Exponential smoothing is often used for short term sales and inventory forecasts. Typical forecast periods are monthly or quarterly. Unlike a moving average, exponential smoothing does not require a great deal of historical data. However , it should not be used with data which has more than a moderate amount of up or down trend.

When using exponential smoothing, a smoothing factor is chosen which affects the sensitivity of the average much the same way as the length of the standard moving average period. The correspondence between the two techniques can be represented by the formula:

α2

=

n + 1

where α is the exponential smoothing factor (with values from 0 to 1) and n is the length of the standard moving average. As the equation shows, the longer the moving average period, the smaller the equivalent and the less sensitive the average becomes to fluctuations in current values.

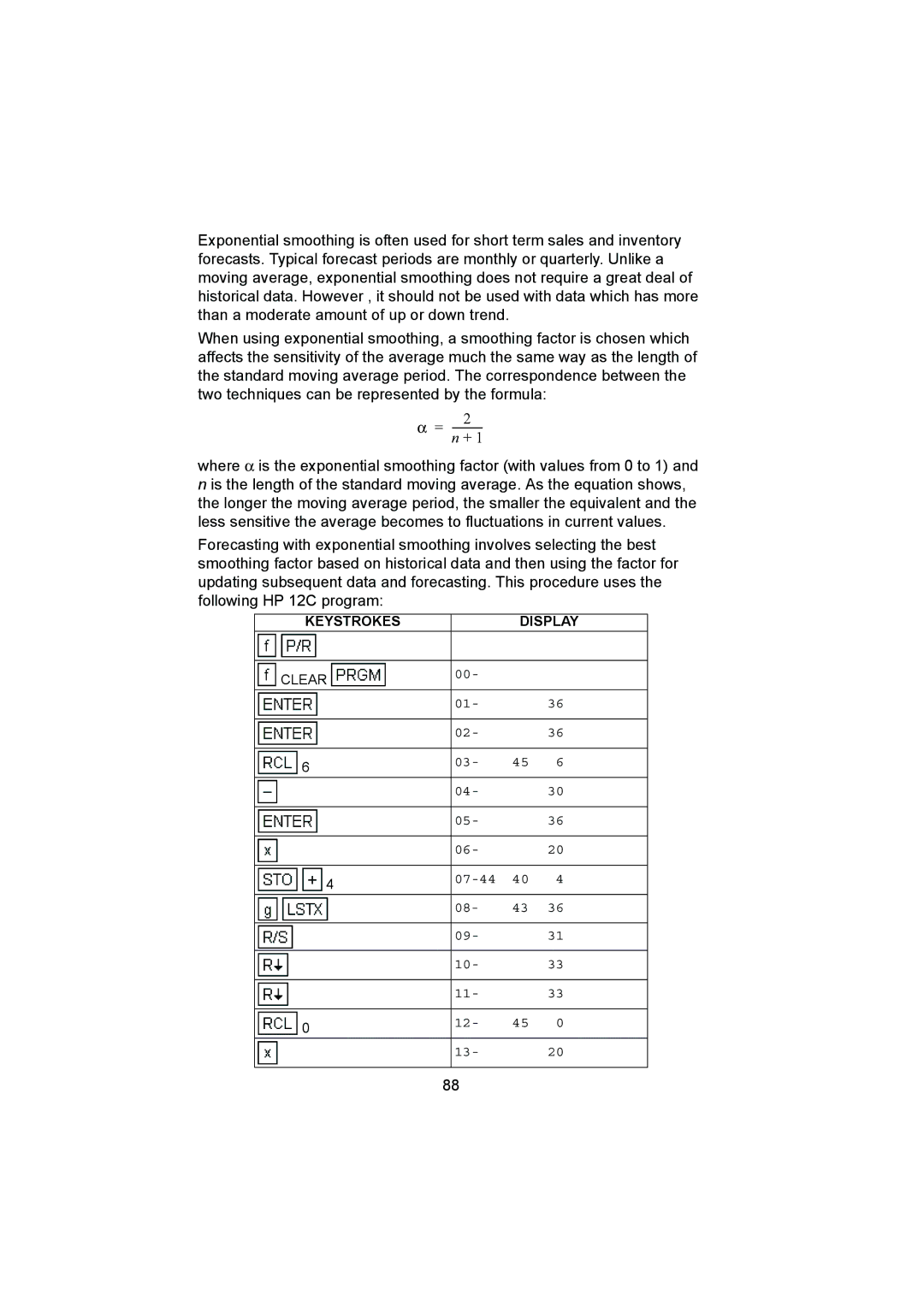

Forecasting with exponential smoothing involves selecting the best smoothing factor based on historical data and then using the factor for updating subsequent data and forecasting. This procedure uses the following HP 12C program:

KEYSTROKES |

| DISPLAY | |

|

|

|

|

CLEAR | 00- |

|

|

| 01- |

| 36 |

|

|

|

|

| 02- |

| 36 |

|

|

|

|

6 | 03- | 45 | 6 |

| 04- |

| 30 |

|

|

|

|

| 05- |

| 36 |

|

|

|

|

| 06- |

| 20 |

|

|

|

|

4 |

| 40 | 4 |

| 08- | 43 | 36 |

|

|

|

|

| 09- |

| 31 |

|

|

|

|

| 10- |

| 33 |

|

|

|

|

| 11- |

| 33 |

|

|

|

|

0 | 12- | 45 | 0 |

| 13- |

| 20 |

|

|

|

|

88