MA-1595-1 Series

FCC Notice

Safety Summary

Meanings of Each Symbol

Safety Summary

Precautions

STAND-ALONE Level OPERATOR’S Guide

Table of Contents

Item Correct

Media Slot

Specifications

Paper Roll 2 pcs Mode Selector Keys

Accessories

To OUR Customers

To OUR Customers

Appearance and Nomenclature

Appearance and Nomenclature

Mode Lock and Mode Selector Keys

Mode Lock

Mode Selector Keys

Display

Display

Operator Display Front Display

Customer Display Rear Display

SET Mode Mode Z Mode

Mode Indications

Upper Row 16-digit dot windows

Digit Range for Various Sales Items REG, MGR

Error Messages in any mode except Lock

Lower Row 10-digit 7-segment Numeric Display

Display Indicator

Numeric Display

DPT 2 digits

Outline of Preparation Procedure Before Operating the ECR

Outline of Preparation Procedure Before Operating the ECR

Installing/Replacing the Receipt Roll

Installing/Replacing the Receipt/Journal Roll

Outline of Preparation Procedure Before Operating the ECR

Paper end by hand. It may cause a paper jam

Installing/Replacing the Journal Roll

Outline of Preparation Procedure Before Operating the ECR

Cashier Code Entry

Cashier Signing or Cashier KEY Operations

For Single-drawer Machines Sign-ON LOG/RECEIPT Sign-OUT

Sign-IN

When Signed-ON or Signed-IN

Mode Changes With Signing Operations

When Signed-OUT

When Signed-OFF

Signing Operation Receipt Print Format Samples

Cashier Key Method CLK Keys

Training Mode Start and End

Condition

LOG/RECEIPT or LOG

Receipt issued in Training Mode

Training Mode Receipt Format

Keyboard Layout

Pack BTL RTN

VND CPN Tare Print STR CPN

Misc Tend

Credit LOG Debit PR Open Sales Person Manual CARD# LC Open

Functions of Each KEY

Functions of Each KEY

LOG

Receipt

Open

AMT

@/FOR

VND

Tend

Check

SI/TL

Code

SI1/TL SI4/TL

SI/M

FS/M

TAX

CHK

CLK

PLU Preset-code

Keys

PLU

Registering Procedure and Print Format

Registering Procedure and Print Format

Condition Setting to Start Sale Entries

Mode Lock Insert the REG key and set it to the REG position

Store Message Display

Receipt-Issue/Non-Issue Selection

LOG/RECEIPT

Operation

No-Sale

Drawer opens and a No-sale receipt is issued

Loan

Receipt Print Format

Department Entry

Preset Dept

Gasoline Entry

PriceOpen Dept

PLU Preset-Code Key of Preset-PLU

PricePLU Preset-Code Key of Preset-PLU

PLU Entry Manual PLU Code Entry

PLU Entry through Barcode Scanner

Repeat Entry

Preset Dept Same Dept or RPT Preset-Dept CodeDP# DP# or RPT

DEPT5

DEPT6

Quantity@/FOR PricePLU Preset-Code Key of Open-PLU

Quantity@/FOR Preset Dept

Quantity@/FOR PLU Preset-Code Key of Preset-PLU

Quantity Extension Multiplication for DEPTs/PLUs

Whole Package Price PLU Preset-code Key

PLU Preset-code Key

PR Open or Open

HI-CONE PLUs

Whole Package PricePLU Preset-code Key

@/FOR

To enter Whole Package Quantity all the items packed

Operation Examples of HI-CONE PLUs

Mix & Match M & M Function of Split-Price PLUs

Operation Examples of Mix & Match Functions

10-11

Price Shift Entry for Split-Price PLUs

