicht Rückansicht

Tastatur Tastaturanordnung

Funktionsschloss und Funktionsschlüssel

Tastenbezeichnungen

Schlitzen einführen

Tastaturfolie

Tastaturfolie ➂ Die Tastaturabdeckung schließen

Kundenanzeige Pop-Up-Typ Schubladenschlüssel

Anzeigen Bedieneranzeige

Initialisierung der Registrierkasse

SCHRITT2 Vorbereitung DER Registrierkasse

Einsetzen der Batterien

Führen Sie das Ende des

Einsetzen einer Papierrolle

Page

Vor der Programmierung Vorgang für die Programmierung

Abkürzungen und Terminologie

Beschreibung spezieller Tasten

Bedieneranzeige Beispiel

Leitfaden zur Textprogrammierung

Tastaturfolie für Textprogrammierung

Verwendung der Zeichentasten Tasten im schattierten Bereich

1430

Sprachauswahl

Einstellung von Datum und Uhrzeit Einstellung des Datums

Einstellung der Uhrzeit

Tastenbedienung BedieneranzeigeDruck

Mehrwertsteuerprogrammierung

Programmierung des Steuersatzes

MWSt-Satz YYY.YYYY

Um einen MWSt-Satz zu löschen, gehen Sie wie folgt vor

Programmierung für Warengruppen

Warengruppen MWSt-Status Vorzeichen

Über die Zehnertastatur einen Einzelpreis

Angabe des Warengruppencodes

Eingeben

Auswahl MWST1 MWST-SATZ1 JA

Registriertyp Normal

Beenden der Programmierung

Zum Beenden die A-Taste drücken

Positionen Wahl Eingabe

Angabe der Direkt-PLU und ihrer Ebene

Programmierung für PLUs Einzelartikel und Sub-Warengruppen

Es lassen sich bis zu max Zeichen eingeben

Eine Artikelbezeichnung eingeben

Es lassen sich bis zu max Stellen eingeben

Bedienernamen 12 Stellen

Textprogrammierung

Auf 2 vorgehen, wenn die Funktion „ARTIKELPLU

Logotext 6 Zeilen und 24 Stellen für jede Zeile

Tastenbedienung Bedieneranzeige Druck

Logodruckformat 3 Typen

Programmierung anderer erforderlicher Positionen

Kassenbondruck

Beispiel für die grundlegende Registrierung

2300

4000

141 p

PLU-Registrierung

Direkt-PLU-Registrierung

PLU-Code-Registrierung

Korrektur der letzten Registrierung Sofortstorno

Löschen eingegebener Ziffern

Gesamt

Zwischensummenstorno

Teil1 Schnellstartanleitung Teil2 Teil3

TastenbedienungBedieneranzeige Berichtsbeispiel

Gesamtumsatzbericht

TastenbedienungBedieneranzeige

Periodische Berichte

Fehlermeldung

Zusätzliche Information für die Grundlegende Registrierung

Fehleraufhebungsfunktion

Postenregistrierungen Einzelpostenregistrierung

Warengruppenregistrierung

PLU/Sub-Warengruppenregistrierung

Tastenbedienung Kassenbondruck

Wiederholungsregistrierung

PLU-Registrierung

Sub-Warengruppenregistrierung offene Preiseingabe für PLUs

Einzelposten-Barverkauf SICS-Registrierung

Multiplikationsregistrierung

TastenbedienungKassenbondruck

Automatischer Rückkehrmodus

PLU-Ebenen-Umschalttasten für Direkt-PLU-Tasten

Verriegelungsmodus

Wenn die Registrierkasse mit Verriegelung programmiert wurde

Anzeige von Zwischensummen

Scheckzahlung

Abschluss einer Transaktion Bar- oder Scheckeingabe

Gemischte Zahlung

Kreditverkauf

Registrierungen mit MWSt-Umschaltung

Prozentberechnung für Postenregistrierungen

Optionale Merkmale

AbzugsRabatt-Registrierungen

Prozentberechnung für Zwischensumme

Eingabe und Ausdrucken von nicht-addierenden Nummern

Retourenregistrierung

Abzug für Postenregistrierungen

Für einen neuen Tisch erstmalige Bestellung

Tischregistrierungen

Abschluss Tastenbedienung Kassenbondruck

Zusätzliche Bestellung

Rechnungsdruck

10000 a

Zahlungshandhabung Fremdwährungsumrechnung

Verwendung des programmierten Umrechnungskurses

4650 d

Registrierung mit der Automatik-Eingabetaste a

Einzahlungsregistrierungen

Auszahlungsregistrierungen

Kein Verkauf Geldwechsel

Führungstexte bei der Textprogrammierung

VOR DER Programmierung

253 065

Eingabe von Zeichencodes mit den Zifferntasten der Tastatur

Alphanumerische Zeichencodetabelle

231

165

Angabe der zu programmierenden Taste

Programmierung Zusätzlicher Funktionen

Programmierung verschiedener Tasten

Programmierung der --Taste

