VAT shift entries

This feature is intended to shift the tax status of a particular department (PLU or EAN) programmed for taxable 1 or taxable 1 and taxable 3.

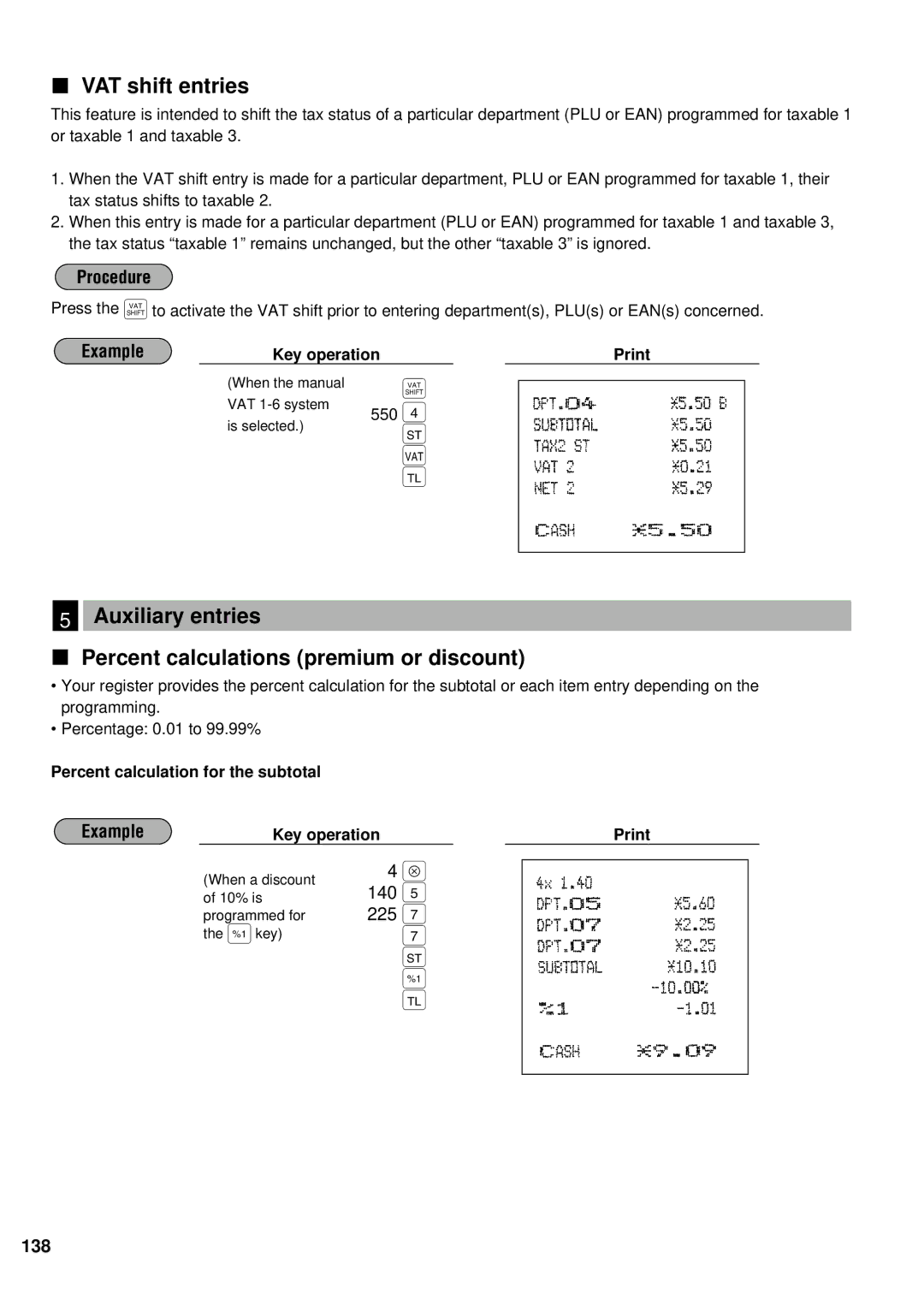

1.When the VAT shift entry is made for a particular department, PLU or EAN programmed for taxable 1, their tax status shifts to taxable 2.

2.When this entry is made for a particular department (PLU or EAN) programmed for taxable 1 and taxable 3, the tax status “taxable 1” remains unchanged, but the other “taxable 3” is ignored.

Procedure

Press the „to activate the VAT shift prior to entering department(s), PLU(s) or EAN(s) concerned.

Example | Key operation |

|

|

|

| |

| (When the manual | „ |

|

| ||

|

|

| ||||

| VAT |

|

| |||

| 4 |

|

|

|

| |

| 550 |

|

|

|

| |

| is selected.) | : |

|

|

|

|

|

|

|

|

|

| |

|

| ◊ |

|

| ||

|

| ; |

|

|

|

|

|

|

|

|

|

|

|

5Auxiliary entries

Percent calculations (premium or discount)

•Your register provides the percent calculation for the subtotal or each item entry depending on the programming.

•Percentage: 0.01 to 99.99%

Percent calculation for the subtotal

Example | Key operation |

|

|

|

| ||

| (When a discount | 4 | ≈ |

|

| ||

|

|

| |||||

| 140 | 5 |

|

|

|

| |

| of 10% is |

|

|

|

| ||

| programmed for | 225 7 |

|

|

|

| |

| the ∞key) |

| 7 |

|

|

|

|

|

|

| : |

|

|

|

|

|

|

| ∞ |

|

| ||

|

|

| ; |

|

|

|

|

|

|

|

|

|

|

|

|

138