When the PLUs are entered in units of whole packages

For the entry of cooled packed item

Barcode Scanning

@/FOR 1 PLU

Pack 1 PLU

3rd Price 1 PLU

Unit PricePLU Preset-Code Key of Preset-PLU

Unit PricePLU Preset-Code Key of Open-PLU

Triple Multiplication

Length@/FOR Width@/FOR

Single-Item Department or Single-Item PLU Entry

Hash Department Entry, Hash PLU Entry

Sub-Link Department Entry

Urgent PLU Maintenance

Sub-Link PLU Entry

TAX1

Returned Merchandise

Bottle Return

RTN Mdse

Dollar Discount

Percent Discount, Percent Charge

Store Coupon

Item Correct

Vendor Coupon

Manual TAX

Item Corr

All Void

Void

Non-Add Number Print

Void

Unit Price Open Dept

Scale Entry

Selective Itemizer SI Status Modification

Listing Capacity Open

RTN Mdse for Return

For Amounts through Doll DISC, VND CPN, STR CPN, BTL RTN

Subtotal Sale Total Pre-taxed Read

Tax Status or Food Stamp Status Modification

Taxable Total Sale Total With Taxes Read

Taxable Total Read and Subtotal Print

Selective Itemizer SI Total Read

PLU Preset Price Read

Tax Calculation and Print

SI/TL

Tax Exemption

Food Stampable Total Read, Food Stamp Tendering

Fstl Tend

Txbl TL

Sale Finalization by Media Keys

CHK TND Chg Misc Tend Other media keys

Code for Credit Card Company Card No Tendered Amount

Split Tendering

Multi-Tendering

Example

Cash Amount Tendered AT/TL Chg ... Cash & Charge

Swipe Card

Sale Finalization by EFT Electronic Fund Transfer

Processing

Decline

Enter PIN#

Debit Authorization

Txbl TL Manual CARD#

CREDIT/DEBIT Refund

EFT Media Key

Card No. # Expiration Date #

Txbl TL Offline Auth

Authorization Code #

Flat Keyboard Type

Debit or EBT Cash

Manual Entry only for EBT Cash key

Card No. # Expiration Date # Security Code #

10-34

EBT Cash EBT F/S

FS TL/TEND

EBT F/S

Sale Amount

FS TL/TEND

10-36

Slide Check

Check Slide

ECR prints a Customer Receipt 10-37

ENT Acct Number

Manual CD

Routing no

Check no

10-39

License No

License Number

Birthdate

ECR prints a Customer Receipt 10-40

Additional transaction, finalization, or ALL Void 10-41

Gift Card Dept

Additional transaction or finalization 10-42

Gift Card Issue Void a gift card is voided

ENT REF.NO

ENT AUT CD

Gift Card Media

ECR prints a Customer Receipt

10-44

10-45

10-46

Key Operation FIU Upper Row Display

10-47

10-48

Additional transaction or finalization 10-49

Void Reload

Gift Card Balance

10-52

10-53

CUR1

Sale Paid in Foreign Currencies

No-Sale Exchange from Domestic Currency to Foreign Currency

No-Sale Exchange from Foreign Currency to Domestic Currency

CUR

Amount of Foreign Currency 1 to be exchanged NS

Paid-Out

Received-on-Account

Amount of Payment R/A

Cash Amount Tendered AT/TL

Salesperson Entry Salesperson Sign-ON

Hold & Recall

HOLD/RECALL

Receipt Issue

Receipt Post-Issue

Credit Card No. Check

Number printed on the card

Charge Posting Previous Balance Manual Entry Type

PB+ or PB

Txbl TL Chg

Operation Contents KEY Operation

PB+

Dept

New Customer File Code Code Open

