Tax status shift

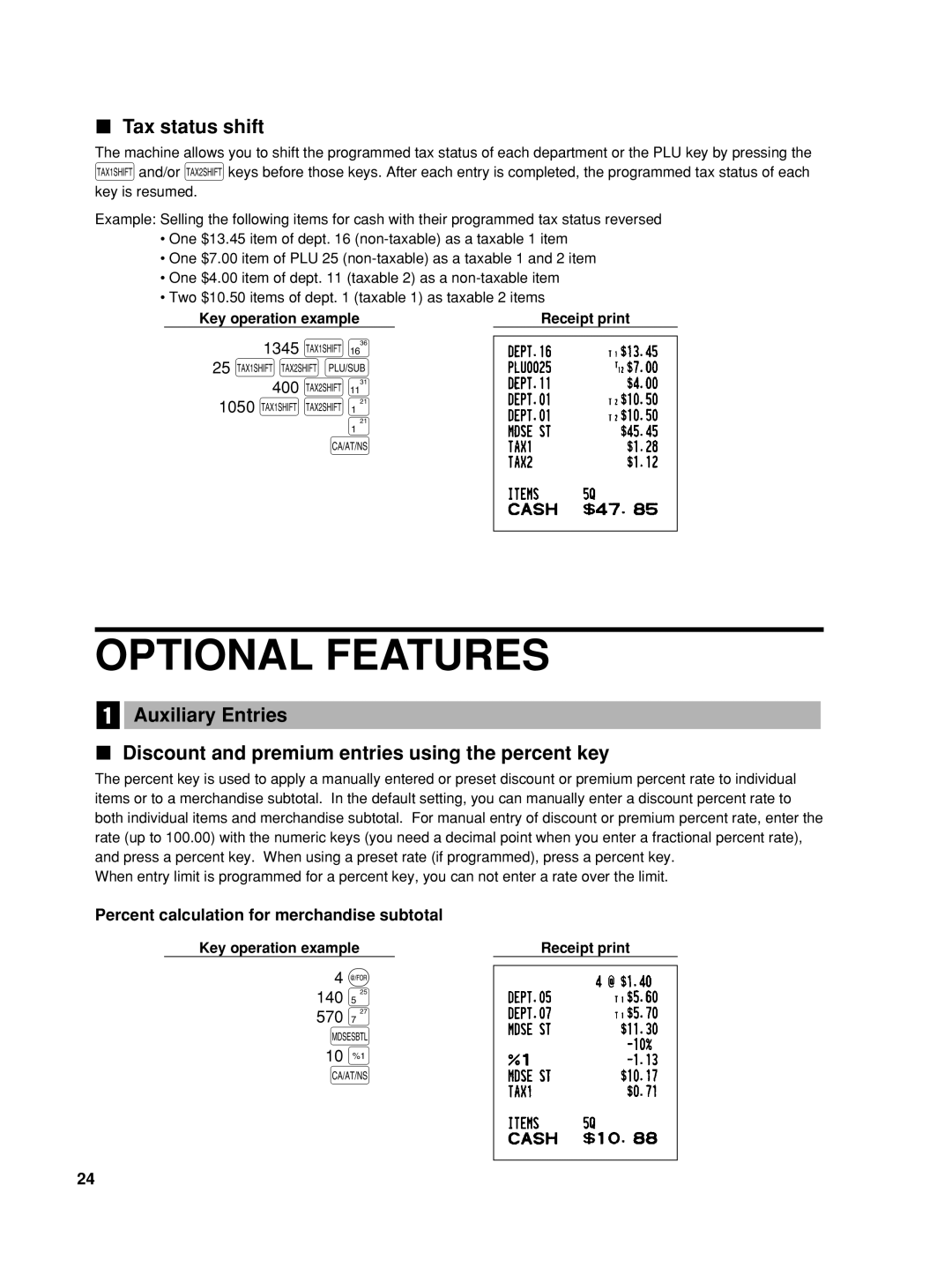

The machine allows you to shift the programmed tax status of each department or the PLU key by pressing the

Tand/or Ukeys before those keys. After each entry is completed, the programmed tax status of each key is resumed.

Example: Selling the following items for cash with their programmed tax status reversed

•One $13.45 item of dept. 16

•One $7.00 item of PLU 25

•One $4.00 item of dept. 11 (taxable 2) as a

•Two $10.50 items of dept. 1 (taxable 1) as taxable 2 items

Key operation example | Receipt print |

1345 T¥

25TUp

400Uœ

1050 TU¡

¡

A

OPTIONAL FEATURES

1Auxiliary Entries

Discount and premium entries using the percent key

The percent key is used to apply a manually entered or preset discount or premium percent rate to individual items or to a merchandise subtotal. In the default setting, you can manually enter a discount percent rate to both individual items and merchandise subtotal. For manual entry of discount or premium percent rate, enter the rate (up to 100.00) with the numeric keys (you need a decimal point when you enter a fractional percent rate), and press a percent key. When using a preset rate (if programmed), press a percent key.

When entry limit is programmed for a percent key, you can not enter a rate over the limit.

Percent calculation for merchandise subtotal

Key operation example | Receipt print |

4@

140∞

570¶

m

10%

A

24