|

|

|

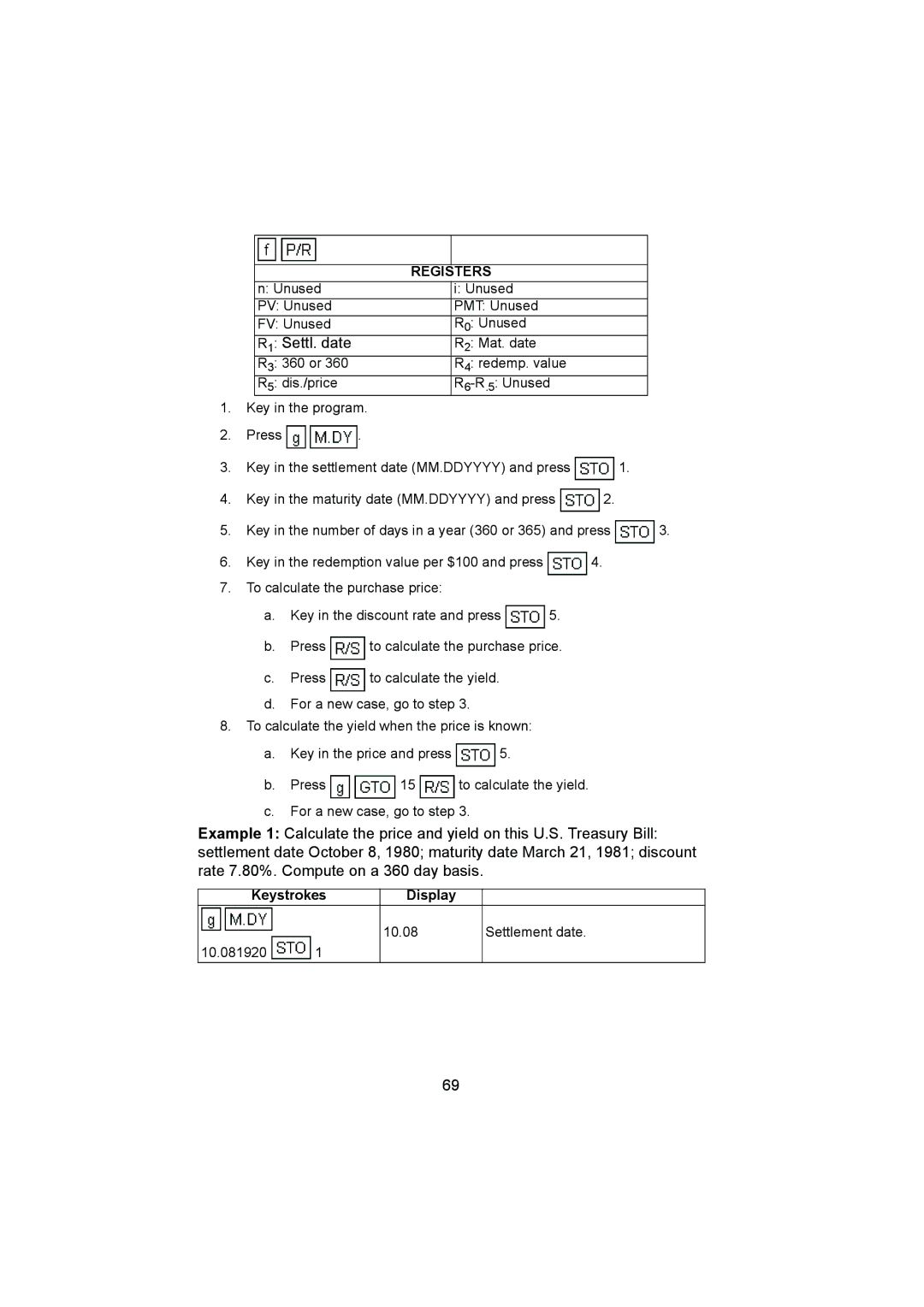

| REGISTERS | |

n: Unused |

| i: Unused |

PV: Unused |

| PMT: Unused |

FV: Unused |

| R0: Unused |

R1: Settl. date |

| R2: Mat. date |

R3: 360 or 360 |

| R4: redemp. value |

R5: dis./price |

| |

1.Key in the program.

2.Press ![]()

![]() .

.

3.Key in the settlement date (MM.DDYYYY) and press ![]() 1.

1.

4.Key in the maturity date (MM.DDYYYY) and press ![]() 2.

2.

5.Key in the number of days in a year (360 or 365) and press ![]() 3.

3.

6.Key in the redemption value per $100 and press ![]() 4.

4.

7.To calculate the purchase price:

a.Key in the discount rate and press ![]() 5.

5.

b.Press ![]() to calculate the purchase price.

to calculate the purchase price.

c.Press ![]() to calculate the yield.

to calculate the yield.

d.For a new case, go to step 3.

8.To calculate the yield when the price is known:

a.Key in the price and press ![]() 5.

5.

b.Press ![]()

![]() 15

15 ![]() to calculate the yield.

to calculate the yield.

c.For a new case, go to step 3.

Example 1: Calculate the price and yield on this U.S. Treasury Bill: settlement date October 8, 1980; maturity date March 21, 1981; discount rate 7.80%. Compute on a 360 day basis.

Keystrokes Display

| 10.08 | Settlement date. |

10.081920 | 1 |

|

69