Charge Posting Customer File Type Check Track Memory Option

Pick UP BAL

488 R/A

1000 AT/TL

Endorsement Print

Function Key Entry

Function

00 DP1 ST AT/TL

Print of the programmed message

Comment Print

Sale Finalization by EBT Electronic Benefit Transfer

Into the validation slot

Validation Print

Program Options Relating to Remote Slip Control

Remote Slip Printer hardware option Operation

Item Corr key → Item Corr key

Item Corr key → C key

Invoice Print Format

Charge Posting Sale File Print Format PB Manual Entry Type

10-68

Outside a

When a Power Failure Occurs

Sale

During a

Journal and Receipt PAPER-END Detector

ECR Printer Motor Lock Detector

Journal and Receipt PAPER-END Detector

Remote Slip Printer Motor Lock Detector

Printer Head Open Detector

Remote Slip Printer Motor Lock Detector

Cleaning the Covers

General Maintenance

Clearing the Cutter Error

General Maintenance

Removing the Drawer

Manual Drawer Release and Lock

Releasing

Locking

Unlock the cover using the key, and lift the front end

Maintenance Operations

Media Slot

CDC Cash Drawer Cover Option Lock

Specifications

Specifications

STAND-ALONE Level MANAGER’S Guide

Daily Operation Flow

Combination Reports General Notes On Report Takings

Programming Submode

Preset Rate Setting for Selective Itemizers SI1 to SI4

Daily Operation Flow

Daily Operation Flow

Manager Intervention

Items Programmed to Require Manager Interventions

Manager Intervention

KEY

Doll Disc VND CPN STR CPN BTL RTN

RTN Mdse Void

Other Operations Required Manager Interventions

Function Keys Amount Limit Read

Negative Amount KEY Amount Limit Read

MANAGER’S OWN Operations in MGR Mode

MANAGER’S OWN Operations in MGR Mode

Pick Up Operation

Or VND CPN

A Signed-OUT condition

Enforced Sign-OFF of a Cashier Code Entry Method

2-digit Cashier Code manager-assign portion

Same will result as the normal Sign-OFF

Manual CARD# Post Auth

Post Authorization Operation

EBT F/S Electronic Voucher Purchase

ENT Amount

ENT VOUCHER#

Manual CARD# Voucher Auth

Sale Amount # Authorization Code # Voucher No. #

Balance Inquiry

EBT CASH, EBT F/S Balance Inquiry

EBT Cash or EBT F/S

Card Slide Case of no response from EFT

With Card Number Entry

Balance Inquiry Manual CARD# EBT Cash EBT F/S

Card No. # Expiration Date #

Ordinary Operations In Mode

Operations in Mode

Operations in Mode

Operation and Receipt Sample

Customer File Code*PICK UP BAL or Code Open

Receipt AT Purchase

Receipt AT Return

Scale Item Entry In Mode

Electronic Fund Transfer EFT Operation In Mode

Tendered Amount Credit Card Slide

Card Slide Input the Pin No. from

Amount to be cashed

Pin Pad. Then depress

Enter key

FS TL/TEND

Manual CARD#

Tendered Amount Gift Card Media

EFT Terminal responds Approved Customer Receipt Print

Customer Receipt 2 Print

Prohibitive Operations In Mode

NO-SALE NS AUTO-SCALE described

NO-SALE Cashing of Cheque or Other NON-CASH Medias

Read X and Reset Z Reports

Read X and Reset Z Reports

# 0 AT/TL

AT/TL to end

# 1 AT/TL

# 2 AT/TL

Then 204 # AT/TL