Taste drücken./Zum Beenden die A-Taste drücken

Positionen Wahl Druck

Programmierung der %-Taste

Die %-Taste drücken, um auf %-Programmierung zu schalten

15.00

Die s-Taste drücken, um die Einstellung zu Speichern

Programmierung der Taste

Beenden die A-Taste drücken

Die Prozentsatzbegrenzung über die Zehnertastatur

Den Umrechnungskurs über die Zehnertastatur

Drücken./Zum Beenden die A-Taste drücken

Eingeben, ggf. mit Dezimalpunkt vor den

Programmierung der Tasten r, o, X, Y, c, und b

Den Text eingeben

1Positionen Wahl Eingabe

Funktionsparameter für die Taste a

207

Fremdwährungssymbol 4 Stellen

Landeswährungssymbol 4 Stellen

Andere Textprogrammierung

TastenbedienungDruck

Text im Schulungsmodus 12 Stellen

Funktionstext 12 Stellen

Mwst S 16%

Funktionstextliste

Laufende Nummer

Weiterführende Funktionsprogrammierung

Programmierung der Maschinennummer und der laufenden Nummer

Maschinennummer

Funktionswahl für verschiedene Tasten

Programmierung der Wahl für zusätzliche Funktionen

Job-Code Positionen Wahl Eingabe

Kassenbon-Druckformat

Druckformat

Druckformat

Sonstige Programmierung

PLU-Ebenen-Umschaltung und Tischfunktions-Programmierung

Job-Code Positionen Wahl Eingabe

Komprimierter Journalausdruck

Teil2 Teil3 FÜR DEN Geschäftsinhaber

Eingaben sperren und Warnung Speicher fast voll

Aufzeichnung der PGM-Programmierungen im Journal

Vorübergehender E-Journalausdruck bei einer Transaktion

Rundungssystem

Stromsparmodus

Logotexttyp

Logodruckformat

Thermodrucker-Druckdichte

Journalspeichertyp Elektronisches Journal

Programmierung der Automatik-Eingabetaste

Schulungsmodus

Währungsumrechnungsmethode

EURO-Programmierung

Einstellungen des EURO-Systems

Einstellungen für automatische EURO-Modifikationsoperation

Zeiteinstellung für EURO-Modifikationsoperation

Datumseinstellung für EURO-Modifikationsoperation

Abruf gespeicherter Programminhalte

Programmierbericht

Druckbeispiele

PLU-Programmierbericht

Warengruppen-Programmierbericht

Schulungsbetriebsart

Abruf X UND Nullstellung VON Umsätzen

Wenn ein Z1-Bericht erstellt wird, wird hier „Z1 gedruckt

Tagesumsatzberichte

PLU-Bericht von bis Einzelbedienerbericht

Gesamtbedienerbericht

Offene Tische pro Bediener-Bericht Gesamtsaldenbericht

Stundenumsatzbericht Offener Tisch-Bericht

Abrufen aller Daten Journalberichtsbeispiel

Abruf UND Nullstellung DES Elektronischen Journals EJ

Ausdrucken der Journaldaten während einer Transaktion

Druckbeispiel

Fehlerhafter Kassenbon Storno-Kassenbon

Überschreibung VON BETRAGS- EINGABE-BEGRENZUNGEN

Periode

EURO-UMRECHNUNGSFUNKTION

So werden Währungen von Ihrer Registrierkasse behandelt

Automatische EURO-Modifikationsoperation

EURO-Status

Gegenstand

Converted auf dem Bericht Nr ausgedruckt

Überprüfen des gegenwärtigen EURO-Status

Optionale Programmierung für die Einführung des Euro

Programmierung für Fremdwährungs-Umrechnungstaste

Vorsichtshinweise zur Handhabung des Thermopapiers

Wartung Durch DEN Bediener

Verhalten bei Stromausfall

Bei Eintritt einer Druckerstörung

Einsetzen der Papierrolle

Austauschen der Batterien

Einsetzen und Herausnehmen der Papierrolle

Papierrollen-Spezifikation

Entfernen Sie die Druckwerkabdeckung

Herausnehmen der Papierrolle

Einsetzen der Journalstreifenrolle

Einsetzen der Papierrolle

„Einsetzen der Papierrolle beschrieben ist

Behebung eines Papierstaus

Reinigung des Druckers Thermodruckkopf / Sensor / Walze

Drehen Sie das Funktionsschloss auf die Position „

Die Schublade kann nicht geöffnet werden, wenn sie mit dem

Entfernen des Schubladeneinsatzes und der Schublade

Öffnen der Schublade von Hand

Siehe linke Abbildung

Liste der Fehlermeldungen

Bevor Sie den Kundendiensttechniker anfordern

Technische Daten

Anderen Ländern außerhalb der EU

Entsorgungsinformationen für Benutzer aus Privathaushalten

Entsorgungsinformationen für gewerbliche Nutzer

Der Europäischen Union

