3.211981 |

| 2 | 3.21 | Maturity dtae. |

|

|

| ||

360 | 3 |

| 360.00 | 360 day basis. |

|

|

| ||

100 | 4 |

| 100.00 | Redemption value per $100. |

|

|

| ||

7.8 | 5 |

| 7.80 | Discount rate. |

|

|

| ||

|

|

| 96.45 | Price. |

|

|

|

|

|

|

|

| 8.09 | Yield. |

|

|

|

|

|

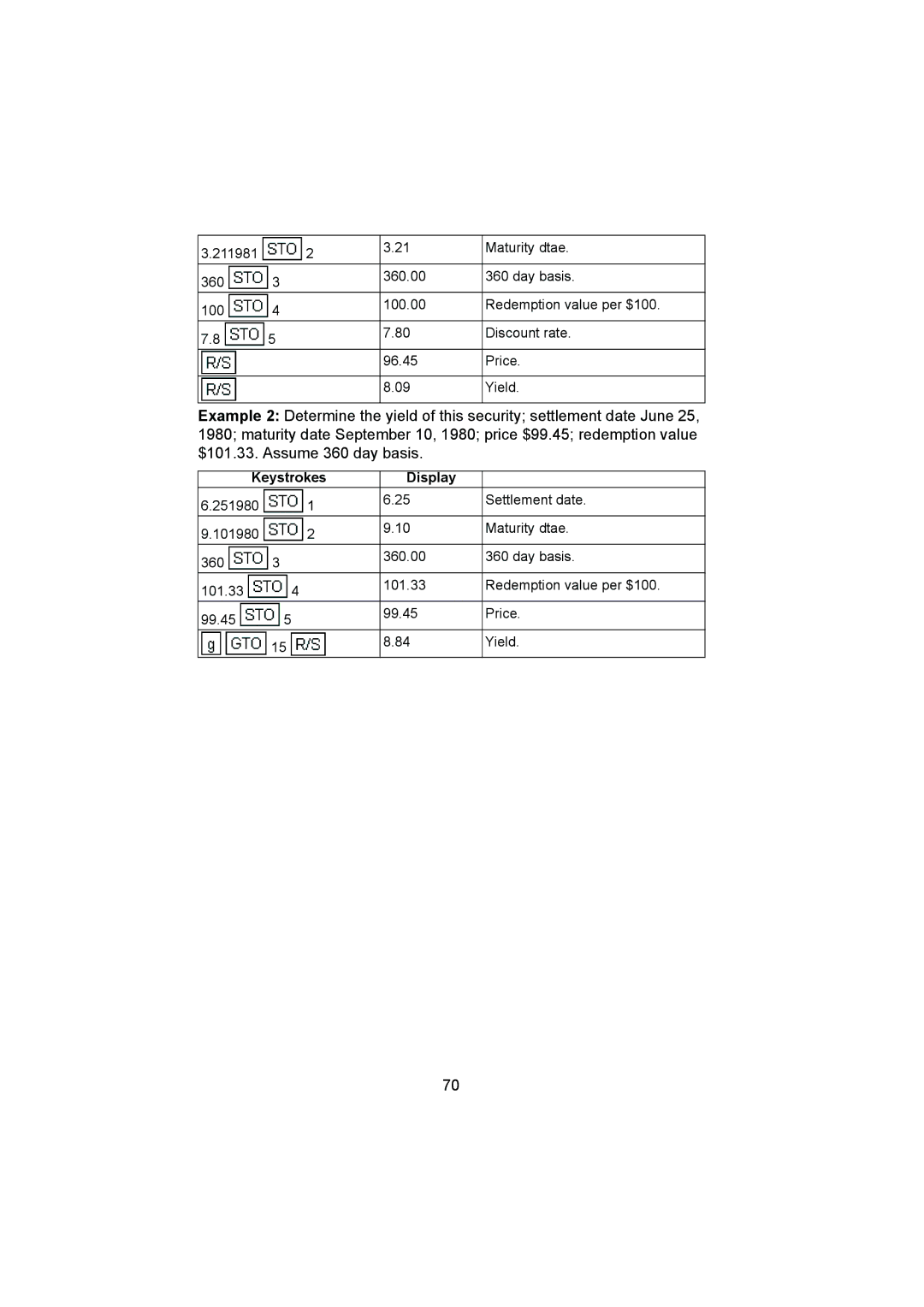

Example 2: Determine the yield of this security; settlement date June 25, 1980; maturity date September 10, 1980; price $99.45; redemption value $101.33. Assume 360 day basis.

Keystrokes | Display |

| |

6.251980 | 1 | 6.25 | Settlement date. |

|

| ||

9.101980 | 2 | 9.10 | Maturity dtae. |

|

| ||

360 | 3 | 360.00 | 360 day basis. |

|

| ||

101.33 | 4 | 101.33 | Redemption value per $100. |

|

| ||

99.45 | 5 | 99.45 | Price. |

|

| ||

| 15 | 8.84 | Yield. |

|

|

| |

70