GT Reports -- to be taken on weekly or monthly basis

206 AT/TL

208 AT/TL

EFT Batch Operation

General Notes On Report Takings

Combination Reports

Report Name Available Reports

GTX GTZ

Read Report Relevant Reset Report

Financial Read or Reset Daily or GT

No Sale Vali CTR Hold CTR

Financial Read or Reset

Reset Report Format Sample

Cashier Read or Reset Daily or GT

Reset Report Sample

Reset Daily or GT

For reset For Daily Enter 206, depress AT/TL For GT

Read only Mode Lock X, enter 12, depress AT/TL

Others

Department Group Read Daily or GT

Read only

Total Read

Individual Department Read Daily or GT

Department Read or Reset

Zdpall

All Department Read or Reset Daily or GT

PLU PLU Sales Data Read or Reset

Zone PLU Read or Reset Daily or GT

Individual PLU Read Daily or GT

Zpluall

Zone Files Read or Reset

Customer File Read or Reset

All Files with balance remaining Read or Reset

Individual Files Read

Xcustcred

Zplugroup

PLU Group Sales Read or Reset Daily or GT

Xmedialog

EFT Media LOG Read or Reset

EFT Batch

30 AT/TL

31 # 1 AT/TL

Max digits 0 to Changed Batch Number will be printed

31 # 2 AT/TL

Tran INQ. ZZZZ9 X

33 AT/TL

Tran ALL

34 AT/TL

Programming Operations

Programming Operations

Table of Programming Operations

Submode No

Keyboard Variations in Programming Operations

Basic Key Functions

Programming Operations

Character Entries

Character Code Standard Characters Column Code Row Code

Character Code Entry Method

Direct Character Entry Method

Character Setting Operations

@/FOR 407 # 502 # 515 # 505 500 #

All Double-sized Declaration

Space

Condition Required for Programming Operations

Mode Lock SET Line No. ST

AT/TL to complete this submode

Key Operation Mode Lock SET, Enter 1 and depress the X key

Cashier Code and Name Programming Submode

Programming

CLK key

Deletion

Item CORRCashier Code NS

Void AT/TL

Department Table Programming Submode

Address No Description of Programming Contents

GP A-GP A-GP

Department Table Programming Contents

Single-item or Itemized Receipt Hash or Ordinary Department

OFF

Hash

Ordinary

Tax 2 Tax 2 taxable

Tax 1 Tax 1 taxable

Tax 3 Tax 3 taxable

Tax 4 Tax 4 taxable

Address No

Vegetable

Department Code DP#

Key Operation Mode Lock SET, Enter 3 and depress the X key

Individual Department Deletion

All Department Deletion

Programming or Changing

PLU Table Programming Submode

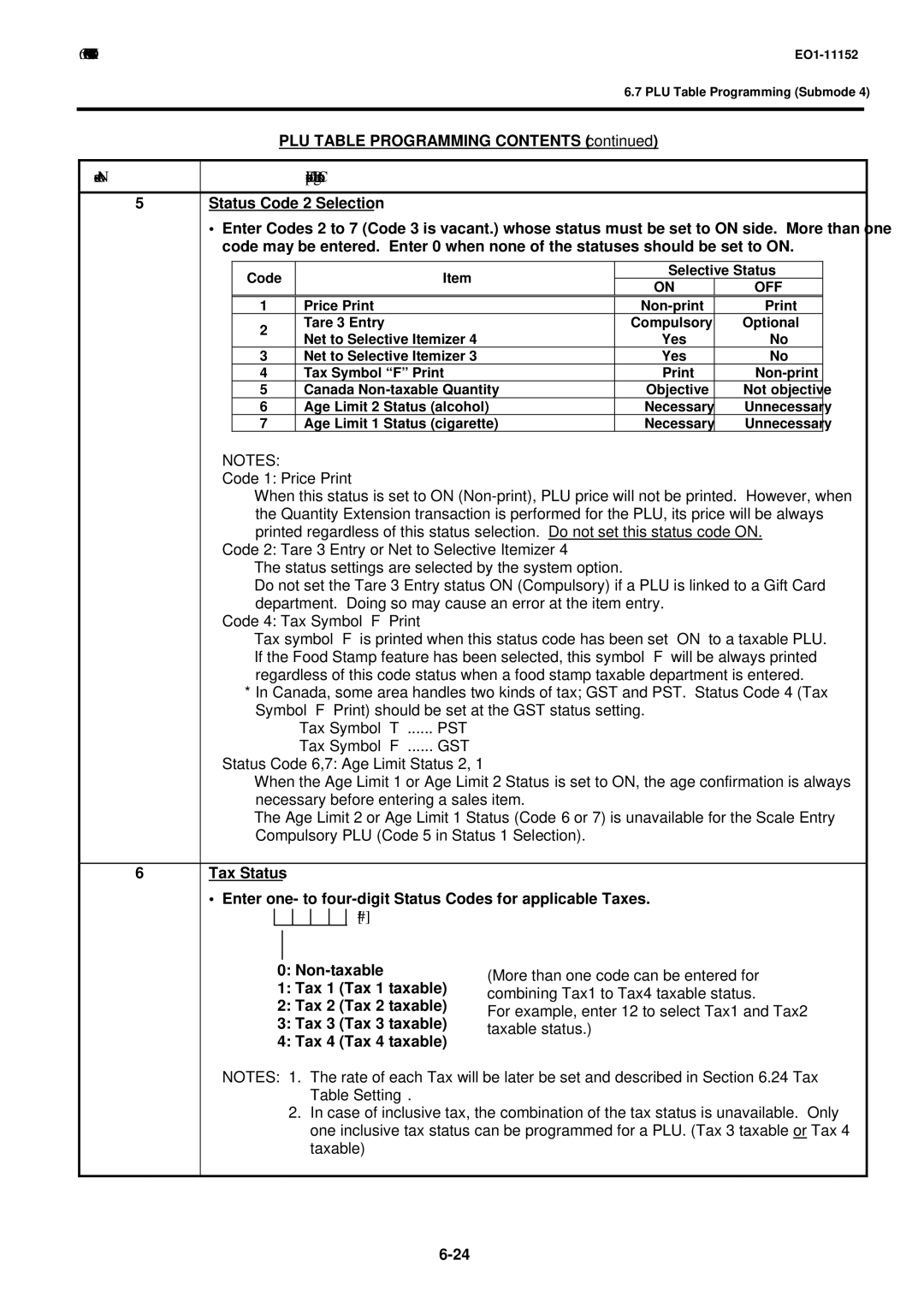

PLU Table Programming Contents

PLU Table Programming Contents

GST

HEAD-LINK PLU SUB-LINK PLU

Remarks

Additional Notes

601

# 615 # 613 #

# 704 # 615 #

ST Name Tomato

Individual PLU Deletion Barcode Scanning

To delete a PLU with sales data of not zero After PLU Reset

PLU Code DP#

Item Corr 90701 PLU AT/TL

Any time outside a sale except the following case

PLU Programmed Data Copying

Digit Length of PLU Codes

Coding PLUs supplement to PLU programming operations

Coding Methods

Coding With Linked Department Code

Using Bar codes source-marking EAN or UPC bar codes

Time Setting or Adjustment Submode

