10. For a new case press ![]()

![]() and go to step 2.

and go to step 2.

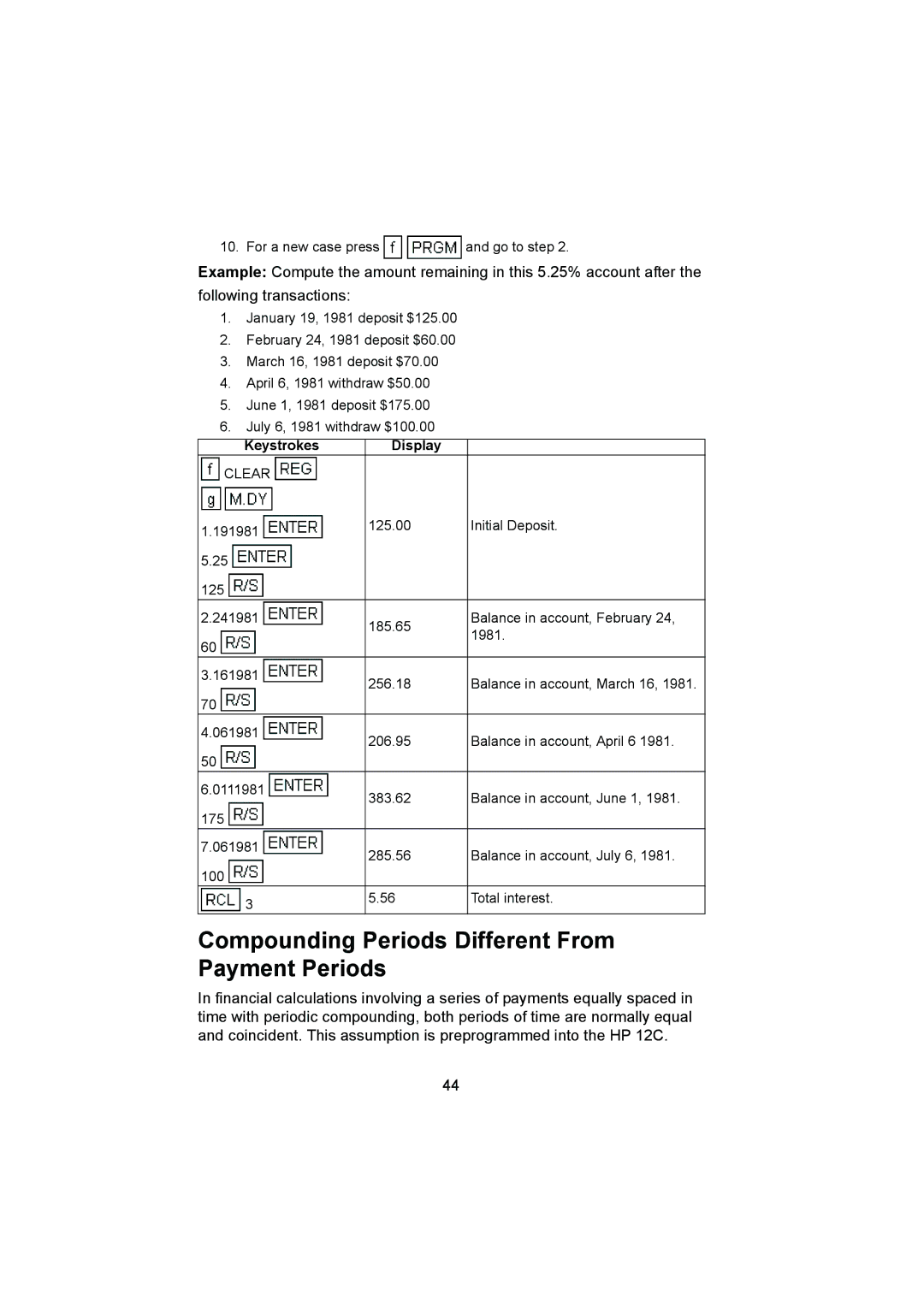

Example: Compute the amount remaining in this 5.25% account after the following transactions:

1.January 19, 1981 deposit $125.00

2.February 24, 1981 deposit $60.00

3.March 16, 1981 deposit $70.00

4.April 6, 1981 withdraw $50.00

5.June 1, 1981 deposit $175.00

6.July 6, 1981 withdraw $100.00

Keystrokes Display

CLEAR

CLEAR

1.191981 | 125.00 | Initial Deposit. |

|

| |

5.25 |

|

|

125 |

|

|

2.241981 | 185.65 | Balance in account, February 24, |

| 1981. | |

60 |

| |

|

| |

3.161981 | 256.18 | Balance in account, March 16, 1981. |

| ||

70 |

|

|

4.061981 | 206.95 | Balance in account, April 6 1981. |

| ||

50 |

|

|

6.0111981 | 383.62 | Balance in account, June 1, 1981. |

| ||

175 |

|

|

7.061981 | 285.56 | Balance in account, July 6, 1981. |

| ||

100 |

|

|

3 | 5.56 | Total interest. |

|

|

Compounding Periods Different From Payment Periods

In financial calculations involving a series of payments equally spaced in time with periodic compounding, both periods of time are normally equal and coincident. This assumption is preprogrammed into the HP 12C.

44