9.Next, to evaluate the entire portfolio, press ![]()

![]() 48.

48.

10.Press ![]() to see the initial portfolio value.

to see the initial portfolio value.

11.Press ![]() to see the present portfolio value.

to see the present portfolio value.

12.Press ![]() to see the percent change in value.

to see the percent change in value.

13.Press ![]() to see the total yearly dividend.

to see the total yearly dividend.

14.Press ![]() to see the annual dividend yield as a percent of the current market value.

to see the annual dividend yield as a percent of the current market value.

15.Press ![]() to see the beta coefficient of the portfolio.

to see the beta coefficient of the portfolio.

16.For a new case return to step 2.

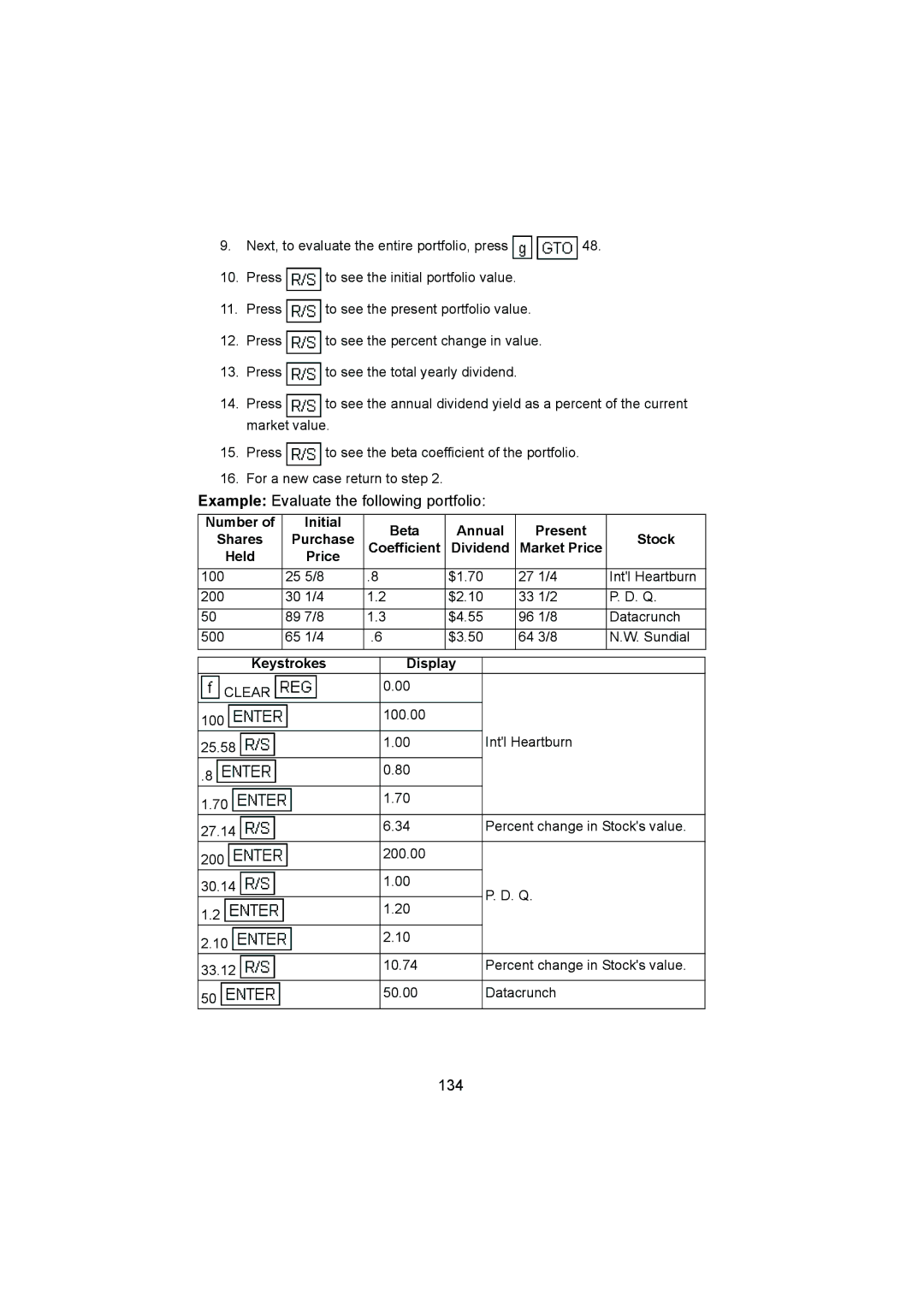

Example: Evaluate the following portfolio:

Number of | Initial |

| Beta | Annual | Present |

| |

Shares | Purchase |

| Stock | ||||

Coefficient | Dividend | Market Price | |||||

Held | Price |

|

|

|

|

|

|

100 | 25 5/8 | .8 |

| $1.70 | 27 1/4 | Int'l Heartburn | |

200 | 30 1/4 | 1.2 | $2.10 | 33 1/2 | P. D. Q. | ||

50 | 89 7/8 | 1.3 | $4.55 | 96 1/8 | Datacrunch | ||

500 | 65 1/4 | .6 | $3.50 | 64 3/8 | N.W. Sundial | ||

|

|

|

|

|

| ||

Keystrokes |

| Display |

|

|

| ||

CLEAR |

|

| 0.00 |

|

|

|

|

|

|

|

|

|

|

| |

100 |

|

| 100.00 |

|

|

|

|

|

|

|

|

|

|

| |

25.58 |

|

| 1.00 |

| Int'l Heartburn |

| |

|

|

|

|

|

|

| |

.8 |

|

| 0.80 |

|

|

|

|

|

|

|

|

|

|

| |

1.70 |

|

| 1.70 |

|

|

|

|

|

|

|

|

|

|

| |

27.14 |

|

| 6.34 |

| Percent change in Stock's value. | ||

|

|

|

|

|

|

| |

200 |

|

| 200.00 |

|

|

|

|

|

|

|

|

|

|

| |

30.14 |

|

| 1.00 |

| P. D. Q. |

| |

|

|

|

|

| |||

1.2 |

|

| 1.20 |

|

| ||

|

|

|

|

|

| ||

|

|

|

|

|

|

| |

2.10 |

|

| 2.10 |

|

|

|

|

|

|

|

|

|

|

| |

33.12 |

|

| 10.74 |

| Percent change in Stock's value. | ||

|

|

|

|

|

|

| |

50 |

|

| 50.00 |

| Datacrunch |

| |

|

|

|

|

|

|

| |