MA-600 Series

Table of Contents

Verification of Programmed Data

Main Features

Description of Model Number

Height when the customer display is fully raised 351 mm

Mm width x 442 mm depth x 291 mm height

Height including rubber feet

Approximately 13.6Kg

Paper Roll Receipt and Journal

Standard paper

High-sensitive paper

Medium-term preserving paper

Input Item Digits

Indexing Capacities

Remarks

Memory Type Counter or Total Digits

Basic Memory Capacities

Memory Type Counter or Total

Financial Memory

Name of Total/Counter Daily Type

Financial Memory

Credit-in-drawer Difference

Cashier Memory

Cashier Memory

Others

Counter Total Digits Digits

GT Grand Total = Sum of Daily GS Gross Sale

Memory Balance

Sum of Daily Net Sales

System START-UP Procedure

Blind mode

Mode Lock Blind POL Watch Timer #

ST Response Watch Timer #

ST Transmission Delay Timer #

ST Transmission Delay Timer 2 #

RAM CLEAR, Data CLEAR, Status Clear

RAM Clear

Data Clear

Depress the following Numeric key

Depress the AT/TL key Status Clear receipt is issued

Status Clear

Operation Condition Mode Lock

Table of Terminal File Programming Operations

Instructions for Programming

Rate %-/%+

Keyboard Layout Variations

Ordinary Type Keyboard

Keyboard layout for programming Mode Lock Position

Ordinary Type Keyboard Del

Rtn Dbl Enter

Flat Type Keyboard End

Keyboard layout for Read/Reset

Mode Lock Position

Ordinary Type Keyboard Rtn Enter

Flat Type Keyboard Rtn

