6Tax Calculation

Automatic tax

When the register is programmed with a tax rate (or tax table) and the tax status of an individual department is set for taxable, it computes the automatic tax on any item that is entered directly into the department or indirectly via a related PLU.

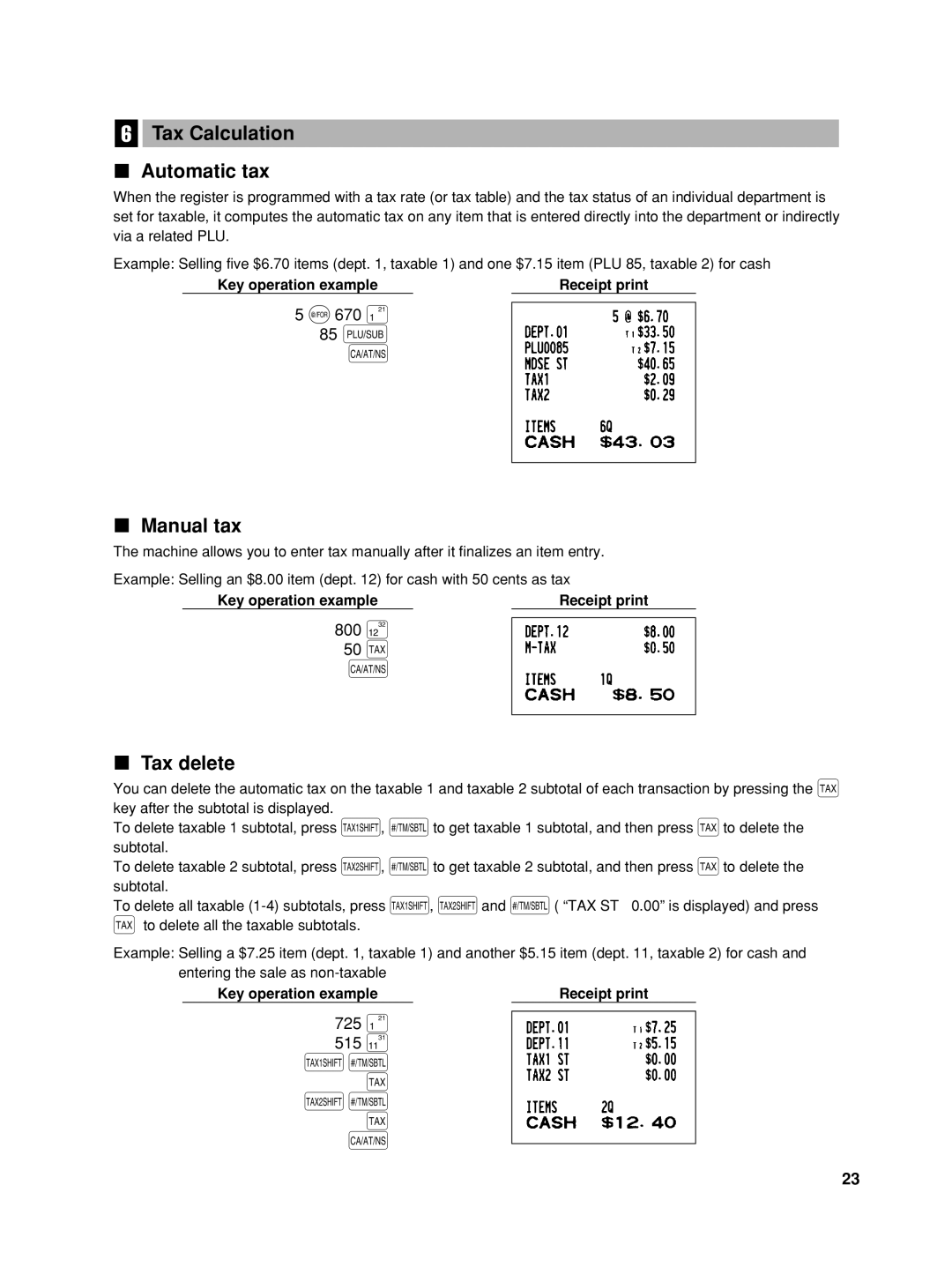

Example: Selling five $6.70 items (dept. 1, taxable 1) and one $7.15 item (PLU 85, taxable 2) for cash

Key operation example | Receipt print |

5@670 ¡ 85 p

A

Manual tax

The machine allows you to enter tax manually after it finalizes an item entry.

Example: Selling an $8.00 item (dept. 12) for cash with 50 cents as tax

Key operation example | Receipt print |

800∑

50t

A

Tax delete

You can delete the automatic tax on the taxable 1 and taxable 2 subtotal of each transaction by pressing the t key after the subtotal is displayed.

To delete taxable 1 subtotal, press T, sto get taxable 1 subtotal, and then press tto delete the subtotal.

To delete taxable 2 subtotal, press U, sto get taxable 2 subtotal, and then press tto delete the subtotal.

To delete all taxable

tto delete all the taxable subtotals.

Example: Selling a $7.25 item (dept. 1, taxable 1) and another $5.15 item (dept. 11, taxable 2) for cash and entering the sale as

Key operation example | Receipt print |

725¡

515œ

Ts t Us t

A

23