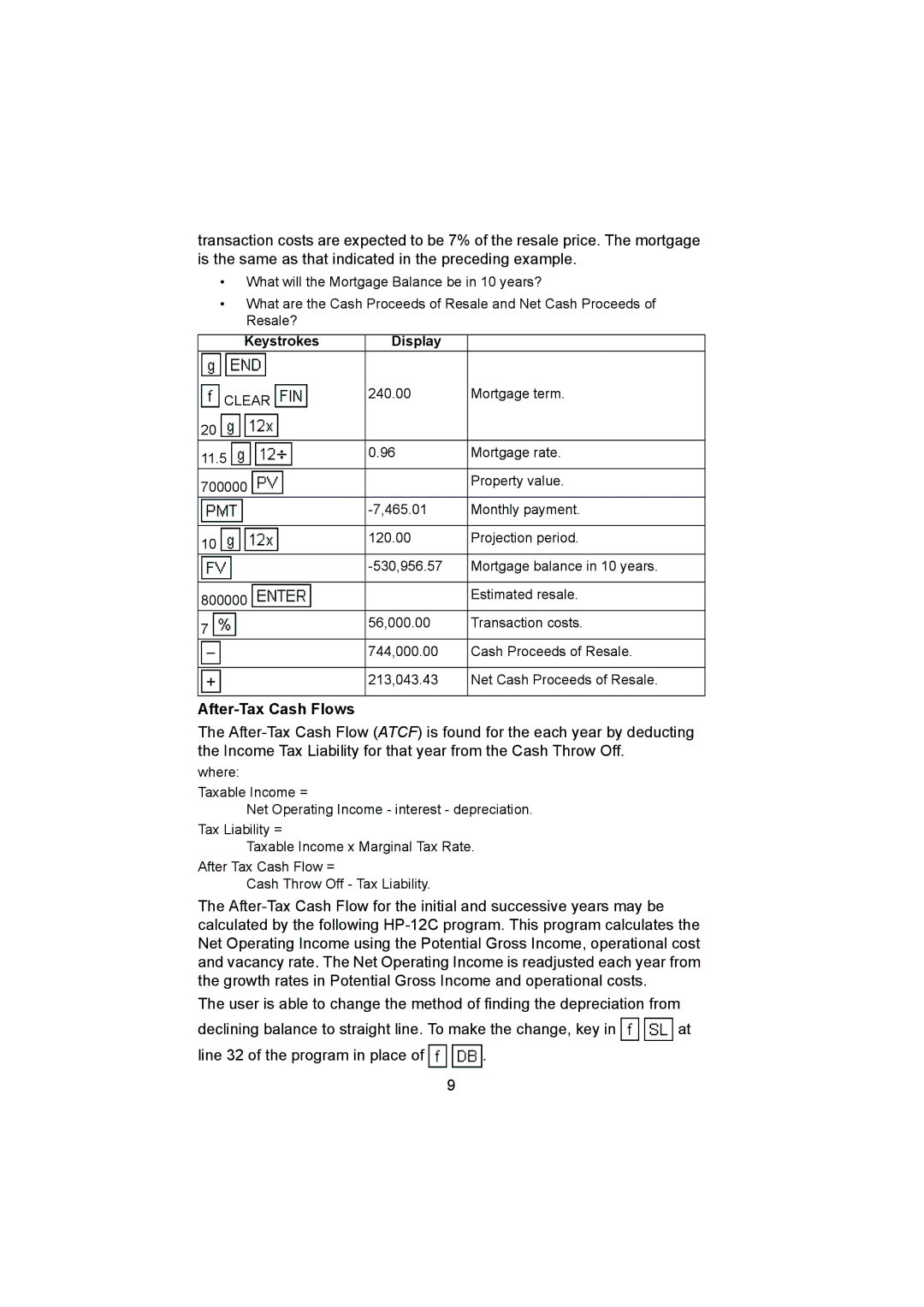

transaction costs are expected to be 7% of the resale price. The mortgage is the same as that indicated in the preceding example.

•What will the Mortgage Balance be in 10 years?

•What are the Cash Proceeds of Resale and Net Cash Proceeds of Resale?

Keystrokes Display

CLEAR | 240.00 | Mortgage term. |

|

| |

20 |

|

|

11.5 | 0.96 | Mortgage rate. |

|

| |

700000 |

| Property value. |

|

| |

| Monthly payment. | |

|

|

|

10 | 120.00 | Projection period. |

|

| |

| Mortgage balance in 10 years. | |

|

|

|

800000 |

| Estimated resale. |

|

| |

7 | 56,000.00 | Transaction costs. |

|

| |

| 744,000.00 | Cash Proceeds of Resale. |

|

|

|

| 213,043.43 | Net Cash Proceeds of Resale. |

After-Tax Cash Flows

The

where:

Taxable Income =

Net Operating Income - interest - depreciation.

Tax Liability =

Taxable Income x Marginal Tax Rate.

After Tax Cash Flow =

Cash Throw Off - Tax Liability.

The

The user is able to change the method of finding the depreciation from

declining balance to straight line. To make the change, key in ![]()

![]() at

at

line 32 of the program in place of ![]()

![]() .

.

9