Manual DE Instrucciones

Advertencia

Warnung

Avertissement

Never operate the register with wet hands

Introduction

U T I O N

Contents

Part2 for the Operator

Other Basic Sales Entries

Correction After Finalizing a Transaction Void mode

Part3 for the Manager

External View Front view Rear view

Printer

Mode Switch and Mode Keys

Keyboard Keyboard layout

Key names

X1/Z1

Keyboard sheet

Keyboard sheet ➂ Close the keyboard cover

Displays Operator display

Customer display Pop-up type Drawer Lock Key

Preparing the Cash Register

Initializing the Cash Register

Be careful with the paper cutter, so as not to cut yourself

Installing Batteries

Display will disappear Close the battery compartment cover

Installing a Paper Roll

Feed the end of the paper along with

When not using the take-up spool using as receipt paper

When using the take-up spool using as journal paper

If necessary, issue programming reports for your reference

Abbreviations and Terminology

Description of special keys

Code entry

Using character keys Keys on the shaded area

Guidance for text programming

Keyboard sheet for text programming

Backs up the cursor, erasing the character to the left

Time

Language Selection

Date and Time Programming

Sign and tax rate X YYY.YYYY

Tax Programming

Tax rate programming

Dept. code VAT/tax status Sign

Department Programming

To delete a tax rate, use the following sequence

Specify the department code

Text programming Press s to skip. / Press a to terminate

300

Key operation Operator display

Select of TAX1 TAX1 YES

Sign programming Press s to skip. / Press a to terminate

Selection Print

Terminate programming

Press the Akey to terminate department code Programming

Specify the direct PLU key and its level

PLU Price Look-Up and Subdepartment Programming

Direct PLU key programming For PLU code 1 to

Text programming Press sto skip. / Press a to terminate

500

Text Programming

Clerk names 12 digits

Function programming Press sto skip. / Press a to terminate

Press the Akey to terminate direct PLU key programming

Key operation example

Logo message print format 3 types

Rounding system

Decimal point position tab setting for domestic currency

Programming Other Necessary Items

Turn the mode switch to the REG position

Basic Sales Entry Example

Press the skey to display the amount due

Receipt print

PLU Entry

Direct PLU entry

PLU code entry

Direct PLU keys Operator display Receipt print

1250 600 d 328 ¡ 250 f

Cancellation of the Numeric Entry

Correction of the Last Entry direct void

Subtotal Void

1310 1755 d 350 250 f 825

350 v ª

1310 1755

Part1 Quick Start Guide

Full sales report

Key operation Sample report Operator display

Periodic consolidation

Additional Information for Basic Sales Entry

Error Warning

Other Basic Sales Entries

PLU/subdepartment entries

Item Entries Single item entries

Department entries

Repeat entries

1200 50 d 1500 d 41 d 80 p 500 fi 85 p 1200 p

1200

50 d 1500 d d 41 d d 80 p p 500 fi fi 85 p 1200 p p

Multiplication entries

Single item cash sale Sics entry

@ 50 d 1500 d @ 41 d @ 80 p @ 500 fi @ 85 p 1200 p

250

Automatic return mode

Returning to level 1 after an item entry default

Lock shift mode

PLU level shift for direct PLU key

Displaying Subtotals

Finalization of Transaction Cash or cheque tendering

Cash or cheque sale that does not require tender entry

1000 a

1000

Credit sale

Mixed-tender sale

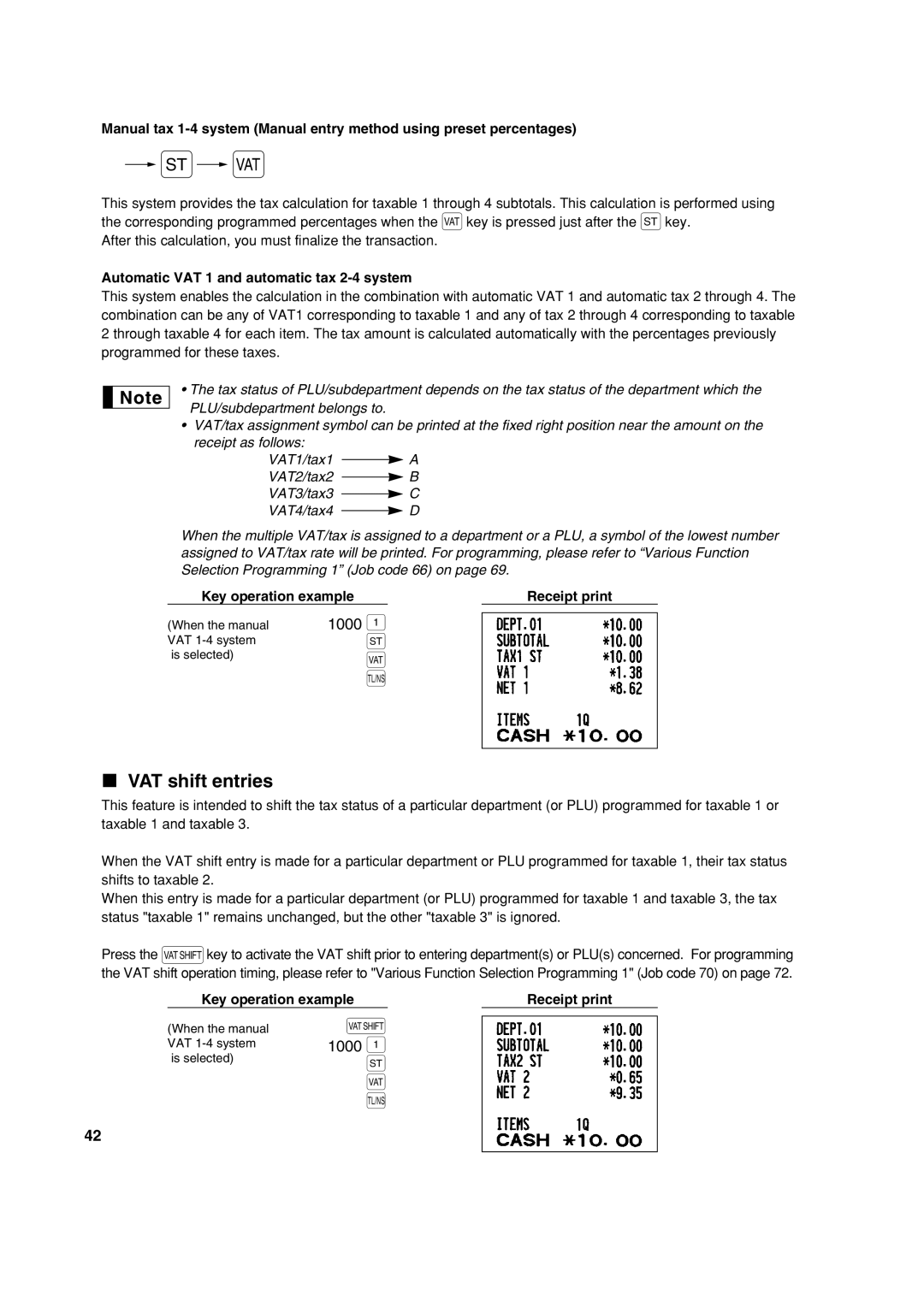

Computation of VAT Value Added Tax/tax VAT/ tax system

2500 3250 d

VAT shift entries

Automatic VAT 1 and automatic tax 2-4 system

Deduction entries

Optional Features

Auxiliary Entries Percent calculations premium or discount

Refund entries

Non-add code number entries and printing

Deduction for item entries

675 d

For new guest

Guest Look-Up GLU

11 G 3500 2700 #

1400 1600

Additional ordering

Settlement Key operation example Receipt print

Guest check receipt bill

Auxiliary Payment Treatment Currency exchange

Exchange rate 0.000000 to

Received-on account entries

Paid-out entries

No sale exchange

Automatic Sequence Key a key Entries

Guidance messages

Procedure for programming

Prior to Programming

Entering character codes with numeric keys on the keyboard

Display

For the Manager

Alphanumeric character code table

Auxiliary Function Programming

Miscellaneous Key Programming

Programming for

Specify the key to program

Part1 Part2 Part3 for the Manager

Programming for %

Press the Akey to terminate the -key Programming

Enter the rate using numeric keys, using a decimal

Point when setting fractional rates

Rate programming Press s to skip. / Press a to terminate

15.00

Enter percent rate limit using numeric key

90.00

Rate limit can be set from 0.00 to

Press the Akey to terminate the %key Programming

Text programming Press s to skip

939938

Programming for r, o, X, Y, cand b

