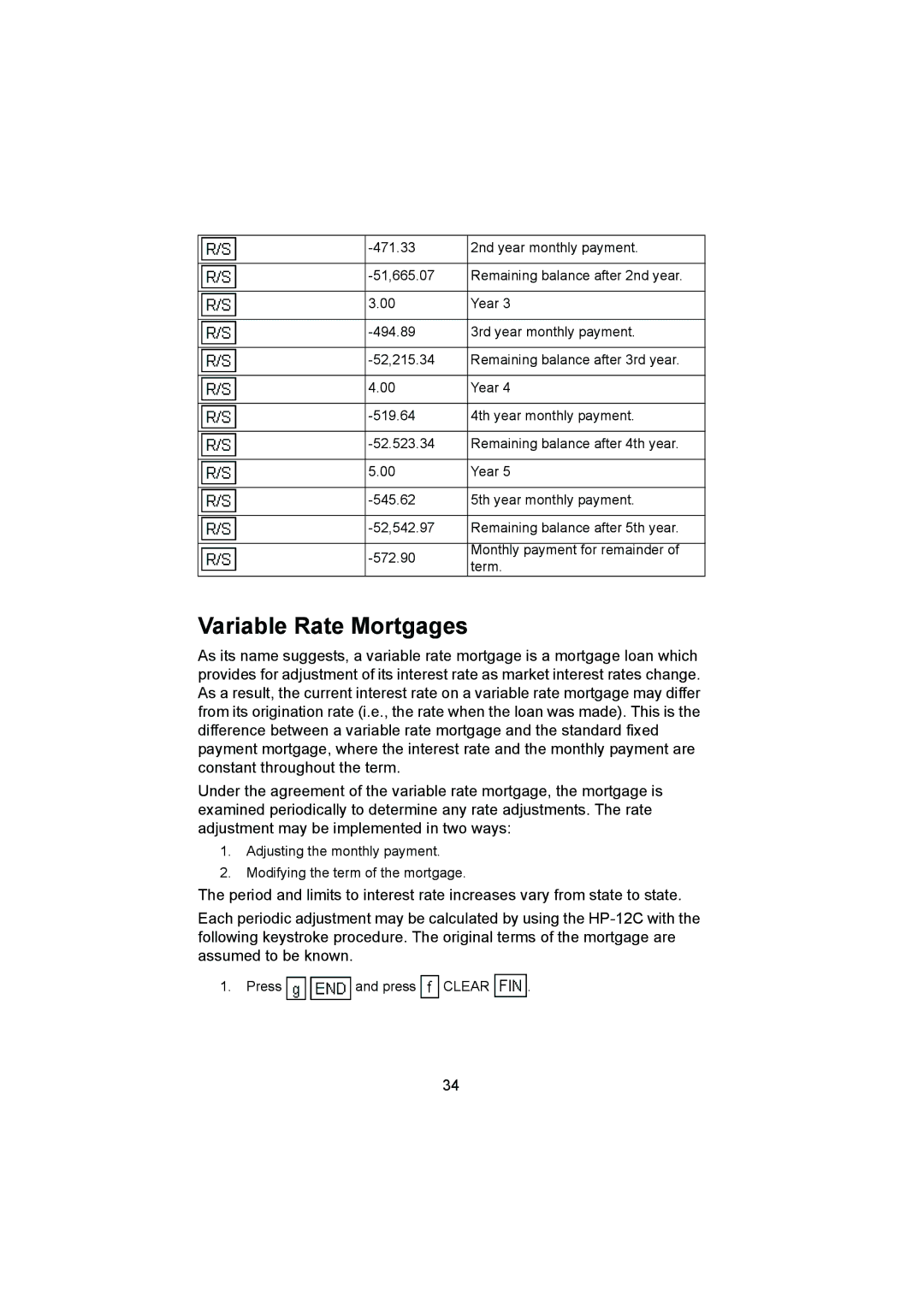

| 2nd year monthly payment. | |

|

|

|

| Remaining balance after 2nd year. | |

|

|

|

| 3.00 | Year 3 |

|

|

|

| 3rd year monthly payment. | |

|

|

|

| Remaining balance after 3rd year. | |

|

|

|

| 4.00 | Year 4 |

|

|

|

| 4th year monthly payment. | |

|

|

|

| Remaining balance after 4th year. | |

|

|

|

| 5.00 | Year 5 |

|

|

|

| 5th year monthly payment. | |

|

|

|

| Remaining balance after 5th year. | |

|

|

|

| Monthly payment for remainder of | |

| term. | |

|

|

Variable Rate Mortgages

As its name suggests, a variable rate mortgage is a mortgage loan which provides for adjustment of its interest rate as market interest rates change. As a result, the current interest rate on a variable rate mortgage may differ from its origination rate (i.e., the rate when the loan was made). This is the difference between a variable rate mortgage and the standard fixed payment mortgage, where the interest rate and the monthly payment are constant throughout the term.

Under the agreement of the variable rate mortgage, the mortgage is examined periodically to determine any rate adjustments. The rate adjustment may be implemented in two ways:

1.Adjusting the monthly payment.

2.Modifying the term of the mortgage.

The period and limits to interest rate increases vary from state to state.

Each periodic adjustment may be calculated by using the

1.Press ![]()

![]() and press

and press ![]() CLEAR

CLEAR ![]() .

.

34