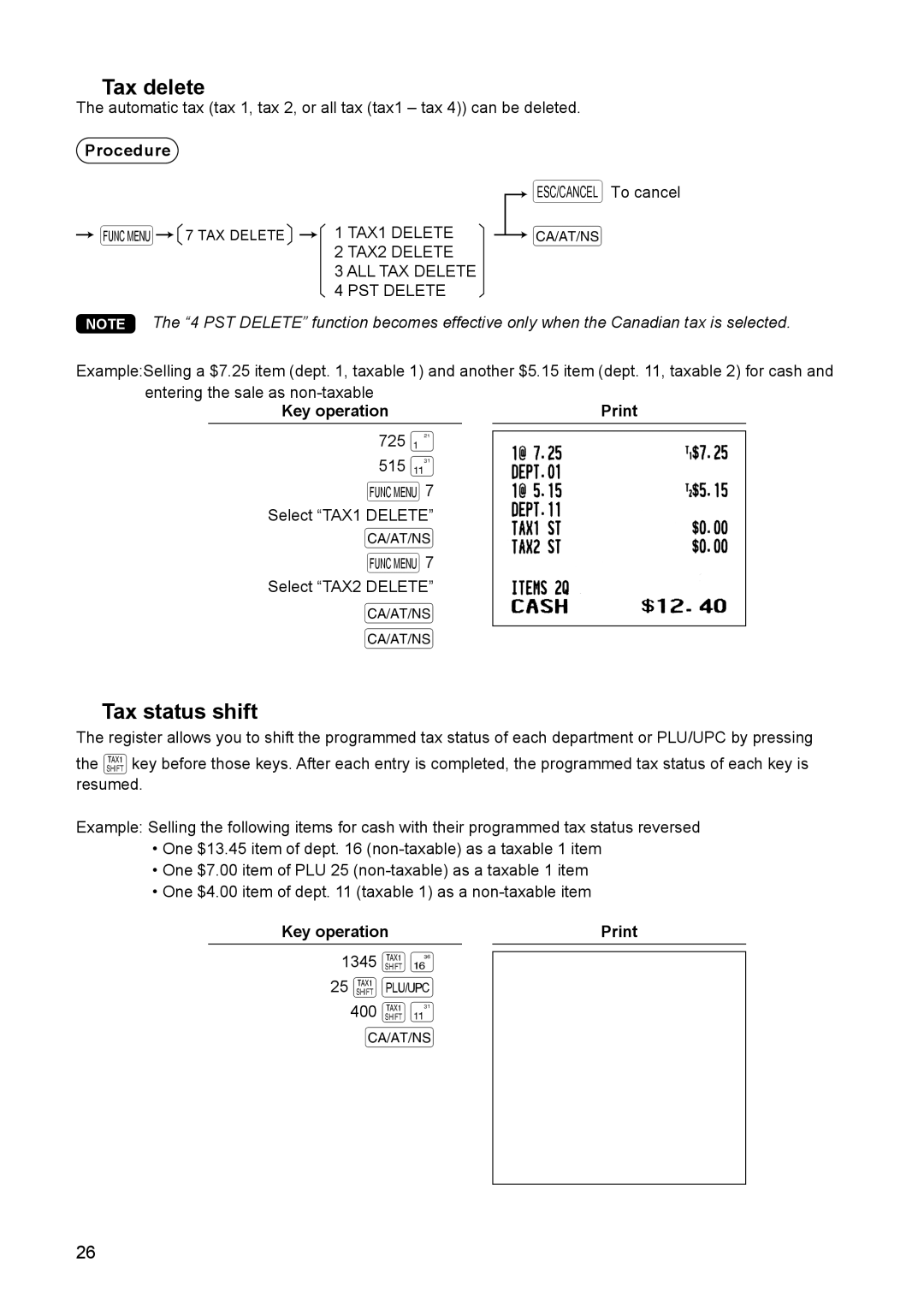

■■ Tax delete

The automatic tax (tax 1, tax 2, or all tax (tax1 – tax 4)) can be deleted.

Procedure |

|

|

|

|

| |||

|

|

|

|

| 1 TAX1 DELETE |

|

| aTo cancel |

|

|

|

|

|

|

| ||

| F |

| 7 TAX DELETE |

|

|

| A | |

|

|

|

|

| ||||

|

|

|

|

| 2 TAX2 DELETE |

|

|

|

|

|

|

|

| 3 ALL TAX DELETE |

|

|

|

|

|

|

|

| 4 PST DELETE |

|

|

|

NOTE The “4 PST DELETE” function becomes effective only when the Canadian tax is selected.

Example:Selling a $7.25 item (dept. 1, taxable 1) and another $5.15 item (dept. 11, taxable 2) for cash and

entering the sale as |

|

Key operation |

7251

515q

F7 Select “TAX1 DELETE”

A

F7 Select “TAX2 DELETE”

A

A

■■ Tax status shift

The register allows you to shift the programmed tax status of each department or PLU/UPC by pressing

the wkey before those keys. After each entry is completed, the programmed tax status of each key is resumed.

Example: Selling the following items for cash with their programmed tax status reversed

•One $13.45 item of dept. 16

•One $7.00 item of PLU 25

•One $4.00 item of dept. 11 (taxable 1) as a

Key operation |

|

1345 wy

25wp

400wq

A

26