Hotline France

Partie 1 Guide DE Demarrage Rapide

Table DES Matieres

Annulation d’un total partiel

Autres Entrees DE Ventes DE Base

Partie 2 Pour L’OPERATEUR

Programmation DE Fonctions Avancees

Partie 3 Pour LE Directeur

Imprimante

Vue extérieure Vue frontale Vue arrière

Clavier Disposition du clavier

Commutateur de mode et clés de mode

Noms des touches

Feuille du clavier

Nota

Fente

Affichages Affichage de l’opérateur

Initialisation de la caisse enregistreuse

ETAPE2 Preparatifs DE LA Caisse Enregistreuse

Installation des piles

Papier, comme il est illustré

Installation d’un rouleau de papier

Nota

Relever d’un rayon

Abréviations et terminologie

Description de touches spéciales

Dept

Pour alterner les caractères en lettres minuscules

Guidage pour la programmation d’un texte

Feuille du clavier pour la programmation d’un texte

Affichage de l’opérateur Exemple

Affichage de l’opérateur Impression

Choix d’une langue

Programmation de la date et de l’heure Date

Exemple de manipulation des touches

Signe et taux de taxe X YYY.YYYY

Heure

Programmation de taxes

Programmation d’un taux d’une taxe

Pour annuler un taux de taxe, utilisez la séquence suivante

Programmation de rayons

Code du rayon Statut de la T.V.A./taxe Signe

Nouvelles données

Spécifiez le code du rayon

Manipulation des touches

Introduction du nom de l’article

Selection Taxe TAXE1 OUI

Mode Ventes Normal

Achèvement de la programmation

Appuyez sur la touche spour

Article Sélection Entrée

Appuyez dans l’ordre sur une touche de ¡

Spécifie la touche d’un PLU direct et son niveau

Changement de niveau et sur une touche de PLU direct

Un maximum de 16 caractères peut être introduit

Introduisez le nom d’un article

Nom des employés 12 chiffres

Programmation d’un texte

Pour programmer un code PLU incrémenté, revenez à l’étape

Disposition d’impression d’un message logotype

NOM Employe No Employe David

Système d’arrondissement

Programmation d’autres articles nécessaires

Appuyez sur la touche spour faire afficher le dû du montant

Exemple d’entrée pour des ventes de base

Impression du reçu

Affichage de l’opérateur Impression du reçu

Entrée de PLU Prix par article déjà programmé

Entrée d’un PLU direct

Entrée d’un code PLU

Rectification de la dernière entrée annulation directe

Annulation d’une entrée numérique

1310 1755 d 350 ª 250 f 825 # 350 v ª

Annulation d’un total partiel

Partie1 Guide DE Demarrage Rapide Partie2 Partie3

Manipulation des touches Affichage de l’opérateur

Rapport complet sur les ventes

Echantillon d’un rapport

Regroupement périodique

Fonction de mise en circuit/hors circuit des reçus

Mode d’économie d’énergie

Avertissement d’une erreur

Affectation d’un employé

Fonction d’échappement à une erreur

Entrées d’articles Entrées d’un seul article

Entrées de rayons

Entrées de PLU/rayons auxiliaires

Exemple de manipulation des touches Impression du reçu

Entrées répétées

Entrées de PLU

Entrées de rayons auxiliaires PLU disponibles

Exemple de manipulation des touchesImpression du reçu

Entrées multiplicatives

Entrées de la vente au comptant d’un seul article Sics

@ 50 d 1500 d

Retour au niveau 1 après l’achèvement d’une opération

Mode de retour automatique

Mode de changement de blocage

Changement de niveau d’un PLU pour une touche de PLU direct

Affichage de totaux partiels

Offre contre un chèque

Vente contre une offre mixte

Vente à crédit

Système de T.V.A automatique et de taxes 2-4 automatique

Entrées d’un changement de T.V.A

Calcul d’un pourcentage pour des entrées d’articles

Fonctions Facultatives

Entrées de déductions

Calcul d’un pourcentage pour un total partiel

Entrées de numéros de codes non-additifs et impression

Entrées de remboursements

Déduction pour des entrées d’articles

Pour un nouveau client

Recherche des données d’un client GLU

Reçu facture vérificatif d’un client