Combining Methods 1, 2,

1 5 AT/TL

Amount Limit Setting for Function Keys Submode

Date Setting or Adjustment Submode

Mode Lock SET Day-of-Week Code Month Day Year

Mode Lock SET Key Code ST Amount Limit Set Value #

Example To set the Amount Limits of the following items

Customer File Code Check Track No. and Name Setting Submode

Key Code Amount Limit Set Values CHK TND

9999

Customer File Code ST

Deletion of Individual Customer File Codes

Deletion of All Customer File Codes

503 # # 408 # 401 # 409 # 412 # 509 # ST

Salesperson Code and Name Programming Submode

Salesperson Code ST Character Entries

To complete this submode

Link-PLU Table Programming Submode

After Daily Salesperson Reset

Deletion

Salesperson Code ST

Tare Table No. ST Tare Weight #

Tare Table and General Unit Weight Setting Submode

General Unit Weight Setting

General Unit Weight Code

Tare Table and General Unit Weight Setting

Barcode Scanning PLU Code KEY

PLU Preset-Code Key Setting Submode

Required key

50322

Remarks

PK-2 Keyboard

EO1-11152 PLU Preset-Code Key Setting Submode

Display Message Programming Submode

Message Line No. ST Character Entries ST

N K

P31

Media Code and KEY Table

Negative Amount Key Limit Amount Setting Submode

Key Code

Doll Disc

ST RTN Mdse Amount #

Dollar Discount Extra Charge Code

14 DP# 210 # AT/TL

Department Preset Price Setting or Changing

P00

21 %+ and %- Preset Rate Setting

Preset Rate %+ For Percent Charge Preset Rate

Preset Rate %-For Percent Discount Preset Rate

SI/TL or SI1/TL

Preset Rate Setting for Selective Itemizers SI1 to SI4

SI2/TL

SI1/TL

Key Operation in REG Mode

Dept 1 SI-net Dept 2 non-SI Dept 3 SI-netSI/TL 1% is preset

Receipt/Journal Print

Foreign Currency Exchange Rate Calculation

Foreign Currency Exchange Rate Setting

Domestic

Euro

TAX Table Setting

Resetting a Foreign Currency Rate Once Set

After Financial Daily Reset

Type 3 TAX 1 % Rate only

Type 2 TAX 1 Combination of NON-CYCLIC Breaks and % Rate

TX1/M

TAX Rate AT/TL

TX2/M 29 TX2/M 59 TX2/M 84 TX2/M 112 TX2/M

Store/Register No. Setting

TX3/M

Store/Register No

Verification of Programmed Data

Verification of Programmed Data

Selective Itemizer Rate Foreign Currency Exchange Rate

104 ST

Mode Lock X or SET Enter any amount

Tax Calculation Test

Depress Txbl TL

BAR Code System for Each Model

BAR Code System for Each Model

Bar Code Type Table

S Level OPERATOR’S Guide

Operator Display Indications of Master-Satellite System

Introduction System Configuration

Introduction

System Configuration

Introduction

TM-U295 Epson

Hardware Description

Operator Display Indications of Master-Satellite System

Hardware Description

Additional Function KEY and Registering Procedure

Additional Function KEY and Registering Procedure

Procedure on a Master Terminal for RTR Declaration

Procedure on a Master Terminal for RTR Declaration Cancel

S Level MANAGER’S Guide

Reservation

Backup Function

DLL Down-Line-Loading Operations

Inquiries

Store Open

Turn on the power of every ECR in the in-line system

