Real Estate

Refinancing

It can be mutually advantageous to both borrower and lender to refinance an existing mortgage which has an interest rate substantially below the current market rate, with a loan at a

To find the benefits to both borrower and lender:

1.Calculate the monthly payment on the existing mortgage.

2.Calculate the monthly payment on the new mortgage.

3.Calculate the net monthly payment received by the lender (and paid by the borrower) by adding the figure found in Step 1 to the figure found in Step 2.

4.Calculate the Net Present Value (NPV) to the lender of the net cash advanced.

5.Calculate the yield to the lender as an IRR.

6.Calculate the NPV to the borrower of the net cash received.

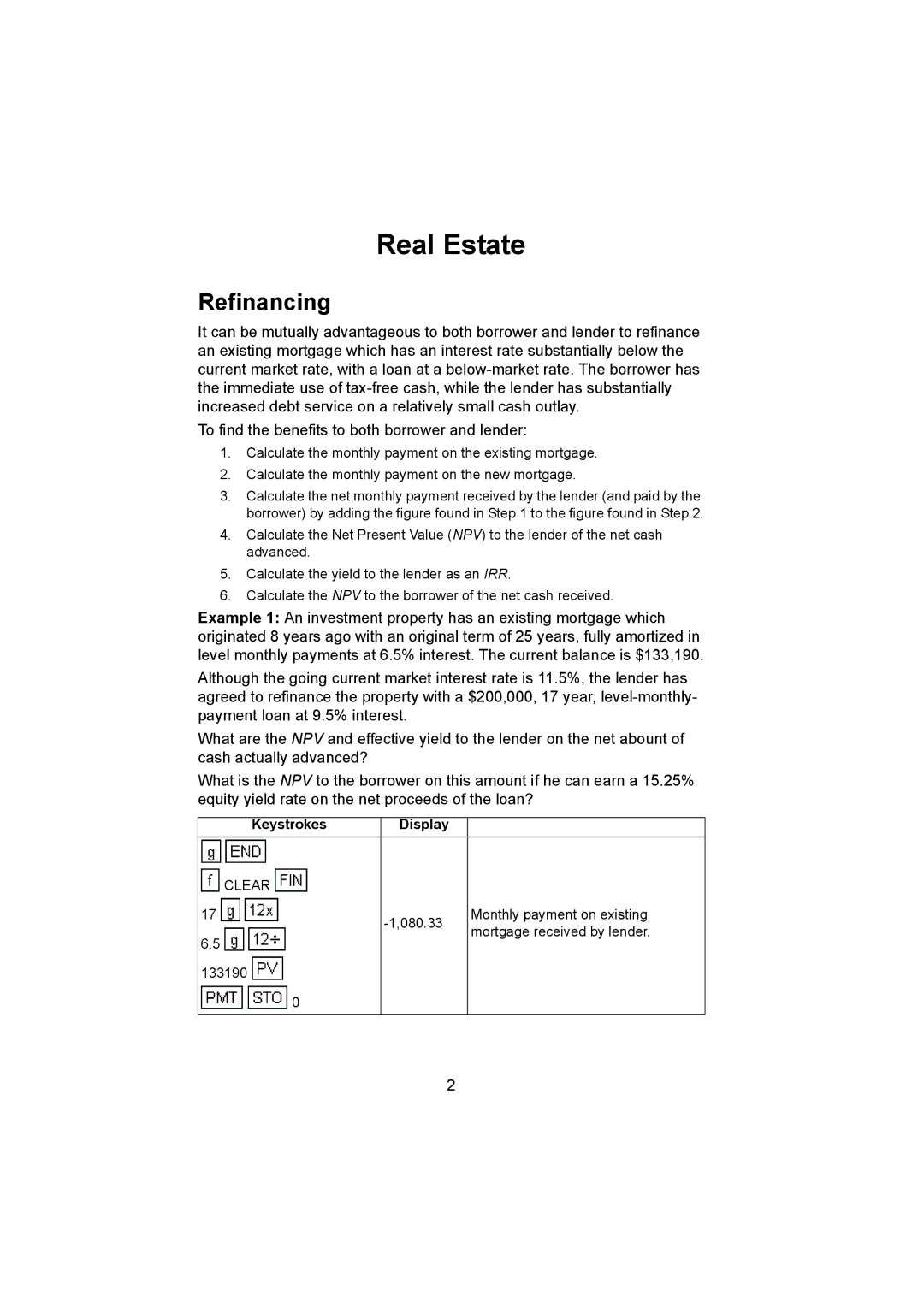

Example 1: An investment property has an existing mortgage which originated 8 years ago with an original term of 25 years, fully amortized in level monthly payments at 6.5% interest. The current balance is $133,190.

Although the going current market interest rate is 11.5%, the lender has agreed to refinance the property with a $200,000, 17 year,

What are the NPV and effective yield to the lender on the net abount of cash actually advanced?

What is the NPV to the borrower on this amount if he can earn a 15.25% equity yield rate on the net proceeds of the loan?

Keystrokes Display

CLEAR |

|

|

17 | Monthly payment on existing | |

| mortgage received by lender. | |

6.5 |

| |

|

| |

133190 |

|

|

| 0 |

|

2