Press the Akey to terminate the Vkey Programming

Cheque

1Item Selection Entry

Function parameters for a

Press the Akey to terminate the Xkey Programming

Foreign currency symbol 4 digits

Domestic currency symbol 4 digits

Other Text Programming

018 @

Training mode text 12 digits

Function text 12 digits

S S Training S S

36 @ CARD1 s

List of function texts

NET2

Register Number and Consecutive Number Programming

Register number

Consecutive number

123456 s a

Example When programming for job code 5 as Abcdefgh

Various Function Selection Programming

Function selection for miscellaneous keys

00000100 s a

Printing style

Print format

Receipt print format

PLU level shift and GLU function parameters

Other programming

Job code Selection Entry

Part2 Part3 for the Manager

Compression print on journal

Only

South Africa Payment Arbitrary

Temporary EJ printing during a transaction

PGM mode operation records type

Action when EJ memory area is full

Selection Entry

Power save mode

10 @ 0060 s a

EJ memory type

Logo message print format

Thermal printer density

Training clerk specification for training mode

Auto key programming Automatic sequence key

86 @ 20 s a

100

Euro system settings

Automatic Euro modification operation settings

Euro Programming

1000 s

Date setting for Euro modification operation

Time setting for Euro modification operation

Reading Stored Programs

Key sequence for reading stored program

Sample printouts

Programming report

Programming report Department programming report

PLU programming report

Auto key programming report

Printer density programming report

Training Mode

1000

Reading X and Resetting Z of Sales Totals

Summary of Reading X and Resetting Z Reports

When you take Z1 report, Z1 is printed

Daily Sales Totals

PLU report by designated range Individual clerk report

Full clerk report

Open GLU report by clerk Balance report

Hourly report

Open GLU report

To reset all of the data

Printing journal data on the way of a transaction

Sample print

Sample EJ report

Incorrect receipt Cancellation receipt

Override Entries

Euro Migration Function

How currencies are treated in your register

Automatic Euro modification operation

Period

Items

Euro status

Programming for Exchange Key

Optional Programming for the Introduction of Euro

Checking the current Euro status

Case of Printer Error

Operator Maintenance

Case of Power Failure

Paper specification

How to set the paper roll

Replacing the Batteries

Replacing the Paper Roll

Removing the paper roll

Installing the journal paper roll

Installing the paper roll

Installing the receipt paper roll

Cleaning the Printer Print Head / Sensor / Roller

Removing a Paper Jam

Drawer will not open if it is locked with the key

Removing the Till and the Drawer

Opening the Drawer by Hand

Before Calling for Service

Error message table

Specifications

Information on Disposal for Users private households

Information on Disposal for Business Users

European Union

European Union

Einleitung

Wichtig

Hotline Nummern

Österreich 08-205 505

Inhalt

Teil

Teil 2 FÜR DEN Bediener

Andere Grundlegenden Registrierungen

Teil 3 FÜR DEN Geschäftsinhaber

Storno-Modus

Außenansicht Vorderansicht Rückansicht

Drucker

Tastenbezeichnungen

Funktionsschloss und Funktionsschlüssel

Tastatur Tastaturanordnung

Tastaturfolie ➂ Die Tastaturabdeckung schließen

Tastaturfolie

Schlitzen einführen

Anzeigen Bedieneranzeige

Kundenanzeige Pop-Up-Typ Schubladenschlüssel

SCHRITT2 Vorbereitung DER Registrierkasse

Initialisierung der Registrierkasse

Einsetzen der Batterien

Einsetzen einer Papierrolle

Führen Sie das Ende des

Page

Beschreibung spezieller Tasten

Abkürzungen und Terminologie

Vor der Programmierung Vorgang für die Programmierung

Leitfaden zur Textprogrammierung

Tastaturfolie für Textprogrammierung

Verwendung der Zeichentasten Tasten im schattierten Bereich

Bedieneranzeige Beispiel

Sprachauswahl

Einstellung von Datum und Uhrzeit Einstellung des Datums

Einstellung der Uhrzeit

1430

Mehrwertsteuerprogrammierung

Programmierung des Steuersatzes

MWSt-Satz YYY.YYYY

Tastenbedienung BedieneranzeigeDruck

Warengruppen MWSt-Status Vorzeichen

Programmierung für Warengruppen

Um einen MWSt-Satz zu löschen, gehen Sie wie folgt vor

Eingeben

Angabe des Warengruppencodes

Über die Zehnertastatur einen Einzelpreis

Auswahl MWST1 MWST-SATZ1 JA

Registriertyp Normal

Positionen Wahl Eingabe

Zum Beenden die A-Taste drücken

Beenden der Programmierung

Programmierung für PLUs Einzelartikel und Sub-Warengruppen

Angabe der Direkt-PLU und ihrer Ebene

Es lassen sich bis zu max Stellen eingeben

Eine Artikelbezeichnung eingeben

Es lassen sich bis zu max Zeichen eingeben

Auf 2 vorgehen, wenn die Funktion „ARTIKELPLU

Textprogrammierung

Bedienernamen 12 Stellen

Logodruckformat 3 Typen

Tastenbedienung Bedieneranzeige Druck

Logotext 6 Zeilen und 24 Stellen für jede Zeile

