A212_3 FOR THE MANAGER 03.7.5 8:02 AM Page 35

When you program tax rate(s) and taxable status for each department (by default, VAT1/tax1 is set to taxable.), tax will be automatically added to sales of items assigned to the department according to the programmed tax status for the department and the corresponding tax rate(s).

For details of the tax systems, refer to “Computation of VAT (Value Added Tax)/tax” section on page 20. To change the tax system, please refer “Other programming” of “Various Function Selection Programming 1” section (Job code 69) on page 55.

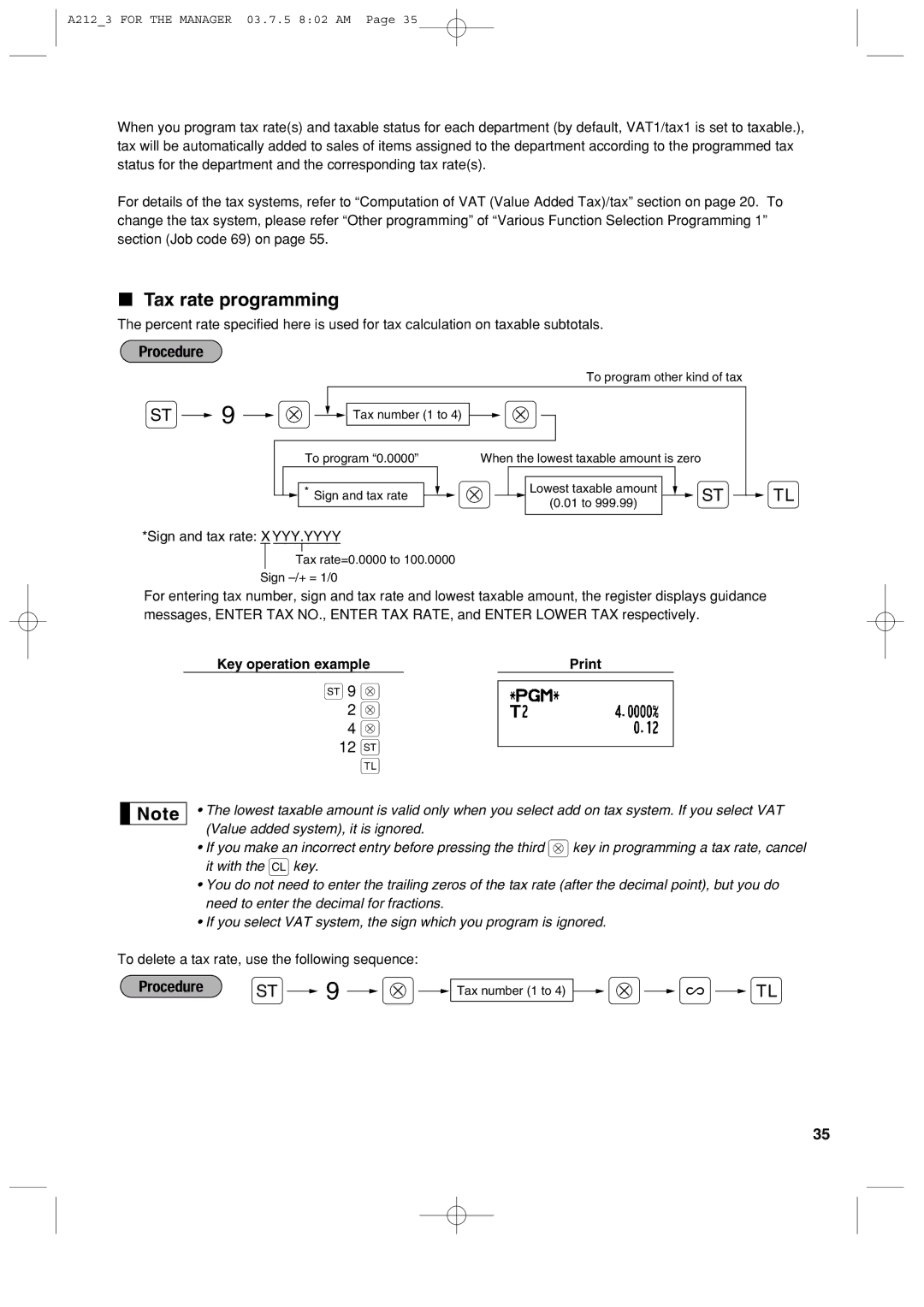

Tax rate programming

The percent rate specified here is used for tax calculation on taxable subtotals.

To program other kind of tax

s![]() 9

9 ![]() @

@![]()

![]() Tax number (1 to 4)

Tax number (1 to 4) ![]() @

@

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| To program “0.0000” |

| When the lowest taxable amount is zero | |||||||||

|

|

|

|

|

| @ |

|

|

|

|

|

|

| s |

|

|

|

|

|

|

|

|

| Lowest taxable amount |

|

| |||

|

|

| * Sign and tax rate |

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

| (0.01 to 999.99) |

|

| ||||

|

|

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Sign and tax rate: X YYY.YYYY

A

Tax rate=0.0000 to 100.0000

Sign

For entering tax number, sign and tax rate and lowest taxable amount, the register displays guidance messages, ENTER TAX NO., ENTER TAX RATE, and ENTER LOWER TAX respectively.

Key operation example |

|

s9 @

2 @

4 @

12s

A

• The lowest taxable amount is valid only when you select add on tax system. If you select VAT (Value added system), it is ignored.

•If you make an incorrect entry before pressing the third @key in programming a tax rate, cancel it with the lkey.

•You do not need to enter the trailing zeros of the tax rate (after the decimal point), but you do need to enter the decimal for fractions.

•If you select VAT system, the sign which you program is ignored.

To delete a tax rate, use the following sequence:

s![]() 9

9 ![]() @

@![]()

![]() Tax number (1 to 4)

Tax number (1 to 4) ![]() @

@![]() v

v![]() A

A

35