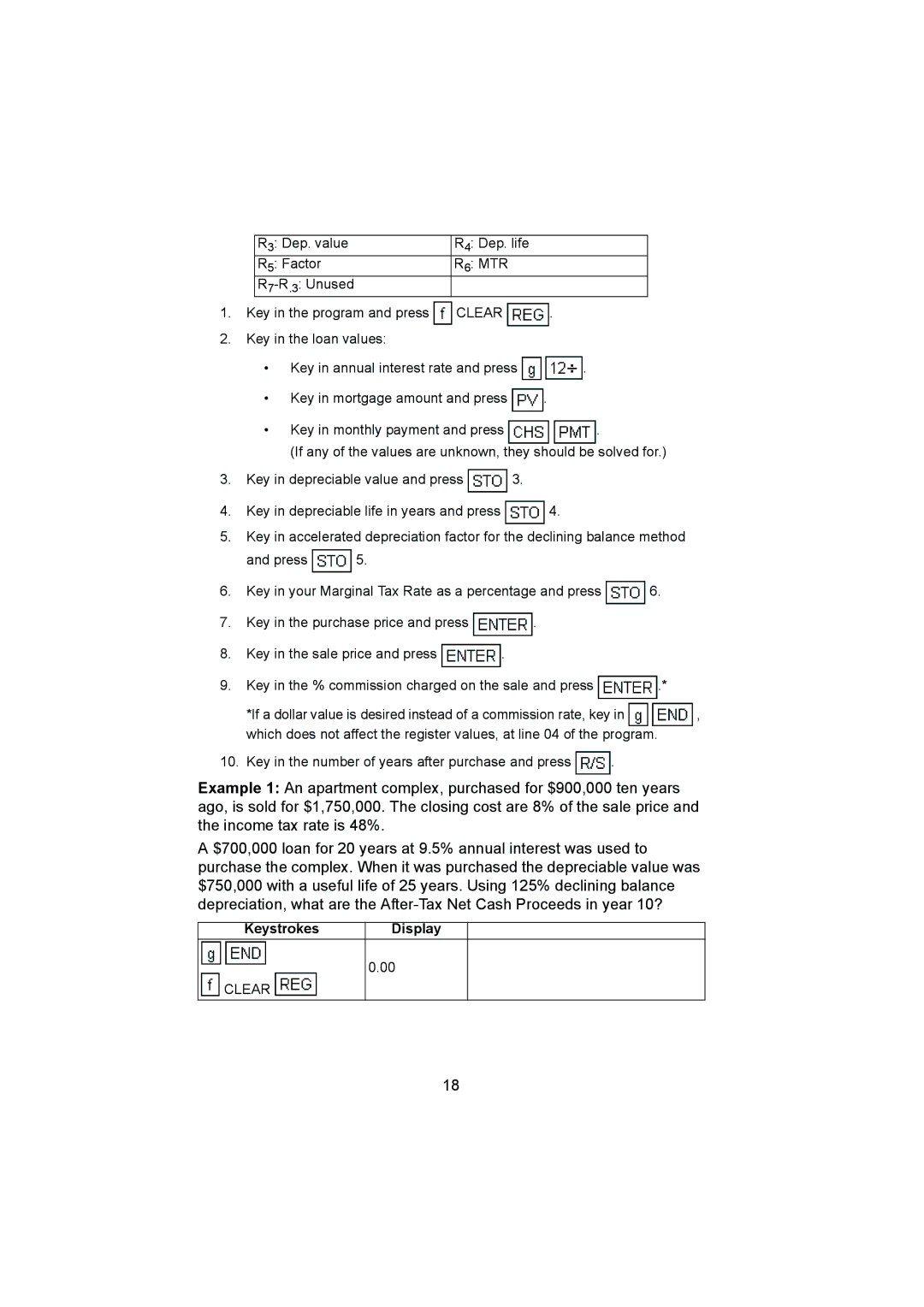

R3: Dep. value | R4: Dep. life |

R5: Factor | R6: MTR |

|

1.Key in the program and press ![]() CLEAR

CLEAR ![]() .

.

2.Key in the loan values:

•Key in annual interest rate and press ![]()

![]() .

.

•Key in mortgage amount and press ![]() .

.

•Key in monthly payment and press ![]()

![]() .

.

(If any of the values are unknown, they should be solved for.)

3.Key in depreciable value and press ![]() 3.

3.

4.Key in depreciable life in years and press ![]() 4.

4.

5.Key in accelerated depreciation factor for the declining balance method

and press ![]() 5.

5.

6.Key in your Marginal Tax Rate as a percentage and press ![]() 6.

6.

7.Key in the purchase price and press ![]() .

.

8.Key in the sale price and press ![]() .

.

9.Key in the % commission charged on the sale and press ![]() .*

.*

*If a dollar value is desired instead of a commission rate, key in ![]()

![]() , which does not affect the register values, at line 04 of the program.

, which does not affect the register values, at line 04 of the program.

10.Key in the number of years after purchase and press  .

.

Example 1: An apartment complex, purchased for $900,000 ten years ago, is sold for $1,750,000. The closing cost are 8% of the sale price and the income tax rate is 48%.

A $700,000 loan for 20 years at 9.5% annual interest was used to purchase the complex. When it was purchased the depreciable value was $750,000 with a useful life of 25 years. Using 125% declining balance depreciation, what are the

Keystrokes Display

CLEAR

CLEAR

0.00

18