Programmierung anderer erforderlicher Positionen

Beispiel für die grundlegende Registrierung

2300

4000

Kassenbondruck

PLU-Registrierung

Direkt-PLU-Registrierung

PLU-Code-Registrierung

141 p

Löschen eingegebener Ziffern

Korrektur der letzten Registrierung Sofortstorno

Zwischensummenstorno

Gesamt

Teil1 Schnellstartanleitung Teil2 Teil3

Gesamtumsatzbericht

TastenbedienungBedieneranzeige Berichtsbeispiel

Periodische Berichte

TastenbedienungBedieneranzeige

Zusätzliche Information für die Grundlegende Registrierung

Fehlermeldung

Postenregistrierungen Einzelpostenregistrierung

Warengruppenregistrierung

PLU/Sub-Warengruppenregistrierung

Fehleraufhebungsfunktion

Wiederholungsregistrierung

PLU-Registrierung

Sub-Warengruppenregistrierung offene Preiseingabe für PLUs

Tastenbedienung Kassenbondruck

TastenbedienungKassenbondruck

Multiplikationsregistrierung

Einzelposten-Barverkauf SICS-Registrierung

Verriegelungsmodus

PLU-Ebenen-Umschalttasten für Direkt-PLU-Tasten

Automatischer Rückkehrmodus

Anzeige von Zwischensummen

Wenn die Registrierkasse mit Verriegelung programmiert wurde

Abschluss einer Transaktion Bar- oder Scheckeingabe

Scheckzahlung

Kreditverkauf

Gemischte Zahlung

Registrierungen mit MWSt-Umschaltung

Optionale Merkmale

AbzugsRabatt-Registrierungen

Prozentberechnung für Zwischensumme

Prozentberechnung für Postenregistrierungen

Abzug für Postenregistrierungen

Retourenregistrierung

Eingabe und Ausdrucken von nicht-addierenden Nummern

Tischregistrierungen

Für einen neuen Tisch erstmalige Bestellung

Rechnungsdruck

Zusätzliche Bestellung

Abschluss Tastenbedienung Kassenbondruck

Zahlungshandhabung Fremdwährungsumrechnung

Verwendung des programmierten Umrechnungskurses

4650 d

10000 a

Einzahlungsregistrierungen

Auszahlungsregistrierungen

Kein Verkauf Geldwechsel

Registrierung mit der Automatik-Eingabetaste a

VOR DER Programmierung

Führungstexte bei der Textprogrammierung

Eingabe von Zeichencodes mit den Zifferntasten der Tastatur

253 065

165

231

Alphanumerische Zeichencodetabelle

Programmierung Zusätzlicher Funktionen

Programmierung verschiedener Tasten

Programmierung der --Taste

Angabe der zu programmierenden Taste

Taste drücken./Zum Beenden die A-Taste drücken

Die %-Taste drücken, um auf %-Programmierung zu schalten

Programmierung der %-Taste

Positionen Wahl Druck

15.00

Programmierung der Taste

Beenden die A-Taste drücken

Die Prozentsatzbegrenzung über die Zehnertastatur

Die s-Taste drücken, um die Einstellung zu Speichern

Eingeben, ggf. mit Dezimalpunkt vor den

Drücken./Zum Beenden die A-Taste drücken

Den Umrechnungskurs über die Zehnertastatur

Programmierung der Tasten r, o, X, Y, c, und b

Den Text eingeben

Funktionsparameter für die Taste a

1Positionen Wahl Eingabe

Fremdwährungssymbol 4 Stellen

Landeswährungssymbol 4 Stellen

Andere Textprogrammierung

207

Text im Schulungsmodus 12 Stellen

Funktionstext 12 Stellen

Mwst S 16%

TastenbedienungDruck

Funktionstextliste

Weiterführende Funktionsprogrammierung

Programmierung der Maschinennummer und der laufenden Nummer

Maschinennummer

Laufende Nummer

Job-Code Positionen Wahl Eingabe

Programmierung der Wahl für zusätzliche Funktionen

Funktionswahl für verschiedene Tasten

Druckformat

Druckformat

Kassenbon-Druckformat

PLU-Ebenen-Umschaltung und Tischfunktions-Programmierung

Sonstige Programmierung

Job-Code Positionen Wahl Eingabe

Teil2 Teil3 FÜR DEN Geschäftsinhaber

Komprimierter Journalausdruck

Eingaben sperren und Warnung Speicher fast voll

Rundungssystem

Vorübergehender E-Journalausdruck bei einer Transaktion

Aufzeichnung der PGM-Programmierungen im Journal

Stromsparmodus

Logodruckformat

Thermodrucker-Druckdichte

Journalspeichertyp Elektronisches Journal

Logotexttyp

Schulungsmodus

Programmierung der Automatik-Eingabetaste

EURO-Programmierung

Einstellungen des EURO-Systems

Einstellungen für automatische EURO-Modifikationsoperation

Währungsumrechnungsmethode

Abruf gespeicherter Programminhalte

Datumseinstellung für EURO-Modifikationsoperation

Zeiteinstellung für EURO-Modifikationsoperation

Druckbeispiele

Programmierbericht

Warengruppen-Programmierbericht

PLU-Programmierbericht

Schulungsbetriebsart

Abruf X UND Nullstellung VON Umsätzen

Tagesumsatzberichte

PLU-Bericht von bis Einzelbedienerbericht

Gesamtbedienerbericht

Wenn ein Z1-Bericht erstellt wird, wird hier „Z1 gedruckt

Stundenumsatzbericht Offener Tisch-Bericht

Offene Tische pro Bediener-Bericht Gesamtsaldenbericht

Abruf UND Nullstellung DES Elektronischen Journals EJ

Ausdrucken der Journaldaten während einer Transaktion

Druckbeispiel

Abrufen aller Daten Journalberichtsbeispiel

Überschreibung VON BETRAGS- EINGABE-BEGRENZUNGEN

Fehlerhafter Kassenbon Storno-Kassenbon

EURO-UMRECHNUNGSFUNKTION

So werden Währungen von Ihrer Registrierkasse behandelt

Automatische EURO-Modifikationsoperation

Periode