Instructions suppplémentaires

2300 4650 d

Traitement d’un payement annexe Change d’une monnaie

Application d’un taux de change préréglé

Application d’un taux de change manuel

Entrées de touches touche a dans une séquence automatique

Entrées de comptes admis

Entrées de décaissements

Pas de vente échange

Messages de guidage

’un rouleau de papier à la page 89 pour le remplacement

Avant UNE Programmation

Procédure pour la programmation

Curseur Les caractères introduits sont affichés ici

Table de caractères alphanumériques

Partie1 Partie2 Partie3 Pour LE Directeur

Introduisez le montant en utilisant les touches

Programmation de touches diverses

Programmation pour

Spécifie la touche à programmer

Sauter./Appuyez sur la touche Apour achever

Appuyez sur s pour sauter

La touche Apour achever

Programmation pour %

Introduisez le taux en utilisant les touches

Appuyez sur la touche Apour achever

Appuyez sur la touche s pour

Sur la touche Apour achever

Numériques. Utilisez le point de décimalisation pour

Appuyez sur la touche a pour achever

Programmation de la touche

Programmation pour r, o, X, Y, cet b

Réglage

Appuyez sur la touche Apour achever la

Appuyez sur s pour sauter./Appuyez

La touche a pour achever

Introduisez le texte

1Article Sélection Entrée

Paramètres de fonction pour a

85 P 207

Symbole d’une monnaie étrangère 4 chiffres

Symbole d’une monnaie nationale 4 chiffres

Programmations d’autres textes

Texte d’un fonction 12 chiffres

Texte pour le mode de formation 12 chiffres

Exemple de manipulation des touches Impression

NET2

Liste des textes de fonctions

Numéro consécutif

Numéro de l’enregistreuse

Sélection de fonctions pour des touches diverses

Programmation 1 pour la sélection de diverses fonctions

Code de travail Article Sélection Entrée

Disposition d’impression d’un reçu

Disposition pour une impression

Type d’impression

Autres programmations Nota

Code de travail Article Sélection Entrée

Impression condensée sur la bande de détails quotidiens

Ou b

Système d’arrondi

Type d’enregistements pour des opérations sur le mode PGM

Programmation 2 pour la sélection de diverses fonctions

Mode d’économie d’énergie

Densité de l’imprimante thermique

Disposition de l’impression d’un message logotype

Exemple de manipulation des touchesImpression

86 @

Méthode de calcul d’un change

Programmation de l’EURO

Réglages du système de l’EURO

01 s

Nom du rapport Séquence des touches

Lecture de programmes mémorisés

Rapport sur la programmation

Exemples d’impressions

Rapport sur la programmation d’un PLU

Mode DE Formation

Résumé des rapports de lectures X et de remises à zéro Z

Lecture X ET Remise a Zero DES Totaux DE Ventes

Lorsque vous effectuez un rapport Z1, Z1 est imprimé

Totaux de ventes quotidiennes

Rapport de l’ensemble des employés

Exemple d’un rapport

Rapport de GLU disponibles

Rapport horaire

Rapport de GLU disponibles par Rapport d’un solde Employé

Pour remettre à zéro toutes les données

Exemple d’impression

Pour lire toutes les données

Exemple d’un rapport EJ

Entrees DE Surpassements

Opération de modification automatique de l’EURO

Comment les monnaies sont traitées dans votre enregistreuse

Période

Statut 2 de l’EURO

Articles

Ce qu’ils soient basés sur la monnaie Euro

Vérification du statut en cours de l’EURO

Programmation facultative pour l’introduction de l’EURO

Programmation pour la touche de change

Dans le cas d’une panne de courant

Entretien PAR L’OPERATEUR

Dans le cas d’une erreur de l’imprimante

Spécifications du papier

Remplacement des piles

Remplacement d’un rouleau de papier

Comment installer le rouleau de papier

Enlèvement du rouleau de papier

Avancera automatiquement

Installation du rouleau de papier

Suppression d’un bourrage du papier

Ouverture du tiroir à la main

Enlèvement du casier pour l’argent et du tiroir

Gauche

Table des messages d’erreurs

