9.5 |

|

|

|

200000 |

| 1,979.56 | Monthly payment on new mortgage. |

|

|

| |

|

|

|

|

0 |

| 899.23 | Net monthly payment (to lender). |

|

|

| |

|

|

|

|

|

| Net amount of cash advanced (by | |

|

| lender). | |

133190 | 0 |

| |

|

| ||

|

|

|

|

11.5 |

| Present value of net | |

|

|

| |

|

|

|

|

0 |

| NPV to lender of net cash advanced | |

|

|

| |

|

|

|

|

0 |

| 14.83 | % nominal yield (IRR). |

|

| ||

12 |

|

|

|

|

|

|

|

15.25 |

| Present value of net monthly | |

| payment at 15.25%. | ||

|

| ||

|

|

|

|

0 |

| 1,433.28 | NPV to borrower. |

|

|

| |

|

|

|

|

Wrap-Around Mortgage

A

When the terms of the original mortgage and the

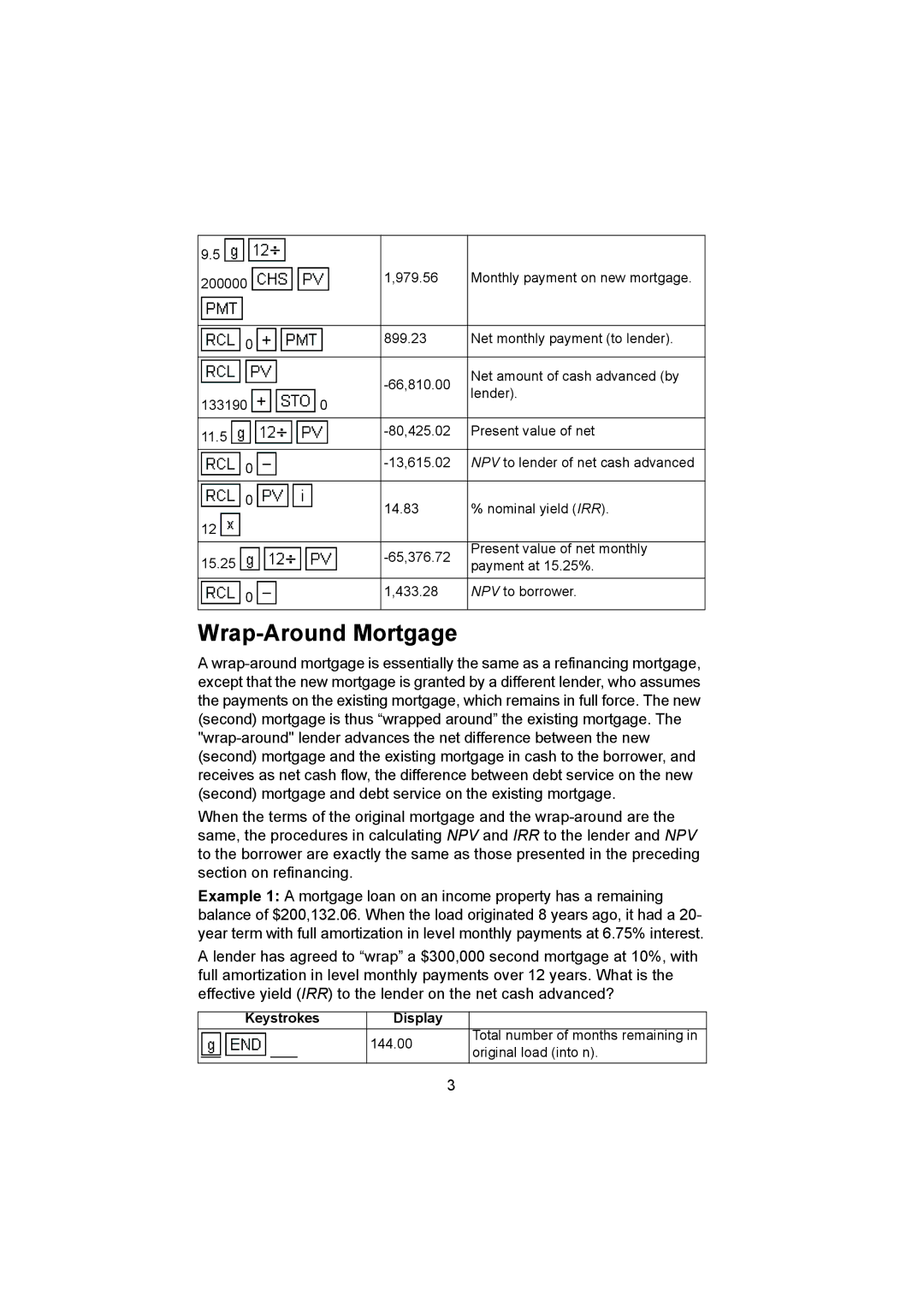

Example 1: A mortgage loan on an income property has a remaining balance of $200,132.06. When the load originated 8 years ago, it had a 20- year term with full amortization in level monthly payments at 6.75% interest.

A lender has agreed to “wrap” a $300,000 second mortgage at 10%, with full amortization in level monthly payments over 12 years. What is the effective yield (IRR) to the lender on the net cash advanced?

Keystrokes Display

144.00Total number of months remaining in original load (into n).

3