A212_2 FOR THE OPERATOR 03.7.5 8:01 AM Page 21

Manual tax

st

This system provides the tax calculation for taxable 1 through 4 subtotals. This calculation is performed using the corresponding programmed percentages when the tkey is pressed just after the skey.

After this calculation, you must finalize the transaction.

Automatic VAT 1 and automatic tax 2-4 system

This system enables the calculation in the combination with automatic VAT 1 and automatic tax 2 through 4. The combination can be any of VAT1 corresponding to taxable 1 and any of tax 2 through 4 corresponding to taxable 2 through taxable 4 for each item. The tax amount is calculated automatically with the percentages previously programmed for these taxes.

•The tax status of PLU/subdepartment depends on the tax status of the department which the PLU/subdepartment belongs to.

•VAT/tax assignment symbol can be printed at the fixed right position near the amount on the receipt as follows:

VAT1/tax1 ![]() A

A

VAT2/tax2 ![]() B

B

VAT3/tax3 ![]() C

C

VAT4/tax4 ![]() D

D

When the multiple VAT/tax is assigned to a department or a PLU, a symbol of the lowest number assigned to VAT/tax rate will be printed. For programming, please refer to “Various Function Selection Programming 1” (Job code 66) on page 53.

OPTIONAL FEATURES

1Auxiliary Entries

Percent calculations (premium or discount)

Your register provides the percent calculation for the subtotal and/or each item entry depending on the programming.

• Percentage: 0.01 to 100.00% (Depending on the programming)

Application of preset rate (if programmed) and manual rate entry are available.

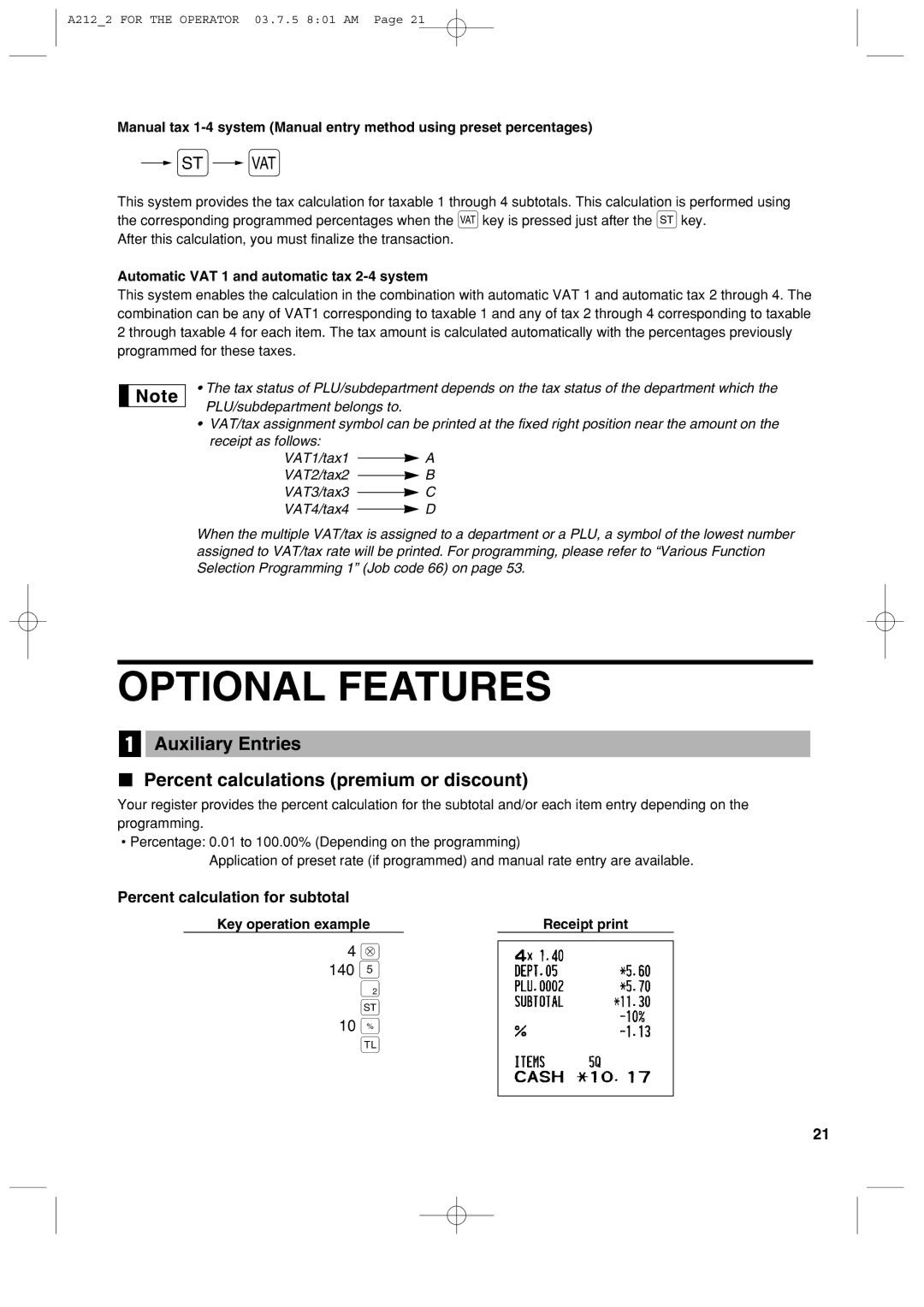

Percent calculation for subtotal

Key operation example |

| Receipt print |

4@

140'

™

s

10%

A

21