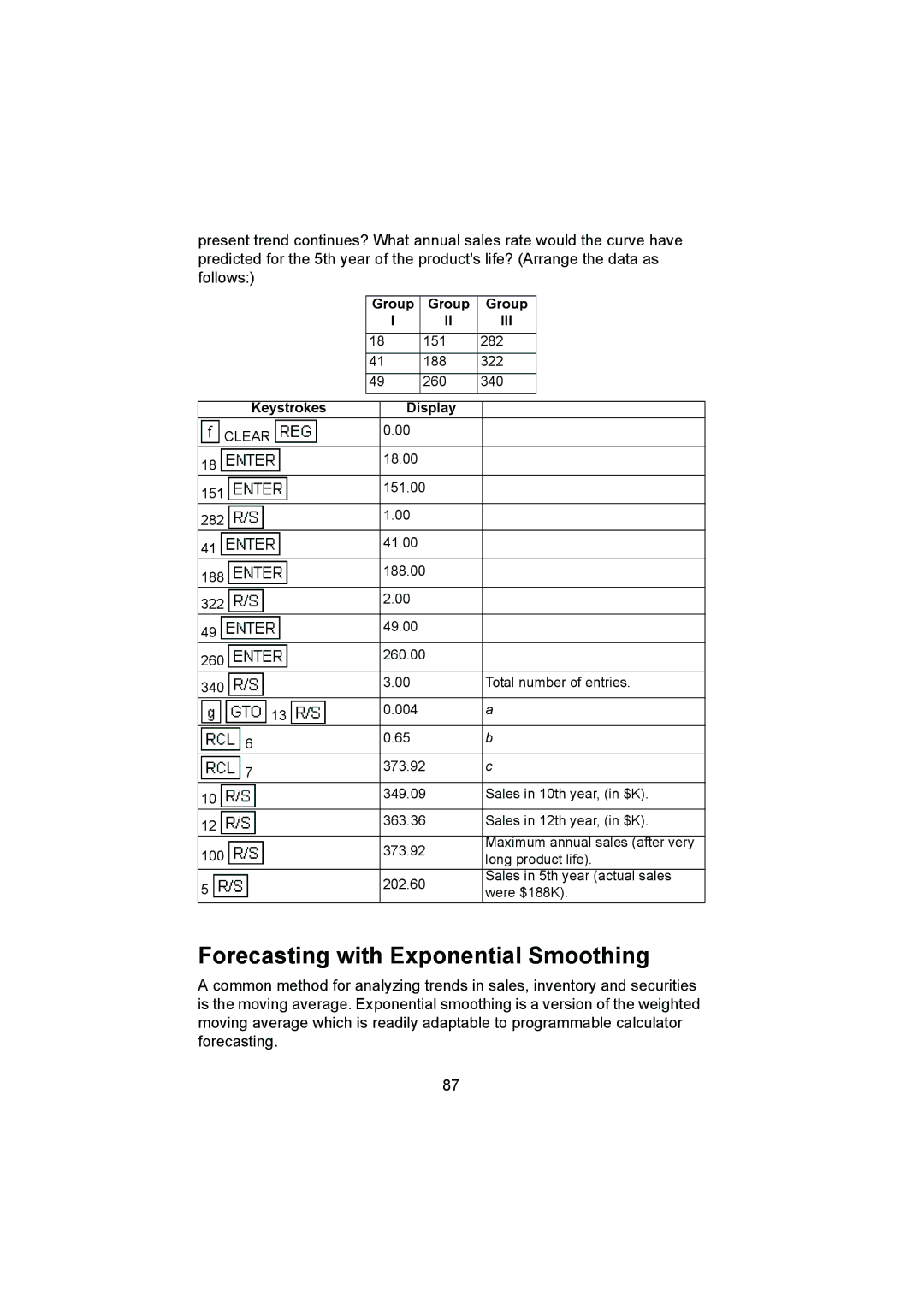

present trend continues? What annual sales rate would the curve have predicted for the 5th year of the product's life? (Arrange the data as follows:)

Group | Group | Group |

I | II | III |

18 | 151 | 282 |

41 | 188 | 322 |

49 | 260 | 340 |

Keystrokes | Display |

| |

CLEAR | 0.00 |

| |

|

| ||

18 | 18.00 |

| |

|

| ||

151 | 151.00 |

| |

|

| ||

282 | 1.00 |

| |

|

| ||

41 | 41.00 |

| |

|

| ||

188 | 188.00 |

| |

|

| ||

322 | 2.00 |

| |

|

| ||

49 | 49.00 |

| |

|

| ||

260 | 260.00 |

| |

|

| ||

340 | 3.00 | Total number of entries. | |

|

| ||

13 | 0.004 | a | |

|

| ||

6 | 0.65 | b | |

|

| ||

7 | 373.92 | c | |

|

| ||

10 | 349.09 | Sales in 10th year, (in $K). | |

|

| ||

12 | 363.36 | Sales in 12th year, (in $K). | |

|

| ||

100 | 373.92 | Maximum annual sales (after very | |

long product life). | |||

| |||

5 | 202.60 | Sales in 5th year (actual sales | |

were $188K). | |||

|

Forecasting with Exponential Smoothing

A common method for analyzing trends in sales, inventory and securities is the moving average. Exponential smoothing is a version of the weighted moving average which is readily adaptable to programmable calculator forecasting.

87