|

|

| |

|

|

|

|

CLEAR |

| 49,316.74 | Remaining balance. |

|

| ||

|

|

|

|

11.75 |

| 0.98 | Adjusted monthly interest. |

|

|

| |

30 | 3 | 27.00 | Remaining life of mortgage. |

|

| ||

|

| 324.00 |

|

|

|

|

|

|

| New monthly payment. | |

|

|

|

|

495.15 |

| Previous monthly payment. | |

|

|

| |

12 |

| 31.67 | New remaining term (years). |

|

|

|

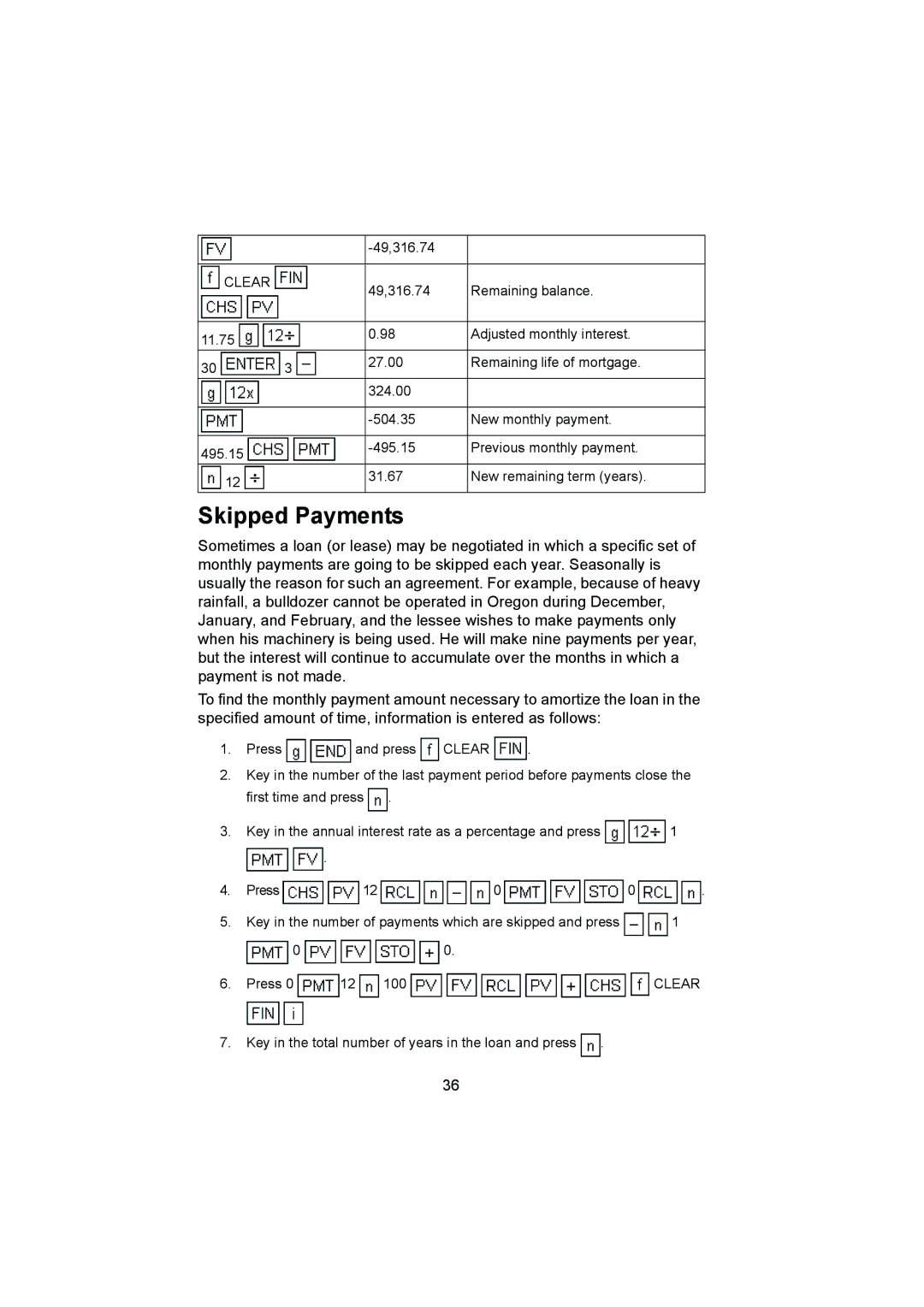

Skipped Payments

Sometimes a loan (or lease) may be negotiated in which a specific set of monthly payments are going to be skipped each year. Seasonally is usually the reason for such an agreement. For example, because of heavy rainfall, a bulldozer cannot be operated in Oregon during December, January, and February, and the lessee wishes to make payments only when his machinery is being used. He will make nine payments per year, but the interest will continue to accumulate over the months in which a payment is not made.

To find the monthly payment amount necessary to amortize the loan in the specified amount of time, information is entered as follows:

1.Press ![]()

![]() and press

and press ![]() CLEAR

CLEAR ![]() .

.

2.Key in the number of the last payment period before payments close the first time and press ![]() .

.

3.Key in the annual interest rate as a percentage and press ![]()

![]() 1

1

![]()

![]() .

.

4.Press ![]()

![]() 12

12 ![]()

![]()

![]()

![]() 0

0 ![]()

![]()

![]() 0

0 ![]()

![]() .

.

5.Key in the number of payments which are skipped and press ![]()

![]() 1

1

![]() 0

0 ![]()

![]()

![]()

![]() 0.

0.

6.Press 0 ![]() 12

12 ![]() 100

100 ![]()

![]()

![]()

![]()

![]()

![]()

![]() CLEAR

CLEAR

7.Key in the total number of years in the loan and press ![]() .

.

36