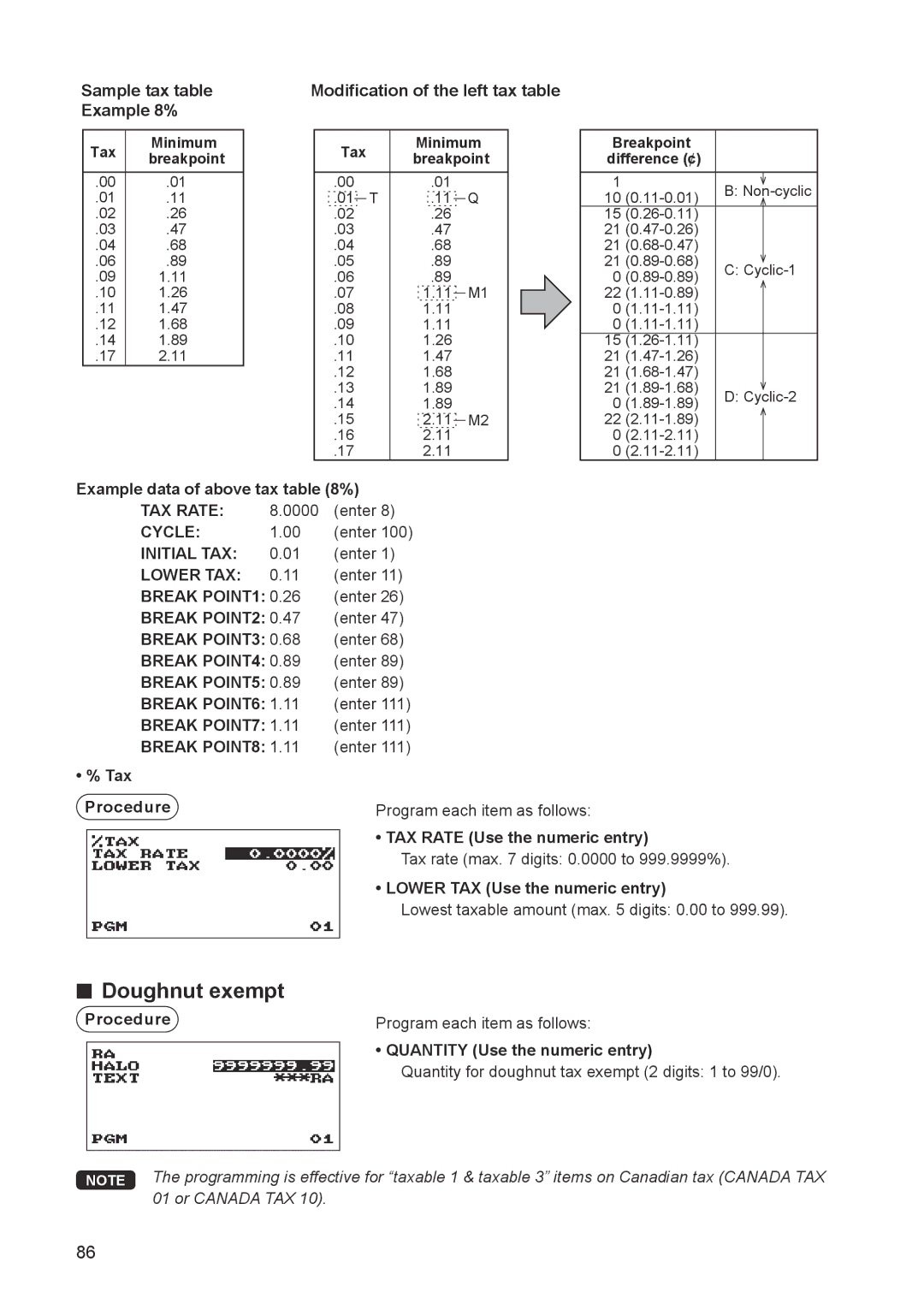

Sample tax table | Modification of the left tax table |

Example 8% |

|

Tax | Minimum | |

breakpoint | ||

| ||

|

| |

.00 | .01 | |

.01 | .11 | |

.02 | .26 | |

.03 | .47 | |

.04 | .68 | |

.06 | .89 | |

.09 | 1.11 | |

.10 | 1.26 | |

.11 | 1.47 | |

.12 | 1.68 | |

.14 | 1.89 | |

.17 | 2.11 |

Tax |

| Minimum | ||||

| breakpoint | |||||

|

|

|

| |||

|

|

|

|

|

|

|

.00 |

|

|

| .01 |

|

|

.01 |

|

| T | .11 |

| Q |

|

|

| ||||

.02 |

|

|

| .26 |

|

|

.03 |

|

|

| .47 |

|

|

.04 |

|

|

| .68 |

|

|

.05 |

|

|

| .89 |

|

|

.06 |

|

|

| .89 |

|

|

.07 |

|

|

| 1.11 |

| M1 |

|

|

|

| |||

.08 |

|

|

| 1.11 |

|

|

.09 |

|

|

| 1.11 |

|

|

.10 |

|

|

| 1.26 |

|

|

.11 |

|

|

| 1.47 |

|

|

.12 |

|

|

| 1.68 |

|

|

.13 |

|

|

| 1.89 |

|

|

.14 |

|

|

| 1.89 |

|

|

.15 |

|

|

| 2.11 |

| M2 |

|

|

|

| |||

.16 |

|

|

| 2.11 |

|

|

.17 |

|

|

| 2.11 |

|

|

Breakpoint difference (¢)

1B:

10

15

21

21

21 | C: | ||

0 | |||

| |||

22 |

| ||

0 |

| ||

0 |

| ||

15 |

| ||

21 |

| ||

21 |

| ||

21 | D: | ||

0 | |||

| |||

22 |

| ||

0 |

| ||

0 |

|

Example data of above tax table (8%)

TAX RATE: | 8.0000 | (enter 8) |

CYCLE: | 1.00 | (enter 100) |

INITIAL TAX: | 0.01 | (enter 1) |

LOWER TAX: | 0.11 | (enter 11) |

BREAK POINT1: | 0.26 | (enter 26) |

BREAK POINT2: | 0.47 | (enter 47) |

BREAK POINT3: | 0.68 | (enter 68) |

BREAK POINT4: | 0.89 | (enter 89) |

BREAK POINT5: | 0.89 | (enter 89) |

BREAK POINT6: | 1.11 | (enter 111) |

BREAK POINT7: | 1.11 | (enter 111) |

BREAK POINT8: | 1.11 | (enter 111) |

•% Tax Procedure

■■ Doughnut exempt

Procedure

Program each item as follows:

• TAX RATE (Use the numeric entry)

Tax rate (max. 7 digits: 0.0000 to 999.9999%).

• LOWER TAX (Use the numeric entry)

Lowest taxable amount (max. 5 digits: 0.00 to 999.99).

Program each item as follows:

• QUANTITY (Use the numeric entry)

Quantity for doughnut tax exempt (2 digits: 1 to 99/0).

NOTE The programming is effective for “taxable 1 & taxable 3” items on Canadian tax (CANADA TAX 01 or CANADA TAX 10).

86