Avant d’appeler pour un dépannage

Donnees Techniques

Pays hors de l’Union européenne

Au sein de l’Union européenne

Importante

Introduccion

No opere nunca la caja registradora con las manos mojadas

Indice

Cancelación del subtotal

Parte 1 Guia DE Inicio Rapido

Otros Registros Basicos DE Ventas

Parte 2 Para EL Operador

Programacion DE Funciones Avanzadas

Parte 3 Para EL Administrador

Impresora

Vista exterior Vista delantera Vista trasera

Teclado Disposición del teclado

Selector de modo y llaves de modo

Nombres de las teclas

Ranura

Lámina del teclado

Visualizadores Visualizador para el operador

Inicialización de la caja registradora

PASO2 Preparacion DE LA Caja Registradora

Instalación de las pilas

Instalación de un rollo de papel

Nota

Impuesto al valor añadido

Abreviaturas y terminología

Descripción de las teclas especiales

Una sección

Lámina del teclado para la programación del texto

Guía para la programación de texto

Visualizador para el operador Ejemplo

Programación de la fecha y de la hora Fecha

Selección del idioma

Procedimiento

Signo y tasa de impuestos X YYY.YYYY

Hora

Programación de los impuestos

Programación de la tasa de impuestos

Código de sección Estado de IVA/impuestos Signo

Programación de secciones

Operación de teclas

Especifique el código de sección

Seleccion TAX1 TAX1 SI

Tipo Registro Normal

Elemento Selección Registro

Terminación de la programación

Especifique la tecla de PLU directa y su nivel

Programación de PLU codificación de precios y subsección

Pulse la tecla para entrar en la programación de texto

Nombres de dependiente 12 dígitos

Programación de texto

Formato de impresión de mensaje del membrete 3 tipos

Mensajes de membrete 6 líneas y 24 dígitos para cada línea

Sistema de redondeo

Programación de otros elementos necesarios

Pulse la tecla spara visualizar el importe a cobrar

Ejemplo de registro básico de ventas

71 p

Registro de PLU

Registro de PLU directa

Registro de códigos de PLU

328 ¡ 250 f

Cancelación del registro numérico

Corrección del último registro cancelación directa

1250

Cancelación del subtotal

Parte1 Guia DE Inicio Rapido Parte2 Parte3

Informe de ventas completo

PASO6 Informe DE Ventas Completo Informe Z

Consolidación periódica

Informe adicional para Registro Basico DE Ventas

Aviso de error

Registros de PLU/subsecciones

Función de escape de error

Registros de artículos Registros de un solo artículo

Registros de sección

Ejemplo de operación de teclas Impresión en el recibo

Registros repetidos

Registros de PLU

Registros de subsección PLU abierta

Registros de venta en metálico de un solo artículo Sics

Registros de multiplicación

Ejemplo de operación de teclasImpresión en el recibo

Modo de cambio fijado

Cambio de nivel de PLU para la tecla de PLU directa

Modo de retorno automático

Retorno al nivel 1 después de finalizar una transacción

Ejemplo de operación de teclas

Visualización de los subtotales

Importe recibido en cheque

Ventas con importe recibido mixto

Ventas a crédito

Registre los artículos y pulse una tecla de crédito co b

Después de este cálculo debe finalizar la transacción

Registros de cambio del IVA

Sistema IVA 1 automático y de impuestos 2 4 automático

Cálculo porcentual para registros de artículos

Caracteristicas Opcionales

Registros de deducción

Cálculo porcentual para el subtotal

Registros e impresión de números de código de no suma

Registros de devolución

Deducción para registros de artículos

Para un cliente nuevo

Codificación de cliente GLU

Recibo factura de cuenta de un cliente

Pedido adicional

Aplicación de la tasa de cambio de moneda extranjera manual

Tratos de pagos auxiliares Cambio de divisas

Tasa de cambio 0,000000 a 999,999999

Registros con la tecla de secuencia automática tecla a

Sin ventas cambios

Registros de recibido a cuenta

Registros de pagos

Procedimiento para la programación