Converted auf dem Bericht Nr ausgedruckt

Gegenstand

EURO-Status

Programmierung für Fremdwährungs-Umrechnungstaste

Optionale Programmierung für die Einführung des Euro

Überprüfen des gegenwärtigen EURO-Status

Wartung Durch DEN Bediener

Verhalten bei Stromausfall

Bei Eintritt einer Druckerstörung

Vorsichtshinweise zur Handhabung des Thermopapiers

Austauschen der Batterien

Einsetzen und Herausnehmen der Papierrolle

Papierrollen-Spezifikation

Einsetzen der Papierrolle

Herausnehmen der Papierrolle

Entfernen Sie die Druckwerkabdeckung

Einsetzen der Papierrolle

Einsetzen der Journalstreifenrolle

Behebung eines Papierstaus

Reinigung des Druckers Thermodruckkopf / Sensor / Walze

Drehen Sie das Funktionsschloss auf die Position „

„Einsetzen der Papierrolle beschrieben ist

Entfernen des Schubladeneinsatzes und der Schublade

Öffnen der Schublade von Hand

Siehe linke Abbildung

Die Schublade kann nicht geöffnet werden, wenn sie mit dem

Bevor Sie den Kundendiensttechniker anfordern

Liste der Fehlermeldungen

Technische Daten

Entsorgungsinformationen für Benutzer aus Privathaushalten

Entsorgungsinformationen für gewerbliche Nutzer

Der Europäischen Union

Anderen Ländern außerhalb der EU

Hotline France

Annulation d’un total partiel

Table DES Matieres

Partie 1 Guide DE Demarrage Rapide

Partie 2 Pour L’OPERATEUR

Autres Entrees DE Ventes DE Base

Partie 3 Pour LE Directeur

Programmation DE Fonctions Avancees

Vue extérieure Vue frontale Vue arrière

Imprimante

Noms des touches

Commutateur de mode et clés de mode

Clavier Disposition du clavier

Fente

Nota

Feuille du clavier

Affichages Affichage de l’opérateur

ETAPE2 Preparatifs DE LA Caisse Enregistreuse

Initialisation de la caisse enregistreuse

Installation des piles

Installation d’un rouleau de papier

Papier, comme il est illustré

Nota

Abréviations et terminologie

Description de touches spéciales

Dept

Relever d’un rayon

Guidage pour la programmation d’un texte

Feuille du clavier pour la programmation d’un texte

Affichage de l’opérateur Exemple

Pour alterner les caractères en lettres minuscules

Choix d’une langue

Programmation de la date et de l’heure Date

Exemple de manipulation des touches

Affichage de l’opérateur Impression

Heure

Programmation de taxes

Programmation d’un taux d’une taxe

Signe et taux de taxe X YYY.YYYY

Code du rayon Statut de la T.V.A./taxe Signe

Programmation de rayons

Pour annuler un taux de taxe, utilisez la séquence suivante

Spécifiez le code du rayon

Manipulation des touches

Introduction du nom de l’article

Nouvelles données

Selection Taxe TAXE1 OUI

Mode Ventes Normal

Article Sélection Entrée

Appuyez sur la touche spour

Achèvement de la programmation

Changement de niveau et sur une touche de PLU direct

Spécifie la touche d’un PLU direct et son niveau

Appuyez dans l’ordre sur une touche de ¡

Introduisez le nom d’un article

Un maximum de 16 caractères peut être introduit

Pour programmer un code PLU incrémenté, revenez à l’étape

Programmation d’un texte

Nom des employés 12 chiffres

NOM Employe No Employe David

Disposition d’impression d’un message logotype

Programmation d’autres articles nécessaires

Système d’arrondissement

Impression du reçu

Exemple d’entrée pour des ventes de base

Appuyez sur la touche spour faire afficher le dû du montant

Entrée de PLU Prix par article déjà programmé

Entrée d’un PLU direct

Entrée d’un code PLU

Affichage de l’opérateur Impression du reçu

Annulation d’une entrée numérique

Rectification de la dernière entrée annulation directe

Annulation d’un total partiel

1310 1755 d 350 ª 250 f 825 # 350 v ª

Partie1 Guide DE Demarrage Rapide Partie2 Partie3

Echantillon d’un rapport

Rapport complet sur les ventes

Manipulation des touches Affichage de l’opérateur

Regroupement périodique

Mode d’économie d’énergie

Avertissement d’une erreur

Affectation d’un employé

Fonction de mise en circuit/hors circuit des reçus

Entrées d’articles Entrées d’un seul article

Entrées de rayons

Entrées de PLU/rayons auxiliaires

Fonction d’échappement à une erreur

Entrées répétées

Entrées de PLU

Entrées de rayons auxiliaires PLU disponibles

Exemple de manipulation des touches Impression du reçu

Entrées multiplicatives

Entrées de la vente au comptant d’un seul article Sics

@ 50 d 1500 d

Exemple de manipulation des touchesImpression du reçu

Mode de retour automatique

Mode de changement de blocage

Changement de niveau d’un PLU pour une touche de PLU direct

Retour au niveau 1 après l’achèvement d’une opération

Affichage de totaux partiels

Offre contre un chèque

Vente à crédit

Vente contre une offre mixte

Entrées d’un changement de T.V.A

Système de T.V.A automatique et de taxes 2-4 automatique

Fonctions Facultatives

Entrées de déductions

Calcul d’un pourcentage pour un total partiel

Calcul d’un pourcentage pour des entrées d’articles

Déduction pour des entrées d’articles