Sign-ON, Sale Entries, Sign-OFF

Read X Report Takings on Individual Terminals

In-line Reset Report Takings on

Store Close

Consolidated Report Data Read

Operations Before IN-LINE Service

Operations Before IN-LINE Service

Terminal Open Check

80 AT/TL

# 333303 # AT/TL

Terminal Designation

81 AT/TL

Terminal Condition Check

Reservation

Reservation Function

Reservation

Reservation

Reserved

Report Reservation Print Format

Operation on ANY Terminal

Operations Relative To Reservation

96 AT/TL

9998 AT/TL

Read and Reset Reports

Read and Reset Reports

Terminal Reports

In-Line Reports

In-Line Report Command Executions

Conditions required on terminals for In-line Report takings

Lock Positions Required

When the option Individual Terminal

Operation Flow of IN-LINE Read or Reset Reports

Data Report Issue is selected

Applicable to Financial Reports only

AT/TL 201 AT/TL

200 AT/TL

AT/TL 202 AT/TL

AT/TL 203 AT/TL

AT/TL

Process Reports and Base Report Data

# → 2 AT/TL

IN-LINE Report Type

In-Line Report Print Format

Copy of daily reset data has completed

Reset Report Collection Indication

Copy of GT reset data has completed

Read Report Collection Indication

Enforced Clear of Hold Condition on Individual Terminals

Operations After In-Line Report Takings

90 AT/TL

9999 AT/TL

Programming Operations Common with Standalone ECR Level

Programming JOB List

Submode Programming Job Terminals Master*1

Programming Operations Added for In-line Terminals

Terminal Connection Table Setting Submode

77 @/FOR

In-line ID and LAN Network Setting Submode

Enter 77, depress @/FOR

ST 04 #

ST 0 #

Programmed data can be read for verification purposes

Verification of Programmed Data

Submode DLL Job Remarks

DLL JOB List

Condition Operation 5XX

Print Format of DLL Operations

Department and PLU Maintenance

Department and PLU Maintenance

Table of Department and PLU Maintenance Operations

Mode Submode

63 @/FOR

PLU Table Addition/Change/Deletion with DLL

Dept. Code DP# New Preset Price #

When the feature PLU to be inquired is selected

Is selected

63 @/FOR

New Preset Price

PLU Price Changing with DLL Submode

73 @/FOR

PLU Inquiries

Inquiries

Customer File Check Track Inquiries

Inquiries

Cashier Cancel Inquires Occupy Cancel

Credit Card No. Inquiries to the Negative Check File

Cashier Occupy Inquiries

Backup Function

Backup Function

Only When the Backup Master is Connected

DLL Data Backup Data Response

Procedure Changing Program Data DLL from the PC

900 AT/TL

Mode Lock Z and IN-LINE Lamp illuminated

Data Capture Function

Data Capture Function

Master and Backup Master Alternation

Master and Backup Master Alternation

9000 AT/TL

Cause of Error

Transmission Error

Error Display

Transmission Error

AT/TL Performs re-sending to the other station

Error Canceling Process

Other Operations Relating to IN-LINE Service

Other Operations Relating to IN-LINE Service

Time Out

Retry

Suspending

Incomplete Ending

Description

Status Print Format

Cancel

Page

Page