Antes DE LA Programacion

Mensajes de guía

253

DC Código de carácter de doble tamaño

Tabla de códigos de caracteres alfanuméricos

Introduzca el importe empleando las teclas

Programación de teclas misceláneas

Programación para

Especifique la tecla para programar

El ajuste predeterminado es Enable

Parte1 Parte2 Parte3 Para EL Administrador

Pulse la tecla Apara terminar la programación de La tecla

Programación para %

Empleando un punto decimal para ajustar tasas

Introduzca la tasa empleando las teclas numéricas

Operación de teclas Visualizador para el operador

Introduzca el límite de la tasa de porcentaje

Empleando las teclas numéricas

Pulse la tecla Apara terminar la programación de La tecla %

Preset Enable

Programación para r, o, X, Y, cy b

Cheque

1Elemento Selección Registro

Parámetros de función para a

Símbolo de divisas 4 dígitos

Otras programaciones de texto

Símbolo de moneda nacional 4 dígitos

Texto de función 12 dígitos

Texto del modo de instrucción 12 dígitos

Lista de textos de función

Número consecutivo

Número de caja registradora

Inhabilitado

Programación 1 de selección de diversas funciones

Selección de función para teclas misceláneas

Código de tarea Elemento Selección Registro

Formato de impresión de recibos

Formato de impresión

Estilo de impresión

Otras programaciones Nota

Parámetros del cambio de nivel de PLU y de la función de GLU

Código de tarea Elemento Selección Registro

Impresión comprimida en registro diario

Parte2 Parte3 Para EL Administrador

PGM

Tipo de registros de operación en el modo PGM

Impresión temporal de EJ durante la transacción

Acción cuando el área de memoria de EJ está llena

Modo de ahorro de energía

Programación 2 de selección de diversas funciones

Procedimiento s 90 @ a

Formato de impresión de mensajes de membrete

Densidad de la impresora térmica

Tipo de memoria de EJ

ProcedimientoBorrar

Programación de la tecla Auto Tecla de secuencia automática

Ejemplo de operación de teclasImpresión

Ajustes del sistema del Euro

Programación del Euro

Método de cálculo de cambio de divisas

Lectura de programas almacenados

13 @

Informe de programación

Impresiones de muestra

Informe de programación de la tecla automática

Informe de programación de PLU

Informe de programación de densidad de impresora

Modo DE Instruccion

Resumen de informes de lectura X y reposición Z

Lectura X Y Reposicion Z DE LOS Totales DE Ventas

Informe de todos los dependientes

Totales de ventas diarias

Cuando saca el informe Z1, se imprime Z1

Informe de balance

Informe horario

Informe de GLU abierta

Informe de GLU abierta por dependiente

Para leer los 10 registros últimos

Impresión de muestra

Informe EJ de muestra

Para reponer todos los datos

Registros DE Anulacion

Recibo incorrecto Recibo cancelado

Procedimiento Ejemplo

Moneda Período

Funcion DE Migracion DEL Euro

Cómo se tratan las monedas en su caja registradora

Operación de modificación automática para el Euro

Estado 2 de Euro

Itemes

Comprobación del estado actual de Euro

Programación opcional para la introducción del Euro

Programación para la tecla de cambio de divisas

Precauciones al manejar la impresora y el papel de registro

En el caso de error de la impresora

Mantenimiento Para EL Operador

En caso de corte de la alimentación

Forma de colocar el rollo de papel

Reemplazo de las pilas

Reemplazo del rollo de papel

Especificaciones del papel

Extracción del rollo de papel

Instalación del rollo de papel de registro diario

Instalación del rollo de papel

Extracción del papel atascado

Abertura manual del cajón

Extracción del separador de dinero y del cajón

Vea la ilustración a la izquierda

Antes de solicitar el servicio de un técnico

Tabla de mensajes de error

Especificaciones

En otros países fuera de la Unión Europea

Información sobre eliminación para usuarios particulares