Entrées de remboursements

Entrées de numéros de codes non-additifs et impression

Recherche des données d’un client GLU

Pour un nouveau client

Instructions suppplémentaires

Reçu facture vérificatif d’un client

Traitement d’un payement annexe Change d’une monnaie

Application d’un taux de change préréglé

Application d’un taux de change manuel

2300 4650 d

Entrées de comptes admis

Entrées de décaissements

Pas de vente échange

Entrées de touches touche a dans une séquence automatique

’un rouleau de papier à la page 89 pour le remplacement

Avant UNE Programmation

Procédure pour la programmation

Messages de guidage

Curseur Les caractères introduits sont affichés ici

Partie1 Partie2 Partie3 Pour LE Directeur

Table de caractères alphanumériques

Programmation de touches diverses

Programmation pour

Spécifie la touche à programmer

Introduisez le montant en utilisant les touches

Appuyez sur s pour sauter

Sauter./Appuyez sur la touche Apour achever

Programmation pour %

La touche Apour achever

Appuyez sur la touche Apour achever

Introduisez le taux en utilisant les touches

Sur la touche Apour achever

Appuyez sur la touche s pour

Appuyez sur la touche a pour achever

Numériques. Utilisez le point de décimalisation pour

Programmation pour r, o, X, Y, cet b

Réglage

Appuyez sur la touche Apour achever la

Programmation de la touche

Introduisez le texte

La touche a pour achever

Appuyez sur s pour sauter./Appuyez

Paramètres de fonction pour a

1Article Sélection Entrée

Symbole d’une monnaie étrangère 4 chiffres

Symbole d’une monnaie nationale 4 chiffres

Programmations d’autres textes

85 P 207

Exemple de manipulation des touches Impression

Texte pour le mode de formation 12 chiffres

Texte d’un fonction 12 chiffres

Liste des textes de fonctions

NET2

Numéro de l’enregistreuse

Numéro consécutif

Code de travail Article Sélection Entrée

Programmation 1 pour la sélection de diverses fonctions

Sélection de fonctions pour des touches diverses

Type d’impression

Disposition pour une impression

Disposition d’impression d’un reçu

Autres programmations Nota

Code de travail Article Sélection Entrée

Impression condensée sur la bande de détails quotidiens

Ou b

Type d’enregistements pour des opérations sur le mode PGM

Système d’arrondi

Mode d’économie d’énergie

Programmation 2 pour la sélection de diverses fonctions

Disposition de l’impression d’un message logotype

Densité de l’imprimante thermique

86 @

Exemple de manipulation des touchesImpression

Programmation de l’EURO

Réglages du système de l’EURO

01 s

Méthode de calcul d’un change

Lecture de programmes mémorisés

Nom du rapport Séquence des touches

Exemples d’impressions

Rapport sur la programmation

Rapport sur la programmation d’un PLU

Mode DE Formation

Lecture X ET Remise a Zero DES Totaux DE Ventes

Résumé des rapports de lectures X et de remises à zéro Z

Totaux de ventes quotidiennes

Rapport de l’ensemble des employés

Exemple d’un rapport

Lorsque vous effectuez un rapport Z1, Z1 est imprimé

Rapport de GLU disponibles par Rapport d’un solde Employé

Rapport horaire

Rapport de GLU disponibles

Exemple d’impression

Pour lire toutes les données

Exemple d’un rapport EJ

Pour remettre à zéro toutes les données

Entrees DE Surpassements

Période

Comment les monnaies sont traitées dans votre enregistreuse

Opération de modification automatique de l’EURO

Ce qu’ils soient basés sur la monnaie Euro

Articles

Statut 2 de l’EURO

Programmation pour la touche de change

Programmation facultative pour l’introduction de l’EURO

Vérification du statut en cours de l’EURO

Dans le cas d’une erreur de l’imprimante

Entretien PAR L’OPERATEUR

Dans le cas d’une panne de courant

Remplacement des piles

Remplacement d’un rouleau de papier

Comment installer le rouleau de papier

Spécifications du papier

Enlèvement du rouleau de papier

Installation du rouleau de papier

Avancera automatiquement

Suppression d’un bourrage du papier

Gauche

Enlèvement du casier pour l’argent et du tiroir

Ouverture du tiroir à la main

Avant d’appeler pour un dépannage

Table des messages d’erreurs

Donnees Techniques

Au sein de l’Union européenne

Pays hors de l’Union européenne

No opere nunca la caja registradora con las manos mojadas

Introduccion

Importante

Parte 1 Guia DE Inicio Rapido

Cancelación del subtotal

Indice

Parte 2 Para EL Operador

Otros Registros Basicos DE Ventas

Parte 3 Para EL Administrador

Programacion DE Funciones Avanzadas

Vista exterior Vista delantera Vista trasera

Impresora

Nombres de las teclas

Selector de modo y llaves de modo

Teclado Disposición del teclado

Lámina del teclado

Ranura

Visualizadores Visualizador para el operador

PASO2 Preparacion DE LA Caja Registradora

Inicialización de la caja registradora

Instalación de las pilas

Instalación de un rollo de papel

Nota

Abreviaturas y terminología

Descripción de las teclas especiales