Key Dbl Del History Function

Key Enter Rtn Function

Key Enter Rtn End

Character Entries

Character Code Entry Method

Character Code Standard Characters Column Code Row Code

Character Setting Operations

407 #

Direct Character Entry Method

End ? a

Using PK-2 PLU Keyboard hardware option

Example of operation

Operation History ↓ Enter

Key operation Description LCD display PLU

Condition Required for Programming Operations

Sfkc Selective Function Key Code Programming

Mode Lock Blind

76 AT/TL

Key Name Memory to be opened Remarks

Sfkc Table

Consignment counter

104 TRF Transfer No memory 105 to

108 AMT Amount 109 RPT Repeat No memory 110 to

116 TX3/M Tax 3 Modifier 117 to

Foreign Currency 1-in-drawer

Sfkc Receipt Sample

Sfkc

Programming in SET mode

System Option Programming

Operation LCD Display Remarks

Programming in Blind mode

System OP

Both Bit 5 & 6 Reset

Department, on Can be issued Department Reports

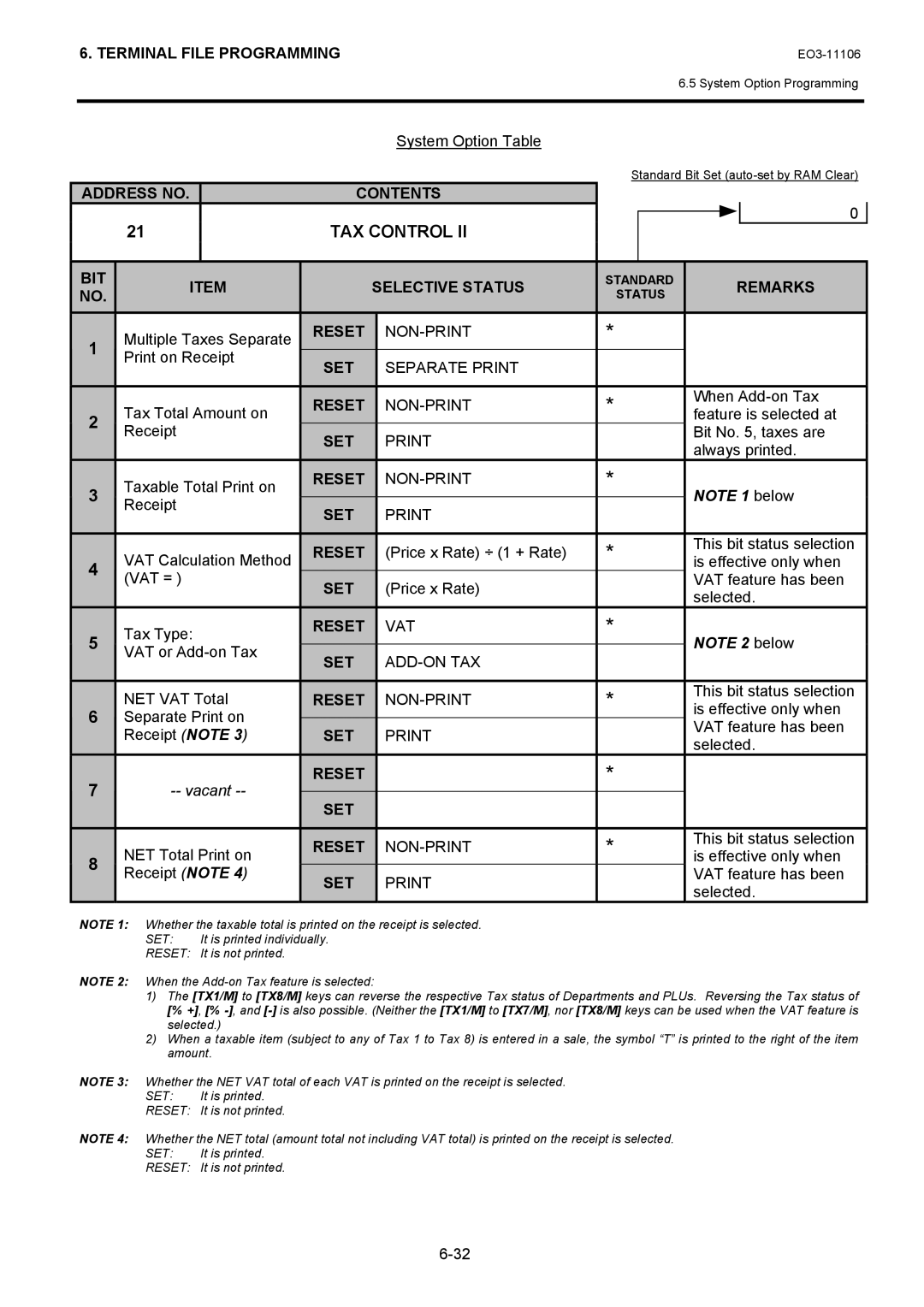

System Option Table

Time on Sale Receipt

Inps 1 for the Charge

Posting on Remote Slip

Printer

Inps 2 for the Charge

REG mode

Cashier feature

Zero-skip in All

Skipped in the report

Reports Zero-skip in PLU

Remote Slip Print

Compulsory for any PB Entry

Cashier Sign ON/OFF

Print and Issue Receipts

Drawer Open by

568

On Reports

Financial and Cashier

Daily Read Counter on Reports

Price Shift Function

SET

Single-Consignment or

Multi-Consignment

Date Print

Consecutive No.

