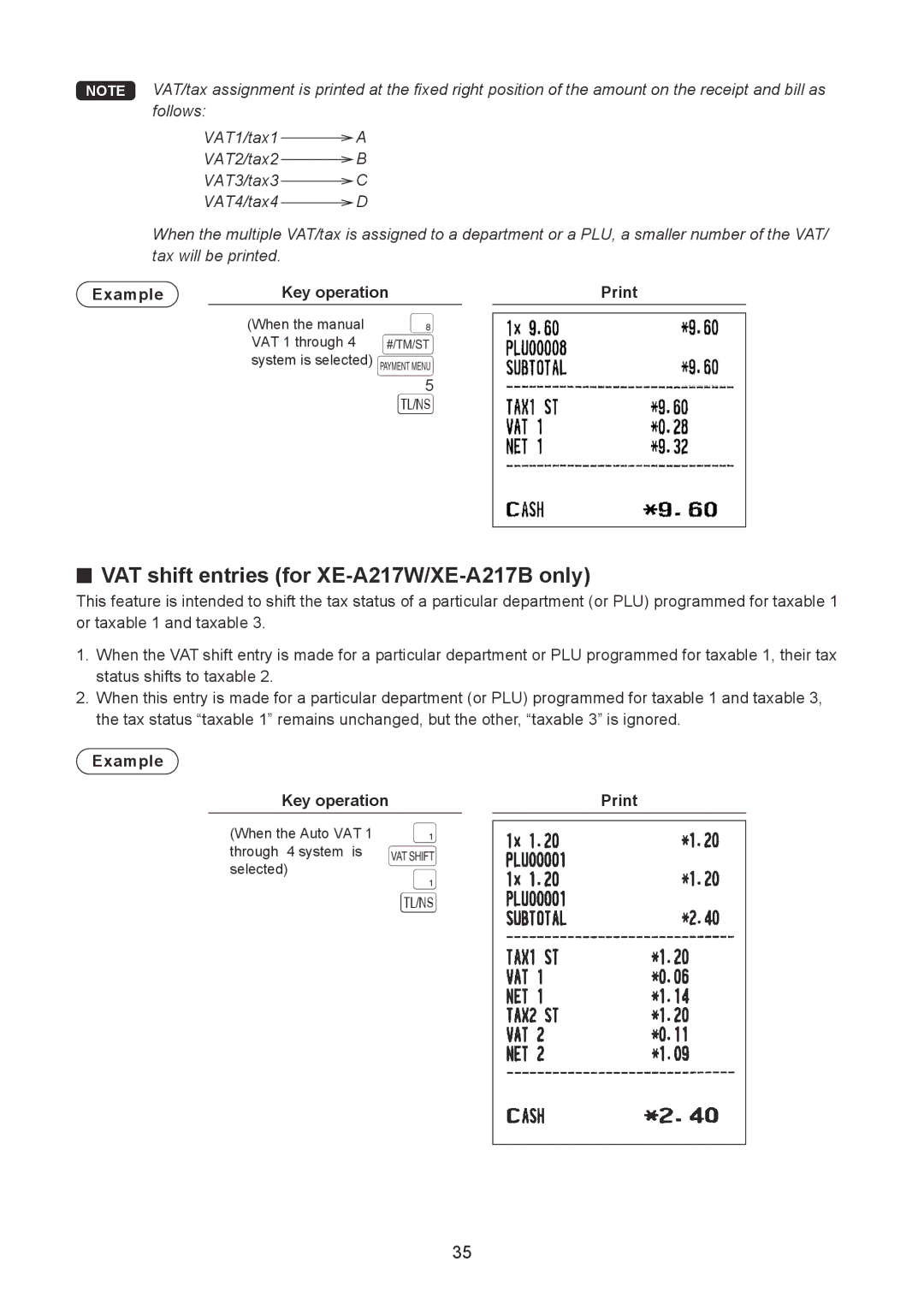

NOTE VAT/tax assignment is printed at the fixed right position of the amount on the receipt and bill as follows:

VAT1/tax1 ![]() A

A

VAT2/tax2 ![]() B

B

VAT3/tax3 ![]() C

C

VAT4/tax4 ![]() D

D

When the multiple VAT/tax is assigned to a department or a PLU, a smaller number of the VAT/ tax will be printed.

Example | Key operation |

|

|

| ||

| (When the manual |

| 8 |

|

|

|

|

|

|

|

| ||

| VAT 1 through 4 | z |

| |||

| system is selected) t |

| ||||

|

|

| 5 |

|

|

|

|

|

| A |

| ||

|

|

|

|

|

|

|

■■ VAT shift entries (for XE-A217W/XE-A217B only)

This feature is intended to shift the tax status of a particular department (or PLU) programmed for taxable 1 or taxable 1 and taxable 3.

1.When the VAT shift entry is made for a particular department or PLU programmed for taxable 1, their tax status shifts to taxable 2.

2.When this entry is made for a particular department (or PLU) programmed for taxable 1 and taxable 3, the tax status “taxable 1” remains unchanged, but the other, “taxable 3” is ignored.

Example

Key operation

(When the Auto VAT 1 | 1 |

through 4 system is | D |

selected) | 1 |

| |

| A |

35