Una sección

Impuesto al valor añadido

Visualizador para el operador Ejemplo

Guía para la programación de texto

Lámina del teclado para la programación del texto

Procedimiento

Selección del idioma

Programación de la fecha y de la hora Fecha

Hora

Programación de los impuestos

Programación de la tasa de impuestos

Signo y tasa de impuestos X YYY.YYYY

Programación de secciones

Código de sección Estado de IVA/impuestos Signo

Especifique el código de sección

Operación de teclas

Seleccion TAX1 TAX1 SI

Tipo Registro Normal

Terminación de la programación

Elemento Selección Registro

Programación de PLU codificación de precios y subsección

Especifique la tecla de PLU directa y su nivel

Pulse la tecla para entrar en la programación de texto

Programación de texto

Nombres de dependiente 12 dígitos

Mensajes de membrete 6 líneas y 24 dígitos para cada línea

Formato de impresión de mensaje del membrete 3 tipos

Programación de otros elementos necesarios

Sistema de redondeo

Ejemplo de registro básico de ventas

Pulse la tecla spara visualizar el importe a cobrar

Registro de PLU

Registro de PLU directa

Registro de códigos de PLU

71 p

Cancelación del registro numérico

Corrección del último registro cancelación directa

1250

328 ¡ 250 f

Cancelación del subtotal

Parte1 Guia DE Inicio Rapido Parte2 Parte3

PASO6 Informe DE Ventas Completo Informe Z

Informe de ventas completo

Consolidación periódica

Aviso de error

Informe adicional para Registro Basico DE Ventas

Función de escape de error

Registros de artículos Registros de un solo artículo

Registros de sección

Registros de PLU/subsecciones

Registros repetidos

Registros de PLU

Registros de subsección PLU abierta

Ejemplo de operación de teclas Impresión en el recibo

Ejemplo de operación de teclasImpresión en el recibo

Registros de multiplicación

Registros de venta en metálico de un solo artículo Sics

Cambio de nivel de PLU para la tecla de PLU directa

Modo de retorno automático

Retorno al nivel 1 después de finalizar una transacción

Modo de cambio fijado

Visualización de los subtotales

Ejemplo de operación de teclas

Importe recibido en cheque

Registre los artículos y pulse una tecla de crédito co b

Ventas a crédito

Ventas con importe recibido mixto

Sistema IVA 1 automático y de impuestos 2 4 automático

Registros de cambio del IVA

Después de este cálculo debe finalizar la transacción

Caracteristicas Opcionales

Registros de deducción

Cálculo porcentual para el subtotal

Cálculo porcentual para registros de artículos

Deducción para registros de artículos

Registros de devolución

Registros e impresión de números de código de no suma

Codificación de cliente GLU

Para un cliente nuevo

Pedido adicional

Recibo factura de cuenta de un cliente

Tasa de cambio 0,000000 a 999,999999

Tratos de pagos auxiliares Cambio de divisas

Aplicación de la tasa de cambio de moneda extranjera manual

Sin ventas cambios

Registros de recibido a cuenta

Registros de pagos

Registros con la tecla de secuencia automática tecla a

Mensajes de guía

Antes DE LA Programacion

Procedimiento para la programación

253

Tabla de códigos de caracteres alfanuméricos

DC Código de carácter de doble tamaño

Programación de teclas misceláneas

Programación para

Especifique la tecla para programar

Introduzca el importe empleando las teclas

Parte1 Parte2 Parte3 Para EL Administrador

El ajuste predeterminado es Enable

Programación para %

Pulse la tecla Apara terminar la programación de La tecla

Introduzca la tasa empleando las teclas numéricas

Empleando un punto decimal para ajustar tasas

Introduzca el límite de la tasa de porcentaje

Empleando las teclas numéricas

Pulse la tecla Apara terminar la programación de La tecla %

Operación de teclas Visualizador para el operador

Preset Enable

Programación para r, o, X, Y, cy b

Cheque

Parámetros de función para a

1Elemento Selección Registro

Símbolo de moneda nacional 4 dígitos

Otras programaciones de texto

Símbolo de divisas 4 dígitos

Texto del modo de instrucción 12 dígitos

Texto de función 12 dígitos

Lista de textos de función

Número de caja registradora

Número consecutivo

Programación 1 de selección de diversas funciones

Selección de función para teclas misceláneas

Código de tarea Elemento Selección Registro

Inhabilitado

Estilo de impresión

Formato de impresión

Formato de impresión de recibos

Parámetros del cambio de nivel de PLU y de la función de GLU

Otras programaciones Nota

Código de tarea Elemento Selección Registro

Parte2 Parte3 Para EL Administrador

Impresión comprimida en registro diario

PGM

Acción cuando el área de memoria de EJ está llena

Impresión temporal de EJ durante la transacción

Tipo de registros de operación en el modo PGM

Programación 2 de selección de diversas funciones

Modo de ahorro de energía

Formato de impresión de mensajes de membrete

Densidad de la impresora térmica