Add-on Tax

Open/Close

When Add-on Tax

Feature is selected at

Price x Rate VAT feature has been Selected Tax Type

Separate Print on VAT feature has been Receipt Note

VAT Symbol Print

Print order of VAT TL

NET TL

Single line spacing

Drawer Warning Alarm

Drawer Close

Compulsory

Single-drawer or Multi

Resetting

Reset on Financial Daily Z Negative Mode

No-sale Entry After

Non-add # Entry

SET NON-PRINT Reset

REG and MGR Modes

IPD or Inpd on Journal

Cashier Interrupt

Date, day of week,

Register No. print on Journal

Selection of the Store

Name Message or Store Name Logo on Receipt

+ and %-after a

Subtotal within a Sale

Automatic Cashier Sign

OFF on finalizing a sale

Follow Bit 2 status If both RESET, it will be Order

Date Set and Print

Special Rounding on

Sale Total

Amount Division Symbol

Type Amount Division Symbol

Decimal Point in Item

Ex 1.5%

CUR 1 Foreign

CUR 2 Foreign

CUR 3 Foreign

CUR 4 Foreign

Post-issue Receipt Print

Department Memory

Process for %- on Department Item

PLU Memory Process

Cashier Identifying

Method Push Sfkc Keys

Money Declaration is

Money Declaration

Performed by

Consecutive No. Print

Reset

Immediately after Previous daily financial

When transmitting to PC

Zero-skip of PLU Data

Disconnection

Narrow Printing on

Journal Printer

Commercial Message Programming

Enter End

Example To program the following Commercial Message

Displayed

To program a message in a desired

ECR to enter the 1st line message

ECR to enter the 3rd line message

Programmed. The 3rd line message

Footer Message Programming

Footer Message is selected

Example To program the following Footer Message

Depress the 2 or Enter key Message already programmed is

Line, move the cursor there with the ↓

Key then depress the Enter key Enter key depression results

→ → → → → → C A/a a l l

→ → → → → → → → → →

→ a g a i n Enter

Store Name Message Programming

Input a message in the 4th line

When Commercial Message is Reset

Example To program the following Store Message

Depress the 3 or Enter key Message already programmed is

→ → → → → →→ Dbl T E

→ S T O R E Enter

ECR to enter the 4th line message

Department Name Programming

Input a department name

Example To program Food as the name of Department

SET mode, depress the ↓ key Depress the 2 or Enter key

Depress the Enter key

Department 01 is selected

Department Group Name Programming

Input a department group name

Example To program the following name on Department Group

Group Operation LCD Display

Department group name already

Department Group 1 is selected

Dbl F R E S H Enter

Cashier Name and Status Programming

Input a cashier name

SET mode, depress the ↓ key

Status input mode

ECR to enter the cashier 1 name input

Mode. The C key depression clears

Name already programmed. Cashier 1 name is input

PLU Name Programming

Maximum of 16 characters of PLU name is programmed here

Input a PLU name

Example To program Tomato as the name of PLU Code No

Depress the 2 or Enter key Depress the ↓ key three times

Depress the 4 or Enter key

PLU Code No is selected

C key depression clears the PLU

Salesperson Name Programming

Enter key

Select a salesperson of which name is

To be programmed with the ↑ or ↓

Example To program White on Salesperson Code

Depress the ↓ key four times

Depress the 5 or Enter key

Salesperson 01 is selected

End key depression allows ECR to end this programming

After Financial Reset

Financial Report Item Name Programming

Input a Financial item name

Financial ITM Name is selected

Depress the ↓ key five times

Depress the ↓ key, then depress

Item code 2 NET GT is selected

Financial item name already

NET GT NEG GT

EO3-11106

Terminal File Programming

Vacant

Print Line Item Name Programming

Anytime outside a sale

Input a print line item name

Print Item Name is selected

Depress the ↓ key six times

Depress the 7 or Enter key

Depress the ↓ key six times, then

Item code 7 @ Item is selected

Print Line Item Name Table

Post-issue Receipt Header

Sunday Monday

Tuesday Wednesday

Thursday Friday

NET Total

Consignment

Department Group Cashier Symbol Salesperson Symbol Remarks

Preset Data

Fixed Data

Input a display item name

Display Item Name Programming

Display Item Name is selected

Application Standard Program Code

Display Item Name Table

Slip Printer Connection Check

Depress the ↓ key seven times

Depress the 8 or Enter key

Depress the ↓ key twice, then

Item code 3 Total is selected

Display Name #003 Balance DUE

Input an error item name

Error Item Name Programming

Error Item Name is selected

Error Code 3 Manager

Required is selected C key depression clears the error

Depress the ↓ key eight times

Depress the 9 or Enter key

Content or Cause of Error Standard Program

Endorsement Print Compulsory Error

Journal Paper Retainer Open Printer Head Temperature Error

Printer Head Voltage Error

Limit Over Warning

ST Key Entry Compulsory error

120 121 Negative Balance Error 122 123

100 101

124 125

200

Input an X/Z report name

Read/Reset Report Name Programming

Z Report Name is selected

Depress the ↓ key nine times

Depress the 0 or Enter key

Depress the ↓ key twenty times, then

Report No Xprofit is

Report Type Standard Program

Department Gross Profit

Hourly Range All Department