Información sobre Eliminación para empresas usuarias

En la Unión Europea

Belangrijk

Introductie

Bedien de kassa nooit met natte handen

Deel 1 Gids Voor Snel Starten

Inhoudsopgave

Invoeren VAN Eenvoudige Verkopen

Deel 2 Voor DE Winkelbediende

Alvorens TE Programmeren Programmeren VAN Extra Functies

Deel 3 Voor DE Manager

Inktpatroon nodig

Exterieur Vooraanzicht Achteraanzicht

Dat u zich bezeert en wees derhalve voorzichtig

Toetsenbord Overzicht van toetsenbord

Functieschakelaar en functiesleutels

Namen van toetsen

Gleuf

Blad voor toetsenbord

Toetsenbordblad ➂ Sluit de afdekking van het toetsenbord

Klantdisplay Omhoog-klap type Ladeslot en sleutel

Displays Winkelbediende-display

Initialiseren van de kassa

STAP2 Voorbereiding Voor DE Kassa

Plaatsen van batterijen

Plaats het uiteinde van het papier

Plaatsen van een papierrol

Page

Afkortingen en termen

Alvorens te programmeren Procedure voor programmeren

Beschrijving van speciale toetsen

Toetsenbordblad voor tekstprogrammering

Belegeiding voor programmeren van tekst

Bediendedisplay voorbeeld

Toetsbediening voorbeeld Bediendedisplay Afdruk

Taalkeuze

Programmeren van de datum en tijd Datum

Tijd

Toetsbediening voorbeeld BediendedisplayAfdruk

Programmeren van belasting

Programmeren van belastingvoet

Teken en belastingvoet X YYY.YYYY

Afdelingscode BTW/belastingstatus Teken

Programmeren van afdeling

Kunt maximaal 6 cijfers invoeren De fabrieksinstelling is

Voer de afdelingscode

Toetsbediening Bediendedisplay

Voer een unit-prijs met de cijfertoetsen

Select of TAX1 TAX1 YES

REGIST.TYPE Normal

12. Beëindig het programmeren

Op a om te beëindigen

Onderdeel Keuze Afdruk

Programmeren van directe PLU toets voor PLU code 1 t/m

Programmeren van PLU Price Look-Up en subafdeling

Specificeer de directe PLU toets en het niveau

Enter DEPT#

Namen van winkelbediendes 12 tekens

Programmeren van tekst

Beëindig het programmeren

Printformaat voor logo-mededeling 3 types

Toetsbediening voorbeeld

Programmeren van andere nodige onderdelen

Afrondsysteem

Bon

Voorbeeld voor invoeren van eenvoudige verkopen

Directe PLU toetsen BediendedisplayBon

Invoeren van PLU

Directe PLU invoer

Invoeren van PLU code

Corrigeren van de laatste invoer direct annuleren

Annuleren van een ingevoerd cijfer

Annuleren van subtotaal

Deel1 Gids Voor Snel Starten Deel2 Deel3

ToetsbedieningBediendedisplay Voorbeeld van overzicht

Volledig verkoopoverzicht

ToetsbedieningBediendedisplay

Periodiek overzicht

Foutmelding

Extra informatie voor Invoeren VAN Eenvoudige Verkopen

Invoeren van afdeling

Invoeren van onderdelen Invoeren van enkele onderdelen

Invoeren van PLU/subafdeling

50 d 1500 d d

Invoeren van herhalingen

80 p p 500 fi fi 85 p 1200 p p

Invoeren van contante verkoop van één artikel Sics

Invoer met vermenigvuldiging

Automatische terugkeerfunctie

PLU niveau shift voor directe PLU toets

Shift-vergrendeling

Indien de shift-vergrendeling voor de kassa is ingesteld

Tonen van subtotaal

Contante betaling

Voltooien van een transactie Contante betaling of cheque

Betaling met cheque

Verkoop met gemengde betaling

Verkoop op krediet

Voer de onderdelen in en druk op een krediettoets cof b

Automatisch BTW 1 en automatisch belasting 2-4 systeem

BTW shift invoer

Berekenen van percentage van artikel

Extra Functies

Invoeren van korting

Berekenen van percentage van subtotaal

Invoeren en afdrukken van een niet-toevoegen codenummer

Invoeren van terugbetalingen

Aftrekken van ingevoerd artikel

Voor een nieuwe gast

GLU Guest Look-up

Afrekenen Toetsbediening voorbeeld Bon

Extra bestellingen

Voorbeeld afdruk van gastenrekening bon

Koers 0.000000 t/m

Andere betalingswijze en betalingen Buitenlands geld

Gebruik van een vooraf-ingestelde koers

Gebruik van een handmatig ingevoerde koers

Invoeren van automatische handelingen met de a toets

Invoeren van ontvangen-op-rekening

