Tax-Free Individual Retirement (IRA) of Keogh Plan.

The advent of

1.The future cash value of the

2.The total cash paid in.

3.The total dividends paid.

4.The future value of the investment at retirement, assuming that after retirement you withdrew the money at a rate which causes the money to be taxed at 1/2 the rate at which it would otherwise have been taxed during the pay in period.

5.The diminished purchasing power assuming a given annual inflation rate.

6.The future value of a comparable taxable investment.

7.The diminished purchasing power of a comparable taxable investment.

Notes:

•The calculations run from the beginning of the first year to the end of the last year.

•The interest (annual yield), i, should be entered to as many significant fig- ures as possible for maximum accuracy.

•The assumed 10% annual inflation rate may be changed by modifying the program at lines 19 and 20.

•The assumed tax rate used to calculate the after tax value of the

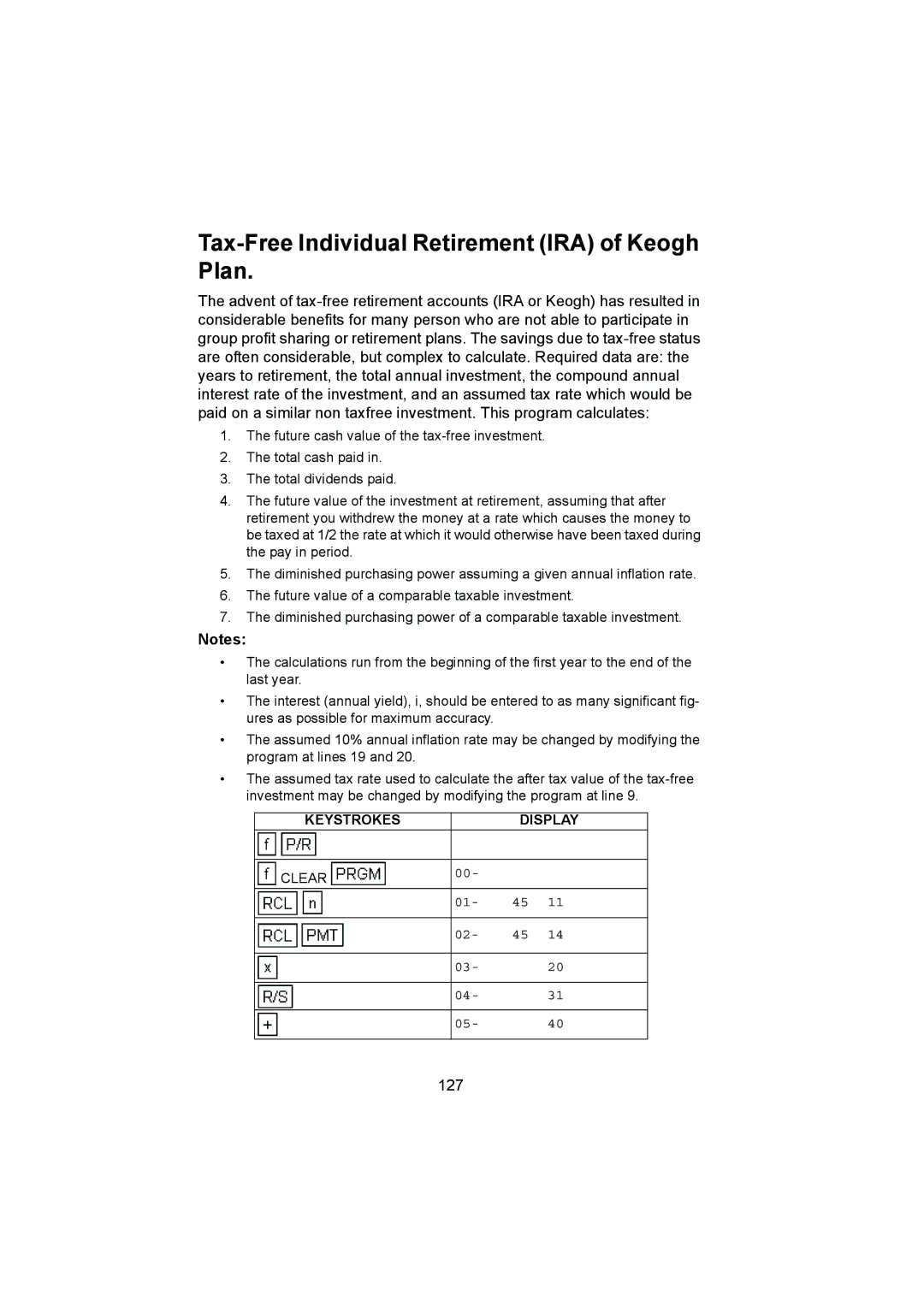

KEYSTROKES |

| DISPLAY | |

|

|

|

|

CLEAR | 00- |

|

|

| 01- | 45 | 11 |

|

|

|

|

| 02- | 45 | 14 |

|

|

|

|

| 03- |

| 20 |

|

|

|

|

| 04- |

| 31 |

|

|

|

|

| 05- |

| 40 |

|

|

|

|