I savings plans however, money may become available for deposit or investment at a frequency different from the compounding frequencies offered. The HP 12C can easily be used in these calculations. However, because of the assumptions mentioned the periodic interest rate must be adjusted to correspond to an equivalent rate for the payment period.

Payments deposited for a partial compounding period will accrue simple interest for the remainder of the compounding period. This is often the case, but may not be true for all institutions.

These procedures present solutions for future value, payment amount, and number of payments. In addition, it should be noted that only annuity due (payments at the beginning of payment period) calculations are shown since this is the most common in savings plan calculations.

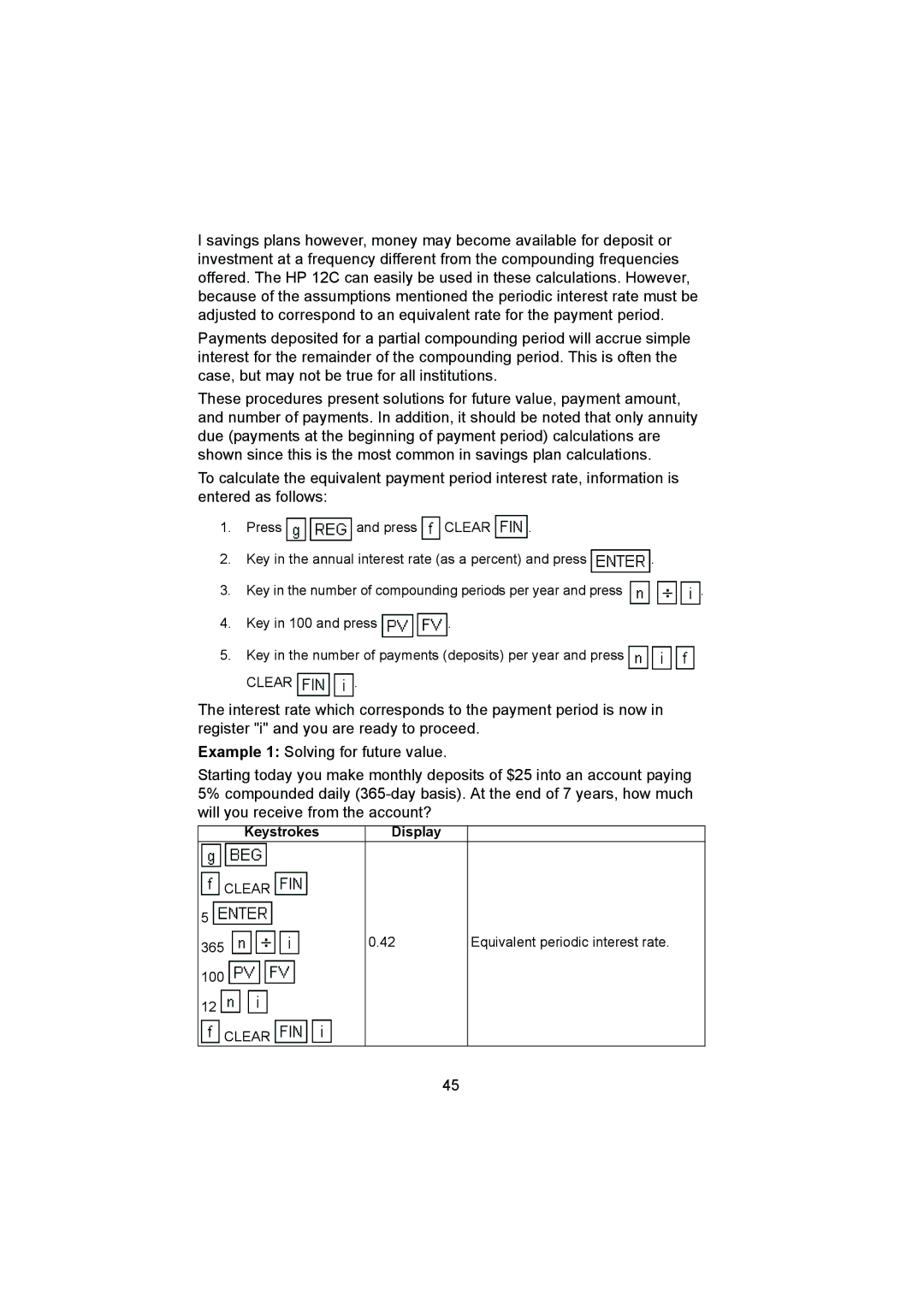

To calculate the equivalent payment period interest rate, information is entered as follows:

1.Press ![]()

![]() and press

and press ![]() CLEAR

CLEAR ![]() .

.

2.Key in the annual interest rate (as a percent) and press ![]() .

.

3.Key in the number of compounding periods per year and press ![]()

![]()

![]() .

.

4.Key in 100 and press ![]()

![]() .

.

5.Key in the number of payments (deposits) per year and press ![]()

![]()

![]()

CLEAR

.

.

The interest rate which corresponds to the payment period is now in register "i" and you are ready to proceed.

Example 1: Solving for future value.

Starting today you make monthly deposits of $25 into an account paying 5% compounded daily

Keystrokes Display

CLEAR

CLEAR  5

5

365 | 0.42 | Equivalent periodic interest rate. |

|

|

100 ![]()

![]()

12 ![]()

![]()

![]() CLEAR

CLEAR ![]()

![]()

45