25 |

|

|

|

|

|

175200 |

| 2 |

|

|

|

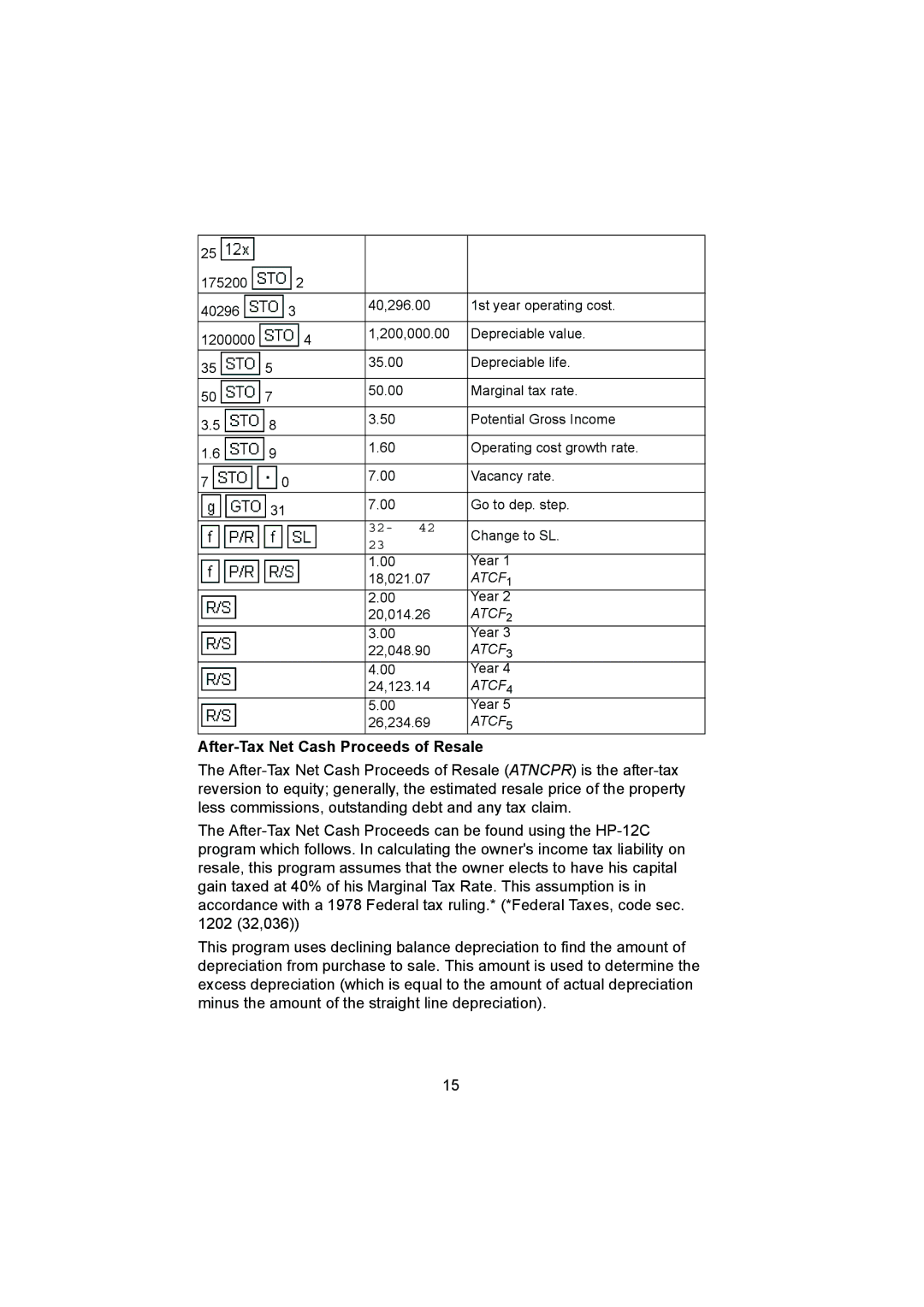

40296 | 3 |

| 40,296.00 | 1st year operating cost. | |

|

|

|

| ||

1200000 |

| 4 | 1,200,000.00 | Depreciable value. | |

|

|

|

| ||

35 | 5 |

| 35.00 |

| Depreciable life. |

|

|

|

| ||

50 | 7 |

| 50.00 |

| Marginal tax rate. |

|

|

|

| ||

3.5 | 8 |

| 3.50 |

| Potential Gross Income |

|

|

|

| ||

1.6 | 9 |

| 1.60 |

| Operating cost growth rate. |

|

|

|

| ||

7 | 0 |

| 7.00 |

| Vacancy rate. |

|

|

|

| ||

| 31 |

| 7.00 |

| Go to dep. step. |

|

|

|

|

| |

|

|

| 32- | 42 | Change to SL. |

|

|

| 23 |

| |

|

|

|

|

| |

|

|

| 1.00 |

| Year 1 |

|

|

| 18,021.07 | ATCF1 | |

|

|

| 2.00 |

| Year 2 |

|

|

| 20,014.26 | ATCF2 | |

|

|

| 3.00 |

| Year 3 |

|

|

| 22,048.90 | ATCF3 | |

|

|

| 4.00 |

| Year 4 |

|

|

| 24,123.14 | ATCF4 | |

|

|

| 5.00 |

| Year 5 |

|

|

| 26,234.69 | ATCF5 | |

After-Tax Net Cash Proceeds of Resale

The

The

This program uses declining balance depreciation to find the amount of depreciation from purchase to sale. This amount is used to determine the excess depreciation (which is equal to the amount of actual depreciation minus the amount of the straight line depreciation).

15