2.Key in the remaining balance of the loan and press ![]() . The remaining balance is the difference between the loan amount and the total principal from the payments which have been made.

. The remaining balance is the difference between the loan amount and the total principal from the payments which have been made.

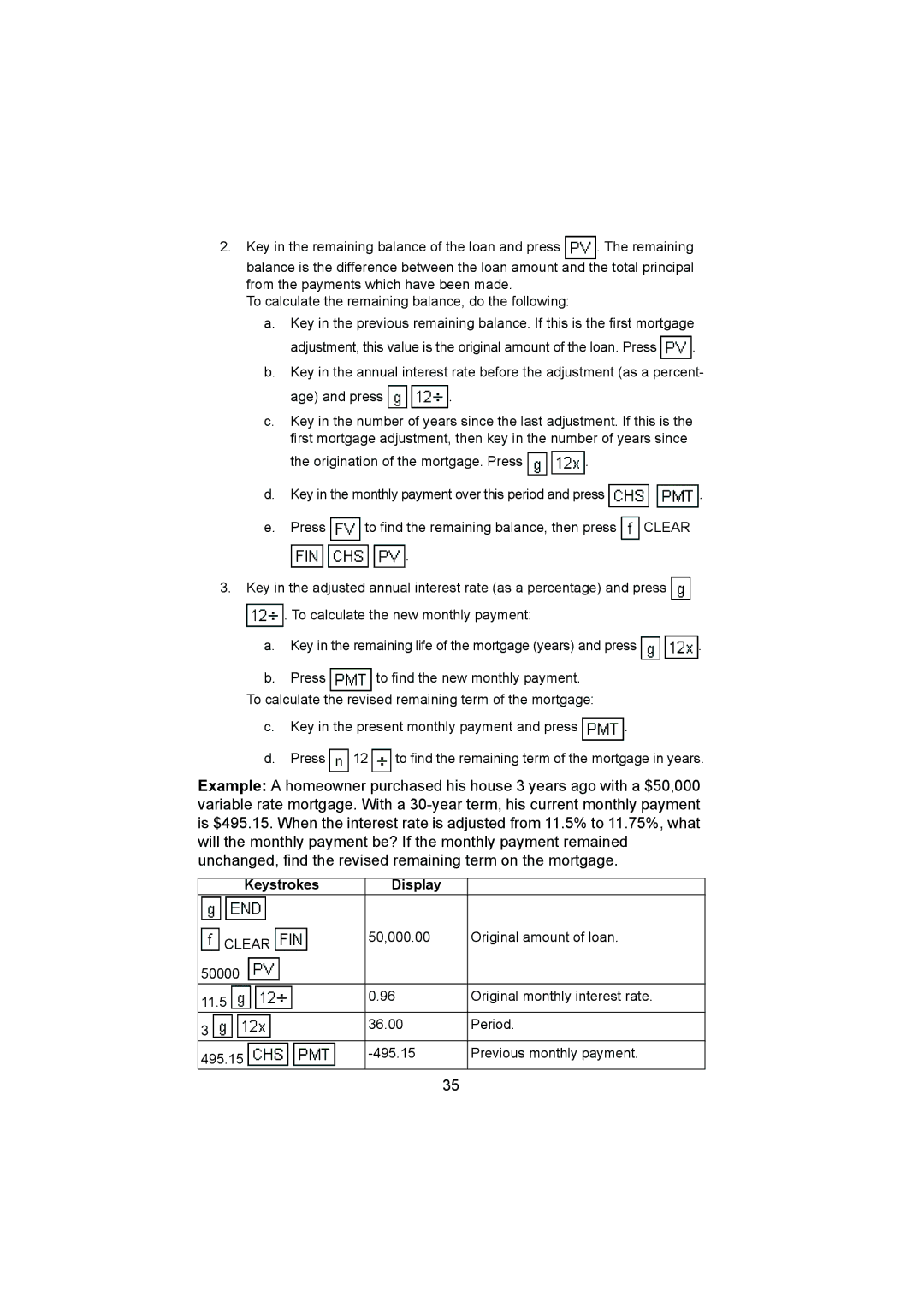

To calculate the remaining balance, do the following:

a.Key in the previous remaining balance. If this is the first mortgage

adjustment, this value is the original amount of the loan. Press ![]() .

.

b.Key in the annual interest rate before the adjustment (as a percent-

age) and press ![]()

![]() .

.

c.Key in the number of years since the last adjustment. If this is the first mortgage adjustment, then key in the number of years since

the origination of the mortgage. Press ![]()

![]() .

.

d.Key in the monthly payment over this period and press ![]()

![]() .

.

e.Press ![]() to find the remaining balance, then press

to find the remaining balance, then press ![]() CLEAR

CLEAR

![]()

![]()

![]() .

.

3.Key in the adjusted annual interest rate (as a percentage) and press ![]()

![]() . To calculate the new monthly payment:

. To calculate the new monthly payment:

a.Key in the remaining life of the mortgage (years) and press ![]()

![]() .

.

b.Press ![]() to find the new monthly payment.

to find the new monthly payment.

To calculate the revised remaining term of the mortgage:

c.Key in the present monthly payment and press ![]() .

.

d.Press ![]() 12

12 ![]() to find the remaining term of the mortgage in years.

to find the remaining term of the mortgage in years.

Example: A homeowner purchased his house 3 years ago with a $50,000 variable rate mortgage. With a

Keystrokes Display

CLEAR | 50,000.00 | Original amount of loan. |

|

| |

50000 |

|

|

11.5 | 0.96 | Original monthly interest rate. |

|

| |

3 | 36.00 | Period. |

|

| |

495.15 | Previous monthly payment. | |

|

|

35