Tipo de memoria de EJ

Procedimiento s 90 @ a

Ejemplo de operación de teclasImpresión

Programación de la tecla Auto Tecla de secuencia automática

ProcedimientoBorrar

Método de cálculo de cambio de divisas

Programación del Euro

Ajustes del sistema del Euro

13 @

Lectura de programas almacenados

Impresiones de muestra

Informe de programación

Informe de programación de densidad de impresora

Informe de programación de PLU

Informe de programación de la tecla automática

Modo DE Instruccion

Lectura X Y Reposicion Z DE LOS Totales DE Ventas

Resumen de informes de lectura X y reposición Z

Cuando saca el informe Z1, se imprime Z1

Totales de ventas diarias

Informe de todos los dependientes

Informe horario

Informe de GLU abierta

Informe de GLU abierta por dependiente

Informe de balance

Impresión de muestra

Informe EJ de muestra

Para reponer todos los datos

Para leer los 10 registros últimos

Procedimiento Ejemplo

Recibo incorrecto Recibo cancelado

Registros DE Anulacion

Funcion DE Migracion DEL Euro

Cómo se tratan las monedas en su caja registradora

Operación de modificación automática para el Euro

Moneda Período

Itemes

Estado 2 de Euro

Programación para la tecla de cambio de divisas

Programación opcional para la introducción del Euro

Comprobación del estado actual de Euro

En el caso de error de la impresora

Mantenimiento Para EL Operador

En caso de corte de la alimentación

Precauciones al manejar la impresora y el papel de registro

Reemplazo de las pilas

Reemplazo del rollo de papel

Especificaciones del papel

Forma de colocar el rollo de papel

Extracción del rollo de papel

Instalación del rollo de papel

Instalación del rollo de papel de registro diario

Extracción del papel atascado

Vea la ilustración a la izquierda

Extracción del separador de dinero y del cajón

Abertura manual del cajón

Tabla de mensajes de error

Antes de solicitar el servicio de un técnico

Especificaciones

Información sobre eliminación para usuarios particulares

Información sobre Eliminación para empresas usuarias

En la Unión Europea

En otros países fuera de la Unión Europea

Bedien de kassa nooit met natte handen

Introductie

Belangrijk

Inhoudsopgave

Deel 1 Gids Voor Snel Starten

Deel 2 Voor DE Winkelbediende

Invoeren VAN Eenvoudige Verkopen

Deel 3 Voor DE Manager

Alvorens TE Programmeren Programmeren VAN Extra Functies

Dat u zich bezeert en wees derhalve voorzichtig

Exterieur Vooraanzicht Achteraanzicht

Inktpatroon nodig

Namen van toetsen

Functieschakelaar en functiesleutels

Toetsenbord Overzicht van toetsenbord

Toetsenbordblad ➂ Sluit de afdekking van het toetsenbord

Blad voor toetsenbord

Gleuf

Displays Winkelbediende-display

Klantdisplay Omhoog-klap type Ladeslot en sleutel

STAP2 Voorbereiding Voor DE Kassa

Initialiseren van de kassa

Plaatsen van batterijen

Plaatsen van een papierrol

Plaats het uiteinde van het papier

Page

Beschrijving van speciale toetsen

Alvorens te programmeren Procedure voor programmeren

Afkortingen en termen

Bediendedisplay voorbeeld

Belegeiding voor programmeren van tekst

Toetsenbordblad voor tekstprogrammering

Taalkeuze

Programmeren van de datum en tijd Datum

Tijd

Toetsbediening voorbeeld Bediendedisplay Afdruk

Programmeren van belasting

Programmeren van belastingvoet

Teken en belastingvoet X YYY.YYYY

Toetsbediening voorbeeld BediendedisplayAfdruk

Programmeren van afdeling

Afdelingscode BTW/belastingstatus Teken

Voer de afdelingscode

Toetsbediening Bediendedisplay

Voer een unit-prijs met de cijfertoetsen

Kunt maximaal 6 cijfers invoeren De fabrieksinstelling is

Select of TAX1 TAX1 YES

REGIST.TYPE Normal

Onderdeel Keuze Afdruk

Op a om te beëindigen

12. Beëindig het programmeren

Specificeer de directe PLU toets en het niveau

Programmeren van PLU Price Look-Up en subafdeling

Programmeren van directe PLU toets voor PLU code 1 t/m

Enter DEPT#

Beëindig het programmeren

Programmeren van tekst

Namen van winkelbediendes 12 tekens

Printformaat voor logo-mededeling 3 types

Afrondsysteem

Programmeren van andere nodige onderdelen

Toetsbediening voorbeeld

Voorbeeld voor invoeren van eenvoudige verkopen

Bon

Invoeren van PLU

Directe PLU invoer

Invoeren van PLU code

Directe PLU toetsen BediendedisplayBon

Annuleren van een ingevoerd cijfer

Corrigeren van de laatste invoer direct annuleren

Annuleren van subtotaal

Deel1 Gids Voor Snel Starten Deel2 Deel3

Volledig verkoopoverzicht

ToetsbedieningBediendedisplay Voorbeeld van overzicht

Periodiek overzicht

ToetsbedieningBediendedisplay

Extra informatie voor Invoeren VAN Eenvoudige Verkopen

Foutmelding

Invoeren van PLU/subafdeling

Invoeren van onderdelen Invoeren van enkele onderdelen

Invoeren van afdeling

80 p p 500 fi fi 85 p 1200 p p

Invoeren van herhalingen

50 d 1500 d d

Invoer met vermenigvuldiging

Invoeren van contante verkoop van één artikel Sics

Shift-vergrendeling

PLU niveau shift voor directe PLU toets

