Securities

After-Tax Yield

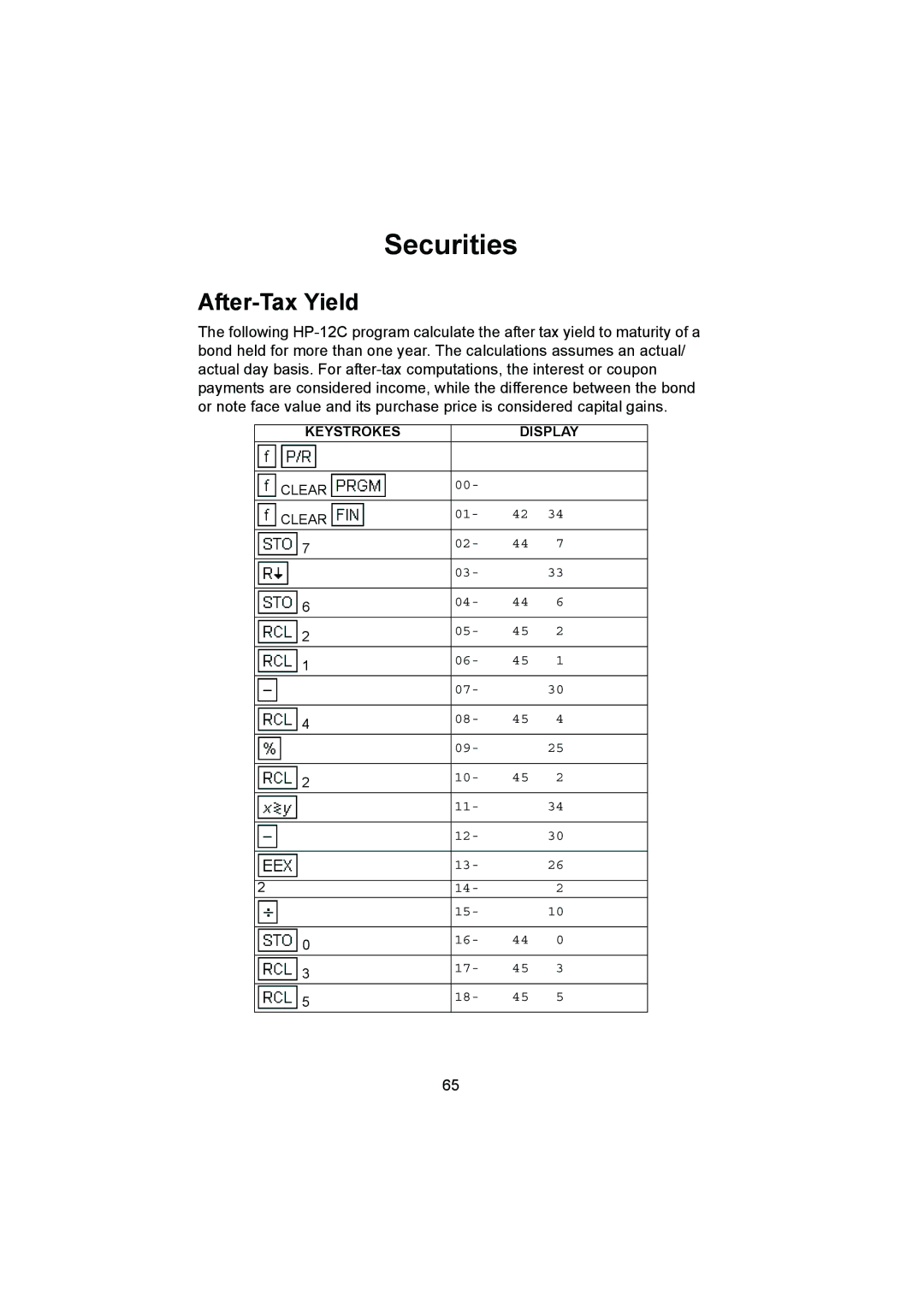

The following HP-12C program calculate the after tax yield to maturity of a bond held for more than one year. The calculations assumes an actual/ actual day basis. For after-tax computations, the interest or coupon payments are considered income, while the difference between the bond or note face value and its purchase price is considered capital gains.

KEYSTROKES | | DISPLAY |

| | | |

CLEAR | 00- | | |

CLEAR | 01- | 42 | 34 |

7 | 02- | 44 | 7 |

| 03- | | 33 |

| | | |

6 | 04- | 44 | 6 |

2 | 05- | 45 | 2 |

1 | 06- | 45 | 1 |

| 07- | | 30 |

| | | |

4 | 08- | 45 | 4 |

| 09- | | 25 |

| | | |

2 | 10- | 45 | 2 |

| 11- | | 34 |

| | | |

| 12- | | 30 |

| | | |

| 13- | | 26 |

| | | |

2 | 14- | | 2 |

| 15- | | 10 |

| | | |

0 | 16- | 44 | 0 |

3 | 17- | 45 | 3 |

5 | 18- | 45 | 5 |