8.Key in the purchase date (MM.DDYYYY) and press ![]() .

.

9.Key in the assumed sell date (MM.DDYYYY) and press ![]() to find the

to find the

10.For the same bond but different date return to step 8.

11.For a new case return to step 2.

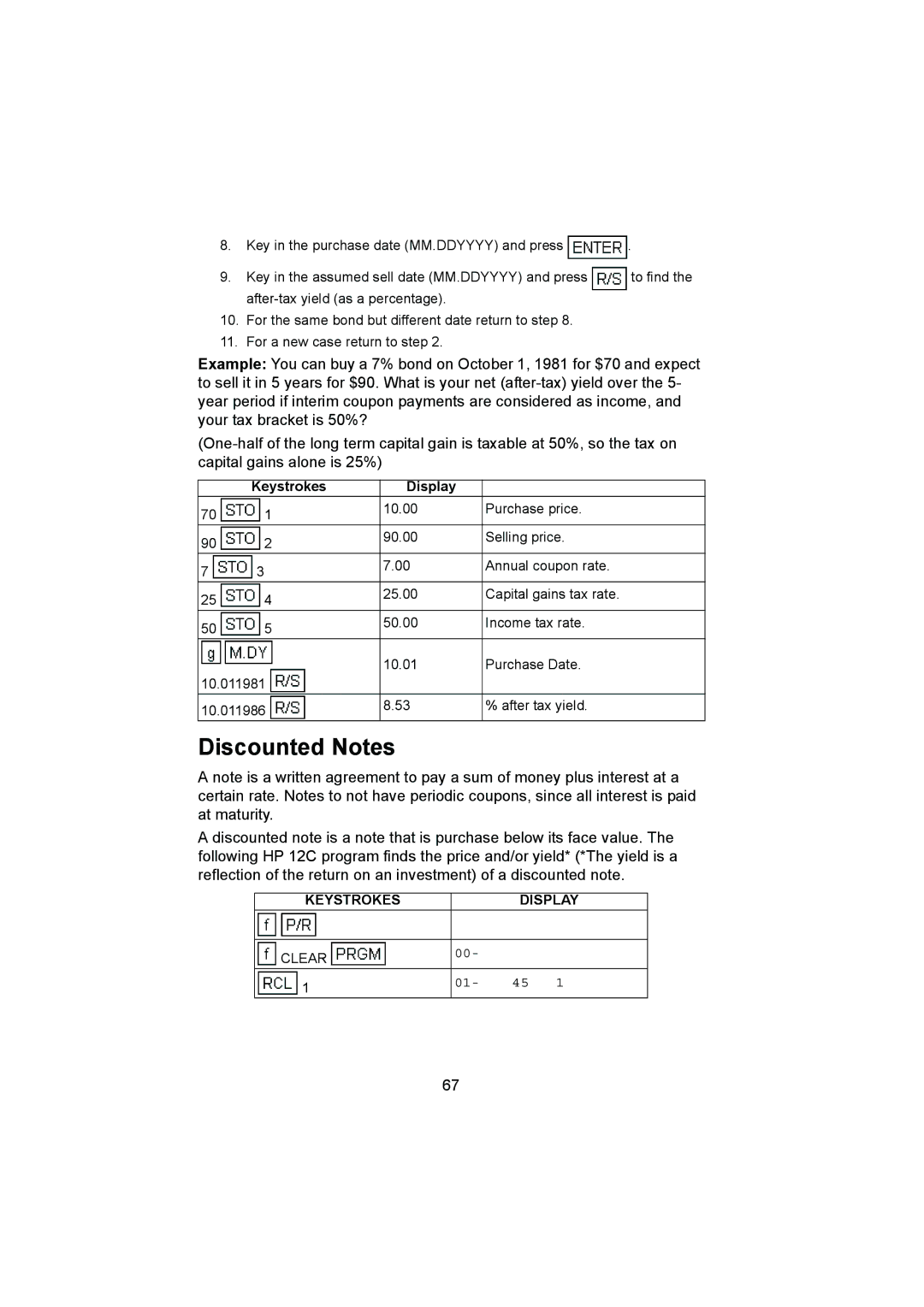

Example: You can buy a 7% bond on October 1, 1981 for $70 and expect to sell it in 5 years for $90. What is your net

| Keystrokes | Display |

|

70 | 1 | 10.00 | Purchase price. |

|

| ||

90 | 2 | 90.00 | Selling price. |

|

| ||

7 | 3 | 7.00 | Annual coupon rate. |

|

| ||

25 | 4 | 25.00 | Capital gains tax rate. |

|

| ||

50 | 5 | 50.00 | Income tax rate. |

|

| ||

|

| 10.01 | Purchase Date. |

10.011981 |

|

| |

10.011986 | 8.53 | % after tax yield. | |

|

| ||

Discounted Notes

A note is a written agreement to pay a sum of money plus interest at a certain rate. Notes to not have periodic coupons, since all interest is paid at maturity.

A discounted note is a note that is purchase below its face value. The following HP 12C program finds the price and/or yield* (*The yield is a reflection of the return on an investment) of a discounted note.

KEYSTROKES |

| DISPLAY |

|

|

|

CLEAR | 00- |

|

1 | 01- | 45 1 |

67