Automatische terugkeerfunctie

Tonen van subtotaal

Indien de shift-vergrendeling voor de kassa is ingesteld

Betaling met cheque

Voltooien van een transactie Contante betaling of cheque

Contante betaling

Voer de onderdelen in en druk op een krediettoets cof b

Verkoop op krediet

Verkoop met gemengde betaling

BTW shift invoer

Automatisch BTW 1 en automatisch belasting 2-4 systeem

Extra Functies

Invoeren van korting

Berekenen van percentage van subtotaal

Berekenen van percentage van artikel

Aftrekken van ingevoerd artikel

Invoeren van terugbetalingen

Invoeren en afdrukken van een niet-toevoegen codenummer

GLU Guest Look-up

Voor een nieuwe gast

Voorbeeld afdruk van gastenrekening bon

Extra bestellingen

Afrekenen Toetsbediening voorbeeld Bon

Andere betalingswijze en betalingen Buitenlands geld

Gebruik van een vooraf-ingestelde koers

Gebruik van een handmatig ingevoerde koers

Koers 0.000000 t/m

Invoeren van ontvangen-op-rekening

Invoeren van uitbetalingen

Geen verkoop wisselen

Invoeren van automatische handelingen met de a toets

Alvorens TE Programmeren

Begeleidingsmededelingen

Cursor Ingevoerde tekens worden hier getoond

Tabel met codes voor tekens, letters, cijfers en symbolen

DC Code voor dubbel-formaat

Programmeren van diverse toetsen

Programmeren van

Kies de te programmeren toets

Toetsbediening

Deel1 Deel2 Deel3 Voor DE Manager

Te slaan. / Druk op a om te beëindigen

Programmeren van %

Voer het percentage met de cijfertoetsen in en

Gebruik de decimale punt voor het instellen van

Voer de limiet voor het percentage met de

Cijfertoetsen in. De limiet voor het percentage kan

Programmeren van tekst Druk op s om deze stap over te slaan

Programmeren van r, o, X, Y, cen b

Over te slaan. / Druk op a om te beëindigen

Functieparameters voor a

1Onderdeel Keuze Invoer

Symbool voor nationale valuta 4 tekens

Programmeren van overige tekst

Symbool voor buitenlandse valuta 4 tekens

Tekst voor trainingfunctie 12 tekens

Tekst voor functies 12 tekens

Lijst met tekst voor functies

Programmeren VAN Geavanceerde Functies

Programmeren van kassanummer en volgnummer

Kassanummer

Volgnummer

Taak-code Onderdeel Keuze Invoer

Diverse Functies Programmeren

Functiekeuze voor diverse toetsen

Drukstijl

Printformaat

Bon printformaat

PLU niveau shift en GLU functie parameters

Overige programmering

Taak-code Onderdeel Keuze Invoer

Deel3 Voor DE Manager

Gecomprimeerd afdrukken van overzicht

Alleen 0 en

Actie wanneer EJ geheugen vol is

Tijdelijk afdrukken EJ tijdens transactie

PGM functie bediening rapport

Energiebesparingsfunctie

Onderdeel Keuze Invoer

EJ geheugentype

Printformaat voor afdrukken van logo

Dichtheid thermische printer

Specificatie voor training bediende

Toetsbediening voorbeeldAfdruk

Programmering voor de Euro

Instellingen voor Euro systeem

Instellingen voor automatische EURO-modificatie

Methode voor geldwisselen

Instellen van datum voor EURO-modificatie

Instellen van tijd voor EURO-modificatie

Lezen van vastgelegde programma’s

Toetsen voor het lezen van vastgelegde programma’s

Voorbeeld van afdrukken

Programmeringsoverzicht

Programmeringsoverzicht Programmeringsoverzicht afdeling

Programmeringsoverzicht PLU

Trainingsfunctie

Lezen X EN Terugstellen Z VAN Verkooptotalen

Beschrijving van overzichten voor lezen X en terugstellen Z

Indien u een Z1 overzicht oproept, wordt Z1 afgedrukt

Totaal dagelijkse verkopen

Volledig bediende-overzicht

Indien u een Z1 overzicht oproept, wordt Z1

Open GLU overzicht

Open GLU overzicht per bediende Balans overzicht

Afdrukken van overzichtsdata tijdens een transactie

Voorbeeld van afdruk

Voorbeeld van EJ overzicht

Terugstellen van de data

Overschrijven VAN Invoer

Foute bon

Functie Voor EURO-MODIFICATIE

Hoe worden de diverse valuta’s met uw kassa behandeld?

Automatische EURO-modificatie

Fase

Gebaseerd

Onderdelen

Euro fase

Controleren van de huidige Euro fase

Programmeren voor de koers-toets

Koers

Keuze invoer koers

Onderhoud Voor Bediening

Bij een stroomonderbreking

Bij een printerfout

Voorzorgen voor het papier thermische papier

Vervangen van de batterijen

Vervangen van de papierrol

Specificaties papierrol

Plaats de papierrol in de printer. Plaats de rol juist

Verwijderen van de papierrol

Plaatsen van de papierrol

Draai de functieschakelaar naar een andere

Verwijder de printerafdekking

Plaatsen van de papierrol voor overzichten

Verwijderen van vastgelopen papier

Reinigen van de printer afdrukkop / sensor / roller

Afbeelding hier links

Verwijderen van de lade en ladehouder van de kassa

Handmatig openen van de lade

Voordat u voor reparatie belt

Foutcodetabel

Technische Gegevens

Andere landen buiten de Europese Unie

Informatie over afvalverwijdering voor bedrijven

De Europese Unie

Geräuschpegel LpA 64,7 dB Gemessen nach EN ISO

Sharp Electronics Europe GmbH

![]() A

A![]() B

B![]() C

C![]() D

D