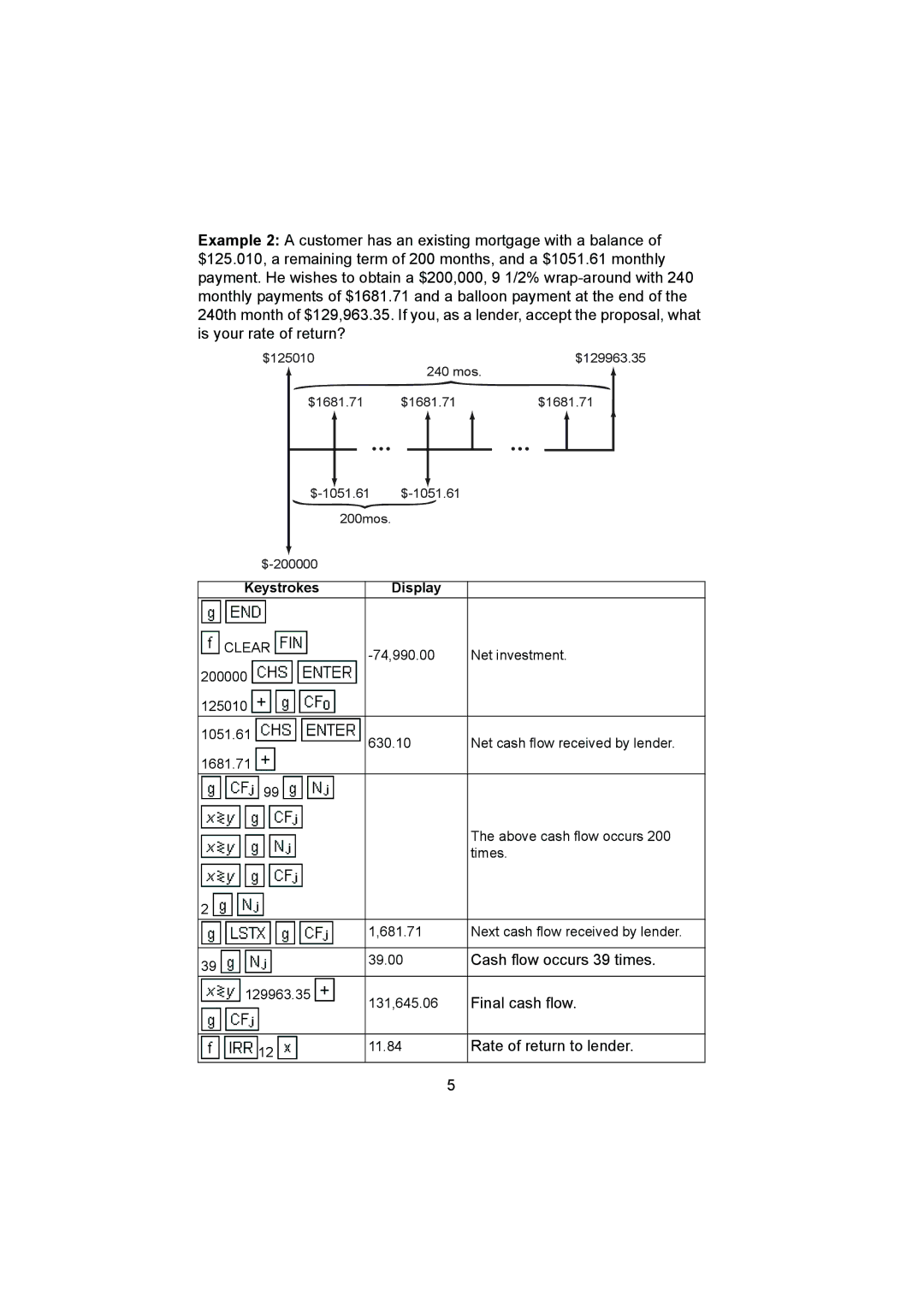

Example 2: A customer has an existing mortgage with a balance of $125.010, a remaining term of 200 months, and a $1051.61 monthly payment. He wishes to obtain a $200,000, 9 1/2%

$125010 | 240 mos. | $129963.35 |

|

| |

$1681.71 | $1681.71 | $1681.71 |

200mos.

Keystrokes Display

CLEAR | Net investment. | |

| ||

200000 |

|

|

125010 |

|

|

1051.61 | 630.10 | Net cash flow received by lender. |

| ||

1681.71 |

|

|

99 |

|

|

|

| The above cash flow occurs 200 |

|

| times. |

2 |

|

|

| 1,681.71 | Next cash flow received by lender. |

|

|

|

39 | 39.00 | Cash flow occurs 39 times. |

|

| |

129963.35 | 131,645.06 | Final cash flow. |

| ||

|

|

|

12 | 11.84 | Rate of return to lender. |

|

|

5