|

| 2 |

| 200 |

|

| 1700 |

| 1000 |

|

|

|

| 3 |

| 200 |

|

| 1700 |

|

|

|

|

|

| 4 |

| 200 |

|

| 1700 |

|

|

|

|

|

| 5 |

| 1500 |

|

| 1700 |

|

|

|

|

|

| 6 |

| 300 |

|

| 1700 |

|

|

|

|

|

| 7 |

| 300 |

|

| 1700 |

|

|

|

|

|

| 8 |

| 300 |

|

| 1700 |

|

|

|

|

|

| 9 |

| 300 |

|

| 0 |

|

| 750 |

|

|

| 10 |

| 300 |

|

| 0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |||

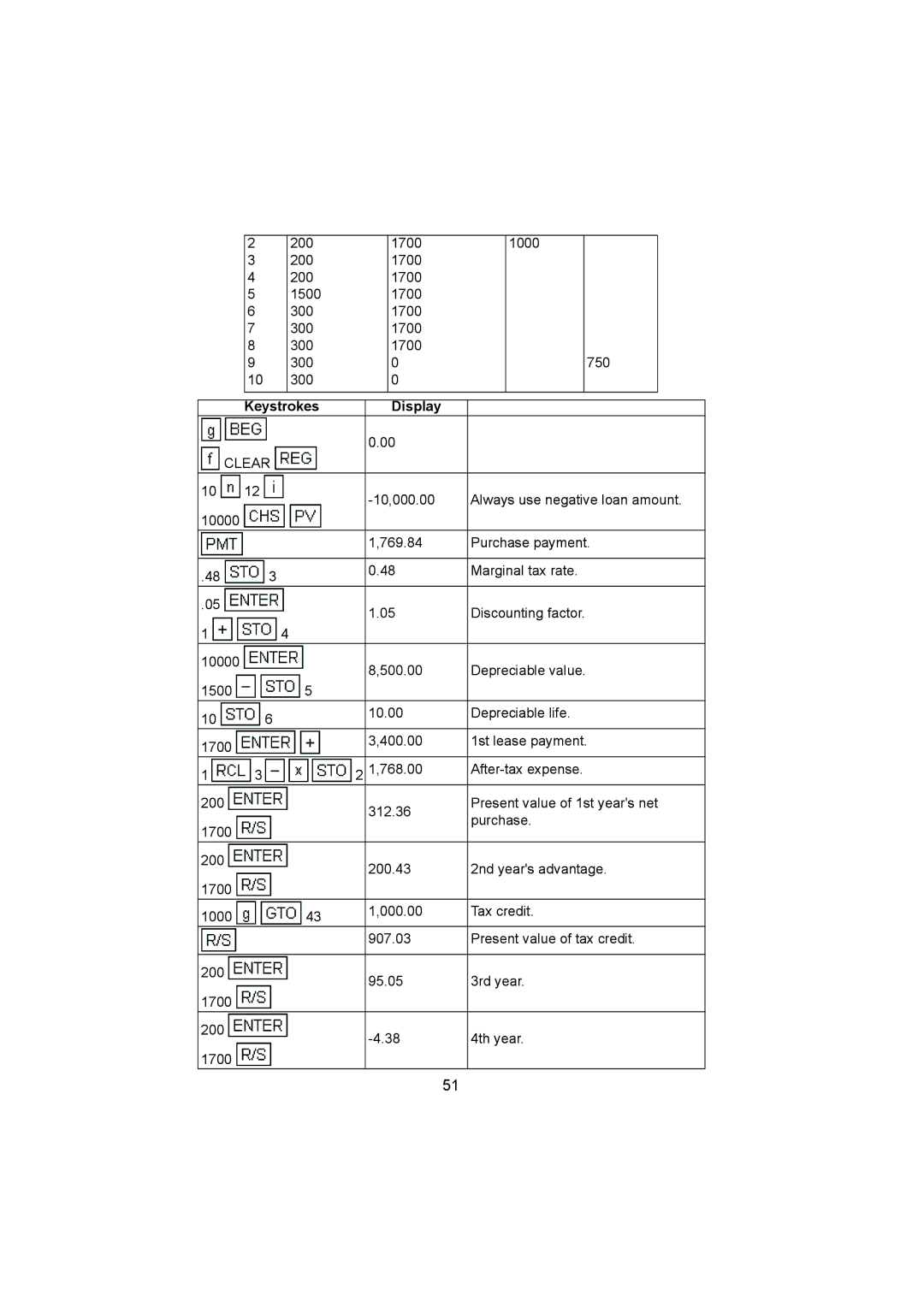

| Keystrokes |

|

| Display |

|

|

|

| |||

|

|

|

|

|

| 0.00 |

|

|

|

| |

CLEAR |

|

|

|

|

|

|

| ||||

10 | 12 |

|

|

| Always use negative loan amount. | ||||||

|

|

|

|

|

| ||||||

10000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1,769.84 | Purchase payment. | ||||

|

|

|

|

|

|

|

| ||||

.48 |

|

| 3 |

|

| 0.48 | Marginal tax rate. | ||||

|

|

|

|

|

|

|

|

|

| ||

.05 |

|

|

|

|

| 1.05 | Discounting factor. | ||||

|

|

|

|

|

| ||||||

1 |

|

| 4 |

|

|

|

|

|

|

| |

10000 |

|

|

|

|

| 8,500.00 | Depreciable value. | ||||

|

|

|

|

|

| ||||||

1500 |

|

| 5 |

|

|

|

|

|

|

| |

10 |

|

| 6 |

|

| 10.00 | Depreciable life. | ||||

|

|

|

|

|

|

|

|

|

| ||

1700 |

|

|

|

|

| 3,400.00 | 1st lease payment. | ||||

|

|

|

|

|

|

|

|

|

|

| |

1 | 3 |

|

| 2 | 1,768.00 | ||||||

200 |

|

|

|

|

| 312.36 | Present value of 1st year's net | ||||

|

|

|

|

|

| purchase. | |||||

1700 |

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

| |

200 |

|

|

|

|

| 200.43 | 2nd year's advantage. | ||||

|

|

|

|

|

| ||||||

1700 |

|

|

|

|

|

|

|

|

|

|

|

1000 |

|

| 43 |

| 1,000.00 | Tax credit. | |||||

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

| 907.03 | Present value of tax credit. | ||||

|

|

|

|

|

|

|

|

|

|

|

|

200 |

|

|

|

|

| 95.05 | 3rd year. | ||||

|

|

|

|

|

| ||||||

1700 |

|

|

|

|

|

|

|

|

|

|

|

200 |

|

|

|

|

| 4th year. | |||||

|

|

|

|

|

| ||||||

1700 |

|

|

|

|

|

|

|

|

|

|

|

51