• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| - |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| - |

| | |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| 1 |

| | |

|

|

| |

|

|

| |

|

|

| | (1 + C) | B |

| (1 + I) |

| | ||

|

|

| | - |

|

|

|

|

|

| (n – AB) |

| | ||||||

|

|

| |

| |

|

|

| |

|

|

|

|

| | ||||

|

|

| | 1 |

| |

| B | |

|

|

|

| I |

|

| | ||

|

|

| |

| - | |

| |

|

|

|

|

|

|

| | |||

PV = | PMT | 1 | |

| (1 + I) |

| |

| (1 + Q) - | | + |

| | ||||||

|

|

|

| ||||||||||||||||

|

| |

| A |

| | 1 |

| | ( | 1 + | I | )AB |

|

| | |||

|

|

| |

| |

| |

|

|

|

| | |||||||

|

|

| |

| I |

| |

| Q | |

|

|

|

|

|

|

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

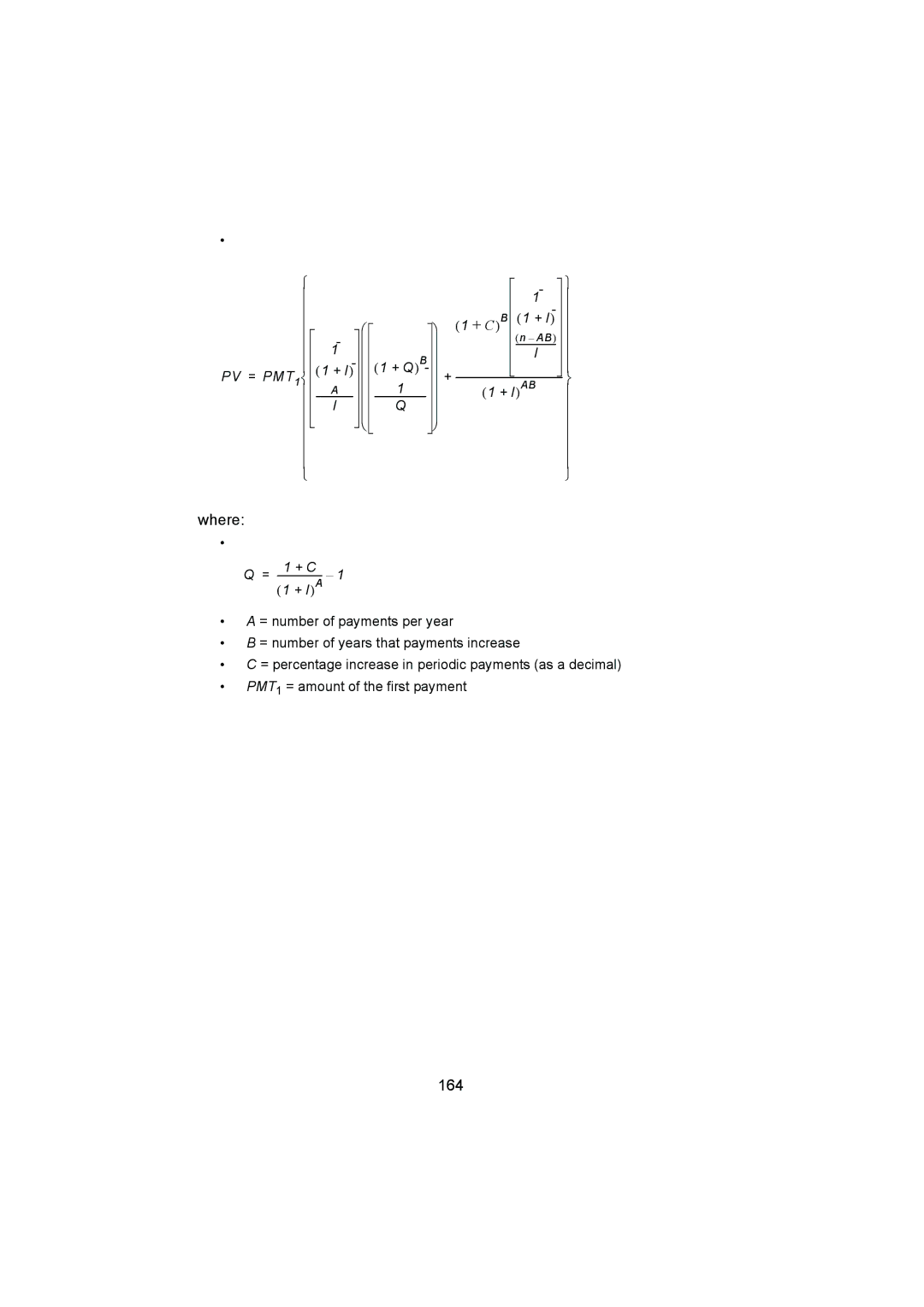

where:

•

1 + C

Q=

•A = number of payments per year

•B = number of years that payments increase

•C = percentage increase in periodic payments (as a decimal)

•PMT1 = amount of the first payment