Chapter 11: Examples

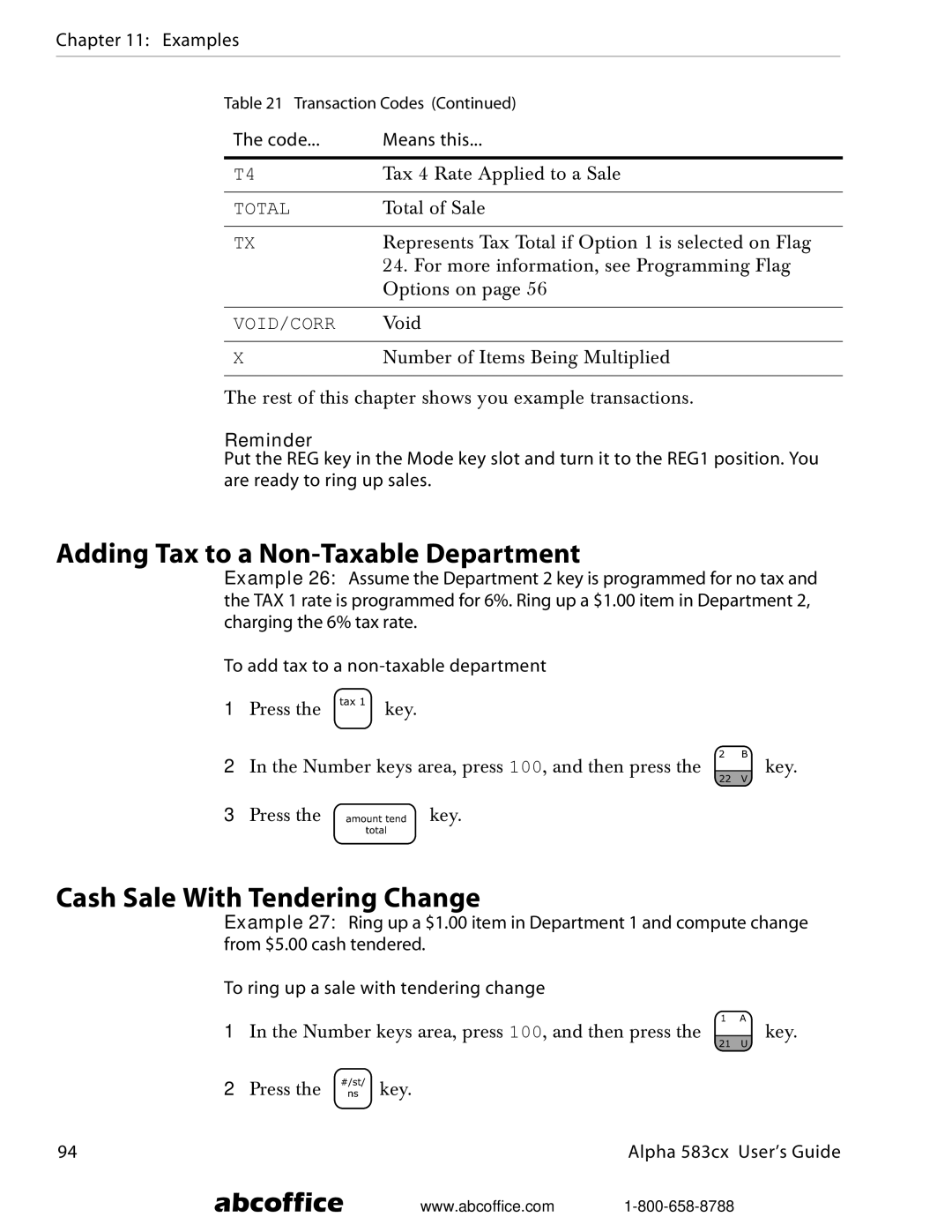

Table 21 Transaction Codes (Continued)

The code... | Means this... |

|

|

T4 | Tax 4 Rate Applied to a Sale |

TOTAL | Total of Sale |

TX | Represents Tax Total if Option 1 is selected on Flag |

| 24. For more information, see Programming Flag |

| Options on page 56 |

|

|

VOID/CORR | Void |

X | Number of Items Being Multiplied |

The rest of this chapter shows you example transactions.

Reminder

Put the REG key in the Mode key slot and turn it to the REG1 position. You are ready to ring up sales.

Adding Tax to a Non-Taxable Department

Example 26: Assume the Department 2 key is programmed for no tax and the TAX 1 rate is programmed for 6%. Ring up a $1.00 item in Department 2, charging the 6% tax rate.

To add tax to a

1Press the ![]() key.

key.

2In the Number keys area, press 100, and then press the ![]() key.

key.

3Press the ![]() key.

key.

Cash Sale With Tendering Change

Example 27: Ring up a $1.00 item in Department 1 and compute change from $5.00 cash tendered.

To ring up a sale with tendering change

1In the Number keys area, press 100, and then press the ![]() key.

key.

2Press the ![]() key.

key.

94 | Alpha 583cx User’s Guide |

abcoffice www.abcoffice.com