Invoeren van uitbetalingen

Geen verkoop wisselen

Begeleidingsmededelingen

Alvorens TE Programmeren

Cursor Ingevoerde tekens worden hier getoond

DC Code voor dubbel-formaat

Tabel met codes voor tekens, letters, cijfers en symbolen

Toetsbediening

Programmeren van diverse toetsen

Programmeren van

Kies de te programmeren toets

Te slaan. / Druk op a om te beëindigen

Deel1 Deel2 Deel3 Voor DE Manager

Programmeren van %

Gebruik de decimale punt voor het instellen van

Voer het percentage met de cijfertoetsen in en

Cijfertoetsen in. De limiet voor het percentage kan

Voer de limiet voor het percentage met de

Programmeren van tekst Druk op s om deze stap over te slaan

Programmeren van r, o, X, Y, cen b

Over te slaan. / Druk op a om te beëindigen

1Onderdeel Keuze Invoer

Functieparameters voor a

Symbool voor buitenlandse valuta 4 tekens

Programmeren van overige tekst

Symbool voor nationale valuta 4 tekens

Tekst voor functies 12 tekens

Tekst voor trainingfunctie 12 tekens

Lijst met tekst voor functies

Volgnummer

Programmeren VAN Geavanceerde Functies

Programmeren van kassanummer en volgnummer

Kassanummer

Functiekeuze voor diverse toetsen

Diverse Functies Programmeren

Taak-code Onderdeel Keuze Invoer

Bon printformaat

Printformaat

Drukstijl

Overige programmering

PLU niveau shift en GLU functie parameters

Taak-code Onderdeel Keuze Invoer

Gecomprimeerd afdrukken van overzicht

Deel3 Voor DE Manager

Alleen 0 en

PGM functie bediening rapport

Tijdelijk afdrukken EJ tijdens transactie

Actie wanneer EJ geheugen vol is

Onderdeel Keuze Invoer

Energiebesparingsfunctie

Dichtheid thermische printer

Printformaat voor afdrukken van logo

EJ geheugentype

Toetsbediening voorbeeldAfdruk

Specificatie voor training bediende

Methode voor geldwisselen

Programmering voor de Euro

Instellingen voor Euro systeem

Instellingen voor automatische EURO-modificatie

Toetsen voor het lezen van vastgelegde programma’s

Instellen van datum voor EURO-modificatie

Instellen van tijd voor EURO-modificatie

Lezen van vastgelegde programma’s

Programmeringsoverzicht

Voorbeeld van afdrukken

Programmeringsoverzicht PLU

Programmeringsoverzicht Programmeringsoverzicht afdeling

Trainingsfunctie

Beschrijving van overzichten voor lezen X en terugstellen Z

Lezen X EN Terugstellen Z VAN Verkooptotalen

Volledig bediende-overzicht

Totaal dagelijkse verkopen

Indien u een Z1 overzicht oproept, wordt Z1 afgedrukt

Open GLU overzicht per bediende Balans overzicht

Open GLU overzicht

Indien u een Z1 overzicht oproept, wordt Z1

Terugstellen van de data

Afdrukken van overzichtsdata tijdens een transactie

Voorbeeld van afdruk

Voorbeeld van EJ overzicht

Foute bon

Overschrijven VAN Invoer

Fase

Functie Voor EURO-MODIFICATIE

Hoe worden de diverse valuta’s met uw kassa behandeld?

Automatische EURO-modificatie

Euro fase

Onderdelen

Gebaseerd

Keuze invoer koers

Controleren van de huidige Euro fase

Programmeren voor de koers-toets

Koers

Voorzorgen voor het papier thermische papier

Onderhoud Voor Bediening

Bij een stroomonderbreking

Bij een printerfout

Plaats de papierrol in de printer. Plaats de rol juist

Vervangen van de batterijen

Vervangen van de papierrol

Specificaties papierrol

Verwijderen van de papierrol

Plaatsen van de papierrol voor overzichten

Plaatsen van de papierrol

Draai de functieschakelaar naar een andere

Verwijder de printerafdekking

Reinigen van de printer afdrukkop / sensor / roller

Verwijderen van vastgelopen papier

Handmatig openen van de lade

Verwijderen van de lade en ladehouder van de kassa

Afbeelding hier links

Foutcodetabel

Voordat u voor reparatie belt

Technische Gegevens

De Europese Unie

Informatie over afvalverwijdering voor bedrijven

Andere landen buiten de Europese Unie

Geräuschpegel LpA 64,7 dB Gemessen nach EN ISO

Sharp Electronics Europe GmbH

![]() s

s![]() VAT rate

VAT rate ![]() t

t