All Media Sales and Cash-in Drawer All PLU

Zone PLU

Enforced Clear of Hold Condition A N C E L

F I N C a L + D P Financial + All Department

Department Table Programming

Condition Operation

Single-item or Itemized Receipt

Positive or Negative Department

Allows any amount equal to or smaller than 39,99

Prohibits any amount smaller than 4,00

€40,00

€4,00

Setting menu

Depress the Enter key to select

Department

See Note below Input 01 or 1, then depress

Setting with the ↓ or ↑ key

Move the cursor on to a desired status

Depress the → key then the Enter

VAT/Add-on tax statuses 1 and 2 are

Long receipt is issued and the display

Department Preset Price Setting or Changing

Example To preset the price €1,00 on Department 1 Food

End key depression allows the ECR to end this setting

Input 100 for the preset price

Department 1 Food

Department Listing Capacity LC Programming

Input a Lalo value

Xxxxxxx Enter

Digit Limitprice is selected

Example To program 100000 for Halo and 10 for Lalo

Input 100000, then depress the Enter

Halo

On the next 107

Lalo End key depression allows

For printing part of department names

Key Sticker Printing

KEY Sticker Print is selected

Example To print all department names

On the next 110

ALL DP is selected

To print part of department names

Move the cursor on to a desired

ECR to end this operation

Individual DP is selected

Menu Tree Operation Flowchart

PLU Table Programming

Enter 01 to

Input 0010 or 10, then depress

PLU key

PLU Code 0010 is set Input 01 or 1, then depress

Linked Department 1 is set On the next 115

Preset Price €1,00 is set Input 120, then depress the Enter

Input 100, then depress the Enter

VAT statuses 1 and 2 are set

PLU key depression completes

Depress Depress ↓ then Enter

Depress Depress ↓ three times then Enter

Depress Input a PLU code to be deleted

SET mode, depress the ↓ key Twice

PLU Code 0501 is specified End key depression allows

Input 0501 or 501, then depress

Indiv

Depress the ALL Void key

PLU Preset Price Setting or Changing

Depress the 2 or Enter key Depress the ↓ key

Depress the 3 or Enter key Depress the ↓ key

On the next 121

Depress the Enter key As the 3rd preset price remains

Make sure the cursor is shown on

01PRICE. Then, input 315

022ND PRICE. Then, input 540

Input a desired key location code

PLU Preset-Code Key Setting

Assign to Keyboard is selected

Key Location Code

Keyboard

ECR to end this setting

Input 55, then depress the Enter key

Key Location Code 55 is set

To assign PLU Code 1111 on the PK-2 keyboard

Depress the ↓ key Depress the 2 or Enter key

Input a Preset Rate

26 %+ and %- Preset Rate Setting

RATE, Limit Amount is selected %- Rate %-/%+ is selected

RATE, Limit Amount is selected

VAT or Add-on Tax Rate Setting

SET mode, depress the ↓ key

Example To set the following VAT rate VAT1………10%

Three times Depress the 4 or Enter key

Foreign Currency Exchange Rate Setting

RATE, Limit Amount is selected CUR Exchange Rate is selected

Dollar Japanese Yen €1,00 $1,20 ¥137,74 Euro Cent 3774 yen

CUR1 CUR2

On the next 133

Resetting a Foreign Currency Rate Once Set

Negative Amount Key Limit Amount Setting

RATE, Limit Amount is selected Disc AMT Limit is selected

10.00

20.00

Input 1000, then depress the Enter

Limit amount of the VND CPN

Example To set time 115 p.m

Time Setting or Adjustment

On the next 137

Date Setting or Adjustment

138

Input

Example To set Date Monday 31 October

139

Example To set the Register No. of this ECR

Store/Register No. Setting

On the next 140

From the previous Operation LCD Display Remarks

Depress the ↓ key twice

Input Store/Register No is set End key depression allows

141

Hourly Range Table Setting

After Hourly Range Reset

Example To set the following hourly range table

Until

800 1200

1200 1500

Hourly Range Table Resetting Procedure

On the next 144

Reset is selected

Tone Volume Setting

Depress the ↑ key

Tone Volume LOW is selected

147

148

Report Item Print/Non-Print Setting

Report Print Item is selected

Example To set Item Code 3 NEG GT with Non-print status

Item Code 3 NEG GT is selected

Select either Print or Non-print status

With the ← or → key

Report Item Name Table Standard Program Code Ground Total

Terminal File Programming

152

Key Status Programming

On the next 153

Depress the Enter key End key depression allows

→ key

154

Bit No Function

Key Status Table Key Code 1 to

Key Name

Disc

Key Status Table Key Code 21 to

1st Price 2nd Price 3rd Price

157

Cash Tender Key Preset Amount Setting

Cash KEY Amount is selected

Amount 1000,00 is preset to

Cash 1 key

Cash 2 key

158

159

Drawer Warning Time Setting

DRW Warning Time is selected

Example To set 30 seconds for the drawer warning time

160

Special Rounding Process Setting, 1-digit type

Round TBL 1 Digit is selected

Input 200, then depress the Enter

162

Special Rounding Process Setting, 2-digit type

Round TBL 2 Digits is selected

Input 1200, then depress the Enter

On the next 164

Input 3725, then depress the Enter key

165

On the next 166

Number of Receipt Print Buffer Line Setting

RCT Print Buffer is selected

167

Serial No. Setting

168

Example To set the serial No

Mode Lock X or SET

Verification of Programmed Data

SET mode

Program Data Read menu