Example: Programming the tax rate 4% as tax rate 2 with tax exempt as 12¢

Key operation example |

s9 @

2 @

4 @

12s

A

• If you make an incorrect entry before pressing the third @key in programming a tax rate, cancel it with the lkey.

•You do not need to enter the trailing zeros of a tax rate (after the decimal point), but you do need to enter the decimal for fractions.

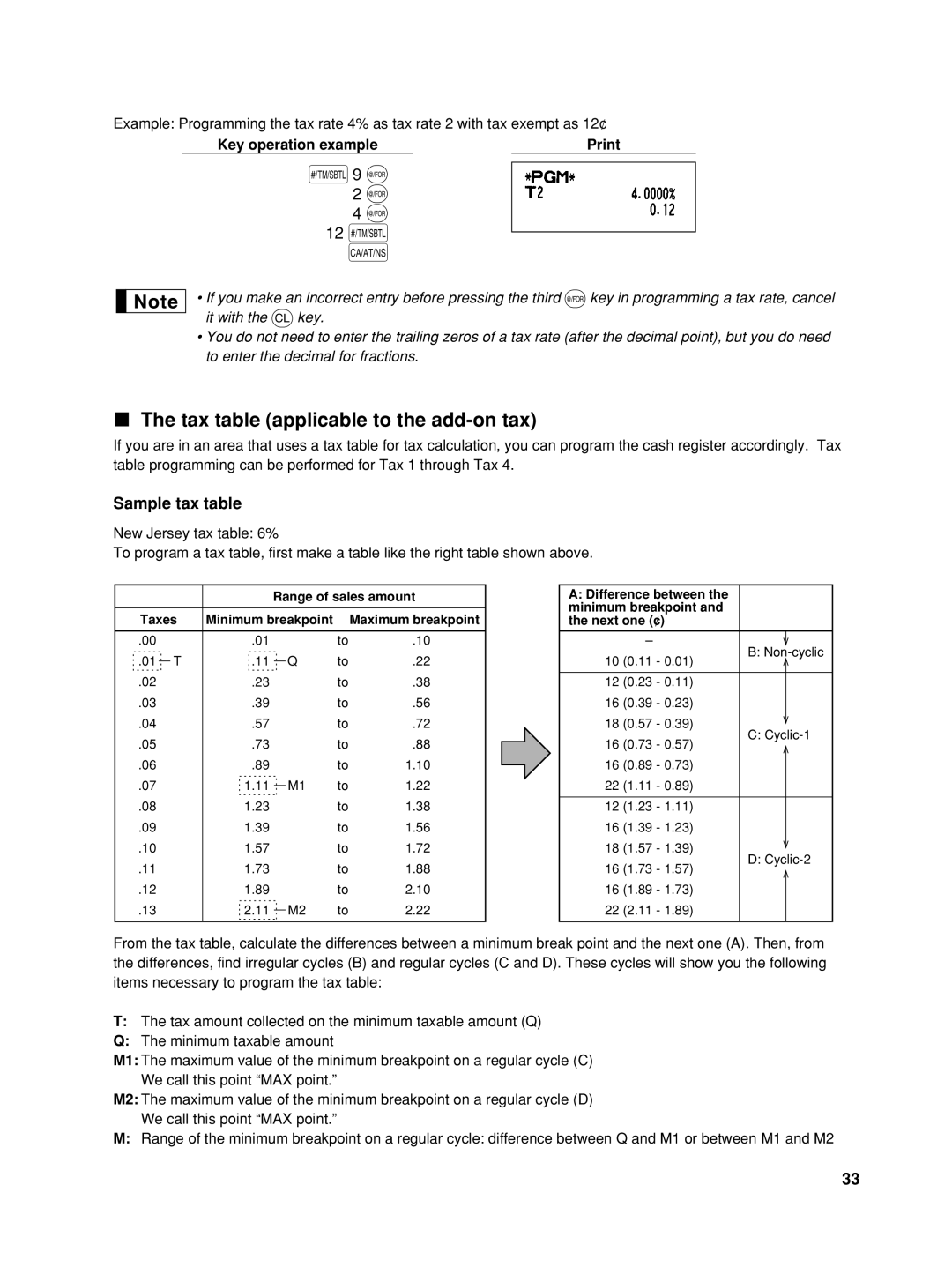

The tax table (applicable to the add-on tax)

If you are in an area that uses a tax table for tax calculation, you can program the cash register accordingly. Tax table programming can be performed for Tax 1 through Tax 4.

Sample tax table

New Jersey tax table: 6%

To program a tax table, first make a table like the right table shown above.

|

|

|

| Range of sales amount | ||||

|

|

|

|

|

|

| ||

Taxes | Minimum breakpoint |

| Maximum breakpoint | |||||

|

|

|

|

|

|

|

|

|

.00 |

|

| .01 |

|

|

| to | .10 |

.01 |

| T | .11 |

|

| Q | to | .22 |

|

| |||||||

.02 |

|

| .23 |

|

|

| to | .38 |

.03 |

|

| .39 |

|

|

| to | .56 |

.04 |

|

| .57 |

|

|

| to | .72 |

.05 |

|

| .73 |

|

|

| to | .88 |

.06 |

|

| .89 |

|

|

| to | 1.10 |

.07 |

|

| 1.11 |

|

| M1 | to | 1.22 |

|

|

|

| |||||

.08 |

|

| 1.23 |

|

|

| to | 1.38 |

.09 |

|

| 1.39 |

|

|

| to | 1.56 |

.10 |

|

| 1.57 |

|

|

| to | 1.72 |

.11 |

|

| 1.73 |

|

|

| to | 1.88 |

.12 |

|

| 1.89 |

|

|

| to | 2.10 |

.13 |

|

| 2.11 |

|

| M2 | to | 2.22 |

|

|

|

| |||||

|

|

|

|

|

|

|

|

|

A:Difference between the minimum breakpoint and the next one (¢)

– | B: | |

10 (0.11 | ||

- 0.01) | ||

12 (0.23 | - 0.11) | |

16 (0.39 | - 0.23) | |

18 (0.57 | - 0.39) | |

16 (0.73 | C: | |

- 0.57) | ||

16 (0.89 | - 0.73) | |

22 (1.11 | - 0.89) | |

|

| |

12 (1.23 | - 1.11) | |

16 (1.39 | - 1.23) | |

18 (1.57 | - 1.39) | |

16 (1.73 | D: | |

- 1.57) | ||

16 (1.89 | - 1.73) | |

22 (2.11 | - 1.89) |

From the tax table, calculate the differences between a minimum break point and the next one (A). Then, from the differences, find irregular cycles (B) and regular cycles (C and D). These cycles will show you the following items necessary to program the tax table:

T:The tax amount collected on the minimum taxable amount (Q)

Q:The minimum taxable amount

M1: The maximum value of the minimum breakpoint on a regular cycle (C)

We call this point “MAX point.”

M2: The maximum value of the minimum breakpoint on a regular cycle (D)

We call this point “MAX point.”

M:Range of the minimum breakpoint on a regular cycle: difference between Q and M1 or between M1 and M2

33