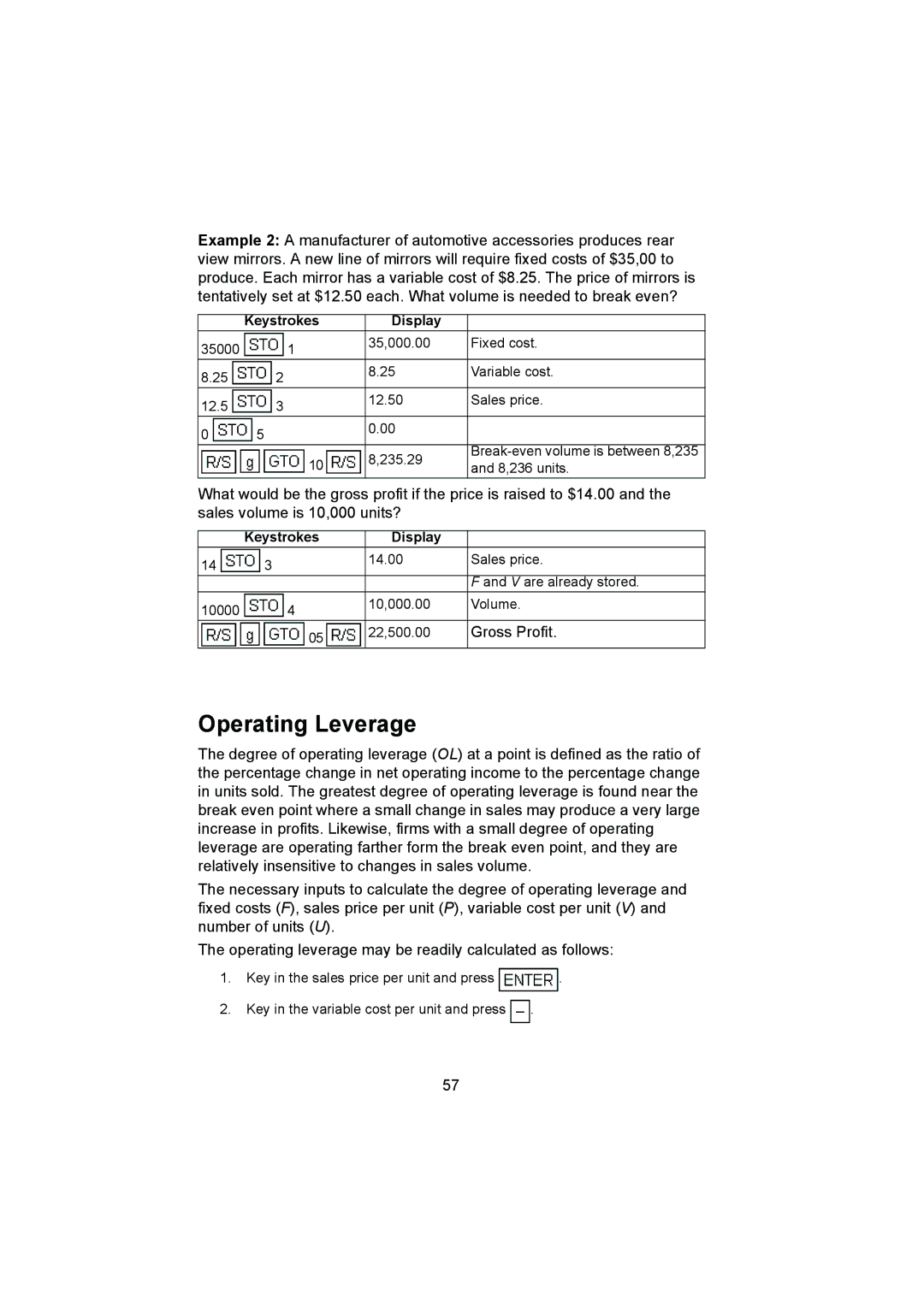

Example 2: A manufacturer of automotive accessories produces rear view mirrors. A new line of mirrors will require fixed costs of $35,00 to produce. Each mirror has a variable cost of $8.25. The price of mirrors is tentatively set at $12.50 each. What volume is needed to break even?

| Keystrokes | Display |

|

35000 | 1 | 35,000.00 | Fixed cost. |

|

| ||

8.25 | 2 | 8.25 | Variable cost. |

|

| ||

12.5 | 3 | 12.50 | Sales price. |

|

| ||

0 | 5 | 0.00 |

|

|

| ||

| 10 | 8,235.29 | |

| and 8,236 units. | ||

|

|

What would be the gross profit if the price is raised to $14.00 and the sales volume is 10,000 units?

| Keystrokes | Display |

|

14 | 3 | 14.00 | Sales price. |

|

|

F and V are already stored.

10000 | 4 | 10,000.00 | Volume. |

|

|

05 | 22,500.00 | Gross Profit. |

|

|

Operating Leverage

The degree of operating leverage (OL) at a point is defined as the ratio of the percentage change in net operating income to the percentage change in units sold. The greatest degree of operating leverage is found near the break even point where a small change in sales may produce a very large increase in profits. Likewise, firms with a small degree of operating leverage are operating farther form the break even point, and they are relatively insensitive to changes in sales volume.

The necessary inputs to calculate the degree of operating leverage and fixed costs (F), sales price per unit (P), variable cost per unit (V) and number of units (U).

The operating leverage may be readily calculated as follows:

1.Key in the sales price per unit and press ![]() .

.

2.Key in the variable cost per unit and press ![]() .

.

57