Profit and Loss Analysis

•Net income = (1 - tax)(net sales price - manufacturing expense - operating expense)

•Net sales price = list price(1 - discount rate)

•where operating expense represents a percentage of net sales price.

Securities

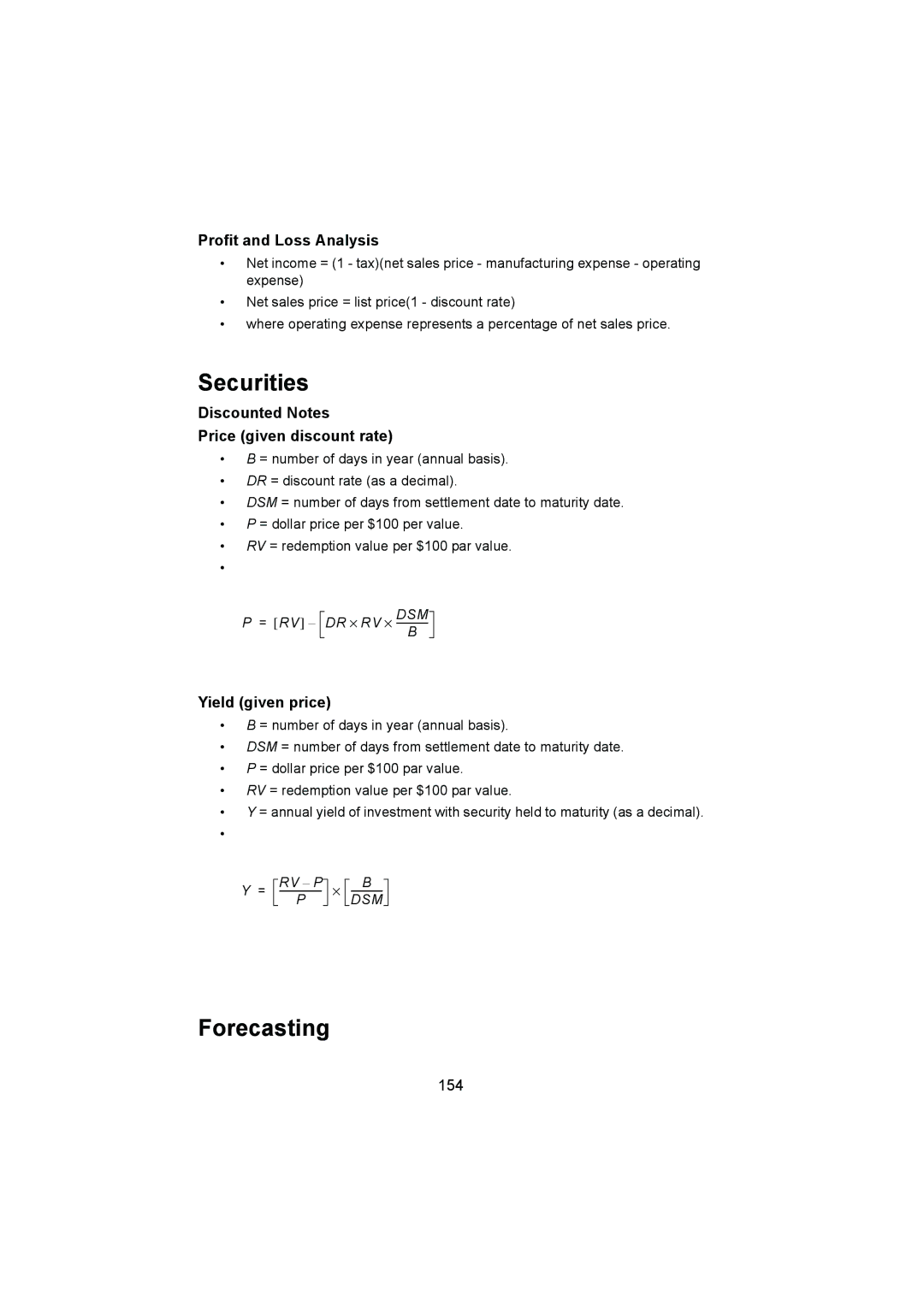

Discounted Notes

Price (given discount rate)

•B = number of days in year (annual basis).

•DR = discount rate (as a decimal).

•DSM = number of days from settlement date to maturity date.

•P = dollar price per $100 per value.

•RV = redemption value per $100 par value.

•

P = [RV] –

⋅ ⋅ DSM DR RV

B

Yield (given price)

•B = number of days in year (annual basis).

•DSM = number of days from settlement date to maturity date.

•P = dollar price per $100 par value.

•RV = redemption value per $100 par value.

•Y = annual yield of investment with security held to maturity (as a decimal).

Y = |

| RV – P |

| ||

|

| P |

⋅

B

DSM

Forecasting

154