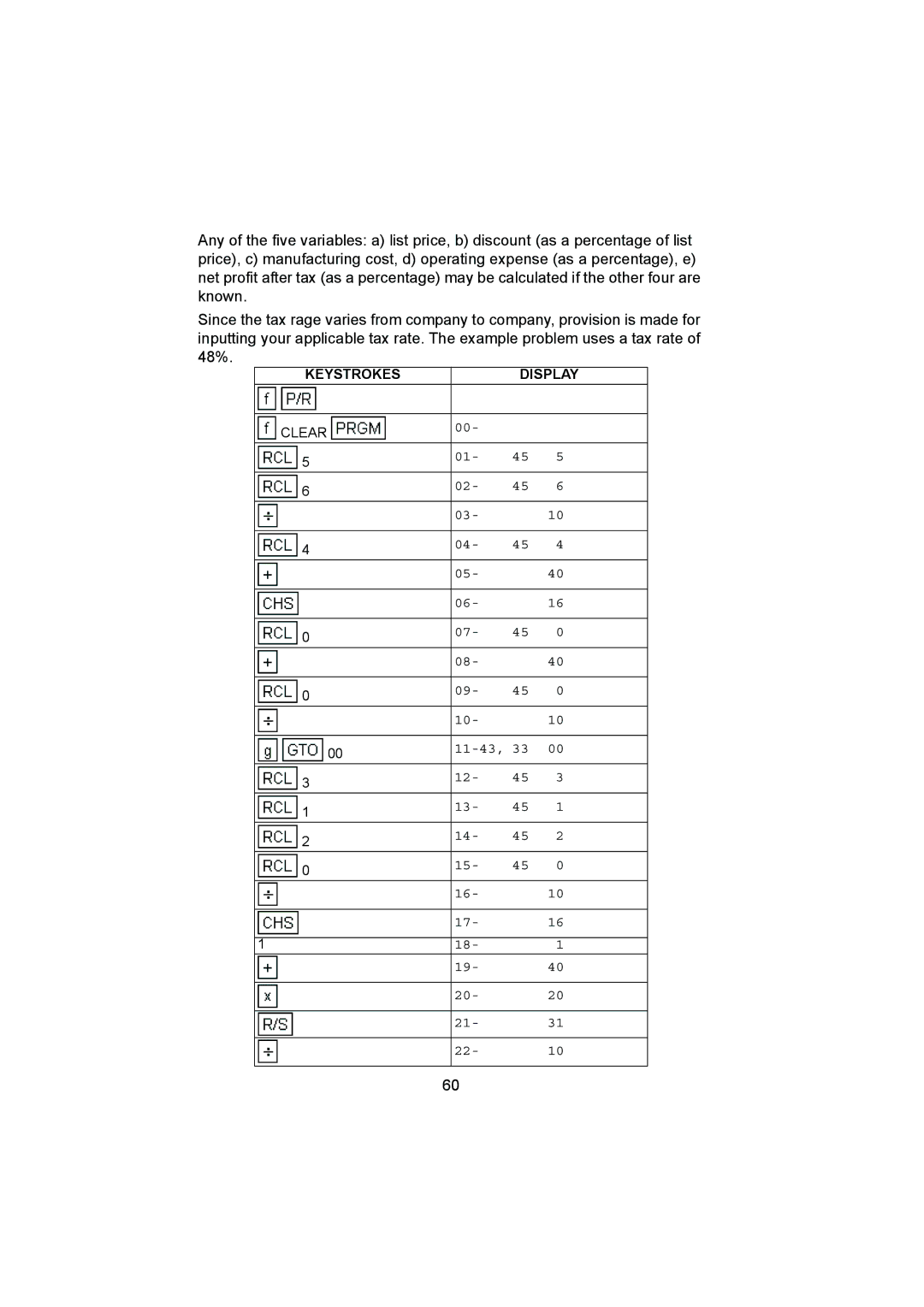

Any of the five variables: a) list price, b) discount (as a percentage of list price), c) manufacturing cost, d) operating expense (as a percentage), e) net profit after tax (as a percentage) may be calculated if the other four are known.

Since the tax rage varies from company to company, provision is made for inputting your applicable tax rate. The example problem uses a tax rate of 48%.

KEYSTROKES |

| DISPLAY | |

|

|

|

|

CLEAR | 00- |

|

|

5 | 01- | 45 | 5 |

6 | 02- | 45 | 6 |

| 03- |

| 10 |

|

|

|

|

4 | 04- | 45 | 4 |

| 05- |

| 40 |

|

|

|

|

| 06- |

| 16 |

|

|

|

|

0 | 07- | 45 | 0 |

| 08- |

| 40 |

|

|

|

|

0 | 09- | 45 | 0 |

| 10- |

| 10 |

|

|

| |

00 |

| 00 | |

3 | 12- | 45 | 3 |

1 | 13- | 45 | 1 |

2 | 14- | 45 | 2 |

0 | 15- | 45 | 0 |

| 16- |

| 10 |

|

|

|

|

| 17- |

| 16 |

|

|

|

|

1 | 18- |

| 1 |

| 19- |

| 40 |

|

|

|

|

| 20- |

| 20 |

|

|

|

|

| 21- |

| 31 |

|

|

|

|

| 22- |

| 10 |

|

|

|

|

60